Global Fatty Acids Market Size, Share, and COVID-19 Impact Analysis, By Type (Saturated, and Unsaturated), By End User (Household & Industrial Cleaning, Food & Beverage, Pharmaceutical & Nutraceutical, Personal Care & Cosmetics, Industrial, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Fatty Acids Market Size Insights Forecasts to 2035

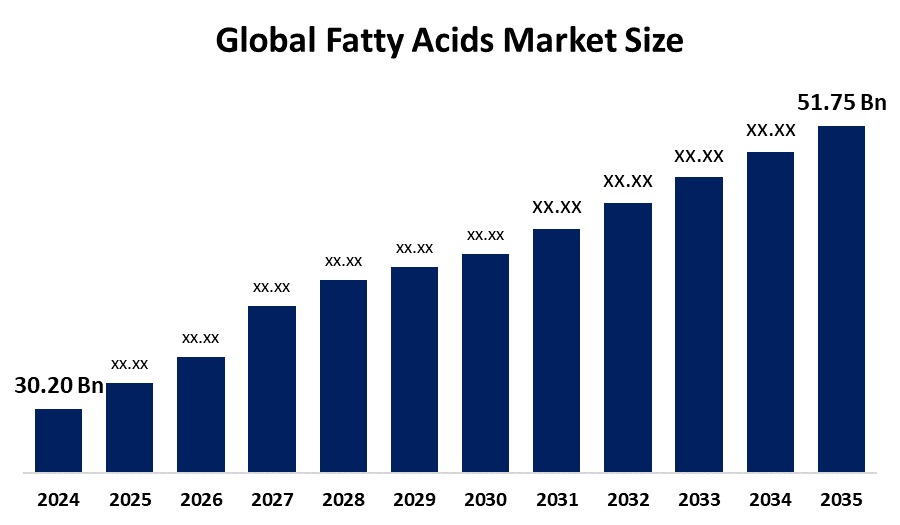

- The Global Fatty Acids Market Size Was Estimated at USD 30.20 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.02% from 2025 to 2035

- The Worldwide Fatty Acids Market Size is Expected to Reach USD 51.75 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Fatty Acids Market Size was worth around USD 30.20 Billion in 2024, Growing to USD 31.72 Billion in 2025, and is predicted to Grow to around USD 51.75 Billion by 2035 with a compound annual growth rate (CAGR) of 5.02% from 2025 to 2035. The market for fatty acids offers opportunities due to the growing demand for bio-based products, the expansion of applications in the food, personal care, and pharmaceutical industries, as well as technical developments and growing awareness of sustainable sourcing techniques and health advantages.

Global Fatty Acids Market Forecast and Revenue Size

- 2024 Market Size: USD 30.20 Billion

- 2025 Market Size: USD 31.72 Billion

- 2035 Projected Market Size: USD 51.75 Billion

- CAGR (2025-2035): 5.02%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The global production, trade, and use of aliphatic carboxylic acids, which are mostly sourced from vegetable and animal fats as well as synthetic sources, are all included in the fatty acids market. These industries include food and beverage, personal care, medicines, and biofuels. Market accessibility and consumer knowledge have been strengthened by government initiatives, such as public health campaigns in the US and the EU that advocate for organic sourcing and balanced meals, as well as laws that support bio-based components. For Instance, In October 2023, BASF SE announced the launch of Emulgade Verde 10 MS, expanding its polyglyceryl fatty acid ester technology. This versatile O/W emulsifier supports natural formulations, aligns with market trends, and delivers both sustainability benefits and high performance in personal care applications. Numerous factors, such as the growing need for plant-based fatty acids, the shift in consumer preferences toward omega-3 and omega-6 fatty acids due to health concerns, and the growth of the biofuels sector, are driving the fatty acids market. The creation of cutting-edge encapsulating technologies for usage in food, medicine, and personal hygiene products is also fueling market expansion. The increasing use of fatty acids in pharmaceutical and nutraceutical goods, as well as in industrial and domestic cleaning, is anticipated to propel market expansion.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the fatty acids market during the forecast period.

- In terms of type, the unsaturated segment is projected to lead the fatty acids market throughout the forecast period

- In terms of end user, the household & industrial cleaning segment captured the largest portion of the market

Fatty Acids Market Trends

- Growing Preference for Eco-friendly and sustainable raw resources is driving the demand for bio-based products.

- Growth in Functional and Nutritional Foods: More omega-3 and omega-6 fatty acids are being used in health foods and dietary supplements.

- Technological Advancements: Efficiency and product quality are increased by innovations in extraction and purification procedures.

- Increasing Use in Personal Care and Cosmetics: Fatty acids are increasingly being used in formulations for skincare, haircare, and cosmetics.

Report Coverage

This research report categorizes the fatty acids market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the fatty acids market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the fatty acids market.

Global Fatty Acids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 30.20 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.02% |

| 2035 Value Projection: | USD 51.75 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 173 |

| Tables, Charts & Figures: | 153 |

| Segments covered: | By Type. By End User and COVID-19 Impact Analysis |

| Companies covered:: | DOW, BASF SE, Akzo Nobel, Ashland Inc., Oleon N.V., Arizona Chemicals, Koninklijke DSM NV, Cargill Incorporated, Croda International Plc, Eastman Chemical Company, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors:

Industry growth is anticipated to be driven by the growing need for fatty acids in a variety of personal care and cosmetics products, such as soap, detergent, moisturizers, and others. The food and beverage industry's need for omega-6 and omega-3 fatty acids is being driven by growing awareness of the benefits of a healthier diet and lifestyle, which is expected to boost market growth. The market for fatty acids is expanding due to several causes, such as the increasing usage of fatty acids in pharmaceutical and nutraceutical products, industrial and domestic cleaning, and the introduction of new products in the areas of surface, fabric, floor, and dish care.

Restraining Factors:

The market for fatty acids is restricted by several factors, including volatile raw material prices, a shortage of high-quality feedstocks, strict environmental laws, high production costs, and competition from synthetic substitutes. These variables all work against the market's stability and prevent steady expansion.

Market Segmentation

The global fatty acids market is divided into type and end user.

Global Fatty Acids Market, By Type:

What are common food sources of unsaturated fats?

The unsaturated segment led the fatty acids market, generating the largest revenue share. Nuts, avocados, canola, olive oil, soybeans, and other foods are sources of unsaturated fats. It helps in the synthesis of chemokines, which draw immune cells to the site of infection and strengthen the immune system.

The unsaturated segment in the fatty acids market is expected to grow at the fastest CAGR over the forecast period. Saturated fatty acids continue to be more prevalent than unsaturated fatty acids in several end-use applications. These consist of crayons, rubbers, metals, and waxes. Fatty acids' shelf life and heat stability are shortened by the unsaturated type's comparatively low melting point.

Global Fatty Acids Market, By End User:

What makes fatty acids suitable for household cleaning products?

The household & industrial cleaning segment held the largest market share in the fatty acids market. The segment of household and industrial cleaning Its high percentage can be attributed to the remarkable antifungal, antiviral, and antibacterial qualities of fatty acids, which make them attractive for use in household cleaning products. They are frequently utilized in domestic applications since they also aid in thickening liquid items.

The pharmaceutical & nutraceutical segment in the fatty acids market is expected to grow at the fastest CAGR over the forecast period. The growing use of omega-3 fatty acids in prescription medications, infant formulae, and supplements to treat diseases like hypertriglyceridemia is responsible for the expansion of the Pharmaceuticals & Nutraceuticals category.

Regional Segment Analysis of the Global Fatty Acids Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Fatty Acids Market Trends

What raw materials make the Asia Pacific region a favorable location for industrial operations?

The Asia Pacific region's high captive consumption and ready access to raw materials attract firms to expand their operations there. Particularly in nations like Indonesia, Malaysia, and the Philippines, the region benefits from a robust supply of raw materials like palm and coconut oils. Furthermore, it is anticipated that the increasing significance of hygiene and immunity-boosting goods in important nations would further support market expansion. KLK Oleo launched vegan omega-6 emollients in 2025, aligning with clean beauty trends, while Evonik’s plant-based fatty acid esters saw a 12% surge in personal care product adoption.

China Fatty Acids Market Trends

What factors are driving the growth of China’s fatty acids industry?

China's strong manufacturing base, rising consumer demand, and expanding applications across numerous industries have propelled the country's fatty acids market to a substantial share of the global industry. Fatty acids are being used more and more in important industries like food and beverage, pharmaceuticals, cosmetics, and industrial chemicals because of their nutritional and functional qualities. Large-scale production is supported by China's plentiful supply of raw resources, especially plant-based oils.

Japan Fatty Acids Market Trends

Which industries in Japan are using high-end, sustainable, and bio-based fatty acid products?

The market for fatty acids in Japan is expanding steadily due to strong consumer demand for high-end, sustainable, and bio-based products in a variety of industries. Innovation in the production and use of fatty acids is encouraged by the nation's robust regulatory framework and sophisticated technological infrastructure, especially in the food, pharmaceutical, and personal care sectors. The demand for omega-rich and useful fatty acids is further increased by consumers' growing awareness of health and wellness.

North America Fatty Acids Market Trends

Why is product consumption of fatty acids expected to increase in North America?

In North America, rising demand from several end-use industries, including as food and beverage, pharmaceuticals, and domestic cleaning, is anticipated to increase product consumption. One of the major users of fatty acids is the United States. The use of fatty acids is being promoted by growing consumer awareness of the effects on health, wellbeing, and the environment in industries such food and beverage, personal care, medicines, and industrial uses. Well-known companies including BASF SE, Cargill integrated, and Eastman Chemical Company are also based there. Epax invested USD 10 million to expand omega-11 production in January 2025, while DSM-Firmenich launched an algal omega-3 supplement in October 2023, highlighting growing demand for eco-friendly nutritional alternatives.

U.S Fatty Acids Market Trends

Where is the demand for fatty acids growing within the United States?

The market for fatty acids in the United States is expanding steadily due to the growing need for bio-based, sustainable ingredients in a variety of sectors, including industrial applications, personal care, pharmaceuticals, and food & beverage. Growing customer preferences for clean-label and plant-based products, as well as increased knowledge of health and wellness issues, are all major factors driving market growth. The existence of sophisticated manufacturing infrastructure, robust regulatory frameworks, and continuous research and development projects further supports innovation in the production and uses of fatty acids.

Canada Fatty Acids Market Trends

What types of products are influencing the growth of fatty acids in the Canadian market?

The growing need for sustainable and health-conscious products across important industries like food and beverage, personal care, pharmaceuticals, and animal nutrition is driving the sluggish expansion of the Canadian fatty acids market. The market is expanding due to rising consumer knowledge of the advantages of omega fatty acids as well as a desire for plant-based and eco-friendly products. The industry's growth is further aided by Canada's strict regulations, focus on clean-label formulations, and improvements in processing technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global fatty acids market, along with a comparative evaluation primarily based on their Type of offerings, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Fatty Acids Market Include

- DOW

- BASF SE

- Akzo Nobel

- Ashland Inc.

- Oleon N.V.

- Arizona Chemicals

- Koninklijke DSM NV

- Cargill Incorporated

- Croda International Plc

- Eastman Chemical Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, DSM and Evonik announced a joint venture to develop algae-based omega-3 fatty acids for animal nutrition. This collaboration enhances their market presence by offering sustainable solutions, meeting rising demand for eco-friendly alternatives in the global fatty acid industry.

- In June 2024, Anhui Refined Oil and Fat Co. Ltd has launched the industry standard for "Industrial Linseed Oil Fatty Acid," effective mid-2024. This milestone boosts product quality, strengthens market competitiveness, and drives innovation in China's linolenic acid and fatty acids sector.

- In May 2024, Emery Oleochemicals announced a partnership with LEHVOSS Functional Fluids to exclusively distribute its esters, polyols, and carbon/fatty acids across Europe. This strategic collaboration aims to enhance Emery Oleochemicals’ market position and expand its reach within the European fatty acids sector.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the fatty acids market based on the following segments:

Global Fatty Acids Market, By Type

- Saturated

- Unsaturated

Global Fatty Acids Market, By End User

- Household & Industrial Cleaning

- Food & Beverage

- Pharmaceutical & Nutraceutical

- Personal Care & Cosmetics

- Industrial

- Others

Global Fatty Acids Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the fatty acids market over the forecast period?The global fatty acids market is projected to expand at a CAGR of 5.02% during the forecast period.

-

2. What is the market size of the fatty acids market?The global fatty acids market size is expected to grow from USD 30.20 billion in 2024 to USD 51.75 billion by 2035, at a CAGR 5.02% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the fatty acids market?Asia Pacific is anticipated to hold the largest share of the fatty acids market over the predicted timeframe.

-

4. Who are the top companies operating in the global fatty acids market?DOW, BASF SE, Akzo Nobel, Ashland Inc., Oleon N.V., Arizona Chemicals, Koninklijke DSM NV, Cargill Incorporated, Croda International Plc, Eastman Chemical Company, and others.

-

5. What factors are driving the growth of the fatty acids market?The fatty acids market growth is driven by increasing demand for bio-based products, expanding applications in food, pharmaceuticals, and personal care, rising health awareness, technological advancements, and supportive environmental regulations.

-

6. What are market trends in the fatty acids market?Growing demand for sustainable ingredients, increased use in nutrition and personal care, technological advancements in processing, growth in emerging economies, and a move toward plant-based fatty acids are some of the major market trends.

-

7. What are the main challenges restricting wider adoption of the fatty acids market?Price fluctuations for raw materials, a lack of high-quality feedstocks, severe restrictions, high production costs, and competition from synthetic alternatives that impede wider market acceptance are some of the challenges.

Need help to buy this report?