France Aerosol Drug Delivery Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Inhaler and Nebulizer), By Application (COPD, Asthma, Cystic Fibrosis, and Others), By Distribution Channel (Institutional Pharmacies, Retail Pharmacies, Online Pharmacies, and Others), and France Aerosol Drug Delivery Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Aerosol Drug Delivery Devices Market Insights Forecasts to 2035

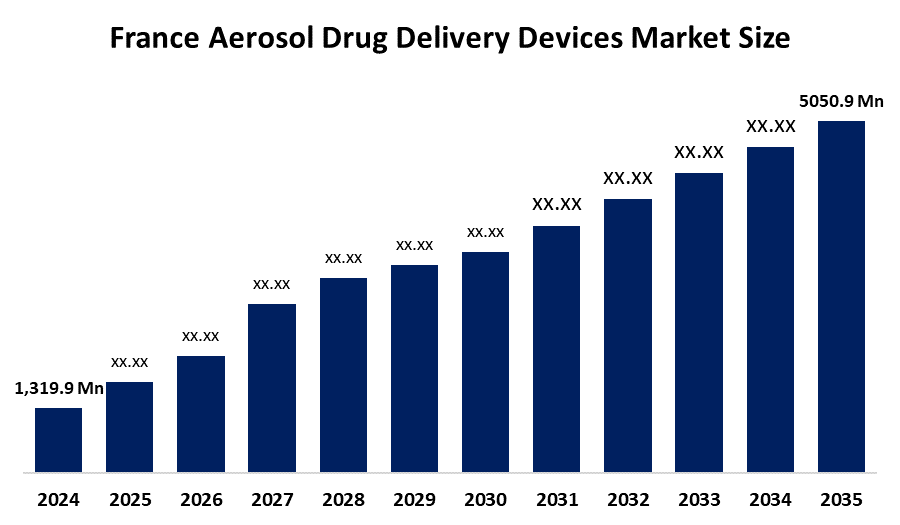

- The France Aerosol Drug Delivery Devices Market Size Was Estimated at USD 1,319.9 Million in 2024.

- The France Aerosol Drug Delivery Devices Market Size is Expected to Grow at a CAGR of Around 12.98% from 2025 to 2035.

- The France Aerosol Drug Delivery Devices Market Size is Expected to Reach USD 5,050.9 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the France Aerosol Drug Delivery Devices Market size is anticipated to reach USD 5,050.9 million by 2035, growing at a CAGR of 12.98% from 2025 to 2035. The France aerosol drug delivery devices market is driven by the rising prevalence of respiratory diseases such as asthma and COPD, an aging population, and a strong healthcare infrastructure with universal coverage. In addition, technological advancements in inhalers and nebulizers, growing patient preference for convenient, self-administered therapies, and increased awareness and diagnosis of respiratory conditions continue to support market growth.

Market Overview

The France aerosol drug delivery devices market encompasses medical devices designed to deliver medications in aerosol form directly to the lungs. This market includes products such as metered-dose inhalers, dry powder inhalers, and nebulizers, which are widely used for the treatment and management of respiratory conditions including asthma, chronic obstructive pulmonary disease (COPD), and other pulmonary disorders. These devices are utilized across hospitals, clinics, and home-care settings throughout France.

In France, the use of aerosol drug delivery devices is largely driven by the country’s high burden of respiratory diseases. Nearly 8 million individuals live with chronic respiratory conditions, with asthma affecting more than 4 million people and chronic obstructive pulmonary disease (COPD) impacting approximately 3–3.5 million adults. As a result, a substantial proportion of these patients require long-term inhalation therapy. Additionally, France’s aging population, high smoking rates, and continued exposure to air pollution contribute to the rising incidence of respiratory disorders and increased hospital admissions. This large patient population highlights the critical need for aerosol drug delivery devices in France to ensure effective disease management, improve quality of life, and reduce the overall healthcare burden.

Report Coverage

This research report categorizes the France aerosol drug delivery devices market based on various segments and regions, forecasting revenue growth and analyzing trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France aerosol drug delivery devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France aerosol drug delivery devices market.

France Aerosol Drug Delivery Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,319.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 12.98% |

| 2035 Value Projection: | USD 5,050.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application, By Distribution Channel |

| Companies covered:: | Sanofi S.A., AstraZeneca PLC, GlaxoSmithKline plc (GSK), Novartis AG, Pfizer Inc., Teva Pharmaceutical Industries Ltd., Koninklijke Philips N.V., AptarGroup, Inc., Aerogen, Medline Industries, Inc., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aerosol drug delivery devices market in France is primarily driven by factors such as the rising prevalence of respiratory diseases, a growing elderly population, ongoing technological advancements in inhalers and nebulizers, easy access to healthcare services, and the convenience of inhaled drug delivery. Additionally, increasing awareness of self-administered inhalation therapies in respiratory care continues to support market growth.

Restraining Factors

The France aerosol drug delivery devices market is constrained by factors such as high device costs, patient non-adherence to treatment regimens, stringent regulatory requirements, competition from alternative therapies, and usability challenges or side-effect concerns. Collectively, these factors slow market growth to some extent, despite the rising demand for aerosol-based drug delivery solutions.

Market Segmentation

The France aerosol drug delivery devices market share is categorized by type, application, and distribution channel.

The inhaler segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France aerosol drug delivery devices market is segmented by type into inhaler and nebulizer. Among these, the inhaler segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The inhaler segment's growth is due to the high prevalence of chronic respiratory diseases like asthma and COPD, the convenience and portability of inhalers for at-home and on-the-go use, technological advancements such as metered-dose and smart inhalers that improve drug delivery and adherence, strong healthcare support and reimbursement, and patient preference for easy-to-use, time-efficient devices.

The COPD segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France aerosol drug delivery devices market is segmented by application into COPD, asthma, cystic fibrosis, and others. Among these, the COPD segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The COPD segmental growth is driven by the high prevalence of COPD among adults, especially the aging population, the chronic nature of the disease requiring long-term inhalation therapy, increased hospitalizations, and healthcare burden associated with COPD exacerbations, and the effectiveness and convenience of aerosol devices like inhalers and nebulizers in delivering targeted medication directly to the lungs.

The institutional pharmacies segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France aerosol drug delivery devices market is segmented by distribution channel into institutional pharmacies, retail pharmacies, online pharmacies, and others. Among these, the institutional pharmacies segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The institutional pharmacies segment's growth is due to the high demand for prescription-based respiratory medications in hospitals and clinics, the availability of a wide range of inhalers and nebulizers, strong linkage with healthcare providers for patient access, and the trust and reliability associated with institutional procurement. Additionally, bulk purchasing, insurance coverage, and hospital-based chronic disease management programs contribute to the segment’s dominant market share and expected growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France aerosol drug delivery devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sanofi S.A.

- AstraZeneca PLC

- GlaxoSmithKline plc (GSK)

- Novartis AG

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd.

- Koninklijke Philips N.V.

- AptarGroup, Inc.

- Aerogen

- Medline Industries, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2025, AstraZeneca’s eco-friendly version of its COPD inhaler Trixeo Aerosphere, featuring a next-generation low-emission propellant, received positive backing from the European Medicines Agency committee, highlighting sustainable inhaler adoption in the France aerosol drug delivery devices market.

- In October 2025, GSK announced positive Phase III data for its next-generation low-carbon Ventolin metered-dose inhaler (MDI), supporting regulatory submissions and a planned launch in 2026, highlighting sustainable inhaler innovation relevant to the France aerosol drug delivery devices market.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Aerosol Drug Delivery Devices Market based on the below-mentioned segments:

France Aerosol Drug Delivery Devices Market, By Type

- Inhaler

- Nebulizer

France Aerosol Drug Delivery Devices Market, By Application

- COPD

- Asthma

- Cystic Fibrosis

- Others

France Aerosol Drug Delivery Devices Market, By Distribution Channel

- Institutional Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Frequently Asked Questions (FAQ)

-

1.What is the France aerosol drug delivery devices market size in 2024?The France aerosol drug delivery devices market size was estimated at USD 1,319.9 million in 2024.

-

2.What is the projected market size of the France aerosol drug delivery devices market by 2035?The France aerosol drug delivery devices market size is expected to reach USD 5,050.9 million by 2035.

-

3.What is the CAGR of the France aerosol drug delivery devices market?The France aerosol drug delivery devices market size is expected to grow at a CAGR of around 12.98% from 2024 to 2035.

-

4.What are the key growth drivers of the France aerosol drug delivery devices market?Rising prevalence of respiratory diseases such as asthma and COPD, an aging population, technological advancements in inhalers and nebulizers, growing patient preference for convenient, self-administered therapies, and increased awareness.

-

5. Which application segment dominated the market in 2024?The COPD segment dominated the market in 2024.

-

6.Which type segment accounted for the largest market share in 2024?The inhaler segment accounted for the largest market share in 2024.

-

7.What segments are covered in the France aerosol drug delivery devices market report?The France aerosol drug delivery devices market is segmented on the basis of type, application, and distribution channel.

Need help to buy this report?