Global Flat Panel Satellite Antenna Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Electronically Steered Antennas and Mechanically Steered Antennas), By Frequency Band (Ku-band, Ka-band, X-band, C-band, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Electronics, ICT & MediaGlobal Flat Panel Satellite Antenna Market Size Insights Forecasts to 2035

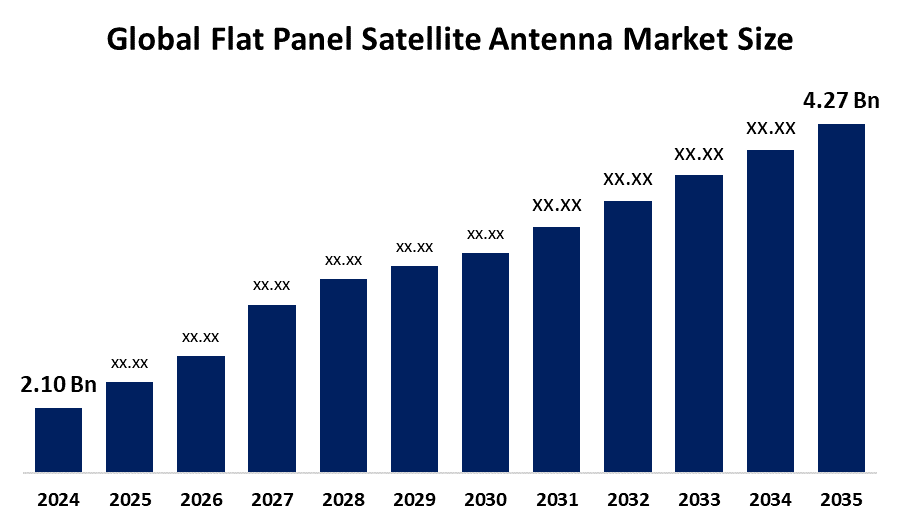

- The Global Flat Panel Satellite Antenna Market Size Was Estimated at USD 2.10 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.66% from 2025 to 2035

- The Worldwide Flat Panel Satellite Antenna Market Size is Expected to Reach USD 4.27 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Flat Panel Satellite Antenna Market Size was worth around USD 2.10 Billion in 2024 and is predicted to Grow to around USD 4.27 Billion by 2035 with a compound annual growth rate (CAGR) of 6.66% from 2025 and 2035. The market for flat panel satellite antenna has a number of opportunities to grow due to the growing need for dependable, fast connectivity in distant and mobile settings, the expanding usage of satellite communication technologies, the growing use of connected cars, and the growing use of these technologies in defense and aerospace applications.

Market Overview

A flat panel satellite antenna is a small, low profile antenna device that transmits and receives satellite signals without the use of conventional parabolic dishes by using electronically or mechanically steered beamforming technologies. The growth of this sector can be attributed mainly to the increasing demand for compact and lightweight antennas, particularly for satellite and mobile communication applications. Moreover, the revolution of 5G technology, which demands better connectivity, is further pushing the utilization of flat panel antennas. The transition to smart technology, especially IoT devices, is also driving demand for flat panel antennas due to advances in both efficiency and coverage. Globally, demand has risen sharply with the advent of a type of low earth orbit satellite which are used for the detection of frequency in space communication systems. According to CARSURANCE in 2020, the world had roughly 35.02 million autonomous vehicles. The dataset noted an approximate increase of 3.62 million from 31.4 million autonomous vehicles in 2019.

Governments everywhere are actively promoting the expansion of the market for flat panel satellite antennas by enacting legislative changes and specific initiatives. In the UK, the government gave £16 million in funding to businesses like Excelerate Technology and EnSilica to create mobile solutions and secure satellite terminals that would improve emergency and rural communications. Furthermore, the UK is collaborating with satellite companies such as OneWeb under it’s Very Hard to Reach Premises initiative to use cutting edge flat panel antenna systems to give high speed, low latency internet to isolated locations.

Report Coverage

This research report categorizes the flat panel satellite antenna market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the flat panel satellite antenna market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the flat panel satellite antenna market.

Global Flat Panel Satellite Antenna Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.10 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.66% |

| 2035 Value Projection: | USD 4.27 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 155 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By Frequency Band and COVID-19 Impact Analysis |

| Companies covered:: | Hanwha Phasor, TTI Norte, OneWeb, L3Harria Technologies, Ball Aerospace, RadioWaves, SatPro Tech, NXT Communications, ALCAN Systems, MTI Wireless Edge, C COM Satellites, Gilat Satellite Networks, China Starwin, ST Engineering, Inmarsat, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The flat panel satellite antenna market is driven by the rising global desire for high speed and ubiquitous connection. The advancement of LEO and MEO satellite constellations provides new possibilities for previously unserved, rural, and remote areas to obtain broadband Internet. This creates significant opportunities for growth for antenna manufacturers, service providers, and system integrators to address the growing demand for reliable and low latency communications. Additionally, with the growing adoption of IoT, connected vehicles, and smart infrastructure, new applications are being developed for flat panel antennas, and that will stimulate innovation and market growth. Opportunities for differentiation and value creation are also being generated by cross industry collaboration, technology licensing, and strategic partnerships.

Restraining Factors

The flat panel satellite antenna market is restricted by factors like regulatory issues around satellite licensing, spectrum allocation, and cross border data transfer. High upfront costs, complex integration requirements, and the need for specialized technical knowledge, especially for startups and small to medium enterprises, can severely constrain adoption.

Market Segmentation

The flat panel satellite antenna market share is classified into product type and frequency band.

- The electronically steered antennas segment dominated the market in 2024, accounting for approximately 40.1% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the flat panel satellite antenna market is divided into electronically steered antennas and mechanically steered antennas. Among these, the electronically steered antennas segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven because it can rapidly and accurately steer beams without moving parts, and has rapidly increased in recent years. Applications that require continuous monitoring of satellites, such as aviation, maritime, and land mobility platforms, would benefit the most from this. Electronic Steered Antennas utilize advanced phased array technology that allows for seamless switching of satellites, as well as reliable performance across a variety of conditions, and present a compelling option for users in both commercial and military sectors due to size and low maintenance, which facilitates widespread use.

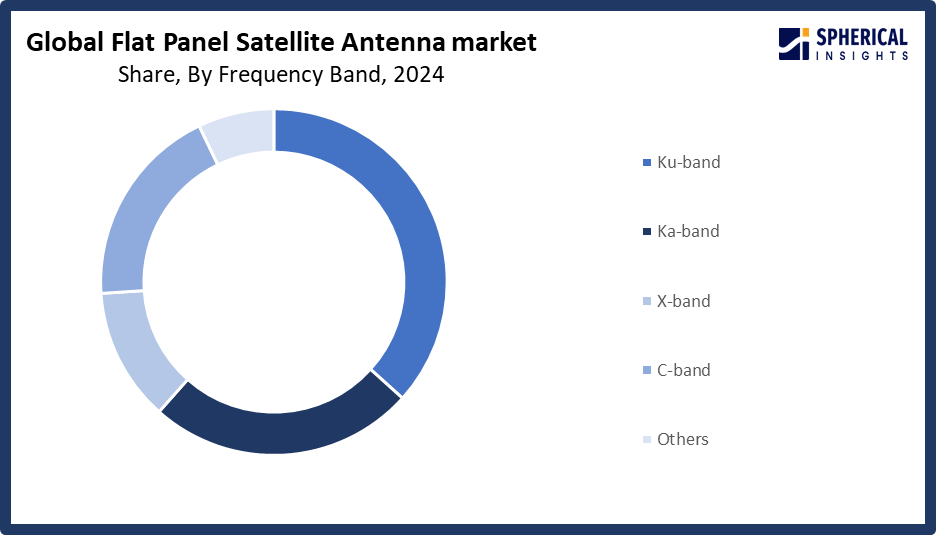

- The Ku-band segment accounted for the largest share in 2024, accounting for approximately 50.2% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the frequency band, the flat panel satellite antenna market is divided into ku-band, ka-band, X-band, C-band, and others. Among these, the Ku-band segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to its extensive use in commercial satellite communications, television transmission, and maritime connectivity. Ku-band antennas are appropriate for a wide range of applications because they provide a well-balanced combination of bandwidth, coverage, and resistance to rain fade. The dominance of this frequency band is anticipated to be maintained in the near future due to the ongoing installation of Ku band satellites as well as the rising demand for broadband services and high-definition content.

Get more details on this report -

Regional Segment Analysis of the Flat Panel Satellite Antenna Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 38% of the flat panel satellite antenna market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share, representing nearly 38% of the flat panel satellite antenna market over the predicted timeframe. In the North America market, the market is rising due to the large investments in satellite communications infrastructure, a multitude of digital entrepreneurs, and the early adoption of LEO satellite services. The U.S. is leading the growth of the industry due to its significant demand from the commercial, aerospace, and defense sectors. Likewise, steady growth is also observed in Canada and Mexico, propelled by growing telecommunications networks and government efforts to bridge the digital divide.

The United States dominates the flat panel satellite antenna market in North America due to the strength of its defense and aerospace industries, considerable investment in satellite-based infrastructure, the presence of major industry players, and government programs supporting rural broadband expansion and military modernization.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 21.2% in the flat panel satellite antenna market during the forecast period. The Asia Pacific area has a thriving market for Flat Panel Satellite Antenna due to investments in broadband technology via satellite, the proliferation of connected devices, and the growing demand for high-speed Internet in rural and remote areas. Leading the way are China, Japan, South Korea, and India, leveraging satellite technology to aid in national security projects, smart cities, and digital infrastructure development. Countries in Southeast Asia are also developing as relevant growth markets influenced by the development of commercial aviation sectors and government initiatives for digital inclusion.

The European market is growing with 14.5% due to strong research and development activity, a robust aerospace industry, and increasing investments in satellite-based services. Latin America, the Middle East, and Africa are slowly catching up due to the expansion of commercial aviation, government initiatives to improve digital infrastructure, and increased demand for connectivity in unserved and rural areas. They have significant long term growth potential as satellite technology becomes more affordable and accessible.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the flat panel satellite antenna market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hanwha Phasor

- TTI Norte

- OneWeb

- L3Harria Technologies

- Ball Aerospace

- RadioWaves

- SatPro Tech

- NXT Communications

- ALCAN Systems

- MTI Wireless Edge

- C COM Satellites

- Gilat Satellite Networks

- China Starwin

- ST Engineering

- Inmarsat

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, Intellian Technologies unveiled three new small flat panel antennas for satellite broadband service on the OneWeb constellation from Eutelsat Group. Fixed, land mobility, and maritime services are served by these active electronically scanned arrays user terminals. These terminals are the smallest in the Eutelsat OneWeb portfolio and are intended for usage on the OneWeb LEO network.

- In April 2024, Micro-Ant, a producer and developer of custom antennas, developed many flat panel antennas for L-band using Ka-band applications. These antennas are inexpensive, very effective, incredibly durable, and useful in a wide range of military and commercial applications. Vehicle monitoring, high-gain satcom links, and field deployable nodes for both passive and active operation are a few examples of applications. They have fielded thousands of flat panels and have created over 15 distinct configurations to meet the needs of their clients. Applications include high-gain satcom communications, vehicle tracking, and field deployable nodes for both passive and active operation.

- In April 2024, Intelsat signed an acquisition agreement with SES to enhance its multi-orbit capabilities and expand its suite of solutions.

- In March 2024, Hanwha Phasor declared the introduction of the Phasor L3300B land antenna for mobile communications. The active electronically steered antenna (AESA) Phasor L3300B was developed for both military and commercial use. Hanwha Phasor's land antenna solution provides customers with constant communications in any location. The antenna can establish connections with new satellites before severing its existing one due to its twin simultaneous reception channels.

- In January 2024, T-Mobile USA, Inc. collaborated with SpaceX's Starlink satellites to enhance its connectivity.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the flat panel satellite antenna market based on the below-mentioned segments:

Global Flat Panel Satellite Antenna Market, By Product Type

- Electronically Steered Antennas

- Mechanically Steered Antennas

Global Flat Panel Satellite Antenna Market, By Frequency Band

- Ku-band

- Ka-band

- X-band

- C-band

- Others

Global Flat Panel Satellite Antenna Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the flat panel satellite antenna market over the forecast period?The global flat panel satellite antenna market is projected to expand at a CAGR of 6.66% during the forecast period.

-

2. What is the market size of the flat panel satellite antenna market?The global flat panel satellite antenna market size is expected to grow from USD 2.10 Billion in 2024 to USD 4.27 Billion by 2035, at a CAGR of 6.66% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the flat panel satellite antenna market?North America is anticipated to hold the largest share of the flat panel satellite antenna market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global flat panel satellite antenna market?Hanwha Phasor, TTI Norte, OneWeb, L3Harria Technologies, Ball Aerospace, RadioWaves, SatPro Tech, NXT Communications, ALCAN Systems, MTI Wireless Edge, C COM Satellites, Gilat Satellite Networks, China Starwin, ST Engineering, Inmarsat, and Others.

-

5. What factors are driving the growth of the Flat Panel Satellite Antenna market?The flat panel satellite antenna market growth is driven by increased use of LEO satellites, improvements in electronically steered antennas, expanding defense and commercial uses, and growing demand for high-speed communication in mobile and remote areas.

-

6. What are market trends in the flat panel satellite antenna market?The flat panel satellite antenna market trends include the rise of electronically steered antennas, hybrid & multi orbit solutions, 5G band integration, mobility & broadband for remote, demand for compact, and low profile & lightweight designs.

-

7. What are the main challenges restricting wider adoption of the flat panel satellite antenna market?The flat panel satellite antenna market trends include high upfront costs, intricate production procedures, a lack of standardization, issues with power consumption, and reduced performance in harsh weather conditions or isolated locations when compared to conventional parabolic antennas.

Need help to buy this report?