Global Fermentation Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Alcohols, Organic Acids, Enzymes, and Other Product Types) By Application (Industrial, Food and Beverage, Pharmaceutical and Nutritional, Plastics and Fibers, and other applications) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) Analysis and Forecast 2022 – 2030

Industry: Chemicals & MaterialsGlobal Fermentation Chemicals Market Insights Forecasts to 2030

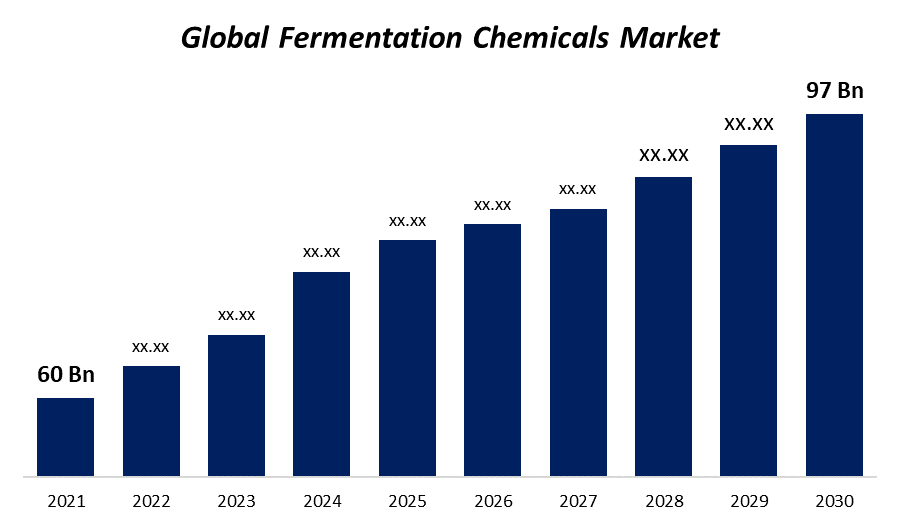

- The global fermentation chemicals market size was valued at USD 60 billion in 2021.

- The market is growing at a CAGR of 5.5% from 2022 to 2030

- The global fermentation chemicals market is expected to reach USD 97 billion by 2030

- Asia-Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The global fermentation chemicals market is expected to reach USD 97 billion by 2030, at a CAGR of 5.5% during the forecast period 2022 to 2030. The fermentation chemicals market is driven by their eco-friendliness and cost advantages over their synthetic or petroleum-derived competitors.

Market Overview

To accelerate or start the chemical process of fermentation in a variety of products, fermentation chemicals are utilized. They are essential for quickening the chemical process, which helps reduce the total manufacturing costs, fermentation times, and energy usage. Due to this, these compounds are widely used in various industries, such as plastic, pharmaceuticals, nutraceuticals, and food and drinks (F&B). Two of the main drivers propelling the market's expansion are the expanding food and beverage sector and the increasing industrialization taking place on a global scale. In addition, the growing demand for alcoholic beverages is accelerating market expansion. Many alcoholic beverages and food items, including breads, cheese, and pickles, are produced using fermented chemicals. Additionally, improvements in fermentation technologies have made it possible to produce lactic, tartaric, and fumaric acid on a large scale, increasing the demand for fermentation chemicals worldwide. Additionally, rising consumer awareness of environmentally friendly and bio-based raw materials encourages market expansion. Industries gradually turn to fermentation chemicals as an alternative to synthetic or petroleum-derived chemicals. It is anticipated that pharmaceutical companies will conduct more research to create novel medicines by cultivating microorganisms. Regulating agencies like the U.S. Environmental Protection Agency (EPA) and the U.S. Department of Energy have implemented strict laws on greenhouse gas (GHG) emissions from chemical industries. This finally caused industry participants to focus on exploiting biological chemical synthesis methods. Beet, sugarcane, tapioca, wheat, and corn are some of the main agricultural products used in manufacturing. These agricultural derivatives include a lot of starch and carbohydrates. The largest consumer of fermentation chemicals is the food industry.

Global Fermentation Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 60 Billion |

| Forecast Period: | 2022-2030 |

| Forecast Period CAGR 2022-2030 : | 5.5% |

| 2030 Value Projection: | USD 97 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By Region, COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, Cargill, Incorporated., Evonik Industries AG, DSM, and Lonza. |

| Pitfalls & Challenges: | Due to the increasing number of COVID-19 cases |

Get more details on this report -

Report Coverage

This research report categorizes the market for global fermentation chemicals based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global fermentation chemicals market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global fermentation chemicals market sub-segments.

Segmentation Analysis

- In 2021, the organic acids segment dominated the market with the largest market share of 42% and market revenue of 25.2 billion.

Based on the product type, the global fermentation chemicals market is categorized into Alcohol, Organic Acids, Enzymes, and Other Product Types. In 2021, the organic acids segment dominated the market with the largest market share of 42% and market revenue of 25.2 billion. Acids having pKa values of 3 (carboxylic) or above are considered organic acids (phenolic). The industrial generation of organic acids is now possible because of developments in fermentation technology. Foods are frequently preserved by adding organic acids such as fumaric acid, tartaric acid, and lactic acid. A significant contributing cause to their usage as a preservative has been their ability to prevent bacterial development. Demand for organic acids in processed meat and foods is anticipated to increase as consumers become more aware of the value of products with longer shelf lives.

- In 2021, the industrial segment accounted for the largest share of the market, with 47% and a market revenue of 28.2 billion.

Based on the application, the fermentation chemicals market is categorized into Industrial, Food and Beverage, Pharmaceutical and Nutritional, Plastics and Fibers, and other applications. In 2021, the industrial segment accounted for the largest share of the market, with 47% and a market revenue of 28.2 billion. Chemicals for fermentation are typically used in industry. Higher penetration has been attained due to the adoption of green chemistry and numerous rules for commercial and industrial uses. Industrial fermentation refers to using microorganisms, such as fungi, bacteria, and eukaryotic cells, to produce products, including ethanol, citric acid, and acetic acid. It has been discovered that naturally derived goods are preferable to chemically generated food additives in terms of antioxidants, preservatives, flavours, colours, and vitamins.

Regional Segment Analysis of the Fermentation Chemicals Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America emerged as the largest market for the global fermentation chemicals market, with a market share of around 34% and 60 billion of the market revenue in 2021.

- In 2021, North America emerged as the largest market for the global fermentation chemicals market, with a market share of around 34% and 60 billion of the market revenue. Major industry players with operations in the food and beverage, pharmaceutical, nutrition, plastics, and fiber sectors are well-represented in the region. Over the course of the forecast period, North America is anticipated to have the quickest growth in the enzymes market. It's anticipated that the growing demand for enzymes from numerous industrial uses, including paper, personal care, and starch, will significantly impact industry growth.

- The Asia-Pacific market is expected to grow at the fastest CAGR between 2021 and 2030, Over the course of the forecast period, it is anticipated that the expansion of important end-user sectors including food and beverage, pharmaceuticals, and polymers, notably in China and India, will continue to be a major driver of the regional market. Over the forecast period, it is anticipated that rising per-capita middle-class disposable income levels and expansion in the food and beverage sector in nations like China and India will boost regional demand.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global fermentation chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- BASF SE

- Cargill

- Incorporated

- Evonik Industries AG

- DSM

- Lonza

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- On January 14, 2022, Evonik Industries AG opened a rhamnolipids production facility. This commercial production facility for bio-based, fully biodegradable rhamnolipids is anticipated to boost market growth from cosmetics and personal care product applications.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global fermentation chemicals market based on the below-mentioned segments:

Global Fermentation Chemicals Market, By Product Type

- Alcohols

- Organic Acids

- Enzymes

- Other Product Types

Global Fermentation Chemicals Market, By End-user Industry

- Industrial

- Food and Beverage

- Pharmaceutical and Nutritional

- Plastics and Fibers

- Others

Global Fermentation Chemicals Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Fermentation Chemicals market?As per Spherical Insights, the size of the Fermentation Chemicals market was valued at USD 60 billion in 2022 to USD 97 billion by 2030.

-

What is the market growth rate of the Fermentation Chemicals market?The Fermentation Chemicals market is growing at a CAGR of 5.5% from 2022 to 2030.

-

Which country dominates the Fermentation Chemicals market?North America emerged as the largest market for Fermentation Chemicals.

-

Who are the key players in the Fermentation Chemicals market?Key players in the Fermentation Chemicals market are BASF SE, Cargill, Incorporated., Evonik Industries AG, DSM, and Lonza.

-

Which factor drives the growth of the Fermentation Chemicals market?Extensive demand in the food, cosmetic, and animal feed industries is expected to drive the market's growth over the forecast period.

Need help to buy this report?