Global Flame Retardant Resin In E&E Composite Market Size, Share, and COVID-19 Impact Analysis, By Resin Type (Epoxy, Phenolic, Polyester, and Others), By Application (PCB Laminates, Enclosures, Electrical Components, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Flame Retardant Resin In E&E Composite Market Insights Forecasts to 2035

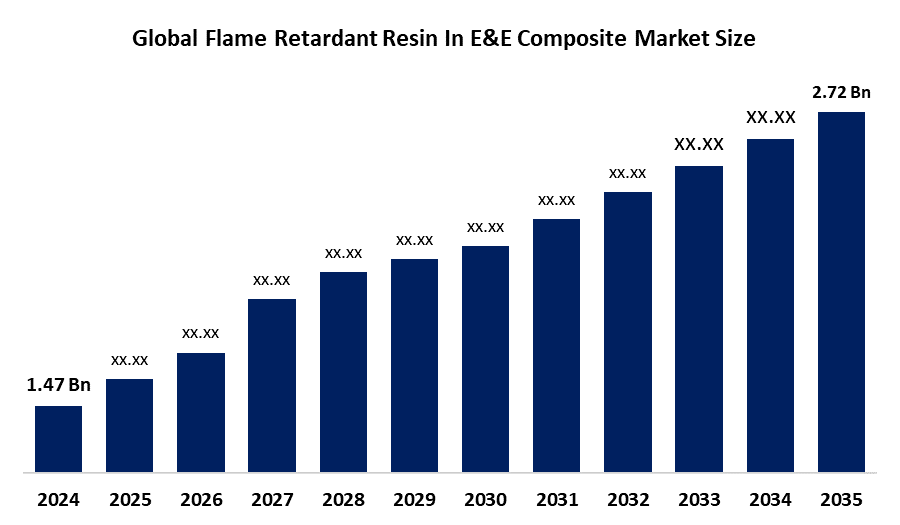

- The Global Flame Retardant Resin In E&E Composite Market Size Was Valued at USD 1.47 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.75% from 2025 to 2035

- The Worldwide Flame Retardant Resin In E&E Composite Market Size is Expected to Reach USD 2.72 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global flame retardant resin in E&E composite market size was worth around USD 1.47 billion in 2024 and is predicted to grow to around USD 2.72 billion by 2035 with a compound annual growth rate (CAGR) of 5.75% from 2025 to 2035. The flame retardant resin market in E&E composite materials is growing due to stringent regulations and standards for fire safety and the need to use fire-resistant materials in electronic equipment and appliances by governments, rewarding growth in the electronics sector, rising awareness levels about the dangers of fire, and a clear move towards a non-halogenated route.

Market Overview

The global flame retardant resin in electrical and electronics (E&E) composites market refers to specialized resins used to boost the fire-retardant properties of electronic components and devices. The flame retardant resin in the electrical and electronics (E&E) composites market is used in consumer electronics, automotive electrical components, industrial machinery, and power distribution equipment to avoid fire risks and ensure safety regulations. The driving factors of this market include increasing demand for fire-resistant materials, a growing number of smart devices and electric vehicles, and the imposition of UL94 and IEC fire safety regulations.

The future opportunities in this market include developing halogen-free, eco-friendly, and advanced flame-retardant resins with excellent thermal stability and mechanical properties while meeting sustainability requirements. The major companies functioning in this market are BASF SE, SABIC, Huntsman Corporation, and Lanxess AG. These factors, combined with the growth of urbanization, industrialization, and the penetration of electronics in the emerging markets, further facilitate the development of the market and create significant growth opportunities during the forecasted period. In January 2025, Washington State's Safer Products Rule will prohibit organohalogen flame retardants (OFRs) greater than 1000 ppm in plastic enclosures of TVs, displays, and other E&E products. Exceptions include necessary uses for safety, reporting, and alternatives assessment, along with other controls for ortho-phthalates and organophosphates in foam.

Report Coverage

This research report categorizes the flame retardant resin in E&E composite market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the flame retardant resin in E&E composite market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the flame retardant resin in E&E composite market.

Flame Retardant Resin In E&E Composite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.47 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.75% |

| 2035 Value Projection: | USD 2.72 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Resin Type, By Application |

| Companies covered:: | Lanxess AG, BASF SE, Albemarle Corporation, SABIC, Huntsman Corporation, Clariant AG, ICL Group, Italmatch Chemicals, Hexion Inc., INEOS, Huber Engineered Materials (HEM), Sumitomo Bakelite Co., Ltd., RTP Company, Polynt Reichhold Group, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drivers operating within the global flame retardant resin in E&E composites market include the adoption of safer and fire-resistant materials designed for consumer electronics, automobiles, and the industrial sector. The stifled growth of smart gadgets, electric cars, and advanced electric gadgets propels the demand for flame-retardant materials. The compliance standards, like UL94 and IEC specifications, also favor using flame-retardant composites. Growing adoption of high-performance flame retardant materials-namely, halogen-free flame retardants-further fosters market growth. The growth rate is further fueled by increased penetration and development in developing nations.

Restraining Factors

Growth in global flame retardant resin in E&E composites is restrained by high material costs, complex manufacturing processes, and environmental issues associated with some halogenated resins. Regulatory stringency related to toxicity potential, with consequent performance tradeoffs in mechanical or thermal performance, further limits their applications.

Market Segmentation

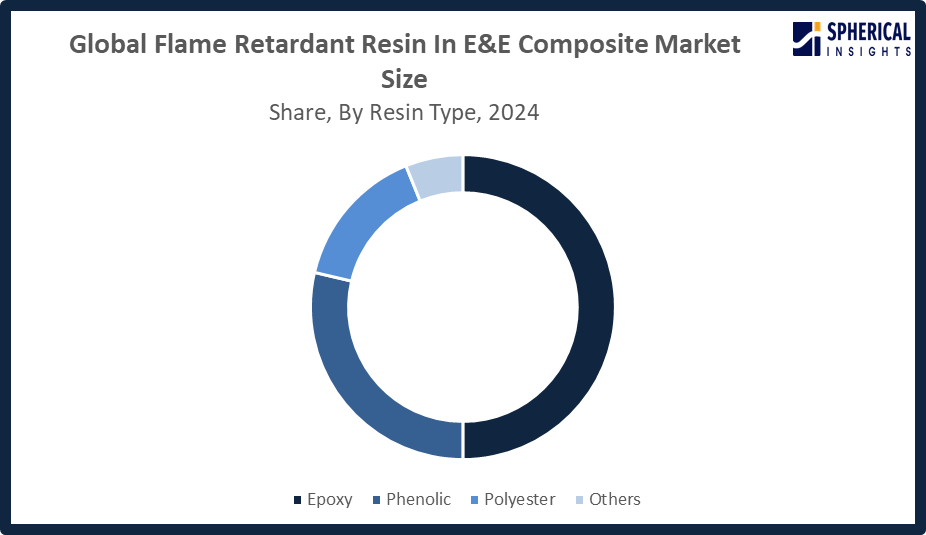

The flame retardant resin in E&E composite market share is classified into resin type and application.

- The epoxy segment dominated the market in 2024, approximately 50% and is projected to grow at a substantial CAGR during the forecast period.

Based on the resin type, the flame retardant resin in E&E composite market is divided into epoxy, phenolic, polyester, and others. Among these, the epoxy segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The demand for flame retardant resin in E&E composite materials was dominated by the epoxy segment due to its superior strength, thermal resistance, and dielectric properties. The prime application of this material in printed circuit boards, E&E components, and electronic enclosures has ensured its growing demand in the concerned market and has made it a material of choice for E&E applications requiring flame resistance.

Get more details on this report -

- The PCB laminates segment accounted for the highest market revenue in 2024, approximately 45% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the flame retardant resin in E&E composite market is divided into PCB laminates, enclosures, electrical components, and others. Among these, the PCB laminates segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. PCB laminates showed a growth rate in the market due to the increased demand for high-quality printed circuit boards in the electronic, automobile, and industrial fields. The application of flame retardant resins in order to achieve improved fire resistance, temperature stability, and electrical insulation is propelling the growth of this segment at the global level.

Regional Segment Analysis of the Flame Retardant Resin In E&E Composite Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

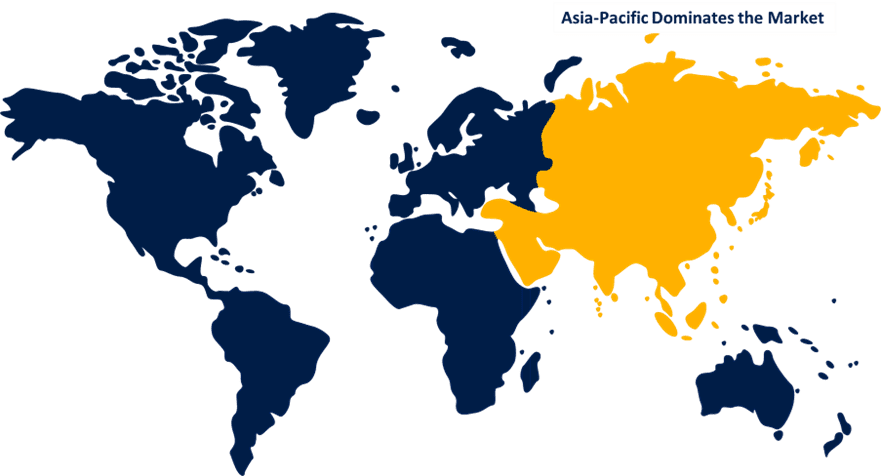

Asia Pacific is anticipated to hold the largest share of the flame retardant resin in E&E composite market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the flame retardant resin in E&E composite market over the predicted timeframe. Asia Pacific will market the 43% share of flame retardant resins used in E&E composites in the market in 2024. This can be attributed to the increasing number of electronic devices produced across the region. China stands out globally for manufacturing PCB products, with Japan and South Korea manufacturing high-end consumer electronics. Facilitative policies, investment in infrastructure, and the use of fire-resistant materials in EVs, consumer electronics, and industrial machinery are additional factors that support growth. In April 2025, China's Ministry of Industry and Information Technology released GB38031-2025, making new EV battery safety standards, including thermal diffusion, bottom impact, and fast-charge safety, effective from July 1, 2026.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the flame retardant resin in E&E composite market during the forecast period. The E&E composite flame retardant resin market in North America is expected to have a 30% market share, owing to the growing need for flame-retardant electronics and the rising adoption of electric vehicles. The United States dominates this market owing to its strong manufacturing sector and R&D infrastructure, and the government aids in the development of safer and halogen-free flame retardant materials. The adoption of PCBs, electronic enclosures, and more components is also boosting this sector. In November 2024, Health Canada informed the industry and importers to satisfy the criteria for flammability without the toxic flame retarders and to practice inherently flame-resistant material usage, limiting the use of TCEP and TDBPP in compliance with the Chemicals Management Plan.

The European flame retardant resin market in E&E is driven by increasing environmental and fire safety regulations. Germany is presently leading this market due to the presence of strong car and electronics manufacturers. In 2024, the European Chemicals Agency (ECHA) furthered its strategy on flame retardants by emphasizing safe alternatives that are not based on halogens, to help the EU reduce Persistent, Bioaccumulative, and Toxic (PBT) chemicals in Electrical and Electronic Equipment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the flame retardant resin in E&E composite market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lanxess AG

- BASF SE

- Albemarle Corporation

- SABIC

- Huntsman Corporation

- Clariant AG

- ICL Group

- Italmatch Chemicals

- Hexion Inc.

- INEOS

- Huber Engineered Materials (HEM)

- Sumitomo Bakelite Co., Ltd.

- RTP Company

- Polynt Reichhold Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, BASF announced the local availability of Ultradur specialty grades, including flame-retardant and hydrolysis-resistant variants, from India. This milestone strengthens BASF’s commitment to the Indian market by enabling faster delivery, improved supply reliability, and greater flexibility for customers seeking high-performance engineering plastics.

- In November 2025, Clariant announced a strategic joint venture with FUHUA to develop innovative non-halogenated, phosphorus-based flame retardants. The initiative targets building, automotive, and electrical and electronics sectors, addressing tightening technical and regulatory requirements while advancing sustainable, next-generation flame-retardant solutions.

- In December 2024, ICL Group Ltd. launched VeriQuel R100, a reactive, phosphorus-based flame retardant for rigid polyurethane insulation products used in sheathing, walls, and PIR roofing. Backed by over $2 million in R&D, the product offers a more sustainable alternative to traditional additive flame retardants for commercial construction applications.

- In October 2022, LANXESS introduced Emerald Innovation NH 500, a phosphorus-based, non-halogen flame retardant for glass fiber-reinforced plastics in the E&E industry. The additive delivers strong fire protection, excellent thermal stability, and maintains mechanical properties, meeting key safety standards in engineering thermoplastics like PA6 and PA66.

- In July 2022, BASF and THOR GmbH partnered to combine expertise in non-halogenated flame retardant additives, offering sustainable, high-performance solutions for plastic compounds. The collaboration aims to meet stringent fire safety standards and address rising demand from construction and automotive industries for safer, environmentally friendly flame-retardant materials.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the flame retardant resin in E&E composite market based on the below-mentioned segments:

Global Flame Retardant Resin In E&E Composite Market, By Resin Type

- Epoxy

- Phenolic

- Polyester

- Others

Global Flame Retardant Resin In E&E Composite Market, By Application

- PCB Laminates

- Enclosures

- Electrical Components

- Others

Global Flame Retardant Resin In E&E Composite Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the flame retardant resin in E&E composite market over the forecast period?The global flame retardant resin in E&E composite market is projected to expand at a CAGR of 5.75% during the forecast period.

-

2. What is the market size of the flame retardant resin in E&E composite market?The global flame retardant resin in E&E composite market size is expected to grow from USD 1.47 billion in 2024 to USD 2.72 billion by 2035, at a CAGR of 5.75% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the flame retardant resin in E&E composite market?Asia Pacific is anticipated to hold the largest share of the flame retardant resin in E&E composite market over the predicted timeframe.

-

4. What is the flame retardant resin in E&E composite market?The flame retardant resin in E&E composites market involves resins used in electrical and electronic components to prevent fire hazards.

-

5. Who are the top 10 companies operating in the global flame retardant resin in E&E composite market?Lanxess AG, BASF SE, Albemarle Corporation, SABIC, Huntsman Corporation, Clariant AG, ICL Group, Italmatch Chemicals, Hexion Inc., INEOS, and Others.

-

6. What factors are driving the growth of the flame retardant resin in E&E composite market?Growth is driven by rising demand for fire‑safe electronics, stricter safety regulations, expanded use in automotive and EV applications, and innovations in eco‑friendly, high‑performance resin technologies for electrical and electronic components.

-

7. What are the market trends in the flame retardant resin in E&E composite market?Key market trends include increasing demand for halogen‑free flame retardants, adoption of phosphorus‑based and nanocomposite technologies, and stricter fire safety regulatory compliance in E&E applications.

-

8. What are the main challenges restricting wider adoption of the flame retardant resin in E&E composite market?The main challenges restricting the wider adoption of flame retardant resins in the electrical and electronics (E&E) composite market include environmental and health concerns, high costs of advanced alternatives, performance trade-offs, and complex regulatory compliance.

Need help to buy this report?