Global Fingerprint Sensor Assembly Market Size, Share, and COVID-19 Impact Analysis, By Technology (Optical, Capacitive, Ultrasonic, and Thermal), By Application (Consumer Electronics, Government and Law Enforcement, Military and Defense, Healthcare, Banking and Finance, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Semiconductors & ElectronicsGlobal Fingerprint Sensor Assembly Market Insights Forecasts to 2035

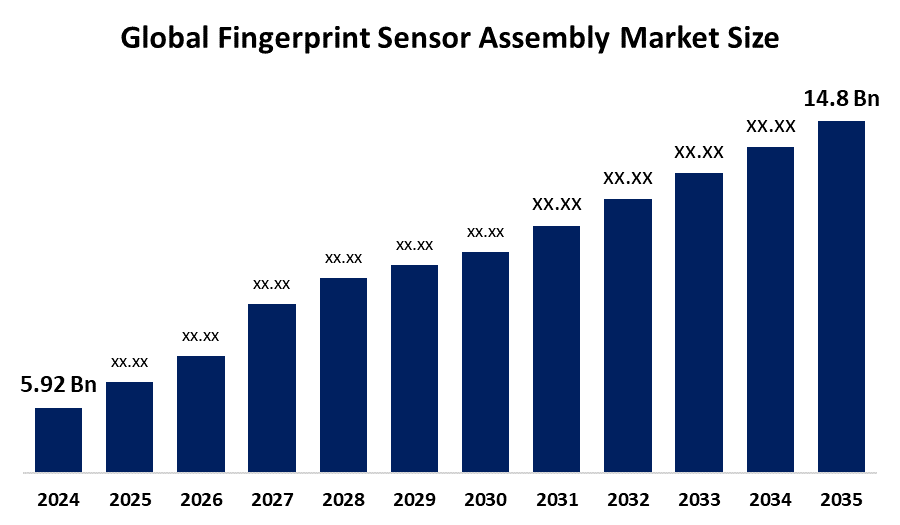

- The Global Fingerprint Sensor Assembly Market Size Was Estimated at USD 5.92 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.69% from 2025 to 2035

- The Worldwide Fingerprint Sensor Assembly Market Size is Expected to Reach USD 14.8 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Fingerprint Sensor Assembly Market Size was worth around USD 5.92 Billion in 2024 and is predicted to grow to around USD 14.8 Billion by 2035 with a compound annual growth rate (CAGR) of 8.69% from 2025 to 2035. The growing usage of biometrics in banking, healthcare, and electronics due to improved security requirements, smooth authentication, and user convenience across a variety of devices and applications is propelling the fingerprint sensor market's expansion.

Market Overview

The global fingerprint sensor assembly market refers to the industry focused on designing, manufacturing, and integrating sensor components for safe biometric authentication in electronic devices, providing accuracy, dependability, and user-friendly security solutions. The market for fingerprint sensor assemblies is expanding rapidly, mostly due to the growing use of biometric authentication in consumer electronics and smartphones. Fingerprint sensors are now a typical feature for safe and easy device access and digital transactions as mobile device manufacturers look to separate out from the competition. Demand is further strengthened by the growing use of digital wallets and mobile payments. In addition to consumer gadgets, wearables, smart home appliances, and automotive systems are seeing new uses. Biometric sensors are being used in wearables like fitness trackers and smartwatches for safe authentication and health monitoring, and the automobile sector is investigating fingerprint-based car entry and customisation. Adoption is also being fuelled by global government initiatives, such as the use of biometric technologies in border control systems, national IDs, and e-passports.

For example, fingerprint sensors are used in large-scale projects like the European Union's eID programs, the U.S. Department of Homeland Security's biometric initiatives, and India's Aadhaar program to ensure trustworthy citizen verification.

An improved ultrasonic fingerprint sensor from Goodix was introduced in October 2024, increasing accuracy and dependability for consumer and mobile devices in a variety of scenarios. Infineon Technologies unveiled automotive-qualified fingerprint sensor integrated circuits (ICs) with sophisticated encryption that same month. These ICs provide reliable performance in a variety of temperature ranges, facilitating safe in-car payment, personalisation, and authentication applications.

Report Coverage

This research report categorizes the fingerprint sensor assembly market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the fingerprint sensor assembly market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the fingerprint sensor assembly market.

Global Fingerprint Sensor Assembly Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.92 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.69% |

| 2035 Value Projection: | USD 14.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Technology, By Application and By Region |

| Companies covered:: | Apple Inc., Synaptics Incorporated, Fingerprint Cards AB, Goodix Technology Inc., Qualcomm Technologies, Inc., IDEX Biometrics ASA, Egis Technology Inc., NEXT Biometrics Group ASA, Shenzhen Huiding Technology Co., Ltd., FocalTech Systems Co., Ltd., Vkansee Technology Inc., CrucialTec Co., Ltd., Sonavation, Inc., BioEnable Technologies Pvt. Ltd., SecuGen Corporation, Crossmatch Technologies, Inc., Suprema Inc., Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The market for fingerprint sensor assemblies is being pushed by the growing need for biometric security in the face of increasing cyber threats, as well as the quick adoption of smartphones that allow for safe unlocking and mobile payments. Adoption is further accelerated by government schemes like the e-passport and the national ID. New opportunities are created by the expansion of contactless payment systems, vehicle integration, and Internet of Things applications. Further driving widespread application across consumer electronics, fintech, automotive, and smart devices, technology innovations, including optical and ultrasonic under-display sensors, improve accuracy, efficiency, and design flexibility, guaranteeing steady market growth.

Restraining Factors

High integration costs, especially for sophisticated ultrasonic and optical sensors, are a barrier to the fingerprint sensor assembly industry, preventing widespread use in low-cost products. Trust is hampered by privacy worries about biometric data breaches and storage. Widespread adoption and market expansion are further limited by sensor performance problems in challenging environments, integrating technological complexity, device compatibility limitations, and growing competition from alternative biometrics like facial and iris recognition.

Market Segmentation

The Fingerprint Sensor Assembly market share is classified into technology and application.

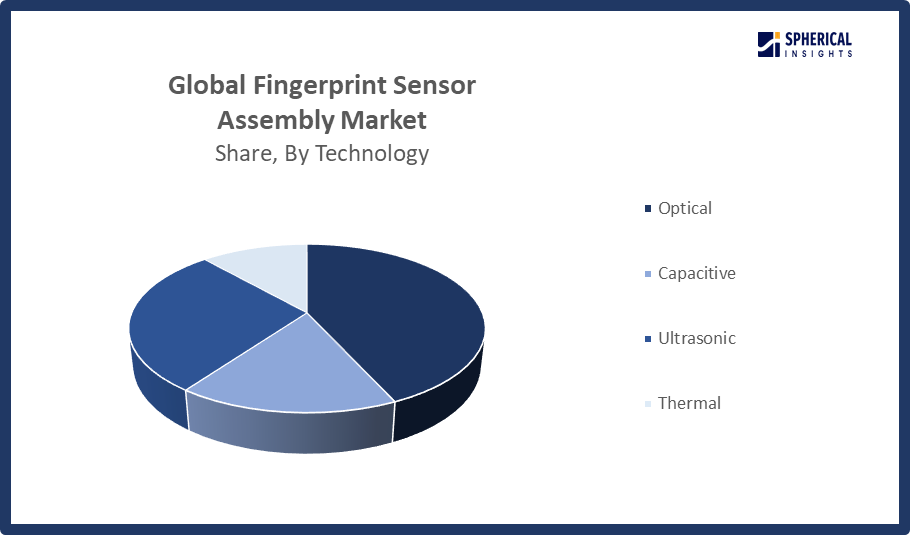

- The optical segment dominated the market in 2024 with approximately 52.8% and is projected to grow at a substantial CAGR during the forecast period.

Based on the technology, the fingerprint sensor assembly market is divided into optical, capacitive, ultrasonic, and thermal. Among these, the optical segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Optical sensors are generally employed in situations where image quality is crucial since they use a light source to take a picture of the fingerprint. Capacitive sensors, on the other hand, are widely used in consumer devices like smartphones because they provide better security and performance by detecting the fingerprint pattern through electrical changes.

Get more details on this report -

- The consumer electronics segment accounted for the largest share in 2024, approximately 51% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the fingerprint sensor assembly market is divided into consumer electronics, government and law enforcement, military and defense, healthcare, banking and finance, and others. Among these, the consumer electronics segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. With smartphones, laptops, tablets, and wearables being the main adopters, consumer electronics continues to be the most important market. These devices' incorporation of fingerprint sensors improves user security and convenience by offering a simple method of transaction authentication and device unlocking. The consumer electronics sector is anticipated to continue to dominate the fingerprint sensor market as the need for smart devices rises on a global scale.

Regional Segment Analysis of the Fingerprint Sensor Assembly Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share with approximately 28.5% of the Fingerprint Sensor Assembly market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the fingerprint sensor assembly market over the predicted timeframe. The market is dominated by North America because biometric technologies are widely used in the banking, government, and consumer electronics industries. Fingerprint sensor assemblies are in high demand due to the presence of large IT companies and strict cybersecurity requirements. Fingerprint sensors are being adopted for a variety of applications, such as government identity systems, computers, and cellphones, due to the region's emphasis on security and technological breakthroughs. The market is growing thanks in large part to the U.S. and Canada, which use state-of-the-art research and development to deliver novel solutions and keep their competitive edge.

Asia Pacific is expected to grow market share with approximately 36.8% at a rapid CAGR in the fingerprint sensor assembly market during the forecast period. The growing demand for wearables, smartphones, and other digital devices is driving the market in the region. Leading the way are nations like China, India, and South Korea, where regional manufacturers and IT firms are essential to fostering innovation and market growth. The market's potential in this region is further supported by government attempts to improve security infrastructure and encourage digitalisation. Due to the widespread use of smartphones, government-sponsored biometric identification schemes, and the growth of fintech applications in nations like China, India, South Korea, and Japan, the Asia Pacific is the region with the quickest rate of growth.

Europe is expected to grow at a rapid CAGR in the fingerprint sensor assembly market during the forecast period. The region's market is growing steadily thanks to strict data protection regulations like GDPR, the growing use of biometric passports, and the growing need for secure authentication in business IT and financial settings. The region's use of biometric technologies is fuelled by the introduction of strict security legislation and the rising demand for digital services. Leading this expansion are nations like Germany, the UK, and France, with an emphasis on strengthening security protocols in government and financial applications. Europe is anticipated to continue to play a significant role in the global fingerprint sensor assembly market as it grows.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the fingerprint sensor assembly market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Apple Inc.

- Synaptics Incorporated

- Fingerprint Cards AB

- Goodix Technology Inc.

- Qualcomm Technologies, Inc.

- IDEX Biometrics ASA

- Egis Technology Inc.

- NEXT Biometrics Group ASA

- Shenzhen Huiding Technology Co., Ltd.

- FocalTech Systems Co., Ltd.

- Vkansee Technology Inc.

- CrucialTec Co., Ltd.

- Sonavation, Inc.

- BioEnable Technologies Pvt. Ltd.

- SecuGen Corporation

- Crossmatch Technologies, Inc.

- Suprema Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, NEXT Biometrics received its first large-scale production order for the new FAP 30 'Granite' sensor from an existing Indian OEM customer. The initial purchase order is valued at NOK 3.2 million, with deliveries scheduled for Q4 2025.

- In June 2025, NEXT Biometrics secured a NOK 6.3 million purchase order for its newly introduced FAP 20 Basalt L1 Slim ultra-thin fingerprint sensor. This product achieved Level 1 certification for India's Aadhaar program, targeting robust security for national ID and payment devices.

- February 2025, Fingerprint Cards AB and CardLab collaborated to introduce "Access," a next-generation biometric smart card that uses Fingerprint Cards' cutting-edge T-Shape fingerprint sensor. By providing quick and accurate identification for secure access systems, this new device seeks to improve security and user experience by substituting biometric access for passwords.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the fingerprint sensor assembly market based on the below-mentioned segments:

Global Fingerprint Sensor Assembly Market, By Technology

- Optical

- Capacitive

- Ultrasonic

- Thermal

Global Fingerprint Sensor Assembly Market, By Application

- Consumer Electronics

- Government and Law Enforcement

- Military and Defense

- Healthcare

- Banking and Finance

- Others

Global Fingerprint Sensor Assembly Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Fingerprint Sensor Assembly market over the forecast period?The global Fingerprint Sensor Assembly market is projected to expand at a CAGR of 8.69% during the forecast period.

-

2. What is the market size of the Fingerprint Sensor Assembly market?The global Fingerprint Sensor Assembly market size is expected to grow from USD 5.92 Billion in 2024 to USD 14.8 Billion by 2035, at a CAGR of 8.69% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Fingerprint Sensor Assembly market?North America is anticipated to hold the largest share of the Fingerprint Sensor Assembly market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Fingerprint Sensor Assembly market?Apple Inc., Synaptics Incorporated, Fingerprint Cards AB, Goodix Technology Inc., Qualcomm Technologies, Inc., IDEX Biometrics ASA, Egis Technology Inc., NEXT Biometrics Group ASA, Shenzhen Huiding Technology Co., Ltd., and FocalTech Systems Co., Ltd.

-

5. What factors are driving the growth of the Fingerprint Sensor Assembly market?Rising smartphone and consumer electronics adoption, the need for safe mobile payments, government digital ID programs, integration in automotive and Internet of Things devices, and technological developments like ultrasonic and optical sensors that improve accuracy, efficiency, and user convenience are all factors propelling the fingerprint sensor assembly market.

-

6. What are the market trends in the Fingerprint Sensor Assembly market?Increased integration in laptops, wearables, and smartphones; improvements in ultrasonic and optical sensors; growth in automotive and Internet of Things devices; adoption in the public and private sectors; and a strong emphasis on safe, privacy-compliant biometric authentication solutions are all driving trends in the fingerprint sensor assembly market.

-

7. What are the main challenges restricting wider adoption of the Fingerprint Sensor Assembly market?High integration costs, privacy and data security issues, accuracy being affected by environmental sensitivity, technological complexity, device incompatibilities, and increasing competition from alternative biometrics like facial and iris recognition are all barriers to the wider adoption of fingerprint sensor assemblies.

Need help to buy this report?