Global Fatty Alcohol Ethoxylates Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Nonionic Ethoxylates, Anionic Ethoxylates, Cationic Ethoxylates, and Amphoteric Ethoxylates), By Application (Household Cleaning, Personal Care, Industrial Cleaning, Textile, and Agriculture), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Fatty Alcohol Ethoxylates Market Size Insights Forecasts to 2035

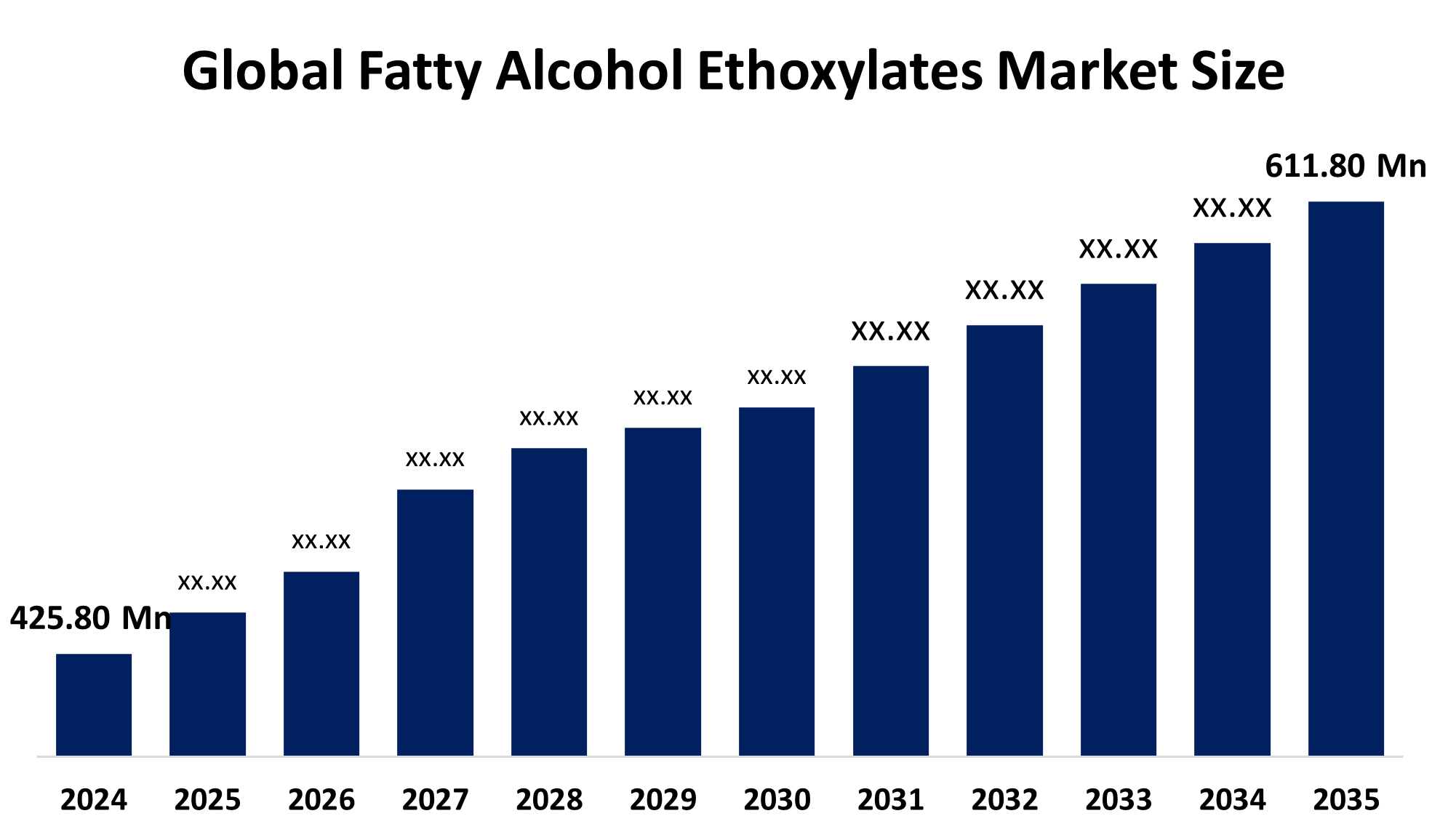

- The Global Fatty Alcohol Ethoxylates Market Size Was Estimated at USD 425.80 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.35 % from 2025 to 2035

- The Worldwide Fatty Alcohol Ethoxylates Market Size is Expected to Reach USD 611.80 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Fatty Alcohol Ethoxylates Market Size was Valued at around USD 425.80 Million in 2024 and is Predicted to Grow to around USD 611.80 Million by 2035 with a Compound Annual Growth Rate (CAGR) of 3.35 % from 2025 to 2035. Growing consumer demand for biodegradable surfactants, expansion in personal care and detergents, regulatory backing for environmentally friendly chemicals, and growth in new industrial applications are all potential opportunities in the fatty alcohol ethoxylates market.

Market Overview

Non-ionic surfactants produced by ethoxylating linear or branched fatty alcohols, mainly the C8–C18 chains, are referred to as fatty alcohol ethoxylates (FAE). A variety of detergents, wetting agents, and emulsifiers are then produced using these surfactants. The exceptional wetting, dispersing, emulsifying, and detergency qualities of adjuvants are the primary factors driving their fatty alcohol ethoxylates market demand, and they are recognized for their high biodegradability and low toxicity. Agrochemicals, textiles, oil and gas, medicines, personal care formulations, household and industrial cleaning products, and many more end-use sectors are included in the FAE market. To increase North American production capacity for environmentally friendly fatty alcohol ethoxylates variations, Stepan Company opened a cutting-edge alkoxylation facility in Pasadena, Texas, in May 2025. Recreaire, a CO2-based carbonate ethoxylate surfactant that outperforms conventional FAE and reduces carbon footprints by up to 80%, was launched by Econic Technologies. The market for fatty alcohol ethoxylates is now undergoing a significant transition due to rising demand in a number of industries, including domestic cleaning, personal care, and industrial applications.

Report Coverage

This research report categorizes the fatty alcohol ethoxylates market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Global Fatty Alcohol Ethoxylates Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the fatty alcohol ethoxylates market.

Global Fatty Alcohol Ethoxylates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 425.80 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.35% |

| 2035 Value Projection: | USD 611.80 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product Type, By Application |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The Global Fatty Alcohol Ethoxylates Market Size is supported globally by the chemical product safety regulatory frameworks. The availability of raw materials, advancements in ethoxylation technology, laws about chemical safety and environmental protection, and shifting consumer perceptions of environmentally friendly and sustainable products on market dynamics. Regulations are being established by manufacturing and industrial associations to ensure the efficacy and safety of fatty alcohol ethoxylates in various applications. This increase reflects the growing use of fatty alcohol ethoxylates in a variety of industries, including the personal care, industrial, and agricultural sectors.

Restraining Factors

The market for fatty alcohol ethoxylates is restricted by a number of issues, such as fluctuating raw material prices, strict safety and environmental requirements, high manufacturing costs, and increasing competition from synthetic and bio-based surfactants with similar performance attributes.

Market Segmentation

The fatty alcohol ethoxylates market share is classified into product type and application.

- The nonionic ethoxylates segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the Global Fatty Alcohol Ethoxylates Market Size is divided into nonionic ethoxylates, anionic ethoxylates, cationic ethoxylates, and amphoteric ethoxylates. Among these, the nonionic ethoxylates segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Nonionic due to there are widely used in many different industries, particularly in household and personal care products. The use of nonionic ethoxylates is further supported by the increasing need for sustainable and environmentally friendly chemical solutions.

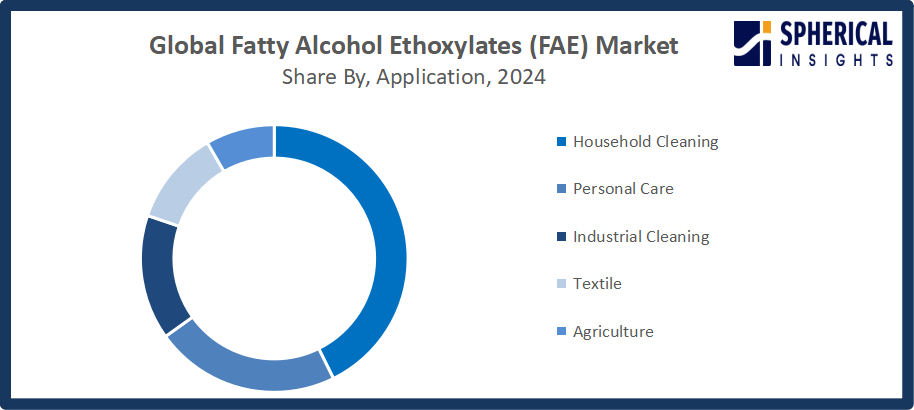

- The household cleaning segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Global Fatty Alcohol Ethoxylates Market Size is divided into household cleaning, personal care, industrial cleaning, textile, and agriculture. Among these, the household cleaning segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing need for efficient and environmentally friendly cleaning products around the world is what motivates household cleaning. due to their exceptional emulsifying, wetting, and foaming qualities, FAEs are frequently used in detergents, dishwashing solutions, and surface cleaners. A greater focus on cleanliness and hygiene, particularly in the wake of the epidemic, is driving demand for these products.

Get more details on this report -

Regional Segment Analysis of the Fatty Alcohol Ethoxylates Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the fatty alcohol ethoxylates market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the Global Fatty Alcohol Ethoxylates Market Size over the predicted timeframe. The Asia Pacific region's growth is primarily driven by rising urbanization, industrialization, and consumer awareness of eco-friendly products. China, Japan, and India are the leading nations in this field due to significant assistance from big businesses like Kao Corporation and Evonik Industries. Additionally, the causes that continue to drive the consumption of FAE products, of which the production and use of FAE by-products are taken into consideration to some extent, include urbanization, rising living standards, and growing awareness of hygiene and cleanliness. Rossari Biotech announced in November 2025 that it will invest INR 128 crores at its Dahej facility in Gujarat to manufacture 30,000 tons of environmentally friendly FAE variants yearly, ensured by the use of high-quality standards in the production process.

North America is expected to grow at a rapid CAGR in the fatty alcohol ethoxylates market during the forecast period. Growth is driven by strict regulatory frameworks that encourage the use of low-toxicity and biodegradable chemicals in industrial, personal care, and cleaning applications. The focus on innovation and adherence to environmental regulations is expected to accelerate market expansion. With a 77.5% regional share, the US is leading the way in the development of low-toxicity emulsifiers. A shift to nonionic ethoxylates FAE in response to customer expectations for sustainability is one of the major trends; market prices stabilized around USD 1,977/MT in mid-2025. Market expansion is further accelerated by the region's strong focus on environmental efforts, innovative manufacturing technology, and product innovation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the fatty alcohol ethoxylates market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Akzo Nobel

- BASF

- Clariant

- Roda International

- Dow Chemical

- Ecolab

- Evonik Industries

- INEOS

- Oxiteno

- P&G Chemicals

- SABIC

- Sasol

- Shell

- Stepan Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Huntsman Corporation launched a strategic partnership with a biotechnology firm to develop next generatin renewable fatty alcohol ethoxylates, enhancing sustainable surfactant offerings and meeting eco conscious consumer demand.

- In October 2025, Clariant announced a new line of biodegradable fatty alcohol ethoxylates for the personal care sector, reinforcing its commitment to sustainability and expanding eco friendly market offerings.

- In August 2025, Econic Technologies recently launched Carbonate ethoxylate surfactant, produced via innovative technology, offering high performance, eco friendly alternatives to conventional ethoxylates while significantly reducing environmental impact.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Global Fatty Alcohol Ethoxylates Market Size based on the below-mentioned segments:

Global Fatty Alcohol Ethoxylates Market, By Product Type

- Nonionic Ethoxylates

- Anionic Ethoxylates

- Cationic Ethoxylates

- Amphoteric Ethoxylates

Global Fatty Alcohol Ethoxylates Market, By Application

- Household Cleaning

- Personal Care

- Industrial Cleaning

- Textile

- Agriculture

Global Fatty Alcohol Ethoxylates Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the fatty alcohol ethoxylates market over the forecast period?The global fatty alcohol ethoxylates market is projected to expand at a CAGR of 3.35% during the forecast period.

-

2.What is the market size of the fatty alcohol ethoxylates market?The global fatty alcohol ethoxylates market size is expected to grow from USD 425.80 million in 2024 to USD 611.80 million by 2035, at a CAGR of 3.35 % during the forecast period 2025-2035.

-

3.Which region holds the largest share of the fatty alcohol ethoxylates market?Asia Pacific is anticipated to hold the largest share of the fatty alcohol ethoxylates market over the predicted timeframe.

-

4.Who are the top companies operating in the global fatty alcohol ethoxylates market?Akzo Nobel, BASF, Clariant, Croda International, Dow Chemical, Ecolab, Evonik Industries, INEOS, Oxiteno, P&G Chemicals, SABIC, Sasol, Shell, Stepan Company, and Others.

-

5.What factors are driving the growth of the fatty alcohol ethoxylates market?The market for fatty alcohol ethoxylates is being driven by the growing need for biodegradable surfactants, the expansion of the cleaning and personal care sectors, technical developments, and growing environmental consciousness that supports environmentally friendly chemical solutions.

-

6.What are the market trends in the fatty alcohol ethoxylates market?The market for fatty alcohol ethoxylates is seeing significant growth in emerging economies, innovation in high-performance surfactants, a shift toward sustainable formulations, and an increase in use in industrial, domestic, and personal care applications.

-

7.What are the main challenges restricting the wider adoption of the fatty alcohol ethoxylates market?High production costs, competing bio-based and synthetic surfactants with comparable functional qualities, severe environmental and safety standards, and variable raw material prices are some of the obstacles that restrict the market adoption of FAE.

Need help to buy this report?