Global Fiber Optic Closures Market Size, Share, and COVID-19 Impact Analysis, By Type (Above-ground Closures, Underground Closures, and Aerial Closures), By Material (Polycarbonate, Metal, and Thermoplastic/ Fiber‑Reinforced Plastic), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Semiconductors & ElectronicsGlobal Fiber Optic Closures Market Insights Forecasts to 2035

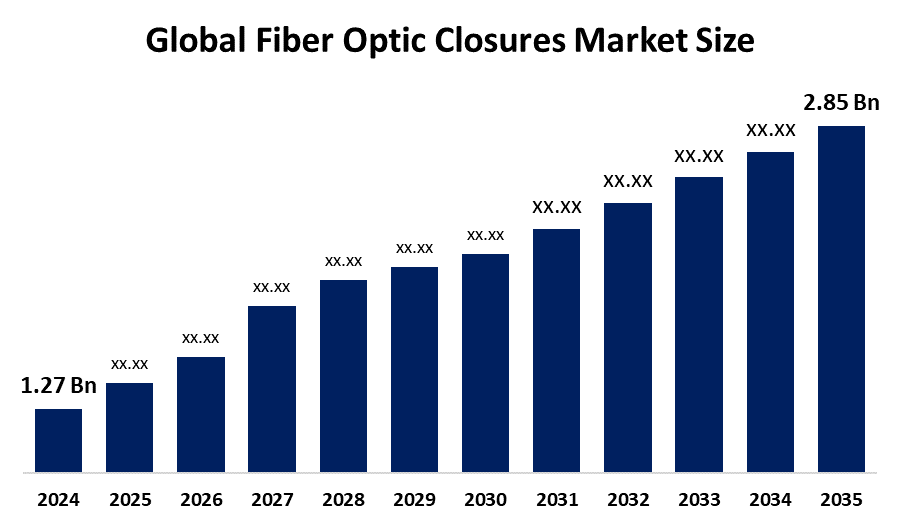

- The Global Fiber Optic Closures Market Size Was Estimated at USD 1.27 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.62% from 2025 to 2035

- The Worldwide Fiber Optic Closures Market Size is Expected to Reach USD 2.85 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Fiber Optic Closures Market Size was worth around USD 1.27 Billion in 2024 and is predicted to grow to around USD 2.85 Billion by 2035 with a compound annual growth rate (CAGR) of 7.62% from 2025 to 2035. Growing need for data transfer and high-speed internet across a range of businesses, combined with developments in fiber optic technology. As the world grows increasingly interconnected and dependent on digital infrastructure, the demand for dependable and secure fiber optic networks will keep propelling the market.

Market Overview

The global fiber optic closures market includes devices used to secure, organise, and manage fibre optic cables and splices, ensuring consistent signal transmission, environmental protection, and effective network maintenance. With the growing need for dependable, fast internet that can accommodate streaming, gaming, and data-intensive applications, the market for fibre optic closures is growing. Growing use of cloud computing and large data in data centres necessitates high-bandwidth, secure connections. Since fibre optic networks allow for real-time data gathering, communication, and analysis across industries, including public safety, healthcare, and transportation, the market is expected to grow even more as smart city and IoT implementation continue to grow.

The necessity of fibre optic closures for preserving network efficiency and integrity is further supported by ongoing improvements in data centre architecture and the drive for scalable, high-performance networking solutions. CommScope's Modular Closure, In 2021, CommScope declared that its modular fibre optic closure would be generally available, improving network deployment scalability and flexibility.

T-Mobile and EQT's Infrastructure VI fund established a partnership to buy Lumos, a fiber-to-the-home company, using T-Mobile's ability to reach customers and EQT's knowledge of fiber infrastructure. At the same time, KKR, a large investor in FiberCop, is assessing the idea of merging with Open Fiber to support the Italian government's goal of creating a single fiber network.

Report Coverage

This research report categorizes the fiber optic closures market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the fiber optic closures market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the fiber optic closures market.

Global Fiber Optic Closures Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.27 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.62% |

| 2035 Value Projection: | USD 2.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Type, By Material and By Region |

| Companies covered:: | 3M, Corning Incorporated, CommScope, Raycap, FIBERON, Fujikura Ltd., Furukawa Electric Co. Ltd, HUBER+SUHNER, ZTT Group, New Northeast Electric Group High Voltage Switchgear Co., Ltd., Orient Rising Sun Telecom, Fiber Home Telecommunication Technologies Co., Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The major growth drivers for the global fiber optic closures market are the rapid proliferation of 5G and broadband networks, ongoing investment in data centers, and rising FTTH subscribers. With an increase in smart city projects and industrialization, the demand for closures that are long-lasting and high-performing has risen. These closures may provide constant connectivity, environmental protection, and continuous data flow across a number of applications. Furthermore, governments are fast-tracking fiber builds into rural and underserved areas through broadband initiatives and financing programs. This has provided opportunities to manufacturers to deliver very advanced, weather-proof, and low-maintenance closure solutions that are built to support the latest communications infrastructure.

Restraining Factors

High installation costs, a lack of experienced labor, and environmental vulnerabilities that shorten product lifespans are some of the issues facing the fiber optic closures market. Network integration and maintenance are made more difficult by compatibility problems and installation complexity. Production and deployment are also delayed by disturbances in the raw material supply chain. Restoring efficiency, cutting expenses, and improving overall network performance and dependability can all be achieved by addressing these concerns with worker training, standardized designs, and durable materials.

Market Segmentation

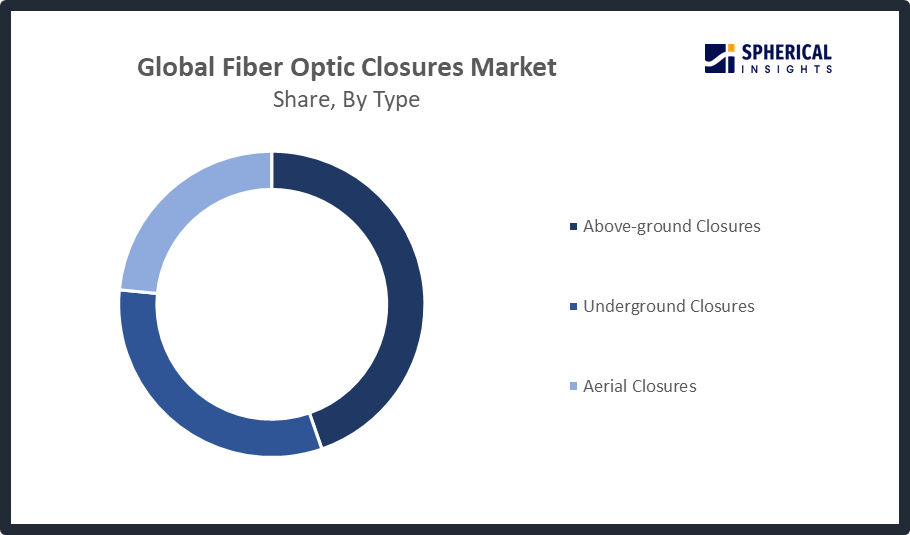

The Fiber Optic Closures market share is classified into type and material.

- The above-ground closures segment dominated the market in 2024, approximately 45% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the fiber optic closures market is divided into above-ground closures, underground closures, aerial closures. Among these, the above-ground closures segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Fiber network aerial deployments frequently involve above-ground closures. They are perfect for telecom and utility infrastructure since they are easy to maintain and made to resist severe weather conditions. driven by broad use in urban fiber network expansions, ease of installation, and accessibility for maintenance.

Get more details on this report -

Regional Segment Analysis of the Fiber Optic Closures Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share with approximately 45% of the Fiber Optic Closures market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the fiber optic closures market over the predicted timeframe. The industry is dominated by North America because of extensive broadband projects, 5G rollout, and significant investments in fiber-optic infrastructure. Steady market expansion is being driven by the presence of major telecom providers and government-backed rural connectivity initiatives. Fibre optic network deployment is being spearheaded by the US and Canada to satisfy the growing demand for high-speed internet and data services. The region's demand for fibre optic closures will be driven by the continuous improvements of current networks as well as the growth of data centres. Additionally, the market's expansion in North America will be aided by the technological improvements in fibre optic solutions and the robust presence of significant manufacturers.

Asia Pacific is expected to grow the fastest market share with approximately 32% at a rapid CAGR in the fiber optic closures market during the forecast period. The fastest-growing region is Asia Pacific, which is being fuelled by government efforts to increase broadband connection, digitalisation, and expanding internet usage. China, India, and Japan are among the major economies making significant investments in the installation of fibre in both urban and rural areas. This expansion is fuelled by the fast industrialisation and urbanisation of nations like China, India, and Japan. To give their citizens high-speed internet access, the governments of these nations are making significant investments in modernising their telecommunications capacities. For example, the "Broadband China" effort in China intends to increase the number of fibre optic networks throughout the nation, which will lead to a considerable demand for fibre optic closures.

Europe is expected to grow at a rapid CAGR in the fiber optic closures market during the forecast period. Europe's industry has been steadily developing thanks to strict data protection regulations, rising FTTH adoption, and smart city projects. Using cutting-edge fibre technologies, nations including the UK, France, and Germany are updating their antiquated telecom networks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the fiber optic closures market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Corning Incorporated

- CommScope

- Raycap

- FIBERON

- Fujikura Ltd.

- Furukawa Electric Co. Ltd

- HUBER+SUHNER

- ZTT Group

- New Northeast Electric Group High Voltage Switchgear Co., Ltd.

- Orient Rising Sun Telecom

- Fiber Home Telecommunication Technologies Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, AFL introduced the Apex® X-1, a compact sealed dome splice closure designed for small network and rural FTTx deployments. The X-1 streamlines installation for network operators and installers, offering enhanced reliability and ease of use.

- In August 2025, Corning Enhances 2178 Fiber Optic Closure Series Corning has expanded its 2178 Fiber Optic Splice Closure series, introducing new models and configurations to meet the complex needs of today's fiber optic networks. These closures are designed to provide reliable protection for fiber optic facilities in various environments.

- In March 2025, R&M launched its SYNO S-500 High-Density Fiber Optic Splice Closure, supporting up to 3,456 ribbon fiber splices. This innovation enhances FTTH and 5G network deployments, offering improved scalability, durability, and faster installation for expanding global fiber infrastructures.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the fiber optic closures market based on the below-mentioned segments:

Global Fiber Optic Closures Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Fiber Optic Closures market over the forecast period?The global Fiber Optic Closures market is projected to expand at a CAGR of 7.62% during the forecast period.

-

2. What is the market size of the Fiber Optic Closures market?The global Fiber Optic Closures market size is expected to grow from USD 1.27 Billion in 2024 to USD 2.85 Billion by 2035, at a CAGR of 7.62% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Fiber Optic Closures market?North America is anticipated to hold the largest share of the Fiber Optic Closures market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Fiber Optic Closures market?3M, Corning Incorporated, CommScope, Raycap, FIBERON, Fujikura Ltd., Furukawa Electric Co. Ltd, HUBER+SUHNER, ZTT Group, and Orient Rising Sun Telecom.

-

5. What factors are driving the growth of the Fiber Optic Closures market?Increased demand for high-speed internet, growing fiber-to-the-home (FTTH) deployments, growing 5G network adoption, expanding data centre construction, and government initiatives to improve broadband infrastructure and connectivity in both urban and rural areas are the main factors propelling the growth of the Fibre Optic Closures market.

-

6. What are the market trends in the Fiber Optic Closures market?Adoption of compact, high-density, and modular designs; improved environmental durability; incorporation of smart monitoring features; growing use in urban subterranean networks; increasing demand from 5G, FTTH, and data centres; and rapid growth in the Asia-Pacific are some of the key trends in the fibre optic closures market.

-

7. What are the main challenges restricting wider adoption of the Fiber Optic Closures market?High installation prices, intricate handling specifications, regulatory discrepancies, supply chain interruptions, and geopolitical unpredictability’s are among of the obstacles facing the fibre optic closures market, which restricts adoption in areas with limited infrastructure and budget.

Need help to buy this report?