Global Fatty Alcohol Alkoxylates Market Size, Share, and COVID-19 Impact Analysis, By Type (Ethoxylates, Propoxylates, and Others), By Application (Detergents & Cleaners, Personal Care, Textile, Agriculture, Paints & Coatings, and Others), By End-User (Household, Industrial, Institutional, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Fatty Alcohol Alkoxylates Market Insights Forecasts to 2035

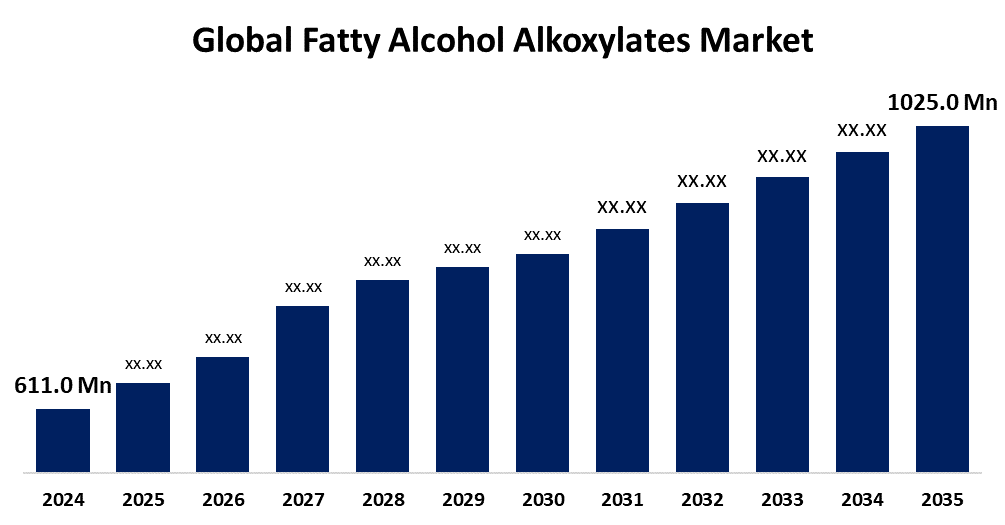

- The Global Fatty Alcohol Alkoxylates Market Size Was Estimated at USD 611.0 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.82% from 2025 to 2035

- The Worldwide Fatty Alcohol Alkoxylates Market Size is Expected to Reach USD 1025.0 Million by 2035

- Europe is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

The Global Fatty Alcohol Alkoxylates Market Size was worth around USD 611.0 Million in 2024 and is predicted to Grow to around USD 1025.0 Million by 2035 with a compound annual growth rate (CAGR) of 4.82% from 2025 to 2035. An increasing demand for eco-friendly and biodegradable surfactants, especially in household and personal care products, is driving the fatty alcohol alkoxylates market globally.

Market Overview

The fatty alcohol alkoxylates market refers to the production and sale of alkoxylates derived from fatty acids, primarily used as surfactants across various applications. Fatty acid alkoxylates are a type of non-ionic surfactant, produced by reacting fatty acids with alkylene oxides, like ethylene oxide or propylene oxide, through the process of alkoxylation. Its widespread application includes cosmetics & personal care, consumer products, paints & coatings, pharmaceuticals, and others. Various types of alkoxylates, including fatty acid ethoxylates, alkyl phenol alkoxylates, sorbitan ester alkoxylates, and others, are used in personal care, oil & gas, and consumer products sectors. An increasing demand for alkoxylate in the cosmetics industry, with the emphasis on the personal care & beauty care industry, is driving the demand for natural and synthetic ethoxylates for use as moderate foaming agents in the formulation of various skin care products, including body soaps, lotion, face creams, and perfumes. The sale of alkoxylates in several end-use sectors is creating lucrative market opportunities for fatty alcohol alkoxylates.

Report Coverage

This research report categorizes the fatty alcohol alkoxylates market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the fatty alcohol alkoxylates market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the fatty alcohol alkoxylates market.

Fatty Alcohol Alkoxylates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 611.0 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.82% |

| 2035 Value Projection: | USD 1025.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 241 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Type, By Application, By End-User and By Region |

| Companies covered:: | BASF SE, Croda International Plc, KLK OLEO, SASOL and Stepan Company, Huntsman Corporation, Clariant International AG, Procter and Gamble Chemicals, Gujchem, HELM AG, Ineos, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

An increasing demand for eco-friendly and biodegradable surfactants, owing to the rising environmental consciousness among consumers, is contributing to driving the fatty alcohol alkoxylates market demand. The use of fatty alcohol alkoxylates in household products as a non-ionic surfactant is propelling the market growth. Further, its use in personal care products, including shampoos, conditioners, body washes, and lotions as cleansing agents, foam boosters, and stabilizers, is driving the market growth.

Restraining Factors

The growing environmental & regulatory concerns, fluctuation in raw material prices, and trade barriers are challenging the fatty alcohol alkoxylates market. Further, the strict government regulations associated with the use of these chemicals are hampering the market growth.

Market Segmentation

The Fatty Alcohol Alkoxylates Market Share is classified into type, application, and end-user.

- The ethoxylates segment dominated the market with a significant share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the fatty alcohol alkoxylates market is divided into ethoxylates, propoxylates, and others. Among these, the ethoxylates segment dominated the market with a significant share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Fatty alcohol alkoxylates are commonly used in the cosmetic industry as well as other industrial applications, including surface cleansers, detergents, cleaners, degreasers, dishwashing agents, leather processing units, and others. The good foaming and great detergency properties make them a good surfactant. Thus, an increasing need for high-performance detergents for different water conditions is anticipated to drive the market demand.

- The detergents & cleaners segment dominated the fatty alcohol alkoxylates market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the fatty alcohol alkoxylates market is divided into detergents & cleaners, personal care, textile, agriculture, paints & coatings, and others. Among these, the detergents & cleaners segment dominated the fatty alcohol alkoxylates market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Fatty alcohol alkoxylates possess excellent emulsifying, wetting, and detergency properties, making them ideal for use, enhancing the performance of cleaning products, including laundry detergents, dishwashing liquids, and industrial cleaners. The increasing demand for effective cleaning solutions is driving the demand for formulating detergents, which are environmentally sustainable, ultimately driving the market demand.

- The household segment accounted for a significant market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

Based on the end-user, the fatty alcohol alkoxylates market is divided into household, industrial, institutional, and others. Among these, the household segment accounted for a significant market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. In the household segment, fatty alcohol alkoxylates are used in detergents, soaps, and other household cleaning solutions. An increasing demand for effective and eco-friendly household cleaning products, owing to consumers' growing awareness about the environmental and health impact of household cleaning agents, is contributing to driving the market growth in the household segment.

Regional Segment Analysis of the Fatty Alcohol Alkoxylates Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the fatty alcohol alkoxylates market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the fatty alcohol alkoxylates market over the predicted timeframe. The adoption of FAE as a surfactant across textiles, agriculture, personal care, home, and other industries, driving market demand. Further, the growing urbanization and industrialization, along with an increasing disposable income in the region, are responsible for driving the market of fatty alcohol alkoxylates.

Europe is expected to grow at a rapid CAGR in the fatty alcohol alkoxylates market during the forecast period. The growing demand for eco-friendly, sustainable products across the personal care and household cleaning industries is contributing to driving the market demand. Further, awareness about hygiene and cleanliness, along with strict environmental regulations anticipated to propel the fatty alcohol alkoxylates market.

North America is anticipated to hold a significant share of the fatty alcohol alkoxylates market during the projected period. The growth in the surfactant market in the industrial and institutional settings is contributing to driving the market demand for fatty alcohol alkoxylates. Further, a smaller environmental footprint and lower toxicity of alcohol ethoxylates are significantly responsible for the fatty alcohol alkoxylates market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the fatty alcohol alkoxylates market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Croda International Plc

- KLK OLEO

- SASOL and Stepan Company

- Huntsman Corporation

- Clariant International AG

- Procter and Gamble Chemicals

- Gujchem, HELM AG

- Ineos

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, Stephan Co., has officially begun production at its new alkoxylation plant in Pasadena, Texas, marking a significant milestone in the company’s expansion of its manufacturing capabilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the fatty alcohol alkoxylates market based on the below-mentioned segments:

Global Fatty Alcohol Alkoxylates Market, By Type

- Ethoxylates

- Propoxylates

- Others

Global Fatty Alcohol Alkoxylates Market, By Application

- Detergents & Cleaners

- Personal Care

- Textile

- Agriculture

- Paints & Coatings

- Others

Global Fatty Alcohol Alkoxylates Market, By End-User

- Household

- Industrial

- Institutional

- Others

Global Fatty Alcohol Alkoxylates Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the fatty alcohol alkoxylates market over the forecast period?The global fatty alcohol alkoxylates market is projected to expand at a CAGR of 4.82% during the forecast period.

-

2. What is the market size of the fatty alcohol alkoxylates market?The global fatty alcohol alkoxylates market size is expected to grow from USD 611.0 Million in 2024 to USD 1025.0 Million by 2035, at a CAGR of 4.82% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the fatty alcohol alkoxylates market?Asia Pacific is anticipated to hold the largest share of the fatty alcohol alkoxylates market over the predicted timeframe.

Need help to buy this report?