Global Fracking Fluids and Chemicals Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Fluid Type (Water-based, Foam-based, and Oil-based), By Additive (Gelling Agents, Friction Reducers, and Biocides), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsFracking Fluids and Chemicals Market Summary, Size & Emerging Trends

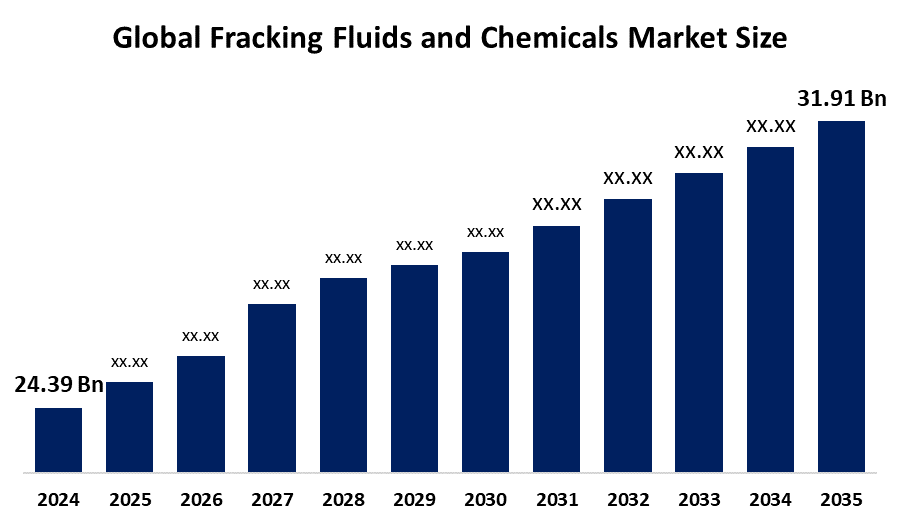

According to Decision Advisor, the Global Fracking Fluids and Chemicals Market Size is expected to grow from USD 24.39 Billion in 2024 to USD 31.91 Billion by 2035, at a CAGR of 2.47% during the forecast period 2025-2035. Increasing demand for efficient and environmentally friendly fracturing processes in the oil and gas industry is a key driving factor for the fracking fluids and chemicals market.

Get more details on this report -

Key Market Insights

- Asia Pacific is expected to account for the largest share in the fracking fluids and chemicals market during the forecast period.

- In terms of fluid type, the water-based fluid segment dominated in terms of revenue during the forecast period.

- In terms of additive, the gelling agents segment accounted for the largest revenue share in the global fracking fluids and chemicals market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 24.39 Billion

- 2035 Projected Market Size: USD 31.91 Billion

- CAGR (2025-2035): 2.47%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Fracking Fluids and Chemicals Market

The fracking fluids and chemicals market focuses on the production and supply of specialized fluids used in hydraulic fracturing to enhance extraction of oil and natural gas. These fluids include water-based, foam-based, and oil-based types, combined with additives such as gelling agents, friction reducers, and biocides to improve efficiency and environmental compliance. The industry is driven by increasing shale gas exploration and technological advancements aimed at minimizing environmental impact. Governments worldwide are implementing regulations to control chemical usage in fracking, promoting safer alternatives and sustainable practices. Rising energy demand, coupled with the shift toward cleaner fuels, continues to fuel growth in fracking fluids and chemicals, positioning the market for steady expansion.

Fracking Fluids and Chemicals Market Trends

- Growing adoption of eco-friendly and biodegradable additives to reduce environmental footprint.

- Innovations in fluid formulations to enhance well productivity and reduce water usage.

- Strategic collaborations and mergers among chemical manufacturers to expand product portfolios and geographic reach.

Fracking Fluids and Chemicals Market Dynamics

Driving Factors: Increasing shale gas production and technological advancements

The global energy landscape is witnessing a significant shift toward unconventional resources, with shale gas production emerging as a vital component. North America, particularly the United States, has led this expansion, with Asia Pacific countries like China and Australia rapidly developing their shale gas reserves. This surge in exploration and production drives the demand for specialized fracking fluids and chemicals that enhance the efficiency and effectiveness of hydraulic fracturing operations. Technological advancements play a pivotal role in this growth. Innovations in hydraulic fracturing techniques require fluids with tailored properties—such as improved viscosity, thermal stability, and chemical compatibility to optimize fracture creation and maximize hydrocarbon recovery. These advancements enable operators to access more challenging reservoirs while reducing operational costs.

Restrain Factors: Environmental concerns and regulatory challenges

Despite the promising growth, the fracking fluids and chemicals market faces significant restraints primarily due to environmental and regulatory pressures. Hydraulic fracturing involves injecting a complex mixture of chemicals into the subsurface, raising concerns about groundwater contamination, surface spills, and overall ecosystem disruption. Regulatory agencies in key markets have imposed stringent guidelines governing chemical disclosure, usage limits, waste management, and spill response. Public opposition and activism against fracking exacerbate these challenges, as communities demand transparency and safer practices.

Opportunity: Development of green fracturing fluids and expansion in emerging markets

There is a growing opportunity for innovation focused on environmentally sustainable fracturing fluids. These “green” fluids utilize biodegradable polymers, naturally derived surfactants, and non-toxic additives that meet or exceed regulatory standards without sacrificing performance. Adoption of such fluids helps operators reduce environmental risks and comply with evolving legislation, making them attractive options globally. Emerging markets in Asia, Latin America, and the Middle East, which possess vast untapped shale reserves, represent significant growth areas. As these regions develop their unconventional energy sectors, the demand for modern fracturing fluids tailored to local geological and regulatory conditions is expected to rise.

Challenges: Supply chain disruptions and chemical safety concerns

The market faces operational challenges stemming from volatility in raw material prices, including polymers, surfactants, and specialty chemicals critical for fluid formulations. Supply chain disruptions—caused by geopolitical tensions, transportation bottlenecks, or natural disasters—can delay production and increase costs, impacting market stability. Chemical safety is a paramount concern, as handling, storage, and disposal of fracking chemicals require strict protocols to protect workers and the environment. Manufacturers and operators must invest in training, infrastructure, and safety technologies to mitigate risks associated with toxic or hazardous substances.

Global Fracking Fluids and Chemicals Market Ecosystem Analysis

The global fracking fluids and chemicals market ecosystem includes key raw material suppliers, chemical manufacturers, service providers in oilfield operations, and end-users in oil and gas exploration companies. Suppliers of base chemicals such as polymers and surfactants significantly influence cost and availability. Leading manufacturers focus on product innovation and compliance with environmental standards. Regulatory agencies enforce safety and environmental guidelines that shape market practices. The ecosystem’s growth depends on technological innovation, regulatory adherence, and collaboration among stakeholders to drive sustainable development.

Global Fracking Fluids and Chemicals Market, By Fluid Type

The water-based fluid segment dominated the global fracking fluids and chemicals market during the forecast period, accounting for approximately 55% of the market revenue. This segment’s dominance is largely due to its cost-effectiveness, ease of handling, and compatibility with a wide range of geological formations. Water-based fluids are also preferred because they generally have a lower environmental impact compared to oil-based fluids, making them more acceptable under increasingly strict environmental regulations. Their versatility and relatively lower cost make them the most widely used fluid type in hydraulic fracturing operations worldwide.

The foam-based fluid segment is gaining traction, capturing around 25% of the market share. Foam-based fluids are particularly efficient in gas well applications, where they help improve extraction efficiency while significantly reducing water consumption. This is a critical advantage in regions facing water scarcity or where environmental sustainability is a priority. The unique properties of foam-based fluids also contribute to enhanced fracture conductivity, making them an attractive option for specific fracturing scenarios.

Global Fracking Fluids and Chemicals Market, By Additive

The gelling agents segment accounted for the largest revenue share in the global fracking fluids and chemicals market, representing approximately 45% of the total market during the forecast period. Gelling agents are essential in hydraulic fracturing as they enhance the viscosity of the fluid, allowing it to effectively suspend and transport proppants into fractures. This function is critical for maintaining fracture width and maximizing hydrocarbon flow. Their ability to control fluid rheology ensures efficient fracture propagation and stability, making them indispensable in high-performance fracturing operations.

The friction reducers segment held a significant market share of around 35%, driven by their crucial role in lowering the pressure required to pump fluids into wells. By reducing friction between the fluid and the wellbore, these additives help decrease energy consumption and wear on equipment. This not only improves operational efficiency but also reduces overall costs, making friction reducers especially valuable in large-scale and high-volume fracturing projects. Their widespread use across both conventional and unconventional wells has cemented their position as a core component in fracking fluid formulations.

The Asia Pacific region is expected to dominate the global fracking fluids and chemicals market, holding approximately 38% of the total revenue share during the forecast period.

Get more details on this report -

This dominance is primarily driven by the region’s expanding energy demand, increasing investment in unconventional oil and gas exploration, and favorable government policies supporting domestic production. Countries such as China and India are aggressively exploring shale gas reserves to reduce reliance on energy imports. China, in particular, is investing heavily in hydraulic fracturing technologies and expanding its domestic chemical manufacturing capacity, which supports local supply chains for fracking fluids. The presence of large shale basins and government-backed infrastructure development further enhances the region’s market growth.

North America continues to be a key player in the market, accounting for approximately 30% of the global market share, and is anticipated to register the fastest growth rate during the forecast period.

The United States has long been a leader in shale gas and tight oil production, with the Permian, Eagle Ford, and Bakken basins at the forefront of hydraulic fracturing activity. The well-established energy sector, advanced drilling technologies, and presence of major fracking fluid manufacturers create a robust ecosystem. Additionally, the U.S. Energy Information Administration (EIA) reports steady investment in shale development, ensuring continued demand for high-performance fracking fluids and additives. Canada also contributes significantly, particularly in regions like Alberta and British Columbia, where unconventional resource development is active.

Europe holds a smaller but steadily growing share of around 12%

largely driven by interest in reducing dependence on Russian natural gas and diversifying energy sources. Countries like Poland and the United Kingdom have shown interest in exploring shale gas, although progress has been slower due to stringent environmental regulations and public opposition. Nevertheless, ongoing research and policy debates may eventually support more hydraulic fracturing activity, especially as energy security becomes a strategic priority.

Product Launches in Fracking Fluids and Chemicals Market

- In May 2022, SPM Oil & Gas, a U.S.-based energy equipment provider, introduced the SPM Simplified Frac Iron System a significant innovation aimed at optimizing hydraulic fracturing operations. Traditional fracking setups often require multiple small-bore tie-in lines that create a complex network of connections, increasing both operational time and potential failure points. The new SPM system replaces these multiple connections with a single large-bore inlet connected directly to the zipper manifold, effectively streamlining the fluid transfer process at frac sites.

- In May 2023, Allison Transmission officially launched the FracTran®, a high-performance transmission system designed specifically for the demanding environment of hydraulic fracturing operations. Built for rugged duty cycles, the FracTran is engineered to handle up to 3,300 horsepower and over 10,000 lb-ft of torque, delivering the power required for heavy fracturing pumps and equipment. What sets FracTran apart is its integration of advanced diagnostic capabilities, including real-time monitoring of filter and fluid life, a transmission-mounted control module, and onboard telematics that provide predictive maintenance data.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the fracking fluids and chemicals market based on the below-mentioned segments:

Global Fracking Fluids and Chemicals Market, By Fluid Type

- Water-based

- Foam-based

- Oil-based

Global Fracking Fluids and Chemicals Market, By Additive

- Gelling Agents

- Friction Reducers

- Biocides

Global Fracking Fluids and Chemicals Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

Q: Which fluid type dominates the Global Fracking Fluids and Chemicals Market?A: The water-based fluid segment dominates the market in terms of revenue, accounting for approximately 55% of the market share.

-

Q: Which additive segment holds the largest revenue share in the Global Fracking Fluids and Chemicals Market?A: The gelling agents segment accounts for the largest revenue share, representing about 45% of the market.

-

Q: What are the key drivers of growth in the Global Fracking Fluids and Chemicals Market?A: Increasing shale gas production, technological advancements in hydraulic fracturing, and rising energy demand are key growth drivers.

-

Q: What challenges are limiting the growth of the Global Fracking Fluids and Chemicals Market?A: Environmental concerns, stringent regulatory frameworks, supply chain disruptions, and chemical safety concerns are major restraints.

-

Q: What opportunities exist in the Global Fracking Fluids and Chemicals Market?A: Development of green, biodegradable fracturing fluids and expansion into emerging markets like Asia, Latin America, and the Middle East offer significant growth opportunities.

-

Q: Who are the top companies operating in the Global Fracking Fluids and Chemicals Market?A: Key players include Halliburton Company, Schlumberger Limited, Baker Hughes Company, BASF SE, The Dow Chemical Company, E.I. du Pont de Nemours and Company, Akzo Nobel N.V., Clariant International Ltd., Albemarle Corporation, and Ashland Global Holdings Inc.

-

Q: What are some recent product innovations in the Global Fracking Fluids and Chemicals Market?A: In May 2022, SPM Oil & Gas introduced the Simplified Frac Iron System to streamline fluid transfer operations. In May 2023, Allison Transmission launched FracTran®, a high-performance transmission system designed for hydraulic fracturing with advanced diagnostic features.

-

Q: How does the foam-based fluid segment perform in the market?A: The foam-based fluid segment holds about 25% of the market share and is gaining traction due to its efficiency in gas well applications and reduced water usage.

-

Q: What is the role of friction reducers in the market?A: Friction reducers account for around 35% of the additive market share by lowering pumping pressure, reducing energy consumption, and minimizing equipment wear.

-

Q: How is Europe positioned in the Global Fracking Fluids and Chemicals Market?A: Europe holds approximately 12% of the market share, with slow but steady growth driven by energy diversification efforts and cautious regulatory environments.

Need help to buy this report?