Global Flue Gas Treatment Systems Market Size, Share, and COVID-19 Impact Analysis, By Type of Business (System and Service), By Pollutant Control System (FGD, DeNOx, Particulate Control, and Mercury Control), By End User (Cement, Power, Iron, and Steel), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Energy & PowerGlobal Flue Gas Treatment Systems Market Insights Forecasts to 2035

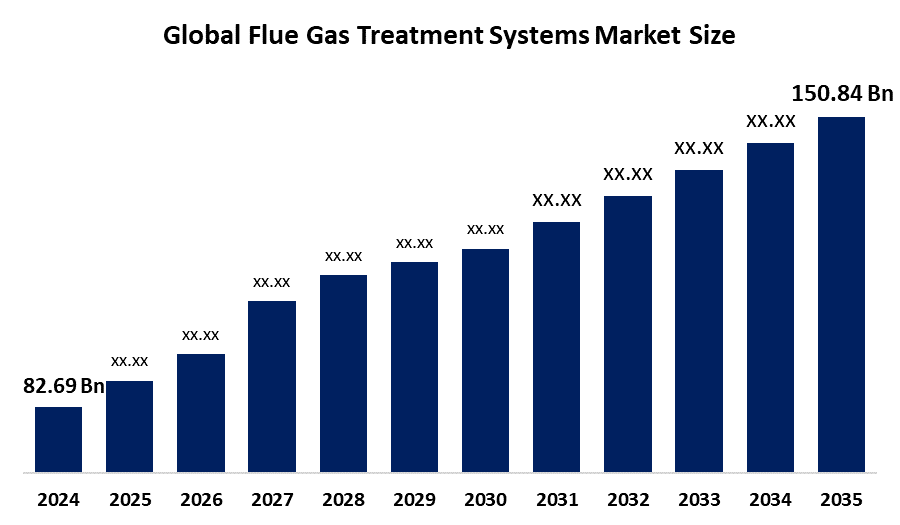

- The Global Flue Gas Treatment Systems Market Size Was Estimated at USD 82.69 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.62% from 2025 to 2035

- The Worldwide Flue Gas Treatment Systems Market Size is Expected to Reach USD 150.84 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global flue gas treatment systems market size was worth around USD 82.69 billion in 2024 and is predicted to grow to around USD 150.84 billion by 2035 with a compound annual growth rate (CAGR) of 5.62% from 2025 to 2035. The flue gas treatment systems market is primarily growing due to increasingly stringent environmental regulations on industrial emissions, rising public awareness of air quality concerns, and ongoing industrialization in emerging economies.

Market Overview

The Global Flue Gas Treatment Systems Market Size refers to technologies and equipment designed to remove harmful pollutants, such as sulfur dioxide, nitrogen oxides, and particulate matter, from industrial exhaust gases before they are released into the atmosphere. These systems are essential across a wide range of industries, including power generation, cement manufacturing, and chemical processing. The market is primarily driven by increasingly stringent environmental regulations worldwide, such as the U.S. Clean Air Act and the European Industrial Emissions Directive, which mandate lower emissions to improve air quality and public health. Other key drivers include growing industrialization, particularly in the Asia Pacific region, and rising awareness of air pollution's environmental and health impacts.

In July 2025, India’s Ministry of Environment, Forest and Climate Change (MoEF&CC) revised 2015 emission standards, mandating flue gas desulphurisation (FGD) systems only for coal-fired plants within 10 km of major cities, critically polluted areas, or using high sulphur imported coal. The update is expected to cover 79% of thermal facilities, reduce generation costs by 25-30 paisa/kWh, and cut sulfur dioxide emissions. Opportunities in the market stem from technological advancements, such as the integration of IoT for real-time emission monitoring, and the growing focus on sustainable solutions such as Carbon Capture and Storage (CCS) technologies. Major players, including GEA, Babcock & Wilcox, Mitsubishi Hitachi, Thermax, FLSmidth, Alstom, Ducon, and Doosan Lentjes, provide advanced flue gas treatment solutions for regulatory compliance.

Report Coverage

This research report categorizes the flue gas treatment systems market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the flue gas treatment systems market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the flue gas treatment systems market.

Global Flue Gas Treatment Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 82.69 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.62% |

| 2035 Value Projection: | USD 150.84 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type of Business, By Region |

| Companies covered:: | General Electric (GE) Siemens AG Mitsubishi Heavy Industries, Ltd. FLSmidth & Co. A/S Ducon Technologies Inc. Thermax Limited Andritz AG Hamon Group GEA Valmet Corporation Johnson Matthey PLC Babcock & Wilcox Enterprises, Inc. Doosan Lentjes GmbH Kawasaki Heavy Industries, Ltd. and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global flue gas treatment systems market size is driven by increasingly stringent environmental regulations aimed at reducing air pollution from industrial facilities, power plants, and waste incinerators. Growing awareness of public health impacts caused by sulfur oxides, nitrogen oxides, particulate matter, and mercury emissions is prompting industries to adopt advanced emission-control technologies. Rapid industrialization, particularly in developing economies, further drives demand for efficient air pollution control systems. Additionally, the trend toward cleaner energy production, rising investments in pollution-control infrastructure, and ongoing technological advancements such as improved filtration, scrubbing efficiency, and multi-pollutant removal capabilities further drive market growth. Sustainability has emerged as a key issue for companies in most industries, accelerating the adoption of such systems.

Restraining Factors

Some of the limiting factors the flue gas treatment systems market size faces include a high installation and operational cost, which restricts the industries to the small and medium categories. Further, complicated regulatory compliance, increased maintenance demands, and the need for skilled labor hamper the growth. Also, price fluctuation of raw materials and the slow modernization of aging industrial infrastructures are some other challenges.

Market Segmentation

The flue gas treatment systems market share is classified into type of business, pollutant control system, and end user.

- The system segment dominated the market in 2024, approximately 65% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type of business, the flue gas treatment systems market is divided into system and service. Among these, the system segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The system segment dominated the flue gas treatment systems market due to growing demand for complete installations of emission control systems such as FGD, SCR, and electrostatic precipitators. The strong adoption rate, on the back of stringent environmental laws, industrialization, and the need for compliance with air quality standards, makes system solutions important for reducing the number of pollutants in the power, cement, and steel industries.

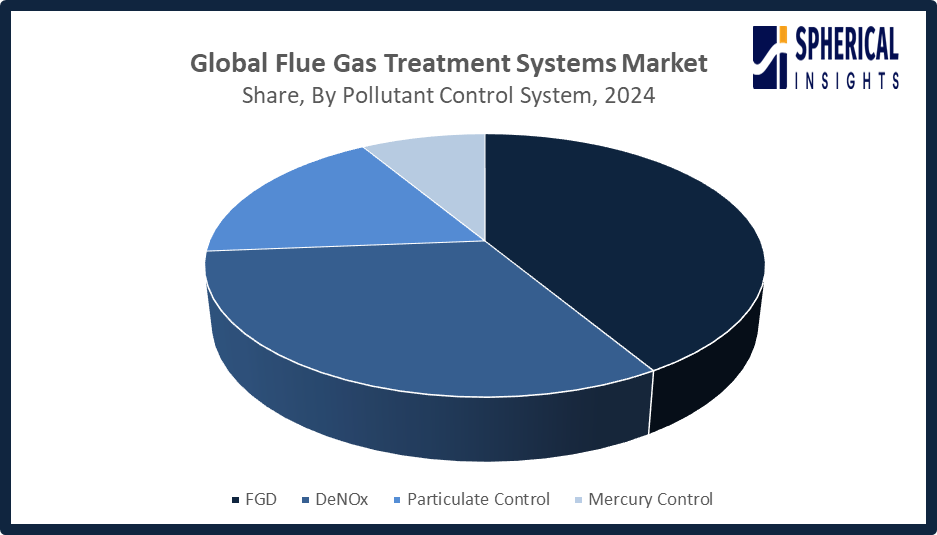

- he FGD segment accounted for the largest share in 2024, approximately 41% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the pollutant control system, the flue gas treatment systems market is divided into FGD, DeNOx, particulate control, and mercury control. Among these, the FGD segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Segment growth of flue gas desulfurization (FGD) is driven by the stringent sulfur dioxide emission regulations related to coal-fired power plants. Increasing energy demand, government mandates for cleaner air, and the adoption of FGD systems in emerging economies further drove the growth, making it a critical solution for industrial emission control.

Get more details on this report -

- The power segment accounted for the highest market revenue in 2024, approximately 50% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the flue gas treatment systems market is divided into cement, power, iron, and steel. Among these, the power segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The power generation segment drives the growth of the flue gas treatment systems market, as there has been a wide usage of coal-fired power plants and stringent emission regulations. Growing demand for electricity, government initiatives towards cleaner energy, and the need to reduce sulfur dioxide, nitrogen oxides, and particulate matter emissions significantly fueled market growth for this sector.

Regional Segment Analysis of the Flue Gas Treatment Systems Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the flue gas treatment systems market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the flue gas treatment systems market over the predicted timeframe. Asia Pacific is expected to have a 45% share in the flue gas treatment systems market due to rapid industrialization, urbanization, and high coal-based power generation in emerging economies such as China and India. The strict regulations set by governments for sulfur dioxide, nitrogen oxides, and particulate emissions accelerate the adoption of technologies such as FGD, SCR, and electrostatic precipitators. National programs for cleaner air quality, in addition to growing electricity demand and expanding cement and steel industries, further fuel the growth of the market, hence making the Asia Pacific the dominant regional market for flue gas treatment systems.

North America is expected to grow at a rapid CAGR in the flue gas treatment systems market during the forecast period. North America is rapidly growing in the flue gas treatment systems, with an approximate 20% market share, propelled mainly by the United States. The country enforces strict environmental policies and regulations, such as the EPA's set emission standards, which accelerate the adoption of improved flue gas treatment technologies such as FGD, SCR, and particulate control systems in power, cement, and industrial sectors. Further, growing investments in pollution control at various industries, retrofitting of old plants, and emphasis on clean energy production are accelerating market growth and making North America a regional high-growth area. In January 2024, the U.S. launched the Waste Emissions Charge under the Inflation Reduction Act, targeting excess methane from oil and gas facilities. Complementary EPA rules mandate 90% Carbon Dioxide capture at power plants, with $850 million in grants supporting methane abatement, including flue gas treatment technologies.

Europe’s flue gas treatment systems market is growing steadily, with Germany, the UK, and France leading the market due to strict EU regulations. Such regulations include emissions standards according to the Industrial Emissions Directive. Demand for FGD, SCR, and particulate control systems is increasing due to the necessity for lowering sulfur dioxide, nitrogen oxides, and particulate matter from coal-fired power plants and industrial facilities. Additionally, the investment in cleaner energy and retrofitting of ageing infrastructure adds to growth in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the flue gas treatment systems market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Electric (GE)

- Siemens AG

- Mitsubishi Heavy Industries, Ltd.

- FLSmidth & Co. A/S

- Ducon Technologies Inc.

- Thermax Limited

- Andritz AG

- Hamon Group

- GEA

- Valmet Corporation

- Johnson Matthey PLC

- Babcock & Wilcox Enterprises, Inc.

- Doosan Lentjes GmbH

- Kawasaki Heavy Industries, Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Ducon Infratechnologies Ltd. began R&D for a next-generation solvent-based carbon capture technology. The initiative targets scalable, cost-effective Carbon Dioxide capture from flue gas streams in power, cement, steel, oil & gas, and other hard-to-abate industries, aiming to enhance sustainability and reduce industrial emissions.

- In July 2025, Valmet received an order from Saica Group to supply a biomass BFB boiler and flue gas cleaning system for its El Burgo de Ebro plant, Spain. The system, operational by late 2026, will produce over 700,000 tonnes of steam annually, reducing fossil fuel use and Carbon dioxide emissions.

- In May 2025, Technische Betriebe Solingen (TBS) awarded ANDRITZ a contract to upgrade the flue gas cleaning system at their waste-to-energy plant. The project aims to improve efficiency and environmental performance, supporting regional sustainability goals, and is included in ANDRITZ’s Q1 2025 order intake.

- In April 2024, ANDRITZ received an order from Billerud AB to supply a flue gas treatment system for its Gruvon mill. The ESP with Switched Integrated Rectifier (SIR) technology enhances boiler output, reduces emissions, and enables soda recovery reuse, supporting efficient and sustainable pulp production.

- In August 2021, Valmet enhanced its wet flue gas desulfurization (FGD) technology to capture both sulfur oxide and nitric oxide sustainably and cost-effectively. With stricter global environmental regulations, energy and pulp & paper producers seek improved emission control solutions that minimize chemical and water use while ensuring regulatory compliance.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the flue gas treatment systems market based on the below-mentioned segments:

Global Flue Gas Treatment Systems Market, By Type of Business

- System

- Service

Global Flue Gas Treatment Systems Market, By Pollutant Control System

- FGD

- DeNOx

- Particulate Control

- Mercury Control

Global Flue Gas Treatment Systems Market, By End User

- Cement

- Power

- Iron

- Steel

Global Flue Gas Treatment Systems Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the flue gas treatment systems market over the forecast period?The global flue gas treatment systems market is projected to expand at a CAGR of 5.62% during the forecast period.

-

2. What is the market size of the flue gas treatment systems market?The global flue gas treatment systems market size is expected to grow from USD 82.69 billion in 2024 to USD 150.84 billion by 2035, at a CAGR of 5.62% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the flue gas treatment systems market?Asia Pacific is anticipated to hold the largest share of the flue gas treatment systems market over the predicted timeframe.

-

4. What is the flue gas treatment systems market?The flue gas treatment systems market refers to the industry that develops and sells equipment and technologies designed to remove pollutants from industrial exhaust gases before they are released into the atmosphere.

-

5. Who are the top 10 companies operating in the global flue gas treatment systems market?General Electric (GE), Siemens AG, Mitsubishi Heavy Industries, Ltd., FLSmidth & Co. A/S, Ducon Technologies Inc., Thermax Limited, Andritz AG, Hamon Group, GEA, Valmet Corporation, Johnson Matthey PLC, and Others.

-

6. What factors are driving the growth of the flue gas treatment systems market?6. What factors are driving the growth of the flue gas treatment systems market?

-

7. What are the market trends in the flue gas treatment systems market?Market trends in flue gas treatment systems include a shift towards sustainable and low-carbon technologies, the integration of AI and IoT for real-time monitoring and control, and the expansion of carbon capture and storage (CCS) solutions.

-

8. What are the main challenges restricting wider adoption of the flue gas treatment systems market?The main challenges restricting the wider adoption of flue gas treatment (FGT) systems are the high costs associated with installation and operation, the technical complexity of integrating systems into existing infrastructure, and varying/complex regulatory landscapes.

Need help to buy this report?