Global Flow Assurance in Oil and Gas Market Size, Share, and COVID-19 Impact Analysis, By Type (Steady State Simulation, and Transient State Simulation), By Application (Scale Management, Asphaltene Management, Hydrate Prevention, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Energy & PowerGlobal Flow Assurance in Oil and Gas Market Insights Forecasts to 2035

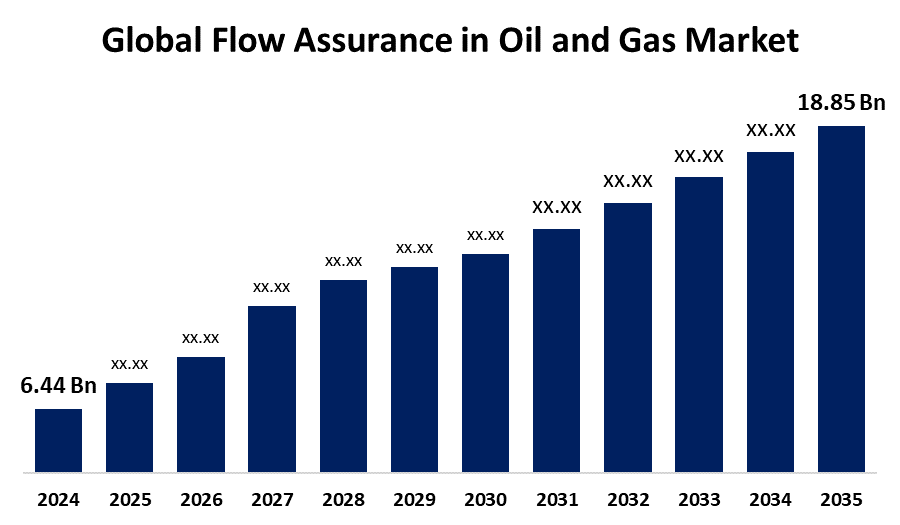

- The Global Flow Assurance in Oil and Gas Market Size Was Estimated at USD 6.44 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.26% from 2025 to 2035

- The Worldwide Flow Assurance in Oil and Gas Market Size is Expected to Reach USD 18.85 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Flow Assurance in Oil and Gas Market Size was Worth around USD 6.44 Billion in 2024 and is Predicted to Grow to around USD 18.85 Billion by 2035 with a compound annual growth rate (CAGR) of 10.26% from 2025 and 2035. AI-driven predictive analytics, sophisticated chemical inhibitors, real-time monitoring, automation, improved pipeline integrity, and sustainable practices are some of the emerging trends in flow assurance in the oil and gas market.

Market Overview

The discipline that guarantees the efficient and continuous movement of hydrocarbons from reservoirs to processing facilities is known as "flow assurance in oil and gas" market. They involved flowlines including hydrate development, scale building, corrosion, asphaltene precipitation, and wax deposition. Flow assurance reduces hazards through engineering solutions, chemical treatments, and operational plans to preserve pipeline integrity and ideal output levels. A crucial component of the oil and gas sector, as well as other sectors that include the movement of fluids via pipelines or other carriers, is flow assurance.

Flow assurance in the oil and gas market supports effective hydrocarbon transportation and operational dependability by offering opportunities in advanced chemical solutions, predictive analytics, improved pipeline integrity, sustainable practices, cost optimization, and technology advances. Rising energy consumption, strict environmental restrictions, complicated reservoirs and fields, increasing automation, and technical improvements are some of the factors driving the flow assurance in the oil and gas market growth. One of the main development factors for the worldwide flow assurance in the oil and gas market is the increasing demand for oil and related resources.

Report Coverage

This research report categorizes the flow assurance in the oil and gas market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the flow assurance in the oil and gas market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the flow assurance in the oil and gas market.

Global Flow Assurance in Oil and Gas Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.44 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 10.26% |

| 2035 Value Projection: | USD 18.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Type, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Baker Hughes Company, SLB, SGS, ROSEN Group, ESSS, Intertek Group plc, GATE Energy, AMOG CONSULTING, METTLER TOLEDO, Exxon Mobil Corporation, Oceaneering International, Inc.,and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The flow assurance oil and gas market is driven by the growing demand for energy, aging infrastructure, and environmental laws. The development of increasingly distant and unconventional oil and gas deposits is a result of the world's ongoing energy demand growth. The significance of flow assurance in gas and oil, which guarantees the continuous and effective transportation of hydrocarbons, is one of the main motivators. The massive global output of gas and oil, which is fueled by the rising need for energy, is largely responsible for supporting flow assurance in the oil and gas market growth.

Restraining Factors

Operating budgets may be strained by the expense of chemical inhibitors, insulation, heating systems, monitoring devices, and maintenance. As a result, it is anticipated that could restrict the flow assurance in the oil and gas market.

Market Segmentation

The flow assurance in the oil and gas market share is classified into type and application.

- The steady state simulation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the flow assurance in the oil and gas market is divided into steady state simulation, and transient state simulation. Among these, the steady state simulation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. An essential tool for flow assurance is steady-state simulation, which helps engineers and operators in simulating and analyzing the behavior of fluids in production systems and pipelines under steady-state circumstances. The hydraulic behavior of production systems and pipelines is examined using steady state simulation.

- The scale management segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the flow assurance in the oil and gas market is divided into scale management, asphaltene management, hydrate prevention, and others. Among these, the scale management segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Experts in flow assurance assess the possibility of scale management in equipment and pipelines using modeling approaches and analytical tools. They forecast the likelihood of scaling based on variables like fluid composition, temperature, pressure, and flow rate. Consequently, this is anticipated to drive the expansion of the scale management market.

Regional Segment Analysis of the Flow Assurance in Oil and Gas Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the flow assurance in the oil and gas market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the flow assurance in the oil and gas market over the predicted timeframe. The increasing output of shale gas is credited to the North American region. Particularly in the Permian Basin in Texas and New Mexico, the area is well-known for its vast shale oil and gas potential. In these regions, flow assurance is crucial for effectively managing the production and transportation of unconventional hydrocarbons. The market's expansion is further supported by the general technical innovation and its quick adoption.

Asia Pacific is expected to grow at a rapid CAGR in the flow assurance in the oil and gas market during the forecast period. The growth of vast pipeline networks, refineries, and LNG facilities throughout Asia also increased demand for flow assurance chemical inhibitors and services because these products are essential for preventing interruptions in the processing and transportation of hydrocarbons, which expands the market's reach in the area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the flow assurance in the oil and gas market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Baker Hughes Company

- SLB

- SGS

- ROSEN Group

- ESSS

- Intertek Group plc

- GATE Energy

- AMOG CONSULTING

- METTLER TOLEDO

- Exxon Mobil Corporation

- Oceaneering International, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2022, The modeling program Maximus 7.3 was launched by KBC, a Yokogawa company. This new edition enhances engineers' modeling abilities for the entire asset, from the reservoir to the facilities, by utilizing automated procedures and historical matching. Then, in order to optimize asset potential and reduce risks, project managers and production and flow assurance engineers can enhance design and operational techniques.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the flow assurance in the oil and gas market based on the below-mentioned segments:

Global Flow Assurance in Oil and Gas Market, By Type

- Steady State Simulation

- Transient State Simulation

Global Flow Assurance in Oil and Gas Market, By Application

- Scale Management

- Asphaltene Management

- Hydrate Prevention

- Others

Global Flow Assurance in Oil and Gas Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the flow assurance in the oil and gas market over the forecast period?The global flow assurance in the oil and gas market is projected to expand at a CAGR of 10.26% during the forecast period.

-

2. What is the market size of the flow assurance in the oil and gas market?The global flow assurance in the oil and gas market size is expected to grow from USD 6.44 Billion in 2024 to USD 18.85 Billion by 2035, at a CAGR of 10.26% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the flow assurance in the oil and gas market?North America is anticipated to hold the largest share of the flow assurance in the oil and gas market over the predicted timeframe.

Need help to buy this report?