Global Flat Panel Display Market Size, Share, and COVID-19 Impact Analysis, By Technology (OLED, Quantum Dot, LED, LCD, and Others), By End-Users (Consumer Electronics, Healthcare, Retail, BFSI, Military and Defense, Automotive, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Semiconductors & ElectronicsGlobal Flat Panel Display Market Insights Forecasts to 2035

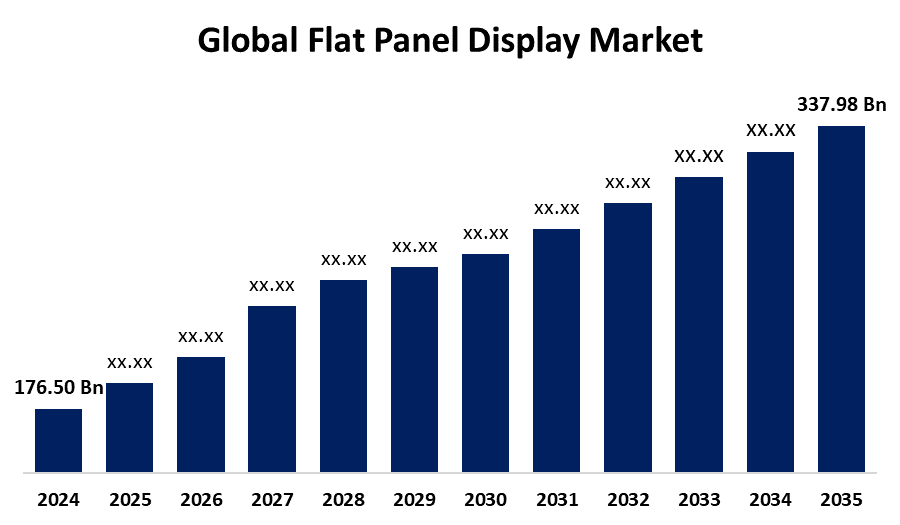

- The Global Flat Panel Display Market Size Was Estimated at USD 176.50 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.08% from 2025 to 2035

- The Worldwide Flat Panel Display Market Size is Expected to Reach USD 337.98 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Flat Panel Display Market Size was worth around USD 176.50 Billion in 2024 and is projected to grow from USD 187.48 Billion in 2025 to around USD 337.98 Billion by 2035 at a compound annual growth rate (CAGR) of 6.08% during the forecast period (2025–2035). One of the key opportunities is to improvements in picture quality, energy economy, and streamlined designs. Display technologies like OLED, QLED, and MicroLED are becoming more and more popular in a variety of industries, including consumer electronics, automotive, and industrial applications.

Global Flat Panel Display Market Forecast and Revenue Size

- 2024 Market Size: USD 176.50 Billion

- 2025 Market Size: USD 187.48 Billion

- 2035 Projected Market Size: USD 337.98 Billion

- CAGR (2025-2035): 6.08%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

A flat panel display is a compact, light electronic screen that can display visual material such as text, images, and movies. The market for flat-panel displays is rapidly evolving due to the integration of automation and artificial intelligence into the manufacturing process. Using forecasting maintenance, for instance, artificial intelligence can reduce downtime and improve display performance. AI can also improve image processing capabilities by adjusting brightness, color, and noise when needed, in addition to improving production processes. AI can further provide display modes for different uses gaming, streaming videos, reading, and so on. In June 2024, Samsung, the largest Electronics company in India, introduced a line of Odyssey OLED gaming displays, Smart displays, and Viewfinity monitors. In addition to the displays, many of the devices included technology for customers to enjoy new AI capabilities and experiences. The Smart Monitor M8 is powered by AI, while ViewFinity extends connectivity to build a full workstation.

The Indian government has taken a number of steps to support the country's flat-panel display sector in an effort to lessen reliance on imports and create a strong manufacturing base. The government provides pari-passu financial assistance for up to 50% of the project cost for the establishment of display fabs in India under the Modified Programme for Semiconductors and Display Fab Ecosystem.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the flat panel display market during the forecast period.

- In terms of technology, the LCD segment is projected to lead the flat panel display market throughout the forecast period

- In terms of end-users, the consumer electronics segment captured the largest portion of the market

Flat Panel Display Market Trends

- Advancements in Display Technologies

- Integration in Wearable and IoT Devices

- Interactive Flat Panels in Education and Business

- Touchless and Gesture Controlled Displays

- Development of Transparent and Flexible Displays

Report Coverage

This research report categorizes the flat panel display market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the flat panel display market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the flat panel display market.

Global Flat Panel Display Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 176.50 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.08% |

| 2035 Value Projection: | USD 337.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Technology, By End-Users, By Region |

| Companies covered:: | AU Optronics Corporation, Display Co, Sony Corporation, Japan Display Inc., Panasonic Corporation, Samsung Electronics Co. Ltd., LG Display Co. Ltd., Universal Display Corporation, Toshiba Corporation, Innolux Corporation, Innolux Corporation, Sharp Corporation, Crystal Display System, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors:

The increasing prevalence of orthopedic conditions drives the flat panel display market.

One major contributing factor to the flat panel display market is the growing demand for improved visual and gaming experiences has contributed to an increase in demand for high-resolution displays in gaming consoles and PCs. The appetite for advanced technology has increased, such as displays with higher pixel densities. Moreover, esports and gaming consoles are expected to continue to grow the market during the forecast period due to the growing need for HDR displays. OnePlus has stated that its next flagship smartphone, the OnePlus 13, will make its debut in China in October 2024. OnePlus showed off its flagship phone design and release date. The OnePlus 13 features a wholly new back panel design, flat display, and flat frame that represent a significant design change for smartphones.

Restraining Factor: High material costs and complex manufacturing processes restrict the market.

The market for flat panel displays is restricted by several important factors, such as the high costs of materials essential to the production of FPDs, such as glass, semiconductors, and earth metals, which impact the overall manufacturing cost of production. Additionally, the process of FPDs is intricate, resulting in higher costs for development and equipment upkeep, not to mention that the reduced mobility of manufacturers depending on yield rates impacts the profitability of manufacturing and increases operating costs.

Market Segmentation

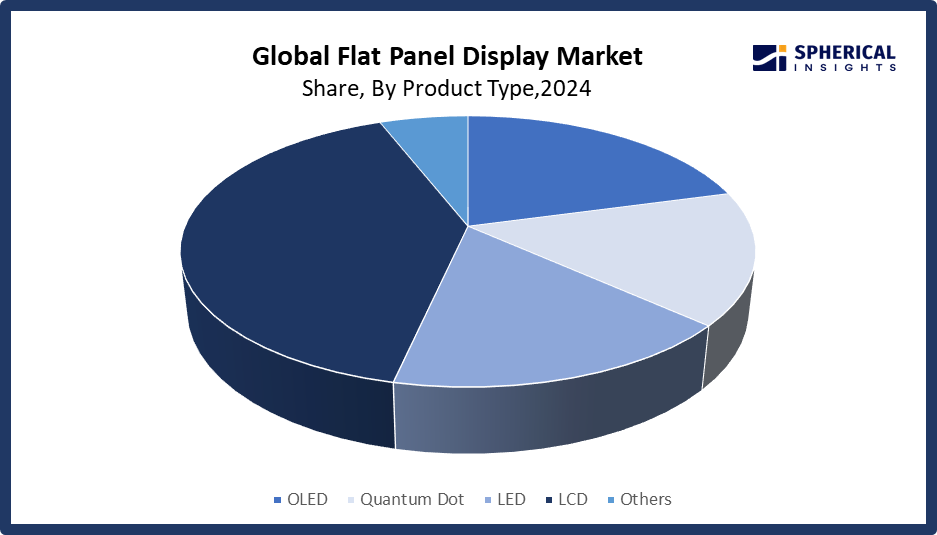

The global flat panel display market is divided into technology and end-users.

Global Flat Panel Display Market, By Technology:

Why does the LCD segment hold the largest revenue share in the global flat panel display market, accounting for approximately 52.7% of the total market during the forecast period?

The LCD segment led the flat panel display market, generating the largest revenue share. The LCD is praised due to its prevalence in consumer electronics like tablets, TVs, PCs, smartphones, and digital signage. Additionally, one of the primary drivers of the adoption of LCD panels among manufacturers and consumers is their cost. With population growth, there was an escalation in demand for consumer electronics, which facilitated low-cost, high-efficiency alternatives to become increasingly available, thereby improving market penetration. LCD panels' attribute of reduced energy consumption further assists the segment's overall growth. At InfoComm India 2024, one of the largest tradeshows for the audio-visual industry in India, in September 2024, ViewSonic, a top global supplier of visual solutions, unveiled the LDC series of the first customisable all-in-one giant LED displays in history.

Get more details on this report -

The OLED segment in the flat panel display market is expected to grow at the fastest CAGR over the forecast period. The OLED segment is driven by the impressive benefits of OLED, which include high contrast ratios, low power consumption, and the ability to produce displays that are transparent, flexible, and foldable. Because of these advantages, the use of OLED technology is experiencing increasing growth in consumer electronics, automotive displays, and wearable technology.

Global Flat Panel Display Market, By End-Users:

Why does consumer electronics represent the largest application segment, capturing approximately 86% market share during the forecast period in the global flat panel display market?

The consumer electronics segment held the largest market share in the flat panel display market. The factors driving increased market penetration are the increased use and adoption of consumer electronics, like video game consoles, laptops, tablets, smartphones, and smart TVs. With consumers increasingly looking for substantial improvement in consumer devices, manufacturers are responding by offering creative front panel displays that incorporate new technologies. And with OLED and quantum dot displays demonstrating advances in both energy efficiency and visual performance, these types of displays are increasingly becoming more common in consumer electronics.

The automotive segment in the flat panel display market is expected to grow at the fastest CAGR over the forecast period. spurred by the increasing demand for advanced in-car displays, such as digital instrument clusters, infotainment systems, head-up displays, and back-seat entertainment systems. These display technologies are becoming a vital part of modern vehicles and improve the user experience.

Regional Segment Analysis of the Global Flat Panel Display Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Flat Panel Display Market Trends

Get more details on this report -

What factors contribute to the Asia Pacific region holding the largest share, approximately 52.87%, of the global flat panel display market during the forecast period?

Asia Pacific is dominant in the global flat panel display market, with an estimated 52.87% share during the forecast period. The flat panel display market in the Asia Pacific has expanded greatly in recent years, mainly because the expanding population is leading to increased demand for consumer devices such as tablets, laptops, and smartphones. In the Asia Pacific region, the growing demand for gaming consoles and smart home solutions has also driven the development of more advanced display technologies. Urbanization, discretionary consumer wealth, as well as the use of smart homes are driving the demand for larger FPDs for use in public spaces and televisions.

Why does China lead the Asia Pacific Flat Panel Display market?

The flat panel display market in China is evidenced by rising research & development spending, and China is leading the region largely through extensive adoption of new innovative technologies within the commercial, educational, and personal sectors. India is expected to develop in R&D spending as government agencies provide domestic capital for display technology development, as well as support for electronics manufacturing. The growing automotive and technology manufacturing sector of the region is likely to positively impact the regional display market in the future.

North America Flat Panel Display Market Trends

How is the North America region expected to capture approximately 16.27% of the flat panel display market by 2025, with the fastest growth rate?

North America is expected to capture approximately 19% of the flat panel display market by 2025, with the fastest growth rate due to several key factors. The presence of competitive landscapes has increased spending on next-generation technologies. R&D spend is supported by government policies that support R&D, such as the National Science Foundation and the Department of Energy. These organizations fund R&D companies, which usually lead to advances in materials science and display technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global flat panel display market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Flat Panel Display Market Include

- AU Optronics Corporation

- Display Co

- Sony Corporation

- Japan Display Inc.

- Panasonic Corporation

- Samsung Electronics Co. Ltd.

- LG Display Co. Ltd.

- Universal Display Corporation

- Toshiba Corporation

- Innolux Corporation

- Innolux Corporation

- Sharp Corporation

- Crystal Display System

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In January 2025, MAXHUB launched its AI-enabled V7 Series interactive flat panel displays, which are designed to transform corporate meetings with novel features. These include AI-Powered Trident Lens System, 4K interactive displays, and intelligent audio solutions.

- In January 2025, Samsung announced the launch of the 2025 QD-OLED, incorporating unique panel driving technology and new organic materials ahead of the CES 2025. The panel intended for 2025 TVs is estimated to be 30% brighter compared to last year’s panel, reaching 4000 nits peak brightness.

- In May 2024, Canon Inc. announced the release of MPAsp-E1003H, a new flat panel display lithography system compatible with 6th generation substrates that achieves a high yield with wider exposure than the previous model. Demand for vehicle displays has been diversifying and increasing in recent years due to advancements in automatic driving technology and the expansion of the market for electric cars.

- In February 2024, Optoma, a world-leading manufacturer of pioneering visual solutions, launched its new Creative Touch 3-Series Interactive Flat Panel Displays (IFPDs), with features of improved functionality and interactive features to meet the requirements of education and corporate environments.

- In October 2022, Akai India launched Interactive Flat Panel Displays (IFPD) on Amazon to revolutionize collaboration across education, business, and government sectors.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the flat panel display market based on the following segments:

Global Flat Panel Display Market, By Technology

- OLED

- Quantum Dot

- LED

- LCD

- Others

Global Flat Panel Display Market, By End-Users

- Consumer Electronics

- Healthcare

- Retail

- BFSI

- Military and Defense

- Automotive

- Others

Global Flat Panel Display Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the flat panel display market over the forecast period?The global flat panel display market is projected to expand at a CAGR of 6.08% during the forecast period.

-

2. What is the market size of the flat panel display market?The global flat panel display market size is expected to grow from USD 176.50 billion in 2024 to USD 337.98 billion by 2035, at a CAGR 6.08% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the flat panel display market?North America is anticipated to hold the largest share of the flat panel display market over the predicted timeframe.

-

4. Who are the top 14 companies operating in the global flat panel display market?AU Optronics Corporation, Display Co, Sony Corporation, Japan Display Inc., Panasonic Corporation, Samsung Electronics Co. Ltd., LG Display Co. Ltd., Universal Display Corporation, Toshiba Corporation, Innolux Corporation, Innolux Corporation, Sharp Corporation, Crystal Display System, and Others.

-

5. What factors are driving the growth of the flat panel display market?The flat panel display market growth is driven by the growing need for high-definition screens for a range of devices, such as commercial displays, cellphones, and televisions.

-

6. What are the market trends in the flat panel display market?The flat panel display market trends include advancements in display technologies, integration in wearable and IoT devices, interactive flat panels in education and business, touchless and gesture-controlled displays, and the development of transparent and flexible displays

-

7. What are the main challenges restricting wider adoption of the flat panel display market?The flat panel display market trends include significant upfront costs, which may discourage adoption, particularly in areas where prices are sensitive.

Need help to buy this report?