Global Fire Fighting Foam Market Size, by Foam Type (AFFF, AR-AFFF), By Fire Type (Class A, B, C), By End-use (Oil & Gas, Chemical), By Region, And Segment Forecasts, By Geographic Scope And Forecast 2022 to 2032

Industry: Chemicals & MaterialsGlobal Fire Fighting Foam Market Insights Forecasts to 2032

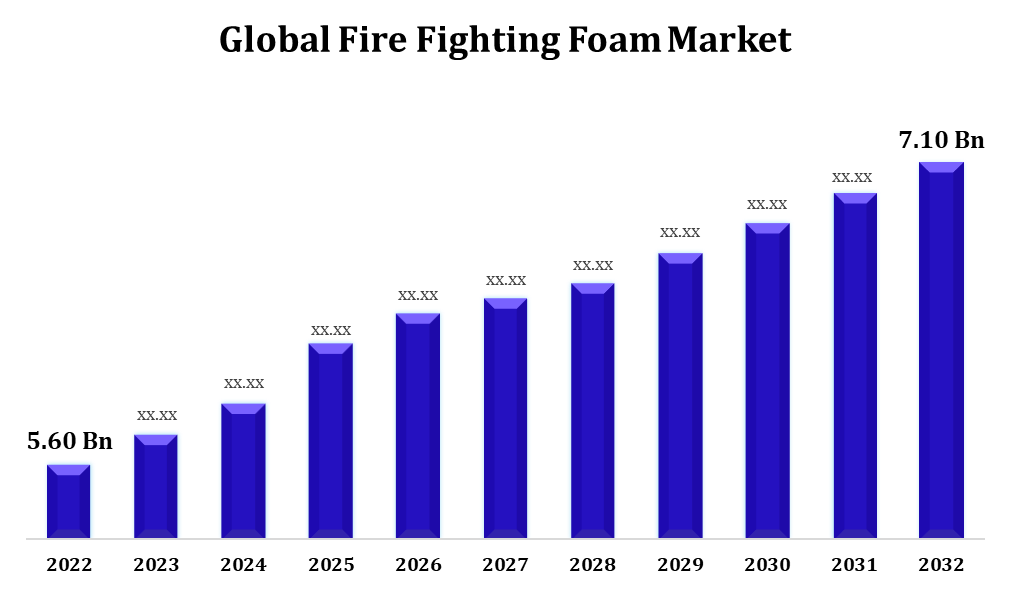

- The Global Fire Fighting Foam Market Size was valued at USD 5.60 Billion in 2022

- The Market Size is reaching at a CAGR of 2.40% from 2022 to 2032

- The Worldwide Fire Fighting Foam Market Size is expected to reach USD 7.10 Billion by 2032

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Fire Fighting Foam Market Size is expected to reach USD 7.10 Billion by 2032, at a CAGR of 2.40% during the forecast period 2022 to 2032.

Several variables influence the growth of the fire fighting foam market. One significant factor is the increased emphasis on industrial safety, as well as the severe rules governing fire safety standards in many industries. As industries grow and infrastructure evolves, there is a greater need for improved fire suppression technologies, such as effective foams. Furthermore, the expansion of sectors such as petrochemicals, oil and gas, and manufacturing contributes to the rising market. These industries frequently handle flammable materials, making them ideal candidates for thorough fire protection measures. Furthermore, technological improvements and innovations in the composition of fire fighting foams contribute to market growth. Manufacturers are always developing new and improved foams with greater firefighting capabilities, environmental sustainability, and lower environmental effect.

Fire Fighting Foam Market Value Chain Analysis

The acquisition of raw materials used in foam manufacture begins the value chain. Water, foam concentration, and chemical additions are frequently used as key constituents. In this stage, foam concentrate producers play a critical role. The foam concentrate is made by combining water, foam concentration, and other components. Following production, the foam concentrate is packed and transported to a variety of end users, including fire departments, industrial facilities, airports, and others. Wholesalers, distributors, and direct sales to end users are all possible distribution methods. The fire fighting foam is used for fire suppression by end users such as fire departments, industrial plants, airports, and other facilities. This step may involve foam application equipment such as foam generators and foam proportioning devices. Training is required to utilise fire fighting foam effectively. Companies and educational institutions may provide training programmes to educate end-users on the proper usage of foam in various fire scenarios. To minimise environmental impact, proper disposal of old foam and debris created during manufacturing is critical. Environmental standards must be followed at this point.

Fire Fighting Foam Market Opportunity Analysis

The development of improved foam technologies that are more successful at suppressing various sorts of fires presents opportunities. Tailoring foam solutions for specific industries like oil and gas, aviation, and manufacturing is a big opportunity. Customised formulas that suit the specific issues of each area can help increase market penetration. Fire safety solutions are in high demand as the world's industrialization accelerates. Expanding global market presence, particularly in emerging markets with developing infrastructure, can be a profitable opportunity for foam manufacturers. Creating a niche opportunity by establishing comprehensive training and education programmes for end-users. This involves not only foam application training, but also maintenance, testing, and compliance with safety regulations. Digital technology and IoT (Internet of Things) integration with fire suppression systems can provide real-time monitoring and data analytics. This can result in predictive maintenance, increased system efficiency, and overall fire safety.

Global Fire Fighting Foam Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 5.60 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 2.40% |

| 2032 Value Projection: | USD 7.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Fire Type, By Region, By Geographic Scope |

| Companies covered:: | Angus Fire Limited, Auxquimia, Bavaria Egypt S.A.E., Buckeye Fire Equipment Company, Chemguard, Dafo Fomtec AB, Fireade Inc., Johnson Controls International PLC., KV Fire Chemicals Pvt. Ltd., Orchidee, Oil Technics (Fire Fighting Foam Products) Limited, Perimeter Solutions, Profoam srl, SEPPIC, VimalFire, and Vintex Fire Protection Pvt Ltd. and Other Key Vendors. |

| Growth Drivers: | Rising popularity of firefighting foam |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Fire Fighting Foam Market Dynamics

Rising popularity of firefighting foam

Firefighting foams are well-known for their ability to put out numerous forms of flames, particularly those involving flammable liquids. Their capacity to form a blanket or film over the liquid's surface, blocking the discharge of flammable vapours, makes them extremely useful in fire suppression. As industries develop globally, so does the demand for reliable fire suppression technologies. The importance of firefighting foam in protecting industrial facilities, petrochemical plants, manufacturing units, and other infrastructure is driving its appeal. Companies and organisations are increasingly implementing risk management strategies that are proactive. The use of firefighting foam is seen as an essential component in reducing the risks connected with fires, particularly in high-risk areas. The general public is becoming more aware of the necessity of fire safety. Training programmes and educational initiatives highlight the importance of firefighting foam in emergency response, which contributes to its appeal among end-users.

Restraints & Challenges

Manufacturers may face difficulties if regulations and restrictions on certain foam formulations, particularly those containing PFAS, change. Adapting to new regulatory standards and ensuring compliance may necessitate substantial investments and changes to existing product lines. Advanced firefighting foam formulations, particularly those with eco-friendly features, might be more expensive than standard foams. Cost-conscious industries may be hesitant to adopt these solutions, which will have an influence on market penetration. Proper training is required for the effective use of firefighting foam. It can be difficult to ensure that end-users are properly trained in foam application and equipment maintenance. Supply chain disruptions, whether caused by geopolitical issues, natural catastrophes, or other unforeseen occurrences, can have an impact on the availability of raw materials and components required for foam manufacture.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Fire Fighting Foam Market from 2023 to 2032. The presence of many industries, such as petrochemicals, manufacturing, and aviation, adds to the requirement for excellent fire suppression solutions. Firefighting foams are critical in protecting industrial sites from the dangers of combustible materials. The use of sophisticated firefighting technologies characterises the North American market. Companies invest in R&D to provide foams with greater performance, faster knockdown times, and versatility in dealing with different types of fires. North America's major aerospace and defence sector contributes to the demand for specialised firefighting foams. These foams are intended to meet the particular requirements of aircraft and military applications. The North American fire fighting foam industry is competitive, with significant competitors contending for market share.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The Asia-Pacific region is rapidly industrialising, with an increasing number of manufacturing factories, petrochemical plants, and industrial complexes. The expanding oil and gas industry in the Asia-Pacific area, particularly in China and Australia, necessitates strong fire protection measures. In these industries, firefighting foams are critical in dealing with fires involving flammable liquids. The expanding oil and gas industry in the Asia-Pacific area, particularly in China and Australia, necessitates strong fire protection measures. In these industries, firefighting foams are critical in dealing with fires involving flammable liquids. The expansion of business centres and urbanisation raise the requirement for fire protection measures in densely populated areas.

Segmentation Analysis

Insights by Foam Type

The Aqueous Film Forming Form (AFFF) segment accounted for the largest market share over the forecast period 2023 to 2032. AFFF is especially good in putting out fires involving combustible liquids like petrol, diesel and jet fuel. Its capacity to form a thin coating on the liquid surface prevents flammable vapours from being released, resulting in faster and more efficient fire control. AFFF is adaptable and finds use in a variety of industries, including petrochemicals, oil & gas, aviation, and manufacturing. Its efficiency in dealing with various forms of flammable liquid flames makes it a popular choice in industries where such fires are common. AFFF is commonly employed in aviation and military contexts where there is a high risk of fuel-related burns. Because of its ability to extinguish flames using aviation fuels, it is an essential component of fire safety practices for airports, military bases, and aircraft.

Insights by Fire Type

The Class A type segment accounted for the largest market share over the forecast period 2023 to 2032. Class A foams are frequently utilised in wildland firefighting to improve the effectiveness of water in extinguishing fires. The foams boost the ability of water to penetrate and moisten the fuels, assisting in wildfire management and extinguishment. In structure firefighting scenarios, municipal fire departments frequently deploy Class A foams. The foams promote water absorption by fire-related materials, enabling for more effective fire extinguishment in residential and commercial structures. To improve their firefighting abilities, firefighters are trained in the use of Class A foams. Training programmes and educational activities emphasise the proper application of these foams in various fire scenarios, which aids in their effective deployment.

Insights by End Use

The oil and gas segment accounted for the largest market share over the forecast period 2023 to 2032. In the oil and gas business, combustible liquids such as crude oil, petrol, diesel, and various chemicals are used. Exploration, manufacturing, refining, and storage activities all carry the danger of flammable liquid fires, making firefighting foams crucial for risk control. Large flammable liquid storage tanks necessitate good fire protection. Foam systems, such as foam monitors and foam chambers, are used to generate a foam blanket over the liquid surface, which prevents vapour leakage and fires. Offshore oil and gas sites face particular fire hazards. Firefighting foams are used on these platforms to quickly extinguish fires, safeguard personnel and assets, and avoid emergency escalation in isolated offshore sites.

Recent Market Developments

- In April 2021, Chemguard 33, a non-fluorinated foam concentrate from Johnson Controls, is designed to provide effective and aggressive fire suppression of Class B hydrocarbon and polar solvent fuel fires.

Competitive Landscape

Major players in the market

- Angus Fire Limited

- Auxquimia

- Bavaria Egypt S.A.E.

- Buckeye Fire Equipment Company

- Chemguard

- Dafo Fomtec AB

- Fireade Inc.

- Johnson Controls International PLC.

- KV Fire Chemicals Pvt. Ltd.

- Orchidee

- Oil Technics (Fire Fighting Foam Products) Limited

- Perimeter Solutions

- Profoam srl

- SEPPIC

- VimalFire, and Vintex Fire Protection Pvt Ltd.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Fire Fighting Foam Market, Foam Type Analysis

- AFFF

- AR-AFFF

Fire Fighting Foam Market, Fire Type Analysis

- Class A

- Class B

- Class C

Fire Fighting Foam Market, End Use Analysis

- Oil & Gas

- Chemical

Fire Fighting Foam Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Fire Fighting Foam Market?The Global Fire Fighting Foam Market is expected to grow from USD 5.60 Billion in 2023 to USD 7.10 Billion by 2032, at a CAGR of 2.40% during the forecast period 2023-2032.

-

2. Who are the key market players of the Fire Fighting Foam Market?Some of the key market players of market are Angus Fire Limited, Auxquimia, Bavaria Egypt S.A.E., Buckeye Fire Equipment Company, Chemguard, Dafo Fomtec AB, Fireade Inc., Johnson Controls International PLC., KV Fire Chemicals Pvt. Ltd., Orchidee, Oil Technics (Fire Fighting Foam Products) Limited, Perimeter Solutions, Profoam srl, SEPPIC, VimalFire, and Vintex Fire Protection Pvt Ltd.

-

3. Which segment holds the largest market share?The oil and gas segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Fire Fighting Foam Market?North America is dominating the Fire Fighting Foam Market with the highest market share.

Need help to buy this report?