Global Fluoropolymer Tubing Market Size By Material (PTFE, FEP, PFA), By Application (Aerospace, Automotive, Medical), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Chemicals & MaterialsGlobal Fluoropolymer Tubing Market Insights Forecasts to 2033

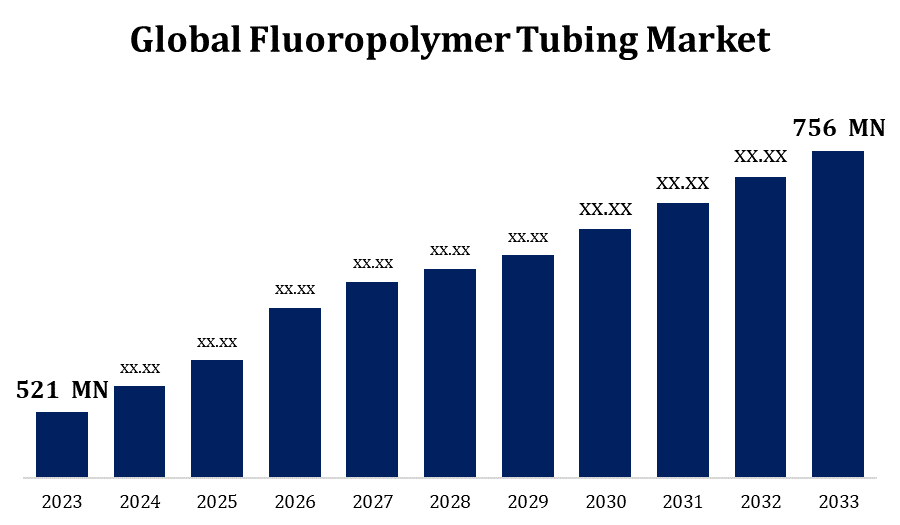

- The Global Fluoropolymer Tubing Market Size was valued at USD 521 Million in 2023.

- The Market Size is Growing at a CAGR of 3.79% from 2023 to 2033

- The Worldwide Fluoropolymer Tubing Market is expected to reach USD 756 Million by 2033

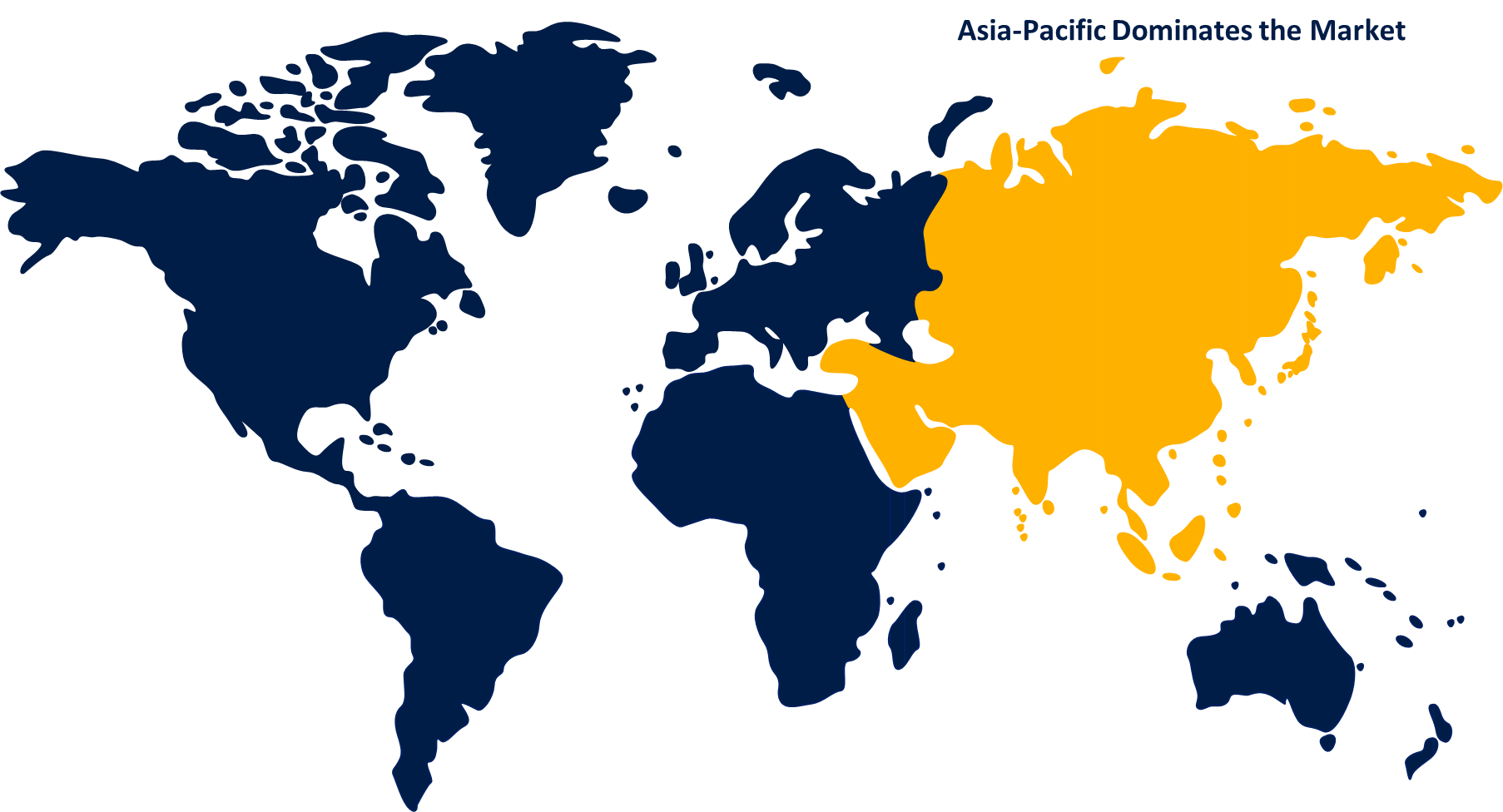

- Asia Pacific is expected to Grow the fastest during the Forecast period

Get more details on this report -

The Global Fluoropolymer Tubing Market Size is expected to reach USD 756 Million by 2033, at a CAGR of 3.79% during the Forecast period 2023 to 2033.

Several factors contribute to the growth of the fluoropolymer tubing market. For starters, the growing demand for high-performance materials in industries such as automotive, electronics, and medicine is propelling the use of fluoropolymer tubing. These tubes are ideal for a variety of applications because to their good chemical resistance, thermal stability, and minimal friction. Furthermore, the growing electronics and semiconductor industries, where fluoropolymer tubing is used for applications such as wire and cable insulation, are driving market expansion. Fluoropolymer tubing is becoming increasingly used in healthcare applications like pharmaceutical manufacture and medical equipment. Furthermore, as more people become aware of the benefits of fluoropolymer tubing, such as its capacity to tolerate harsh chemical conditions and extreme temperatures, its use is increasing across industries.

Fluoropolymer Tubing Market Value Chain Analysis

The value chain begins with raw material providers, typically fluoropolymers such as PTFE, FEP, and PFA. These suppliers may offer resins, additives, and other components required for the production of fluoropolymer tubing. Manufacturers of fluoropolymer tubing play an important role. They start with raw materials and then use specialised techniques like extrusion or moulding to create tube in a variety of shapes and sizes. The tubing is subsequently manufactured and distributed to various end-users via a network of distributors, wholesalers, or directly to original equipment manufacturers (OEMs). In this stage, logistics and transportation are critical. Fluoropolymer tubing is used in a variety of industries, including electronics, automotive, medical, chemical processing, and more. Manufacturers of electronic components, medical gadgets, chemical processing equipment, and other products may be end users.

Fluoropolymer Tubing Market Opportunity Analysis

High-performance materials are in high demand due to the rising complexity and miniaturisation of electronic components. With its high electrical qualities and chemical resistance, fluoropolymer tubing represents a substantial opportunity in this booming area. Fluoropolymer tubing is expected to increase significantly due to the growing need for medical devices and pharmaceutical manufacturing. Because of its biocompatibility and chemical resistance, it is widely employed in applications such as catheters, fluid transfer systems, and medical tubing. As the automobile industry evolves with electric vehicles and complex fuel systems, there is a growing demand for long-lasting and dependable tubing. Fluoropolymer tubing, which is resistant to fuels and chemicals, offers chances in this fast-paced industry. Because of its resistance to corrosive substances, fluoropolymer tubing is an important component.

Global Fluoropolymer Tubing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 521 million |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 3.79% |

| 022 – 2032 Value Projection: | USD 756 million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Material, By Application, By Region, By Geographic Scope And Forecast to 2033. |

| Companies covered:: | Saint-Gobain (France), Optinova (Finland), TE Connectivity (Switzerland), Teleflex Inc. (US), Tef-Cap Industries (US), Zeus Industrial Products (US), Fluorotherm (US), and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Fluoropolymer Tubing Market Dynamics

Growing demand from the medical and semiconductor industry

Because of its superior biocompatibility and chemical resistance, fluoropolymer tubing is widely employed in medical applications. It is required for catheters, fluid transfer systems, and surgical instruments. The medical business demands high precision and dependability from its equipment. Fluoropolymer tubing fits these requirements because to its consistent performance and longevity, making it a popular choice among medical device manufacturers. Fluid transfer accuracy and safety are critical in medical applications. Fluoropolymer tubing protects fluid transfer systems by preventing contamination and preserving the purity of medications and other medical fluids. The electrical insulating qualities of fluoropolymer tubing, particularly PTFE, are good. This is critical in the semiconductor sector, where electrical process precision and control are critical.

Restraints & Challenges

Certain sectors may be unaware of the advantages of fluoropolymer tubing. It is critical for market expansion to educate potential clients about the benefits and applications of these materials. Global catastrophes such as pandemics or geopolitical tensions, as seen recently, can affect supply networks. The fluoropolymer tubing market is vulnerable to such disruptions since it is reliant on raw materials and global delivery. The pricing of raw ingredients, particularly fluoropolymers, might fluctuate. This volatility can have an impact on the whole cost structure of manufacturers, necessitating proactive planning to reduce risks. Fluoropolymer tubing is produced using specialised methods and raw ingredients, which results in increased manufacturing costs. This cost component can be difficult to manage, particularly in price-sensitive businesses.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Fluoropolymer Tubing Market from 2023 to 2033. The region is home to numerous large manufacturers and consumers of fluoropolymer tubing, which contributes to its industry supremacy. In North America, the demand for fluoropolymer tubing is particularly high in sectors such as electronics and healthcare. High-performance tubing is in high demand due to the region's advanced electronics sector and ongoing innovation in medical equipment. North America's diversified industrial landscape, which includes automotive, chemical processing, and aerospace, gives potential for fluoropolymer tubing in a variety of applications.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region, particularly China and India, is seeing tremendous industrialization. This industrial expansion increases the demand for high-performance materials, such as fluoropolymer tubing, in a variety of applications across industries. Asia-Pacific is a global manufacturing powerhouse for electronics. Due to its use in cable insulation, semiconductor production, and electronic components, the demand for fluoropolymer tubing is high in this region. The Asia-Pacific healthcare and medical device sectors are growing. Fluoropolymer tubing is widely utilised in medical applications, and rising healthcare infrastructure in countries such as China and India is driving up demand.

Segmentation Analysis

Insights by Material

The FEP segment accounted for the largest market share over the forecast period 2023 to 2033. In the electronics and semiconductor sectors, FEP tubing is commonly utilised. Its outstanding electrical insulation capabilities and high temperature resistance make it perfect for wire and cable insulation, semiconductor production, and electronic component protection. FEP tubing is widely used in the medical and healthcare industries. It's used in things like medical tubing, catheters, and fluid transfer systems. The biocompatibility and transparency of FEP are helpful in medical applications that require clarity and purity. FEP tubing is highly valued in the chemical processing industry due to its resistance to corrosive substances. It is used to handle and transport corrosive chemicals, acids, and solvents. The durability and chemical inertness of the tubing lead to its expansion in this industry.

Insights by Application

The medical tubing segment accounted for the largest market share over the forecast period 2023 to 2033. Biocompatibility is well known for medical tubing composed of fluoropolymers such as PTFE (Polytetrafluoroethylene) and FEP (Fluorinated Ethylene Propylene). This is critical in medical applications because it ensures that the tubing does not produce unwanted reactions when it comes into contact with living tissues. Fluoropolymer medical tubing can survive a wide temperature range. This property is useful in medical treatments where temperature control is crucial, such as in thermal therapy medical equipment. To avoid contamination, medical applications frequently demand high-purity materials. Fluoropolymer medical tubing is noted for its low extractables and purity, making it ideal for use in pharmaceutical manufacture and other medical operations that need product purity.

Recent Market Developments

- In March 2020, within its StreamLiner family of thin, extruded PTFE catheter liners for the medical industry, Zeus Industrial Company introduced StreamLiner OTW.

Competitive Landscape

Major players in the market

- Saint-Gobain (France)

- Optinova (Finland)

- TE Connectivity (Switzerland)

- Teleflex Inc. (US)

- Tef-Cap Industries (US)

- Zeus Industrial Products (US)

- Fluorotherm (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Fluoropolymer Tubing Market, Material Analysis

- PTFE

- FEP

- PFA

Fluoropolymer Tubing Market, Application Analysis

- Aerospace

- Automotive

- Medical

Fluoropolymer Tubing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Fluoropolymer Tubing Market?The global Fluoropolymer Tubing Market is expected to grow from USD 521 million in 2023 to USD 756 million by 2033, at a CAGR of 3.79% during the forecast period 2023-2033.

-

2. Who are the key market players of the Fluoropolymer Tubing Market?Some of the key market players of market are Saint-Gobain (France), Optinova (Finland), TE Connectivity (Switzerland), Teleflex Inc. (US), Tef-Cap Industries (US), Zeus Industrial Products (US), Fluorotherm (US).

-

3. Which segment holds the largest market share?The FEP segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Fluoropolymer Tubing Market?North America is dominating the Fluoropolymer Tubing Market with the highest market share.

Need help to buy this report?