Expanded Polystyrene Market Size, Share, and COVID-19 Impact Analysis, By Product (White, Grey), By Application (Construction, Packaging, Automotive), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Expanded Polystyrene Market Insights Forecasts to 2035

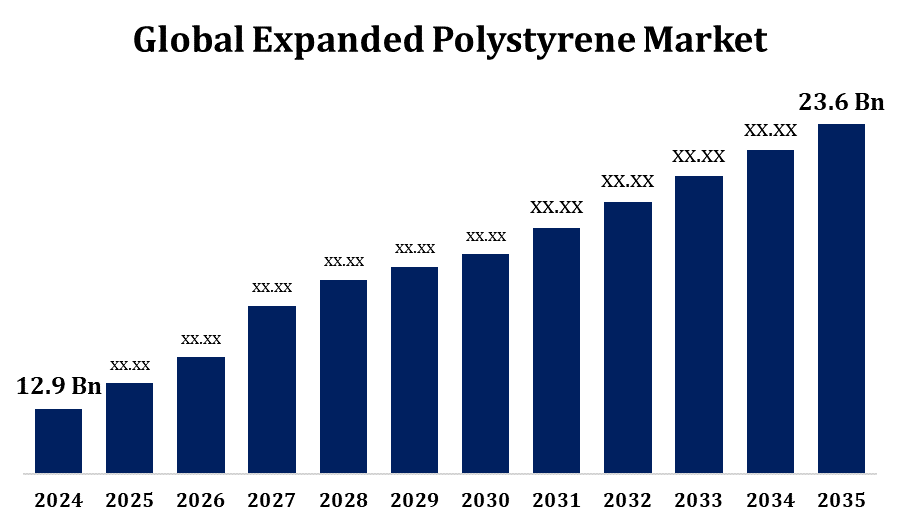

- The Expanded Polystyrene Market Size was valued at USD 12.9 Billion in 2024.

- The market is growing at a CAGR of 6.23% from 2025 to 2035.

- The Global Expanded Polystyrene Market Size is expected to reach USD 23.6 Billion by 2035.

- Asia Pacific is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

The Global Expanded Polystyrene Market Size is Expected to reach USD 23.6 Billion by 2035, at a CAGR of 6.23% during the forecast period 2025 to 2035.

The Expanded Polystyrene (EPS) market size is experiencing steady growth driven by rising demand across packaging, construction, and consumer goods industries. EPS is favored for its lightweight, durability, thermal insulation, and cushioning properties, making it a preferred material for protective packaging and building insulation. The construction sector, particularly in developing regions, is witnessing increased EPS adoption in insulation panels and structural components due to energy efficiency regulations. In the packaging industry, EPS is extensively used for food containers, electronics, and fragile items. Technological advancements have enhanced EPS recyclability and sustainability, further supporting market growth. Asia-Pacific dominates the global EPS market, led by rapid urbanization, infrastructure development, and industrial expansion. However, environmental concerns and regulations around single-use plastics may challenge market expansion in the coming years.

Expanded Polystyrene Market Value Chain Analysis

The value chain of the Expanded Polystyrene (EPS) market involves multiple interconnected stages, beginning with the procurement of raw materials, primarily styrene monomer, derived from petroleum. This is followed by polymerization processes conducted by chemical manufacturers to produce polystyrene beads. These beads are then expanded and molded into EPS by processors to create various product forms. Distributors and suppliers play a key role in delivering EPS products to end-use industries, including construction, packaging, automotive, and consumer goods. Downstream, companies utilize EPS in insulation panels, packaging solutions, and other applications. The chain also increasingly incorporates recycling and waste management services due to rising environmental concerns. Technological innovations and vertical integration among key players are helping streamline operations, reduce costs, and enhance sustainability across the EPS value chain.

Expanded Polystyrene Market Opportunity Analysis

The Expanded Polystyrene (EPS) market presents significant growth opportunities driven by rising demand for energy-efficient building materials and sustainable packaging solutions. The construction industry, especially in emerging economies, is increasingly adopting EPS for insulation and structural applications due to its thermal efficiency, lightweight nature, and cost-effectiveness. The shift toward green buildings and stricter energy regulations further boost its appeal. In packaging, the growing e-commerce sector and demand for safe, lightweight, and protective materials offer strong growth potential. Additionally, innovations in EPS recycling and the development of bio-based alternatives are opening new avenues for eco-friendly product lines. Asia-Pacific, with its rapid industrialization and infrastructure expansion, remains a key opportunity hub. As industries seek durable and low-cost materials, EPS stands poised to benefit from diversified applications and evolving market needs.

Market Dynamics

Expanded Polystyrene Market Dynamics

The growth and expansion of operations within the construction industry

The growth and expansion of operations within the construction industry are significantly driving the demand for Expanded Polystyrene (EPS) across global markets. EPS is increasingly utilized in construction for insulation, void-forming, and lightweight fill applications due to its excellent thermal insulation, moisture resistance, and durability. As urbanization accelerates and infrastructure development surges, especially in emerging economies, the need for cost-effective and energy-efficient building materials has become more pronounced. EPS supports green building initiatives and helps meet stringent energy efficiency standards, making it a preferred material for modern construction. Additionally, its ease of installation and compatibility with various building systems enhance its appeal. The push toward sustainable and thermally insulated buildings is expected to further strengthen EPS adoption, reinforcing its role as a vital component in the construction sector growth.

Restraints & Challenges

Environmental concerns surrounding EPS disposal and its non-biodegradable nature have led to increasing regulatory pressures, particularly in regions with strict sustainability mandates. The material’s association with single-use plastics has prompted bans and restrictions in packaging applications, impacting market potential. Additionally, volatility in raw material prices, especially styrene derived from petroleum, affects production costs and profit margins. The growing emphasis on circular economy practices demands enhanced recycling infrastructure, which remains underdeveloped in many regions. Competition from alternative eco-friendly materials such as biodegradable polymers and fiber-based packaging also poses a threat. Addressing environmental impacts, improving recycling technologies, and adapting to evolving regulations are critical to overcoming these obstacles and ensuring long-term market viability.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Expanded Polystyrene Market from 2025 to 2035. In the construction industry, EPS is widely used for insulation, geofoam, and structural applications due to its lightweight, energy-efficient, and cost-effective properties. Growing focus on green building practices and energy conservation has further boosted EPS adoption. The packaging sector also contributes significantly, with EPS favored for protective packaging of electronics, appliances, and perishable goods. Technological advancements in recycling and increased awareness about sustainable practices are supporting market expansion. The U.S. dominates regional demand, backed by robust infrastructure development and industrial activity. Additionally, strategic investments, mergers, and product innovations by key players are enhancing market competitiveness and strengthening the EPS value chain across North America.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2025 to 2035. The construction sector is a key driver, with increasing use of EPS for insulation, roofing, and structural applications due to its energy efficiency and lightweight nature. Additionally, the packaging industry is expanding significantly, fueled by booming e-commerce and growing demand for protective and thermal packaging. Government initiatives promoting energy-efficient buildings and sustainability are further accelerating EPS adoption. Technological advancements, improved recycling capabilities, and rising awareness about environmental benefits are supporting long-term market expansion. Countries such as China, India, Japan, and South Korea are at the forefront of this growth, benefiting from robust industrial activity and favorable policy frameworks that encourage the use of advanced insulation and packaging materials.

Segmentation Analysis

Insights by Application

The construction segment accounted for the largest market share over the forecast period 2025 to 2035. The growth is fueled by rising demand for energy-efficient, cost-effective, and lightweight building materials. EPS is widely used in insulation panels, roofing systems, floor insulation, and foundation applications due to its excellent thermal insulation, moisture resistance, and structural strength. With increasing emphasis on sustainable construction and energy conservation, EPS has become a preferred choice for residential, commercial, and infrastructure projects. Its ease of installation and compatibility with modern construction methods further enhance its adoption. Rapid urbanisation, infrastructure development, and supportive government regulations promoting green building practices, especially in emerging economies, are accelerating EPS usage. As construction activities expand globally, the segment is expected to maintain strong growth, reinforcing EPS’s critical role in modern building systems.

Insights by Product

The white product segment accounted for the largest market share over the forecast period 2025 to 2035. The growth is driven by its widespread use in packaging and building insulation applications. White EPS, known for its lightweight, cushioning, and thermal insulation properties, is extensively utilised for protective packaging of consumer electronics, appliances, and food items. In the construction sector, it is used in insulation boards, wall panels, and roofing due to its excellent energy efficiency and moisture resistance. The affordability and versatility of white EPS make it a popular choice across various end-use industries. As sustainability and energy-saving initiatives gain momentum, white EPS is increasingly adopted in both developed and developing regions. Continuous innovations in manufacturing and recycling technologies are also supporting the segment’s growth, reinforcing its relevance in diverse industrial applications.

Recent Market Developments

- In October 2024, Carlisle Companies Inc. announced a definitive agreement to acquire the EPS insulation business of PFB Holdco, Inc., which includes its Plasti-Fab and Insulspan brands.

Competitive Landscape

Major players in the market

- BASF SE (Germany)

- ACH Foam Technologies, Inc (U.S.)

- Kaneka Corporation (Japan)

- SABIC (Saudi Arabia)

- Alpek S.A.B. de C.V (Mexico)

- Synbra Holding bv (the Netherlands)

- NOVA Chemicals Corporation (Canada)

- StyroChem (Canada)

- Unipol Holland B.V. (the Netherlands)

- Versalis S.p.A (Italy)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2025 to 2035.

Expanded Polystyrene Market, Product Analysis

- White

- Product

Expanded Polystyrene Market, Application Analysis

- Construction

- Packaging

- Automotive

Expanded Polystyrene Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Expanded Polystyrene Market?The global Expanded Polystyrene Market is expected to grow from USD 12.9 billion in 2024 to USD 23.6 billion by 2035, at a CAGR of 6.23% during the forecast period 2025-2035.

-

2. Who are the key market players of the Expanded Polystyrene Market?Some of the key market players of the market are BASF SE (Germany), ACH Foam Technologies, Inc (U.S.), Kaneka Corporation (Japan), SABIC (Saudi Arabia), Alpek S.A.B. de C.V (Mexico), Synbra Holding bv (the Netherlands), NOVA Chemicals Corporation (Canada), StyroChem® (Canada), Unipol Holland B.V. (the Netherlands), and Versalis S.p.A (Italy).

-

3. Which segment holds the largest market share?The white product segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?