Global Explosive Trace Detection Market Size, By Product (Handheld, Portable/ Movable, and Fixed Point/ Standalone), By Technology (Colorimetrics, Ion Mobility Spectrometry, Thermo Redox, Chemiluminescence, and Amplifying Fluorescent Polymer), By End Use (Commercial, Defense, Public Safety & Law Enforcement, and Others), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Explosive Trace Detection Market Insights Forecasts to 2033

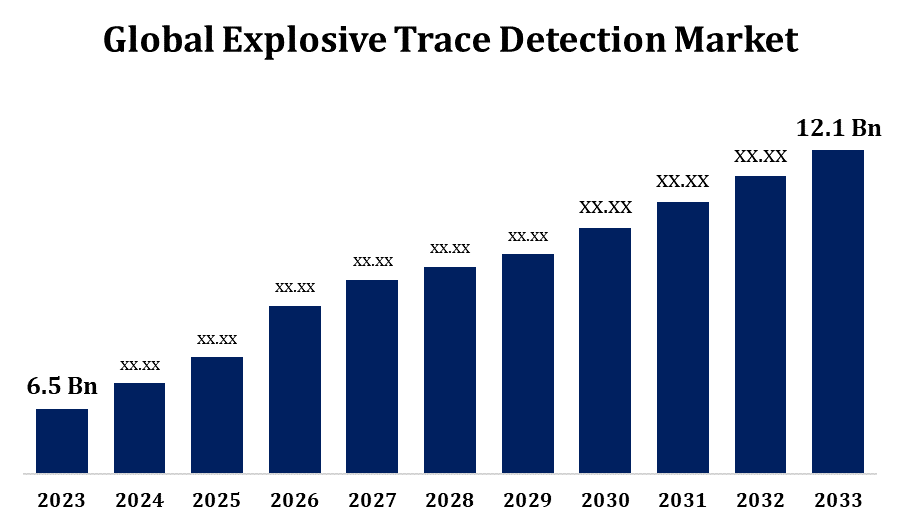

- The Global Explosive Trace Detection Market Size was valued at USD 6.5 Billion in 2023.

- The Market is Growing at a CAGR of 6.41% from 2023 to 2033

- The Worldwide Explosive Trace Detection Market Size is expected to reach USD 12.1 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Explosive Trace Detection Market Size is expected to reach USD 12.1 Billion by 2033, at a CAGR of 6.41% during the forecast period 2023 to 2033.

The technology and tools used to find explosives in trace amounts are covered by the Explosive Trace Detection (ETD) market. The growing threat of terrorism and the requirement for strict security measures in a number of industries, including public safety, vital infrastructure protection, border security, and transportation, are the main drivers of this industry. Airports are implementing cutting-edge ETD technologies to improve security screening procedures while preserving operational efficiency in response to the ongoing increase in air traffic. Beyond the realm of typical airline security, additional industries like public spaces, event security, and cargo screening are embracing ETD technology. The deployment of ETD systems is being driven by the need for increased security at ports, border crossings, and cargo facilities as a result of growing globalisation and trade operations.

Explosive Trace Detection Market Value Chain Analysis

The first step involves vendors of components and raw materials needed in the production of ETD systems. Electronic parts, sensors, detectors, circuits, and other required materials can all be considered raw materials. Equipment for explosive trace detection is designed, developed, and produced by ETD system manufacturers. This includes sophisticated screening systems for airports and other high-security locations, as well as portable and stationary detectors for checkpoints. To produce functional ETD systems, manufacturers integrate various components, sensors, software, and user interfaces. Technology businesses and research and development (R&D) institutions are key players in the advancement of ETD technology. They create integrated solutions that provide thorough security screening capabilities, design new detection techniques, boost sensor sensitivity, and improve data analysis algorithms. Distribution of ETD systems to end users, such as airports, transportation hubs, government agencies, and private sector organisations, is the responsibility of distributors and resellers. Installing ETD systems at customer locations is a speciality of installation businesses. They guarantee that ETD equipment is installed, calibrated, and integrated correctly with the current security infrastructure, including surveillance networks, access control systems, and baggage screening systems. Operators and security personnel can participate in training programmes on the usage of ETD systems from providers of maintenance and training services. Government organisations in charge of border security, transportation security, and critical infrastructure protection are among the end customers of ETD systems. Additionally, ETD technology is used by private sector organisations to improve security protocols and lessen the possibility of terrorist attacks, including airports, seaports, mass transit systems, event venues, and corporate buildings.

Explosive Trace Detection Market Opportunity Analysis

The need for more sophisticated ETD systems is driven by increased security threats, such as terrorism and the spread of IEDs. Tight rules requiring explosive detection devices to be used in public spaces, important infrastructure locations, and transportation hubs foster a regulatory climate that is conducive to the expansion of the ETD business. Although the major use case for ETD systems is still aviation security, other non-aviation industries including mass transportation, border security, critical infrastructure protection, and event security are starting to recognise the value of these technologies. Ports, border crossings, and cargo facilities require increased security due to growing globalisation and international trade. Seamless security operations are made possible by the integration of ETD systems with the current security ecosystems, which include biometric identity technologies, video surveillance, and access control systems.

Global Explosive Trace Detection Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.41% |

| 2033 Value Projection: | USD 12.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Technology, By End Use, By Region. |

| Companies covered:: | Smiths Detection Group Ltd. (UK), L3Harris Technologies Inc. (US), OSI Systems Inc. (US), Nuctech Company Limited (China), Teledyne FLIR LLC (US), Chemring Group PLC (UK), Analogic Corporation (US), Leidos Holdings Inc. (US), American Innovations Inc. (US), and other key vendors. |

| Growth Drivers: | Expanding Global Terrorism Drives the Explosive Trace Detection Market |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Explosive Trace Detection Market Dynamics

Expanding Global Terrorism Drives the Explosive Trace Detection Market

Concerns about security have grown in a number of areas due to the increase in international terrorism, including transportation, vital infrastructure, public spaces, and government buildings. As a result, there is an increasing need for security systems that are both effective and capable of detecting explosive threats. Increased investments in aviation security infrastructure are a result of the aviation industry's continued status as a key target for terrorist strikes. The market demand in this industry is driven by the critical role ETD systems play in improving the security screening procedure for travellers, luggage, and cargo at airports across the globe. Strong security measures are required to protect international trade routes, supply chains, and transportation networks from terrorist threats due to the interconnectedness of the world economy.

Restraints & Challenges

ETD systems can be expensive to buy, set up, and keep up, especially for smaller businesses or those in areas with tighter resources. Some potential customers may be discouraged from investing in ETD technology due to the high upfront and continuing expenditures. Terrorist groups are always changing their strategies and methods to avoid being discovered by security systems. In order to remain successful, ETD technology must keep up with new threats, which calls for constant improvements, upgrades, and R&D expenditures. The worldwide environment in which the ETD market operates is marked by trade disputes, geopolitical unpredictability, and regulatory complexity. Market actors may face difficulties due to the influence of trade restrictions, geopolitical concerns, and economic changes on supply chains, investment decisions, and market dynamics.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Explosive Trace Detection Market from 2023 to 2033. North America is a leader in aviation security due to its vast airport network and high amount of air traffic. When it comes to preventing explosives from being carried onboard aeroplanes, ETD systems are essential for screening travellers, luggage, and cargo. For nations in North America, protecting their borders from illegal activity such as the smuggling of explosives and contraband is of utmost importance. ETD technologies are used to improve security screening procedures and stop threats from entering the nation at ports of entry, border crossings, and customs facilities. National security depends on preventing terrorist attacks on vital infrastructure, including power plants, government buildings, transit systems, and public spaces.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Critical infrastructure is becoming more susceptible to security risks due to the Asia-Pacific region's increasing urbanisation and infrastructural expansion. To bolster security and fend off possible terrorist attacks, ETD systems are installed at public spaces, government buildings, seaports, airports, and transportation hubs. Airports, cargo facilities, and border crossings are seeing an increase in demand for increased security screening procedures due to the growth in air travel and international trade in the Asia-Pacific area. ETD systems are essential for preventing the smuggling of explosives and illegal items by checking travellers, luggage, cargo, and shipments. The Asia-Pacific region places a high priority on maritime security because of its vast coastline and marine commerce routes.

Segmentation Analysis

Insights by Product

The handheld segment accounted for the largest market share over the forecast period 2023 to 2033. Security professionals may perform on-the-spot screenings in a variety of settings, such as airports, transit hubs, border crossings, public events, and key infrastructure facilities, owing to the portability and mobility of Handheld ETD devices. As it allows for quick and focused inspections in response to particular threats or security issues, this flexibility improves security measures. Complementing fixed ETD systems installed at security checkpoints and screening stations are handheld ETD devices. While permanent systems can conduct thorough screenings for large numbers of travellers and goods, mobile devices bring extra security for focused inspections, random checks, and secondary screenings in locations where fixed systems might not be feasible or accessible.

Insights by Technology

The ion mobility spectrometry segment is dominating the market with the largest market share over the forecast period 2023 to 2033. For the detection of trace levels of explosive chemicals, including both conventional explosives and homemade explosive (HME) components, ion mobility spectrometry (IMS) offers exceptional sensitivity and selectivity. IMS technology is very useful for security screening applications since it can identify even trace amounts of explosive vapour. IMS systems offer quick trace explosive detection and analysis, with real-time results in a matter of minutes or seconds. By reducing delays and disturbances and maintaining high security standards, this rapid screening capability improves security screening procedures at airports, transportation hubs, border crossings, and vital infrastructure facilities. Numerous IMS systems are made to be small and lightweight, making it simple to set them up in a variety of operational settings, such as distant places, field operations, and mobile security checkpoints.

Insights by End Use

The defence segment accounted for the largest market share over the forecast period 2023 to 2033. The need for sophisticated security technologies in the defence industry is rising as a result of the changing nature of security threats, such as terrorism, insurgency, and asymmetric warfare. When it comes to identifying and reducing explosive threats from hostile actors and terrorist groups, ETD systems are indispensable. ETD systems are used by security services and military forces all over the world in the fight against terrorism, insurgency, and force protection. By improving operational safety and effectiveness, ETD technology helps military personnel to identify explosive devices, improvised explosive devices (IEDs), and explosive materials in battle zones, conflict areas, and high-risk locations. ETD systems improve situational awareness, information collecting, and threat detection capabilities by being integrated with a variety of military platforms, such as vehicles, aircraft, unmanned aerial vehicles (UAVs), and marine boats.

Recent Market Developments

- In November 2021, the Transportation Security Administration (TSA) and Smiths Detection Group Ltd., a threat detection and security screening technology business, inked a USD 20 million contract for the provision of CTX 9800 Explosive Detection Systems (EDS) for baggage screening at several US airports.

Competitive Landscape

Major players in the market

- Smiths Detection Group Ltd. (UK)

- L3Harris Technologies Inc. (US)

- OSI Systems Inc. (US)

- Nuctech Company Limited (China)

- Teledyne FLIR LLC (US)

- Chemring Group PLC (UK)

- Analogic Corporation (US)

- Leidos Holdings Inc. (US)

- American Innovations Inc. (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Explosive Trace Detection Market, Product Analysis

- Handheld

- Portable/ Movable

- Fixed Point/ Standalone

Explosive Trace Detection Market, Technology Analysis

- Colorimetrics

- Ion Mobility Spectrometry

- Thermo Redox

- Chemiluminescence

- Amplifying Fluorescent Polymer

Explosive Trace Detection Market, End Use Analysis

- Commercial

- Defense

- Public Safety & Law Enforcement

- Others

Explosive Trace Detection Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Explosive Trace Detection Market?The global Explosive Trace Detection Market is expected to grow from USD 6.5 billion in 2023 to USD 12.1 billion by 2033, at a CAGR of 6.41% during the forecast period 2023-2033.

-

2. Who are the key market players of the Explosive Trace Detection Market?Some of the key market players of the market are Smiths Detection Group Ltd. (UK), L3Harris Technologies Inc. (US), OSI Systems Inc. (US), Nuctech Company Limited (China), Teledyne FLIR LLC (US), Chemring Group PLC (UK), Analogic Corporation (US), Leidos Holdings Inc. (US), American Innovations Inc. (US). And others.

-

3. Which segment holds the largest market share?The defence segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Explosive Trace Detection Market?North America is dominating the Explosive Trace Detection Market with the highest market share.

Need help to buy this report?