Global Footwear Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Type (Athletic, Casual, Formal, and Safety Footwear), By Application (Retail, Sports, and Industrial Use), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Consumer GoodsGlobal Footwear Manufacturing Market Insights Forecasts to 2035

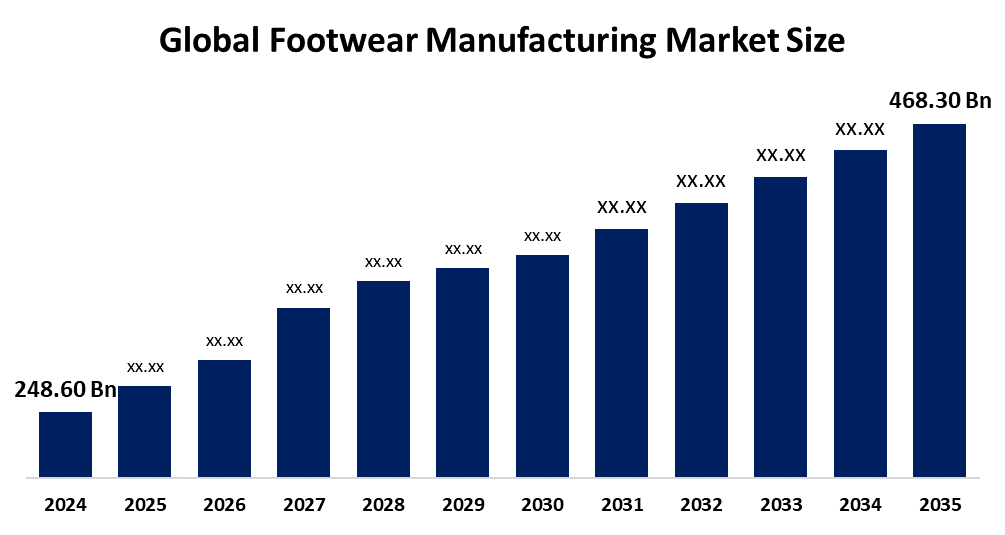

- The Global Footwear Manufacturing Market Size Was Estimated at USD 248.60 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.93 % from 2025 to 2035

- The Worldwide Footwear Manufacturing Market Size is Expected to Reach USD 468.30 Billion by 2035

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Footwear Manufacturing Market Size was worth around USD 248.60 Billion in 2024 and is Predicted to Grow to around USD 468.30 Billion by 2035 with a compound annual growth rate (CAGR) of 5.93 % from 2025 and 2035. The footwear manufacturing market has numerous opportunities for growth due to increased consumer demand, urbanization, and government regulations that support the business. Some of these prospects include sustainable production, new technologies, e-commerce growth, customisation, and worldwide trade.

Market Overview

The footwear manufacturing market mainly consists of manufactures, produces, and distributors of shoes for various consumer segments, such as men, women, and children, in the global footwear manufacturing market. The footwear manufacturing market cover the product within the category are casual wear, formal shoes, sports shoes, and specialty designs for medical or occupational use. in the manufacturing unit involves various process such as acquiring materials, cutting, building, finishing, and packaging, with the use of leather, fabrics, plastics, and environmentally friendly alternatives. trending lifestyle and performance footwear is the primary force driving the footwear manufacturing market. The tremendous urbanization, growing customer demand towards fashionable and comfortable shoes, and increasing disposable incomes are some of the key drivers of the footwear manufacturing market. The trending fashionable and comfortable shoes, and growing incomes powers are driving the footwear manufacturing market.

Report Coverage

This research report categorizes the footwear manufacturing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the footwear manufacturing market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the footwear manufacturing market.

Global Footwear Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 248.60 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.93 % |

| 2035 Value Projection: | USD 468.30 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Type, By Application. |

| Companies covered:: | Nike, Adidas, Puma, Asics, Clarks, Skechers, Converse, Merrell, Reebok, Salomon, Hoka One, Timberland, Under Armour, Steve Madden and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A crucial footwear manufacturing market trend is the expanding attention toward active lives and fitness. Sports footwear is therefore becoming more and more in demand as consumers' need for versatile products that combine style and functionality increases. Increased environmental consciousness is reflected in the rising demand for eco-friendly production methods and sustainable resources. Market expansion is further accelerated by the expansion of international trade networks and e-commerce platforms. The footwear manufacturing market is expanding significantly due to changing fashion trends, growing disposable incomes, and growing health consciousness. Technological innovations that boost production efficiency and product innovation include 3D printing, automation, and AI-based personalization.

Restraining Factors

The footwear manufacturing market is restricted in its potential to be profitable, scalable, and innovative by a number of restraining issues, including growing raw material costs, labor shortages, supply chain disruptions, regulatory compliance requirements, and market saturation.

Market Segmentation

The footwear manufacturing market share is classified into type and application.

- The athletic segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the footwear manufacturing market is divided into athletic, casual, formal, and safety footwear. Among these, the athletic segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Athletic footwear includes specialty shoes with improved support, cushioning, and durability that are made to improve physical performance. They support a variety of sports and fitness activities and are designed with cutting-edge materials and ergonomic features that enhance comfort, stability, and the avoidance of injuries when moving.

- The retail segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the footwear manufacturing market is divided into retail, sports, and industrial use. Among these, the retail segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Rising consumer demand across online and offline retail channels, pushed by changing fashion trends, rising disposable incomes, and the extensive use of e-commerce platforms, is the primary driver of the retail segment.

Regional Segment Analysis of the Footwear Manufacturing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the footwear manufacturing market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the footwear manufacturing market over the predicted timeframe. Asia Pacific is due to its strong industrial base, large labor pool, and advantageous economic climate. China, India, and Vietnam are important manufacturing hubs that draw well-known global businesses due to their affordable production capacities. Over 2,900 factories are operating in the region, which benefits from low labor costs and great production scalability. Rapid urbanization, growing disposable incomes, and growing consumer demand for athletic and non-athletic footwear all contribute to the region's noteworthy contribution.

North America is expected to grow at a rapid CAGR in the footwear manufacturing market during the forecast period. The growing desire from consumers for creative, cozy, and environmentally friendly footwear solutions is driving the North America market. High consumption and growing reshoring trends are driving the footwear market in North America. Compared to the previous year, the average cost per pair of sustainable footwear produced in the North American region increased by 22%. Sales of sports footwear are fueled by the region's strong brand presence, cutting-edge production technology, and growing health consciousness.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the footwear manufacturing market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nike

- Adidas

- Puma

- Asics

- Clarks

- Skechers

- Converse

- Merrell

- Reebok

- Salomon

- Hoka One

- Timberland

- Under Armour

- Steve Madden

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, Timberland Pro expanded their product line to include shoes designed specifically for the hospitality industry. Timberland launched the Burbank Collection, the brand's first footwear collection created especially for employees in the restaurant and hotel industries, through its dedicated division for skilled trade professionals. Comfort, durability, protection, and slip resistance are all given top priority in the collection's industry-standard all-black styles.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the footwear manufacturing market based on the below-mentioned segments:

Global Footwear Manufacturing Market, By Type

- Athletic

- Casual

- Formal

- Safety Footwear

Global Footwear Manufacturing Market, By Application

- Retail

- Sports

- Industrial Use

Global Footwear Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the footwear manufacturing market over the forecast period?The global footwear manufacturing market is projected to expand at a CAGR of 5.93% during the forecast period.

-

2. What is the market size of the footwear manufacturing market?The global footwear manufacturing market size is expected to grow from USD 248.60 billion in 2024 to USD 468.30 billion by 2035, at a CAGR of 5.93% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the footwear manufacturing market?Asia Pacific is anticipated to hold the largest share of the footwear manufacturing market over the predicted timeframe.

-

4. What is the market size of the Global footwear manufacturing Market in 2025?The global footwear manufacturing market size was estimated USD 263.52 billion in 2025.

-

5. Who are the top 10 companies operating in the global footwear manufacturing market?Key players include Nike, Adidas, Puma, Asics, Clarks, Skechers, Converse, Merrell, Reebok, Salomon, Hoka One, Timberland, Under Armour, Steve Madden, and Others.

-

6. What are the main drivers of growth in the footwear manufacturing market?Growing disposable incomes, urbanization, changing fashion trends, growing health consciousness, technology breakthroughs, and growing e-commerce platforms are some of the major factors driving demand and innovation in the worldwide footwear manufacturing market.

-

7. What are the latest trends in the footwear manufacturing market?The latest trends in footwear manufacturing reflect changing customer demands and technical advancements. These include eco-friendly production, 3D printing, personalized footwear, smart shoes, AI-driven automation, sustainable materials, and direct-to-consumer models.

-

8. What are the top investment opportunities in the global footwear manufacturing market?Global industry innovation and changing customer demand are reflected in prominent investing opportunities such as direct-to-consumer platforms, smart shoe technologies, eco-friendly materials, automation in manufacturing, and developing market expansion.

-

9. What challenges are limiting the adoption of footwear manufacturing market?The production of footwear has several challenges to general acceptance and scalability, including supply chain disruptions, high raw material prices, regulatory compliance, inventory inefficiencies, workforce retention concerns, and inadequate digital infrastructure.

-

10. Which regions are leading and growing fastest in the footwear manufacturing market?Asia-Pacific leads the footwear manufacturing market, with China dominating in revenue. North America is the fastest-growing region, driven by rising demand, urbanization, and expanding retail infrastructure.

Need help to buy this report?