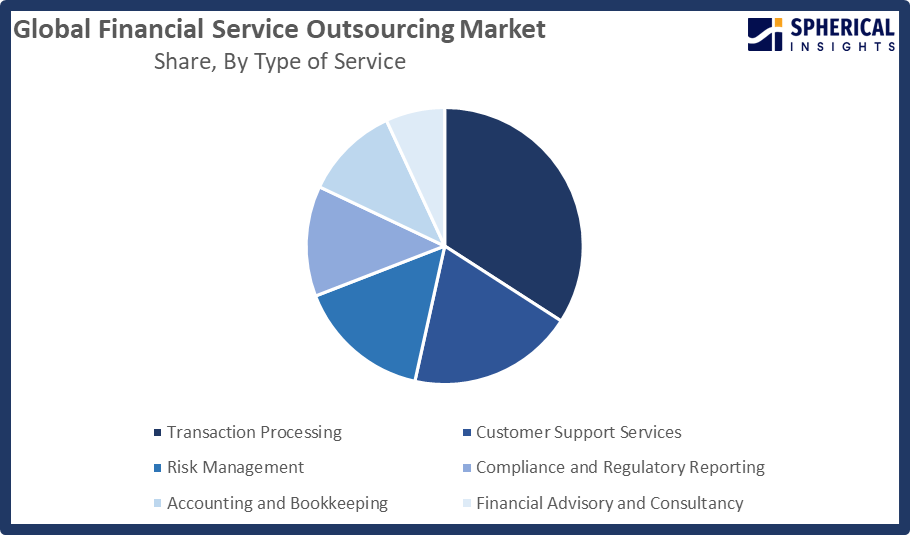

Global Financial Service Outsourcing Market Size, Share, and COVID-19 Impact Analysis, By Type of Service (Transaction Processing, Customer Support Services, Risk Management, Compliance and Regulatory Reporting, Accounting and Bookkeeping, and Financial Advisory and Consultancy), By Client Type (Banking Sector, Insurance Companies, Investment Firms, Crowdfunding Platforms, and Fintech Companies), By Functionality (Back Office Operations, Front Office Services, and Middle Office Services), By Technology Utilization (Robotic Process Automation (RPA), Artificial Intelligence (AI), Cloud Computing, Big Data Analytics, and Blockchain Technology) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Banking & FinancialGlobal Financial Service Outsourcing Market Insights Forecasts to 2035

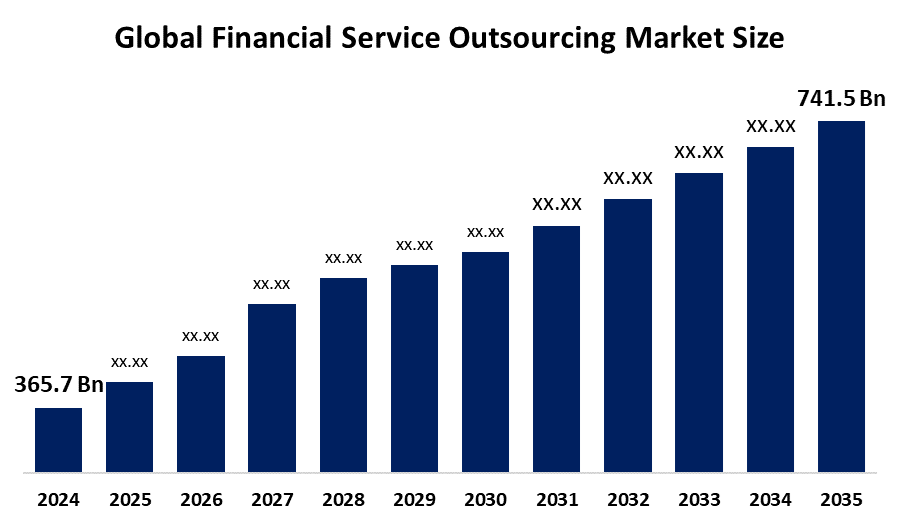

- The Global Financial Service Outsourcing Market Size Was Estimated at USD 365.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.64% from 2025 to 2035

- The Worldwide Financial Service Outsourcing Market Size is Expected to Reach USD 741.5 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Financial Service Outsourcing market size was worth around USD 365.7 Billion in 2024 and is predicted to grow to around USD 741.5 Billion by 2035 with a compound annual growth rate (CAGR) of 6.64% from 2025 to 2035. The industry's expansion in emerging nations and the rising need for dependable, reasonably priced services with cutting-edge technologies are the main causes of the rise. the growing demand for efficiency gains, cost reduction, and the capacity to concentrate on core business operations.

Market Overview

The global financial service outsourcing market includes contracting with third-party providers to handle banking, insurance, accounting, and other financial processes, resulting in cost savings, operational scalability, and access to specialised expertise. The demand for financial institutions to increase operational efficiency, changing regulations, and technology breakthroughs are driving the global financial services outsourcing market. Businesses are looking to cut expenses and enhance customer experience as digital transformation picks up speed. Technologies like blockchain, AI, and machine learning can be adopted through outsourcing without requiring a large financial outlay. Due to the growing emphasis on risk management and cybersecurity, FSO providers are now providing strong, secure solutions. Institutions may now offer individualised, seamless experiences due to the growth of digital banking and the increased demand for individualised financial services. Further driving demand for outsourcing solutions are rising areas like Asia-Pacific and Latin America, which are drawing significant investment in financial services. Together, these factors put the FSO market in a position for long-term innovation and expansion on a worldwide scale.

The growth of the outsourcing market includes the technological advances in Financial Service ICT, the low-cost labour in countries such as India and the Philippines, and the creative labour-intensive process outsourcing. However, adoption is limited due to concerns over data security and mistakes. Robotic Process Automation (RPA) is a technology that supports growth in the sector by improving efficiency.

Globally, Tata Consultancy Services offers business solutions, IT services, and consulting in the following areas: manufacturing, retail & consumer business, banking, financial services & insurance, and communication, media & technology. Serving the banking, healthcare, travel, insurance, manufacturing, and retail sectors, TCS has submitted 4,596 patent applications, 946 of which have been approved. Genpact is a business process outsourcing and IT management company that also provides supply chain, enterprise application, research and analytics, accounting and finance, and business consulting services.

Report Coverage

This research report categorizes the financial service outsourcing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the financial service outsourcing market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the financial service outsourcing market.

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Financial Service Outsourcing market over the forecast period?The global Financial Service Outsourcing market is projected to expand at a CAGR of 6.64% during the forecast period.

-

2. What is the market size of the Financial Service Outsourcing market?The global Financial Service Outsourcing market size is expected to grow from USD 365.7 Billion in 2024 to USD 741.5 Billion by 2035, at a CAGR of 6.64% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Financial Service Outsourcing market?North America is anticipated to hold the largest share of the Financial Service Outsourcing market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Financial Service Outsourcing market?GE Capital, Citigroup, IBM, Deloitte, Accenture, Capgemini, Wipro, Standard Chartered, HSBC, and Amex.

-

5. What factors are driving the growth of the Financial Service Outsourcing market?Focus on core capabilities, cost reduction, and operational efficiency are the main factors driving the financial services outsourcing market. Global market expansion is further fuelled by growing digital transformation, the adoption of AI, RPA, and blockchain, as well as the need for enhanced analytics, cybersecurity, and regulatory compliance.

-

6. What are the market trends in the Financial Service Outsourcing market?The use of AI, RPA, and cloud technologies; the expansion of fintech and digital banking; nearshoring to cost-effective locations; the need for individualised financial services; and an emphasis on cybersecurity, regulatory compliance, and operational efficiency are some of the major trends in the financial services outsourcing market.

-

7. What are the main challenges restricting wider adoption of the Financial Service Outsourcing market?The adoption of financial services outsourcing is hampered primarily by issues with data security, risks associated with regulatory compliance, the possibility of mistakes in crucial financial procedures, opposition to outsourcing, and reliance on outside vendors for delicate operations.

Need help to buy this report?