Global Fog Light Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Technology Type (LED, Halogen, and HID), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Automotive & TransportationFog Light Market Summary, Size & Emerging Trends

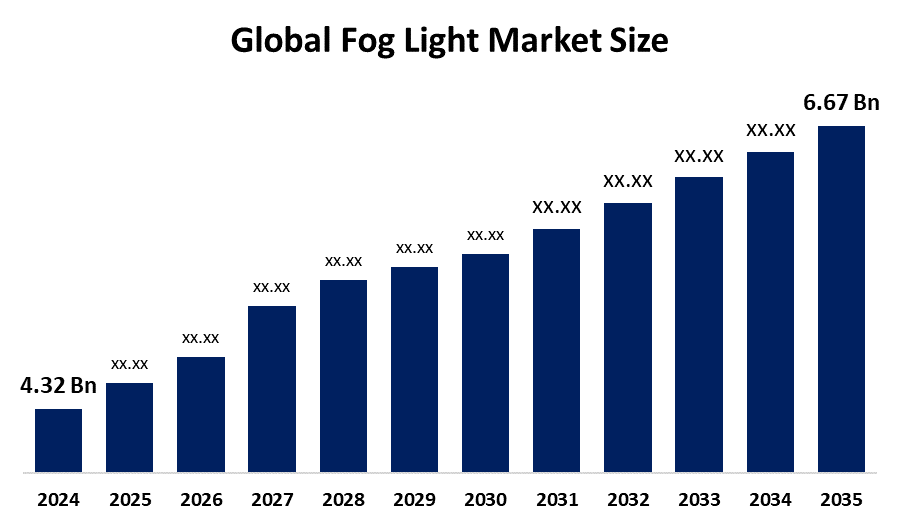

According to Decision Advisor, The Global Fog Light Market Size is Expected to Grow from USD 4.32 Billion in 2024 to USD 6.67 Billion by 2035, at a CAGR of 4.03% during the forecast period 2025-2035. The growth is primarily driven by increasing vehicle production worldwide and rising demand for advanced lighting technologies to improve safety in adverse weather conditions.

Get more details on this report -

Key Market Insights

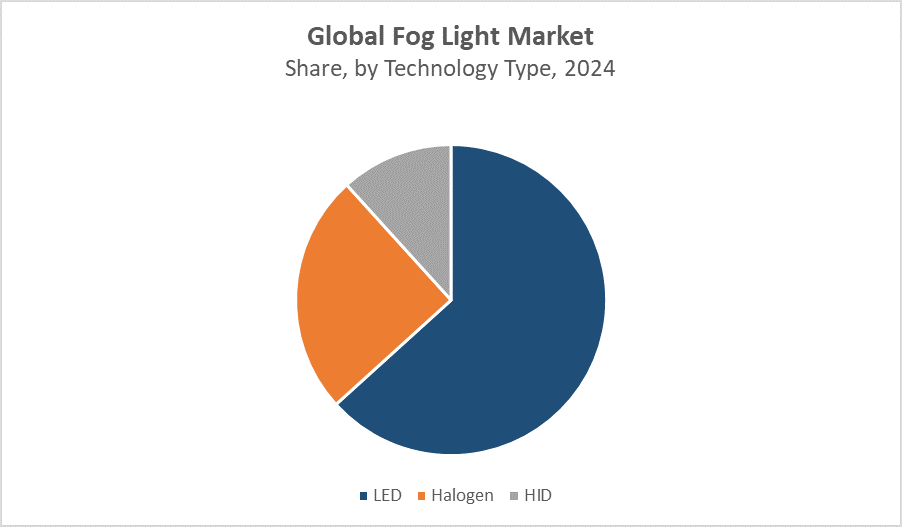

- The LED technology segment is expected to dominate the fog light market, attributed to its energy efficiency, longer lifespan, and superior illumination capabilities.

- Passenger cars account for the largest share of the market due to high production volumes and growing consumer preference for enhanced safety features.

- Adoption of fog lights in commercial vehicles, including light and heavy commercial vehicles, is also increasing, driven by regulatory safety standards and fleet modernization.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4.32 Billion

- 2035 Projected Market Size: USD 6.67 Billion

- CAGR (2025-2035): 4.03%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Fog Light Market

The Fog Light Market Size focuses on producing and integrating lighting systems that improve visibility during foggy or poor weather conditions, helping reduce road accidents by enhancing driver vision. A major trend driving this market is the shift toward LED technology, which provides better illumination, greater energy efficiency, and longer lifespan compared to traditional halogen and HID lights. Globally, stricter vehicle safety standards are encouraging automakers to adopt advanced fog lighting systems, further boosting demand. Technological innovations in automotive lighting, such as adaptive and smart lighting solutions, are also contributing to market growth. As drivers and manufacturers prioritize safety and efficiency, fog lights are becoming essential features across passenger and commercial vehicles, reinforcing their importance in modern vehicle design and safety protocols.

Fog Light Market Trends

- Growing adoption of LED fog lights due to their durability and low power consumption.

- Integration of smart lighting systems with vehicle sensors for adaptive lighting control.

- Rising aftermarket demand for fog light upgrades and replacements.

Fog Light Market Dynamics

Driving Factors: Rise in adverse weather conditions such as fog

The fog light market is growing due to increasing vehicle production worldwide and stricter safety regulations that mandate fog light installation. Consumers are also prioritizing enhanced road safety, driving demand for better lighting solutions. Additionally, the rise in adverse weather conditions such as fog, rain, and snow increase the need for reliable fog lights. Growing awareness about road safety and accident prevention further supports market expansion, encouraging automakers to integrate advanced fog lighting systems in new vehicles.

Restraining Factors: Market growth is hindered by the high costs of advanced lighting technologies like LED and HID

Market growth is hindered by the high costs of advanced lighting technologies like LED and HID, which can make fog lights expensive for some consumers and manufacturers. Competition from alternative lighting solutions, such as daytime running lights or adaptive headlights, also limits demand. Additionally, regulatory differences across regions create challenges for standardized product adoption, slowing market penetration. These factors combined can restrict overall growth, especially in price-sensitive and emerging markets.

Opportunity: Expanding commercial vehicle segment is adopting advanced fog lighting

There is significant growth potential in developing smart, adaptive fog light systems integrated with autonomous driving and sensor technologies. These innovations enhance safety by automatically adjusting lighting based on driving conditions. The aftermarket sector presents another opportunity, as vehicle owners seek upgrades or replacements. Additionally, the expanding commercial vehicle segment is adopting advanced fog lighting for better visibility and safety, creating new markets and revenue streams for manufacturers.

Challenges: Supply chain disruptions caused by raw material shortages

Key challenges include the high costs of LED and HID lighting technologies, which may limit affordability and widespread use. Supply chain disruptions caused by raw material shortages or geopolitical issues can delay production and increase prices. Furthermore, the lack of uniform global regulations makes it difficult to standardize fog light requirements, complicating market expansion and product development. These challenges require manufacturers to innovate and adapt to maintain competitiveness and meet diverse market needs.

Global Fog Light Market Ecosystem Analysis

The global fog light market ecosystem consists of raw material suppliers, lighting system manufacturers, automotive OEMs, and aftermarket distributors. These players collaborate to develop and supply fog lighting solutions for various vehicle types. Leading companies prioritize technological innovation and form strategic partnerships to enhance product offerings and expand their market presence. Meanwhile, regulatory bodies enforce safety standards that drive the adoption of fog lights, ensuring improved visibility and road safety. This interconnected ecosystem supports continuous market growth and product advancement.

Global Fog Light Market, By Technology Type

What key advantages helped LED fog lights outperform other lighting technologies in the market?

LED technology leads the fog light market, accounting for approximately 55% of the global market share, due to its superior energy efficiency, longer lifespan, and enhanced illumination capabilities compared to traditional halogen and HID lights. LEDs provide better visibility in adverse weather conditions, consume less power, and require less maintenance, making them an ideal choice for both manufacturers and consumers. The rising demand for advanced vehicle lighting systems, along with the growing adoption of LEDs in modern automotive design, has further fueled their dominance in the fog light segment.

Get more details on this report -

How did halogen fog lights manage to secure approximately 35% market share despite the rise of LED technology?

Halogen fog lights hold around 35% of the global fog light market share due to their cost-effectiveness, widespread availability, and ease of replacement. Despite the rise of more advanced technologies like LEDs, halogen lights remain a popular choice, especially in budget and mid-range vehicles, where affordability is a key factor. Their simple design, compatibility with older vehicle models, and established manufacturing infrastructure have also contributed to their sustained presence in the market. These factors enable halogen fog lights to retain a significant share, even as the market gradually shifts toward newer lighting technologies.

Global Fog Light Market, By Vehicle Type

Why were fog lights more widely adopted in passenger cars than in other vehicle segments?

Passenger cars dominate the fog light market, holding approximately 65% of the global market share, primarily due to their high production volume and growing consumer demand for enhanced safety and visibility features. Manufacturers increasingly integrate fog lights as standard or optional features in passenger vehicles to improve driving safety in poor weather conditions. Additionally, the rising popularity of premium styling and advanced lighting systems in passenger vehicles has further driven fog light adoption. With the global expansion of the automotive industry and increasing vehicle ownership, especially in developing regions, passenger cars continue to be the leading segment in fog light installations.

What contributed to commercial vehicles capturing approximately 35% of the fog light market share?

Commercial vehicles account for around 35% of the fog light market share due to the growing emphasis on road safety and visibility for heavy-duty and long-distance transportation. Fog lights are increasingly being installed in commercial vehicles to reduce accident risks during adverse weather conditions, such as fog, rain, and snow. Additionally, regulatory pressures and fleet operators’ focus on minimizing downtime and enhancing driver safety have driven adoption. As logistics and construction industries expand globally, the demand for well-equipped commercial vehicles continues to rise, supporting their substantial share in the fog light market.

Asia Pacific holds the largest share of the fog light market, accounting for approximately 43% of global revenue. This leadership is driven by rapid vehicle production growth in major markets like China, India, and Japan. Expanding automotive manufacturing, rising consumer awareness about safety features, and favorable government regulations further boost demand. The region’s cost advantages in manufacturing and strong aftermarket presence also support its dominant position.

Europe holds approximately 22% of the global fog light market share. The region benefits from a well-established automotive industry and stringent safety regulations that mandate the use of fog lights in many vehicle categories. Countries like Germany, France, and the UK lead in vehicle production and adoption of advanced lighting technologies. European consumers prioritize safety and vehicle performance, driving demand for high-quality fog light systems. Additionally, strong OEM presence and innovation in automotive lighting contribute to consistent market growth across the region.

Global Fog Light Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.32 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.03% |

| 2035 Value Projection: | USD 6.67 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 251 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Vehicle Type, By Technology Type |

| Companies covered:: | OSRAM GmbH, HELLA GmbH & Co. KGaA, Philips Lighting, Koito Manufacturing Co., Ltd., Stanley Electric Co., Ltd., Valeo SA, Magneti Marelli S.p.A., ZKW Group, Hyundai Mobis, Lumileds Holding B.V., and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

WORLDWIDE TOP KEY PLAYERS IN THE FOG LIGHT MARKET INCLUDE

- OSRAM GmbH

- HELLA GmbH & Co. KGaA

- Philips Lighting

- Koito Manufacturing Co., Ltd.

- Stanley Electric Co., Ltd.

- Valeo SA

- Magneti Marelli S.p.A.

- ZKW Group

- Hyundai Mobis

- Lumileds Holding B.V.

- Others

Product Launches in Fog Light Market

- In October 2023, HELLA launched a new series of LED fog lights designed for energy-efficient and high-performance use in both passenger and commercial vehicles. These lights aim to improve visibility in challenging weather conditions while reducing power consumption. The product line reflects HELLA’s commitment to advancing automotive lighting technology and aligns with the industry's shift toward sustainable and high-efficiency LED solutions. This launch also strengthens HELLA’s position in the growing market for advanced vehicle safety systems.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the fog light market based on the below-mentioned segments:

Global Fog Light Market, By Technology Type

- LED

- Halogen

- HID

Global Fog Light Market, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Global Fog Light Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Global Fog Light Market in 2024?The Global Fog Light Market size was estimated at USD 4.32 billion in 2024.

-

What is the forecasted CAGR of the Global Fog Light Market from 2025 to 2035?The market is expected to grow at a CAGR of 4.03% during the period 2025–2035.

-

What is the projected market size of the Global Fog Light Market by 2035?The market size is forecasted to reach USD 6.67 billion by 2035.

-

Which fog light technology segment is expected to dominate the market?The LED technology segment is expected to dominate, accounting for approximately 55% of the global market share due to its energy efficiency, longer lifespan, and superior illumination.

-

Why do halogen fog lights still hold a significant market share despite the rise of LED technology?Halogen fog lights hold about 35% market share because they are cost-effective, widely available, easy to replace, and popular in budget and mid-range vehicles.

-

Which vehicle type accounts for the largest share in the fog light market?Passenger cars account for the largest share, approximately 65%, driven by high production volumes and consumer demand for enhanced safety features.

-

What share do commercial vehicles hold in the fog light market?Commercial vehicles, including light and heavy commercial vehicles, hold around 35% of the market share due to regulatory safety standards and fleet modernization efforts.

-

Which region holds the largest share of the fog light market?Asia Pacific is the largest market, accounting for approximately 43% of global revenue, driven by rapid vehicle production in China, India, and Japan.

-

Which region is the fastest growing in the fog light market?Europe is the fastest growing market, benefiting from stringent safety regulations and a strong automotive industry.

-

What are the main drivers for growth in the Global Fog Light Market?Key drivers include increasing vehicle production worldwide, rising demand for advanced lighting technologies, and growing awareness about safety in adverse weather conditions.

-

What are the key challenges facing the Global Fog Light Market?Challenges include high costs of advanced lighting technologies like LED and HID, supply chain disruptions, and lack of uniform global regulations for fog light standards.

Need help to buy this report?