Global Femtech Market Size, Share, and COVID-19 Impact Analysis, By Type (Devices, Software, Services, and Consumer Products), By Application (Pregnancy & Nursing Care, Reproductive Health & Contraception, Menstrual Health, General Health, and Others), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Femtech Market Insights Forecasts to 2035

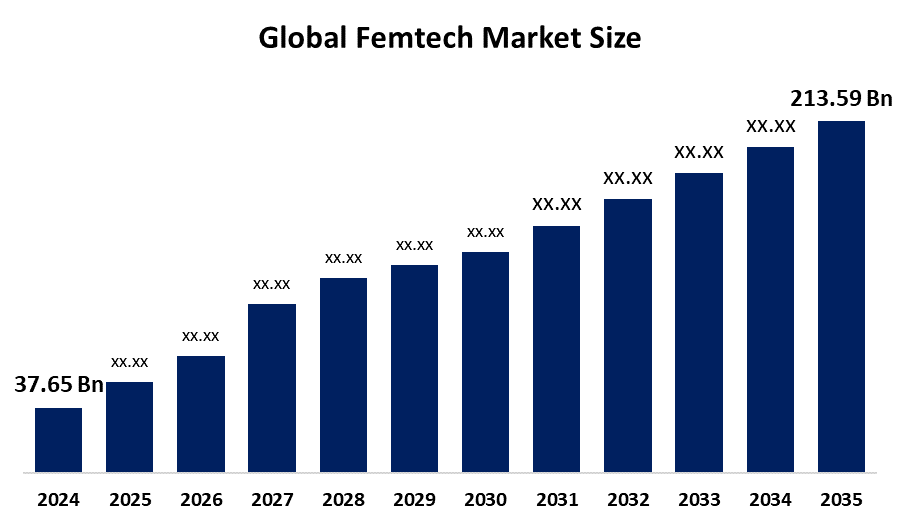

- The Global Femtech Market Size Was Estimated at USD 37.65 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 17.09 % from 2025 to 2035

- The Worldwide Femtech Market Size is Expected to Reach USD 213.59 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Femtech Market Size was worth around USD 37.65 Billion in 2024 and is predicted to Grow to around USD 213.59 Billion by 2035 with a compound annual growth rate (CAGR) of 17.09% from 2025 to 2035. Future opportunities in the femtech market include expanded AI-powered personalized health solutions, telehealth services, fertility and pregnancy monitoring innovations, wearable diagnostics, and increased investment in underserved women’s health areas like menopause and chronic conditions.

Market Overview

femtech refers to technology-driven products and services designed to address women’s health needs across areas such as reproductive health, menstrual care, pregnancy, menopause, and chronic disease management. The market is driven by rising health awareness among women, increasing smartphone and wearable adoption, and growing demand for personalized and preventive healthcare solutions. According to the World Health Organization, women spend nearly 25% more years in poor health than men, highlighting unmet needs in female healthcare. Government initiatives supporting digital health and women-centric care, such as expanded maternal health programs and telehealth reimbursement policies, are further accelerating adoption. Additionally, increased public and private funding for women’s health innovation and supportive regulatory frameworks are strengthening the global femtech ecosystem.

Report Coverage

This research report categorizes the femtech market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the femtech market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the femtech market.

Global Femtech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 37.65 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Chiaro Technology Limited, HeraMED, Flo Health, Inc., Natural Cycles USA Corp, Glow, Inc, Allara Health, NUVO Inc., Bloomlife, Syrona Health, Sirona Hygiene Private Limited, Samplytics Technologies Private Limited, iSono Health, Inc., Athena Feminine Technologies, and Other key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The femtech market is driven by increasing awareness of women’s health issues and the rising use of digital health technologies. Growing adoption of smartphones, wearables, and mobile health apps supports personalized health tracking. The rising prevalence of reproductive, hormonal, and lifestyle-related conditions among women further fuels demand. Additionally, expanding telehealth services, increasing venture capital investments, and supportive government initiatives focused on maternal health, reproductive rights, and preventive care are accelerating the adoption of femtech solutions worldwide.

Restraining Factors

Data privacy and security concerns, regulatory uncertainty, limited reimbursement policies, lack of clinical validation, and cultural stigma around women’s health issues restrict wider adoption of femtech solutions.

Market Segmentation

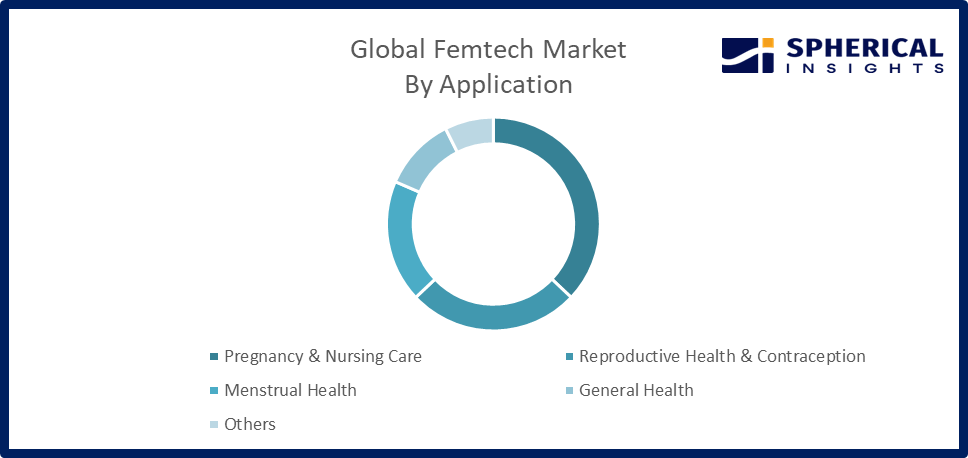

The femtech market share is classified into type and application.

- The devices segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the femtech market is divided into devices, software, services, and consumer products. Among these, the devices segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Driven by strong demand for wearable health trackers, fertility monitors, and diagnostic tools that enable personalized women’s health monitoring. This segment is also anticipated to grow at a significant CAGR during the forecast period, supported by technological advancements, increasing consumer adoption of health devices, and integration with digital health platforms for real-time insights and preventive care.

- The pregnancy & nursing care segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the femtech market is divided into pregnancy & nursing care, reproductive health & contraception, menstrual health, general health, and others. Among these, the pregnancy & nursing care segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This dominance is due to increasing demand for advanced maternal health monitoring, prenatal care solutions, and related femtech technologies addressing pregnancy and post-natal needs.

Get more details on this report -

Regional Segment Analysis of the Femtech Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the femtech market over the predicted timeframe.

North America is anticipated to hold the largest share of the femtech market over the predicted timeframe. This dominance is driven by advanced digital health infrastructure, high consumer adoption of femtech solutions, strong venture capital funding, and growing awareness of women’s health technology needs. The United States, in particular, leads the market with significant investments and widespread use of fertility, pregnancy, and wellness tech.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the femtech market during the forecast period. Asia Pacific is expected to grow rapidly due to rising awareness of women’s health, increasing smartphone penetration, expanding digital healthcare access, and strong government initiatives supporting maternal and reproductive health, particularly in countries such as India, China, and Australia, alongside growing startup activity and investments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the femtech market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chiaro Technology Limited

- HeraMED

- Flo Health, Inc.

- Natural Cycles USA Corp

- Glow, Inc

- Allara Health

- NUVO Inc.

- Bloomlife

- Syrona Health

- Sirona Hygiene Private Limited

- Samplytics Technologies Private Limited

- iSono Health, Inc.

- Athena Feminine Technologies

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, UNICEF and the Embassy of Finland have launched a global investment opportunity for femtech solutions targeting startups in low- and middle-income countries to improve women’s health, wellness, and socio-economic participation.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the femtech market based on the below-mentioned segments:

Global Femtech Market, By Type

- Devices

- Software

- Services

- Consumer Products

Global Femtech Market, By Application

- Pregnancy & Nursing Care

- Reproductive Health & Contraception

- Menstrual Health

- General Health

- Others

Global Femtech Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the femtech market over the forecast period?The global femtech market is projected to expand at a CAGR of 17.09% during the forecast period.

-

2. What is the market size of the femtech market?The global femtech market size is expected to grow from USD 37.65 billion in 2024 to USD 213.59 billion by 2035, at a CAGR of 17.09 % during the forecast period 2025-2035

-

3. Which region holds the largest share of the femtech market?North America is anticipated to hold the largest share of the femtech market over the predicted timeframe

-

4. Who are the top 10 companies operating in the global femtech market?Chiaro Technology Limited, HeraMED, Flo Health, Inc., Natural Cycles USA Corp, Glow, Inc., Allara Health, NUVO Inc., Bloomlife, Syrona Health, Sirona Hygiene Private Limited, Samplytics Technologies Private Limited, iSono Health, Inc., and Athena Feminine Technologies.

-

5. What factors are driving the growth of the femtech market?Rising women’s health awareness, digital health adoption, increasing smartphone penetration, supportive investments, AI-based solutions, and growing demand for personalized healthcare drive market growth

-

6. What are the market trends in the femtech market?AI diagnostics, wearable health tech, fertility and menstrual tracking apps, telemedicine integration, personalized care solutions, data analytics, and preventive wellbeing services.

-

7. What are the main challenges restricting the wider adoption of the femtech market?High data privacy concerns, regulatory hurdles, limited clinical validation, social stigma, low awareness, and affordability issues restrict wider femtech adoption.

Need help to buy this report?