Global Fertilizer Market Size, Share, and COVID-19 Impact Analysis, By Type (Organic and Inorganic), By Form (Dry and Liquid), Application (Horticulture, Agriculture, Gardening, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

Industry: Chemicals & MaterialsGlobal Fertilizer Market Insights Forecasts to 2030

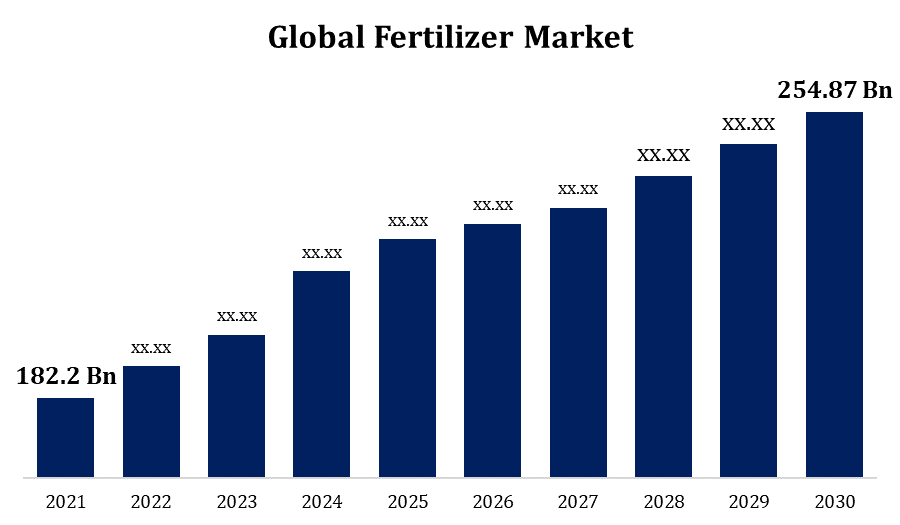

- The global Fertilizer market was valued at USD 182.2billion in 2021.

- The market is growing at a CAGR of 3.89% from 2021 to 2030

- The global Fertilizer market is expected to reach USD 254.87 billion by 2030

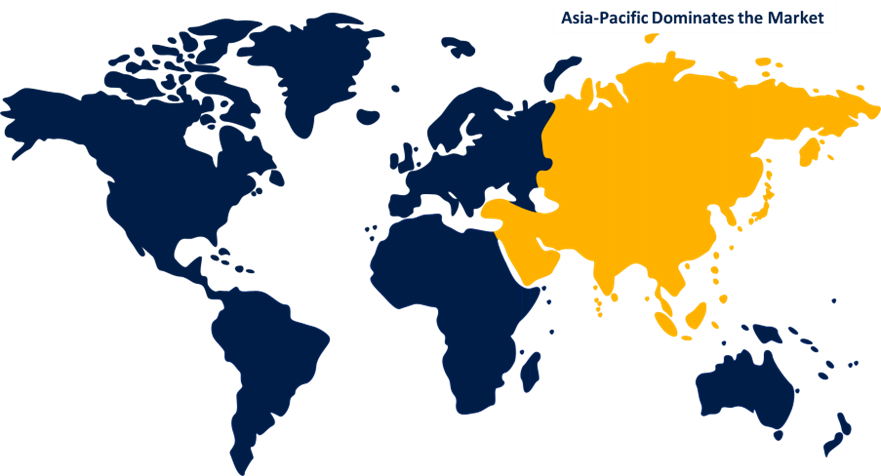

- The Asia Pacific is expected to grow the fastest during the forecast period

The Global Fertilizer Market is expected to reach USD 254.87 billion by 2030, at a CAGR of 3.89% during the forecast period 2021 to 2030. The fertilizer market is becoming extremely popular since it is critical for increasing crop output by giving crops vital nutrients like nitrogen, phosphate, potassium, and others that increase soil fertility.

Get more details on this report -

Market Overview

Fertilizers are substances added to the soil or plant tissue to boost agricultural yield by giving nutrients necessary for plant growth. They may be organic or inorganic in origin. For instance, nitrogen, the primary component of chlorophyll, is found in nitrogen-based fertilizers, which help plants perform photosynthesis. Because phosphorous promotes cell growth and proliferation and is found in protoplasm, phosphorous fertilizers are advantageous for plant roots. Additionally, organic fertilizers are pure fertilizers made from animal dung, municipal sludge, industrial waste, or agricultural waste. These fertilizers encourage the growth of microorganisms, improve the chemical and physical characteristics of the soil, and increase the soil's ability to retain water. Additionally, fertilizers are chemicals that are added to soil or plant tissues to supply one or more nutrients necessary for plant growth. While maintaining and improving the availability of soil nutrients, higher crop yields are encouraged. With the increased use of organic fertilizers, farmers may now use fertilizers more safely and effectively while lowering their risk of exposure to hazardous chemicals. The fertilizer market is becoming extremely popular since it is critical for increasing crop output by giving crops vital nutrients like nitrogen, phosphate, potassium, and others that increase soil fertility. The demand for fertilizers, particularly in the agricultural sector, has risen quickly due to rising food consumption brought on by a growing population. A loss in agricultural output has also been caused by the lack of nutrients in the soil because of the use of pesticides and other toxic chemicals. Fertilizer demand is anticipated to rise as a result of this. Additionally, the fertilizer industry is fragmented, with numerous fertilizer businesses active globally. Due to the importance of fertilizers in boosting agricultural productivity, industry players are forming joint ventures and strategic alliances to broaden their geographic reach and product lines. For instance, the Haifa Group declared in 2019 that it had increased the capacity of its Controlled Release Fertilizer (CRF) business in France to produce 8,000 MTPA. The business was able to boost its production capacity with this technology by as much as 24,000 MTPA. Yara International ASA purchased Brazil's Vale Cubatao Fertilizantes Complex in 2018 for USD 255 billion. This strategy strengthened the company's nitrogen production assets and market position in the Brazilian fertilizer sector. However, it is projected that the market expansion will be constrained by the lack of knowledge regarding the best usage of fertilizers. A good strategy to increase crop productivity, for instance, is to employ chemical fertilizers as effectively as possible. However, excessive use of chemical fertilizers destroys the soil because it alters the pH balance, which is bad for the crop and the environment.

Global Fertilizer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 182.2 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 3.89% |

| 2030 Value Projection: | USD 254.87 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 129 |

| Segments covered: | By Type, By Form, By Application, By Region |

| Companies covered:: | ARA International, Nutrien Ltd., The Mosaic Company, Haifa Group, Syngenta AG, ICL Group Ltd., EuroChem Group, OCP Group S.A., K+S Aktiengesellschaft, Uralkali. |

| Growth Drivers: | The inorganic segment dominated the market with the largest market share |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the market for fertilizers based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Fertilizer market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Fertilizer market.

Segmentation Analysis

- In 2021, the inorganic segment dominated the market with the largest market share of 72% and market revenue of 131.1 billion.

Based on the type, the Fertilizer market is bifurcated into organic and inorganic. In 2021, the inorganic segment dominated the market with the largest market share of 72% and market revenue of 131.1 billion. The inorganic segment is likely to account for the highest revenue in the market. With the fast infusion of nutrients provided by inorganic fertilizers, plants can be fed as needed. They are precisely dosed and entirely synthetic. Inorganic fertilizers have a fast-acting quality, which is one of their main benefits, and their nutrient ratios are clearly stated on the package. For instance, nutrient-rich salts are a component of inorganic fertilizers that dissolve quickly and are made readily available to plants for nutrient uptake. Additionally, inorganic fertilizers are precisely formulated to contain necessary nutrients like nitrogen, potassium, and phosphorus to fulfill the needs of individual plant species. These fertilizers are very simple to use because they come in a variety of forms, including dry granules, liquid concentrates, and powders that dissolve in water.

- In 2021, the dry segment accounted for the largest share of the market, with 79% and a market revenue of 143.9 billion.

Based on form, the fertilizer market is categorized into dry and liquid. In 2021, the dry segment accounted for the largest share of the market, with 79% and market revenue of 143.9 billion. The dry segment has accounted for the largest revenue in the market. Dry fertilizers are used extensively. Since the plants must first break down these fertilizers before they can be absorbed, slow-release formulations are most suited for them. Also, as these fertilizers do not "settle out" over time or in cold weather, they are less expensive and simpler to store. Additionally, dry fertilizers are nutrients that have been dried. They are often referred to as granular fertilizers. The size and consistency of granular fertilizers vary depending on the brand and the product's origin. The physical nature of these fertilizers varies from enormous grains the size of an orange seed to a fine powdered form. Dry fertilizers also last longer on the shelf. If kept out of dampness and direct sunshine, most dry fertilizers will last a lifetime.

- In 2021, the agriculture segment accounted for the largest share of the market, with 33% and a market revenue of 60.12 billion.

The market is segmented based on application into horticulture, agriculture, gardening, and others. The agriculture segment dominated the market. Due to the growing global population, globalization, and development of smart cities, which have resulted in a decrease in the amount of arable land available and a rise in the need for food, the demand for fertilizers in the agriculture sector has become extremely popular. Fertilizers are crucial to maintaining the soil's nutrient content, meeting the nutritional needs of crops, and increasing agricultural production. The world's population is anticipated to reach the 10 billion level by 2050, according to Future Farming, a company focusing on smart farming, which announced this on October 30, 2019. Therefore, increasing agricultural production is essential to supplying the growing population's food needs. Therefore, using fertilizers in the agricultural sector is essential for balancing the nutrients in the soil.

Regional Segment Analysis of the Fertilizer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

Asia Pacific emerged as the largest market for the global Fertilizer market, with a market share of around 35.4% and 64.4 billion of the market revenue in 2021.

- In 2021, Asia Pacific emerged as the largest market for the global Fertilizer market, with a market share of around 35.4% and 64.4 billion of the market revenue. The largest fertilizer consumers in this area are mostly responsible for this growth. For instance, China is the world's largest urea consumer, accounting for one-third of global urea usage, according to a report published on December 12 in the World Fertilizer, a popular news source for fertilizer information. China consumes more than 60% of the area that is used as a fertilizer to grow cereals and oilseeds, including rapeseed, corn, soybean, and others. Regarding ammonia consumption, India is third behind China and the United States. In India, urea is 99% utilized as fertilizer for agricultural purposes. In the Asia-Pacific region, behind China and India, Indonesia ranks third in terms of nitrogen fertilizer usage. Hong Kong Special Administrative Region, Singapore, Malaysia, New Zealand, Vietnam, South Korea, and other nations in this region also consume a lot of fertilizer. During the projection period, all of these factors are expected to increase the demand for fertilizer in the Asia-Pacific area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global Fertilizer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- ARA International

- Nutrien Ltd.

- The Mosaic Company

- Haifa Group

- Syngenta AG

- ICL Group Ltd.

- EuroChem Group

- OCP Group S.A.

- K+S Aktiengesellschaft

- Uralkali

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Recent Development

- In September 2021, Yara announced that it acquired Finish colan to grow its organic fertilizer business, demonstrating the company's commitment to taking a larger role in the industry.

- In January 2020, Nutrien Ltd acquired Agrosema Commerical Agricola Ltd to deepen its roots in the Brazilian market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2030. Spherical Insights has segmented the global Fertilizer market based on the below-mentioned segments:

Fertilizer Market, By Product Type

- Organic

- Inorganic

Fertilizer Market, By Form

- Dry

- Liquid

Fertilizer Market, By Application

- Agriculture

- Horticulture

- Gardening

- Others

Fertilizer Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the global Fertilizer market?As per Spherical Insights, the size of the fertilizer market was valued at USD 182.2 billion in 2021 to USD 254.87 billion by 2030.

-

What is the market growth rate of the global Fertilizer market?The global Fertilizer market is growing at a CAGR of 3.89% during the forecast period 2021-2030.

-

Which region dominates the global Fertilizer market?The Asia Pacific emerged as the largest market for fertilizers.

-

What is the significant driving factor for the Fertilizer market?Rising food consumption will influence the market's growth.

-

Which factor is limiting the growth of the Fertilizer market?Possible side effects could hamper the market growth.

-

What is an opportunity for the Fertilizer market?Advancements in the food and agriculture industry will provide considerable opportunities to the market.

-

Who are the key players in the global Fertilizer market?Key players of the Fertilizer market ARA International, Nutrien Ltd., The Mosaic Company, Haifa Group, Syngenta AG, ICL Group Ltd., EuroChem Group, OCP Group S.A., K+S Aktiengesellschaft, and Uralkali.

Need help to buy this report?