Global Flat Glass Coatings Market Size, Share, and COVID-19 Impact Analysis, By Resin Type (Acrylic, Polyurethane, Epoxy, Others), By Application (Mirror, Solar Power, Architectural, Automotive, Decorative, Others), By Technology (Water-based, Solvent-based, Nano Coatings), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Flat Glass Coatings Market Insights Forecasts to 2035

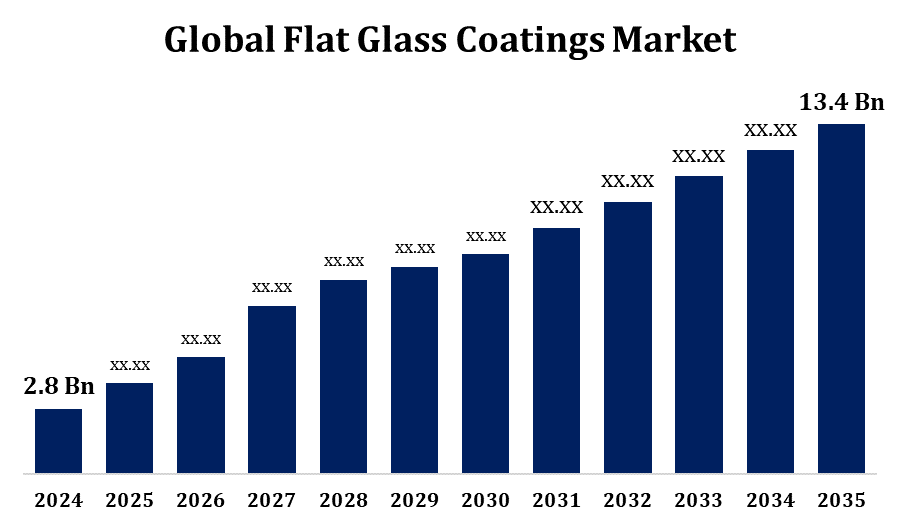

- The Flat Glass Coatings Market Size was valued at USD 2.8 Billion in 2024.

- The Market Size is Growing at a CAGR of 16.95% from 2025 to 2035.

- The Global Flat Glass Coatings Market Size is Expected to reach USD 13.4 Billion by 2035.

- Asia Pacific is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

The Global Flat Glass Coatings Market Size is Expected to reach USD 13.4 Billion by 2035, at a CAGR of 16.95% during the forecast period 2025 to 2035.

The flat glass coatings market is experiencing robust growth, driven by rising demand for energy-efficient and aesthetically appealing architectural solutions. These coatings enhance solar control, thermal insulation, and UV protection, making them ideal for applications in residential, commercial, and automotive sectors. Rapid urbanization, expanding infrastructure projects, and stringent energy regulations are accelerating adoption, particularly in Asia-Pacific, North America, and Europe. Technological advancements in low-E and anti-reflective coatings are further contributing to market expansion. Additionally, the shift toward green buildings and sustainable construction practices is fueling demand. Key players are investing in R&D to develop multifunctional coatings with self-cleaning and anti-glare properties. The market is highly competitive, with companies focusing on innovation, strategic partnerships, and regional expansion to gain a competitive edge.

Flat Glass Coatings Market Value Chain Analysis

The value chain of the flat glass coatings market involves multiple interconnected stages, starting with raw material suppliers providing base glass, metal oxides, and specialty chemicals. These materials are then processed by coating manufacturers who apply advanced technologies such as chemical vapor deposition (CVD), magnetron sputtering, and sol-gel techniques to develop functional coatings. The coated glass is subsequently distributed to fabricators and processors who customize it for end-use applications, including windows, facades, and automotive glazing. Distributors and wholesalers then channel the finished products to construction companies, architects, and automotive OEMs. Throughout the chain, R&D and innovation play a critical role in enhancing coating performance. Additionally, regulatory bodies influence the value chain by setting environmental and energy efficiency standards that drive product development and adoption.

Flat Glass Coatings Market Opportunity Analysis

The flat glass coatings market is poised for strong growth, driven by increasing demand for energy-efficient, aesthetically advanced solutions across construction, automotive, and solar energy sectors. Opportunities are emerging as architects and developers prioritize green buildings, leading to higher adoption of coated glass for insulation, solar control, and UV protection. The shift toward smart cities and sustainable infrastructure further boosts demand. In the automotive sector, lightweight, coated glass supports fuel efficiency and passenger comfort. Solar panel manufacturers are increasingly using anti-reflective and protective coatings to improve performance. Technological advancements, such as smart coatings and multifunctional surfaces, are opening new avenues for innovation. Additionally, favorable regulations promoting energy conservation and eco-friendly materials are creating a conducive environment for market expansion across both developed and emerging economies.

Global Flat Glass Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.95% |

| 2035 Value Projection: | USD 13.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Resin Type, By Application, By Technology and By Region |

| Companies covered:: | LUPICIA CO. LTD, COFCO, Teasenz, FMS Consumer Products Pvt Ltd, Blue Lake Group, Twinings, Harney and Sons, Pukka Herbs, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Flat Glass Coatings Market Dynamics

Growing Demand from Solar Applications to Drive Market Expansion

The growing demand from solar applications is a major driver of flat glass coatings market expansion. As solar energy adoption accelerates worldwide, there is a rising need for high-performance coated glass that enhances the efficiency and durability of photovoltaic panels and solar thermal systems. Coatings such as anti-reflective, hydrophobic, and protective layers improve light transmission, reduce surface contamination, and extend the lifespan of solar modules. Governments across various regions are promoting renewable energy through incentives and mandates, further fueling the use of coated flat glass in solar installations. Additionally, the push for energy independence and sustainability is encouraging investments in solar infrastructure. Manufacturers are increasingly focusing on developing advanced coatings tailored to harsh environmental conditions, enabling optimal performance in utility-scale, rooftop, and building-integrated solar applications, thereby strengthening overall market growth.

Restraints & Challenges

The flat glass coatings market faces several challenges that hinder its widespread adoption and scalability. High production and operational costs, particularly for advanced coatings like low emissivity, anti-reflective, and self-cleaning types, pose a barrier, especially for small and mid-sized manufacturers. Price fluctuations and limited availability of raw materials such as high-purity silica and specialty chemicals add further pressure. The coating process itself can be time-consuming, involving slow curing and energy-intensive operations that raise overhead costs and reduce efficiency. Additionally, strict environmental regulations require companies to invest in cleaner technologies and sustainable practices, increasing compliance costs. The need for specialized equipment and skilled labor further complicates market entry. These factors collectively challenge the market’s ability to expand at scale, particularly in cost-sensitive and developing regions.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Flat Glass Coatings Market from 2025 to 2035. The United States is at the forefront, with increasing adoption of energy-efficient coated glass in buildings, including low-emissivity and solar control variants. Growth in the solar industry is a major contributor, as coatings like anti-reflective and hydrophobic layers improve the performance and durability of solar panels. Additionally, the expanding electric vehicle segment is creating demand for advanced automotive glazing with properties such as acoustic insulation and thermal efficiency. However, market growth faces challenges such as high production costs, strict regulatory standards, and logistical issues related to the transport of large glass panes. Ongoing innovation and sustainability initiatives are expected to support future market expansion across the region.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2025 to 2035. China, India, and those in Southeast Asia are leading demand for energy-efficient and multifunctional coated glass in both residential and commercial buildings. China dominates the regional landscape, supported by large-scale infrastructure projects and smart city developments requiring high-performance glazing solutions. India and ASEAN countries are emerging as fast-growing markets, fueled by government-led housing and renewable energy initiatives. The region is also seeing rising use of coated glass in solar panels, where anti-reflective and protective coatings enhance efficiency and durability.

Segmentation Analysis

Insights by Resin Type

The acrylic segment accounted for the largest market share over the forecast period 2025 to 2035. The growth is driven by its excellent durability, UV resistance, and optical clarity. Acrylic coatings offer superior adhesion to glass surfaces and are widely preferred in architectural glazing, solar panels, and decorative applications. Their compatibility with water-based and low-VOC formulations makes them an environmentally friendly choice, aligning with increasing sustainability standards and green building certifications. The segment is gaining traction across residential, commercial, and industrial projects where long-lasting performance and aesthetic appeal are essential. Additionally, acrylic coatings are cost-effective and easy to apply, further supporting their rising adoption. With growing emphasis on energy efficiency, eco-friendly construction practices, and high-performance materials, the acrylic resin segment is expected to maintain its momentum and contribute significantly to overall market expansion.

Insights by Technology

The water-based segment accounted for the largest market share over the forecast period 2025 to 2035. These coatings emit low levels of volatile organic compounds (VOCs), making them compliant with strict environmental regulations across major regions. Their strong adhesion, durability, and ease of application make them a preferred choice in applications such as architectural glass, automotive glazing, and solar panels. Water-based coatings are gaining popularity as industries and consumers shift toward greener alternatives that support energy efficiency and reduce environmental impact. Advancements in formulation technologies have enhanced their performance in terms of clarity, weather resistance, and longevity. As sustainability becomes a key priority in construction and manufacturing, the adoption of water-based flat glass coatings is expected to continue growing across both developed and emerging markets.

Insights by Application

The mirror segment accounted for the largest market share over the forecast period 2025 to 2035. In architecture and interior design, coated mirrors are widely used for their aesthetic appeal and enhanced performance features such as thermal insulation and anti-reflective properties. The automotive industry is increasingly adopting coated mirrors that offer durability, anti-fogging, and improved visibility, contributing to driver safety. Additionally, mirrors are gaining popularity in decorative applications, including furniture, cosmetics, and retail displays. Innovations in self-cleaning, scratch-resistant, and anti-fog coatings are further boosting their appeal. As the demand for both functional and decorative mirrors continues to rise across residential, commercial, and industrial sectors, the mirror segment is expected to play a significant role in driving overall market growth.

Recent Market Developments

- In September 2021, Guardian Glass has begun producing superjumbo SunGuard coatings, measuring 130” x 240”, on clear or Guardian UltraClear float glass at its Carleton, Michigan facility.

Competitive Landscape

Major players in the market

- Arkema (France)

- FENZI (Italy)

- Ferro Corporation (US)

- Sherwin-Williams Company (US)

- Vitro Architectural Glass (Mexico)

- NIPPONPAINT (Japan)

- SunGuard (Guardian Glass) (US)

- Hesse (Germany)

- DIAMON-FUSION INTERNATIONAL (US)

- Tribos Coatings (International) Ltd. (UK)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2025 to 2035.

Flat Glass Coatings Market, Resin Type Analysis

- Acrylic

- Polyurethane

- Epoxy

- Others

Flat Glass Coatings Market, Application Analysis

- Mirror

- Solar Power

- Architectural

- Automotive

- Decorative

- Others

Flat Glass Coatings Market, Technology Analysis

- Water-based

- Solvent-based

- Nano Coatings

Flat Glass Coatings Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Flat Glass Coatings Market?The global Flat Glass Coatings Market is expected to grow from USD 2.8 billion in 2024 to USD 13.4 billion by 2035, at a CAGR of 16.95% during the forecast period 2025-2035.

-

2. Who are the key market players of the Flat Glass Coatings Market?Some of the key market players of the market are Arkema (France), FENZI (Italy), Ferro Corporation (US), Sherwin-Williams Company (US), Vitro Architectural Glass (Mexico), NIPPONPAINT (Japan), SunGuard (Guardian Glass) (US), Hesse (Germany), DIAMON-FUSION INTERNATIONAL (US), and Tribos Coatings (International) Ltd. (UK).

-

3. Which segment holds the largest market share?The mirror segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?