Europe Veterinary Services Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Production Animal and Companion Animal), By Service Type (Medical Services and Non-Medical Services), and Europe Veterinary Services Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareEurope Veterinary Services Market Insights Forecasts to 2035

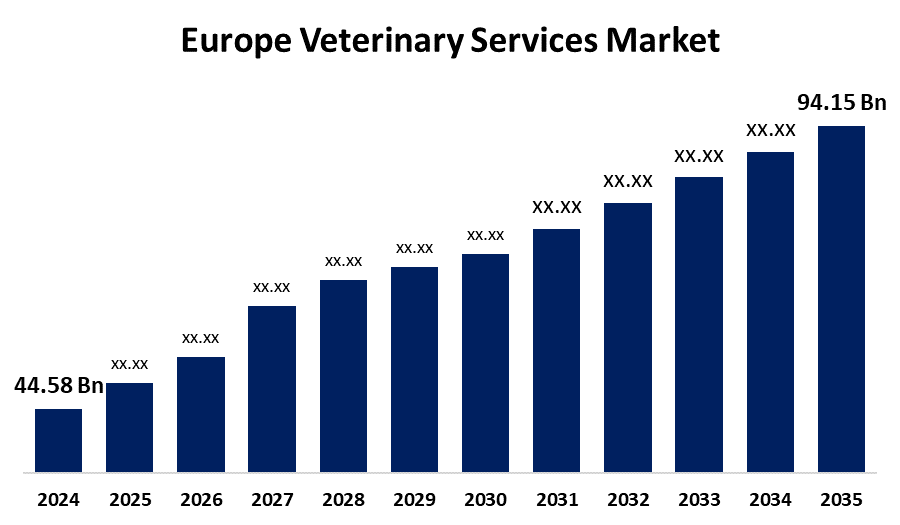

- The Europe Veterinary Services Market Size was estimated at USD 44.58 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.03% from 2025 to 2035

- The Europe Veterinary Services Market Size is Expected to Reach USD 94.15 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Veterinary Services Market Size is anticipated to reach USD 94.15 Billion by 2035, Growing at a CAGR of 7.03% from 2025 to 2035. The increased pet population and improved animal husbandry practices in the region are responsible for driving the veterinary services market in the Europe region.

Market Overview

The Europe veterinary services market is an industry that emphasizes providing medical care, diagnostics, and treatment for animals, including companion animals and livestock. Veterinary services refer to the medical treatment offered by or under the direct supervision of a veterinarian, including prescribed medications by the veterinarian. There is growing advancement in veterinary services with an increasing pet ownership and spending on animal healthcare. In the agribusiness sector, veterinary services are being integrated to provide on-farm support for diagnostics, treatment, and preventive care. Introduction of telemedicine for veterinary consultations, demand for pet insurance, and advancements in veterinary technology are several factors that are providing growth opportunities in the veterinary services market.

Report Coverage

This research report categorizes the market for the Europe veterinary services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe veterinary services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe veterinary services market.

Europe Veterinary Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 44.58 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.03% |

| 2035 Value Projection: | USD 94.15 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Animal Type, By Service Type, |

| Companies covered:: | Zoetis, Boehringer Ingelheim Animal Health, Elanco Animal Health, Merck Animal Health, Virbac, Idexx Laboratories Inc., Vetoquinol SA, Hipra, Ceva Santé Animale, ECO Animal Health Group PLC, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

An increased pet population is responsible for driving the market demand for veterinary services. It was estimated that the total number of pets in Europe has increased by nearly 3 million. Further, improvement in animal husbandry practices in the European region, with emphasis on ensuring food safety, animal welfare, and sustainable production, is contributing to driving market growth. Additionally, technological advancements in veterinary services, along with increasing consumer inclination towards pet healthcare needs, are bolstering market growth.

Restraining Factors

The increased cost of veterinary services and the lack of veterinary professionals are negatively affecting the market. Further, regulatory uncertainty and the prevalence of counterfeit veterinary products are hampering the market growth.

Market Segmentation

The Europe veterinary services market share is classified into animal type and service type.

- The production animal segment held the largest market revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe veterinary services market is segmented by animal type into production animal and companion animal. Among these, the production animal segment held the largest market revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. An increasing adoption of precision farming techniques, animal biosecurity, as well as the implementation of measures like annual vaccinations and antibiotics administration in livestock farming, are promoting the market.

- The medical services segment dominated the market with the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe veterinary services market is segmented by service type into medical services and non-medical services. Among these, the medical services segment dominated the market with the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment includes routine check-ups and vaccinations to advanced diagnostics and surgical procedures. An increasing awareness about animal health is driving the need for preventative care, diagnostics, and surgeries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe veterinary services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zoetis

- Boehringer Ingelheim Animal Health

- Elanco Animal Health

- Merck Animal Health

- Virbac

- Idexx Laboratories Inc.

- Vetoquinol SA

- Hipra

- Ceva Santé Animale

- ECO Animal Health Group PLC

- Others

Recent Developments:

- In March 2025, Zoetis announced results from the first clinical trial comparing Librela (bedinvetmab) to meloxicam for managing canine osteoarthritis (OA) pain.

- In February 2025, Virbac introduced a broad-spectrum vaccine for neonatal piglet diarrhea in France, extending its 2024 German launch.

- In January 2025, Lupa, the London-based AI native veterinary practice management platform, closed a €3.8 million seed funding round to expand and onboard more veterinary providers across the UK.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Veterinary Services Market based on the below-mentioned segments:

Europe Veterinary Services Market, By Animal Type

- Production Animal

- Companion Animal

Europe Veterinary Services Market, By Service Type

- Medical Services

- Non-Medical Services

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Europe Veterinary Services Market over the forecast period?The Europe Veterinary Services Market is projected to expand at a CAGR of 7.03% during the forecast period.

-

2. What is the market size of the Europe Veterinary Services Market?The Europe Veterinary Services Market size is expected to grow from USD 44.58 billion in 2024 to USD 94.15 billion by 2035, at a CAGR of 7.03% during the forecast period 2025-2035.

-

3. Who are the 10 top companies operating in the Europe Veterinary Services Market?Key players in the Europe Veterinary Services Market include Zoetis, Boehringer Ingelheim Animal Health, Elanco Animal Health, Merck Animal Health, Virbac, Idexx Laboratories Inc., Vetoquinol SA, Hipra, Ceva Santé Animale, and ECO Animal Health Group PLC.

-

4. What are the main drivers of growth in the Europe Veterinary Services Market?The creased pet population and improved animal husbandry practices are the main drivers of growth in the Europe veterinary services market.

-

5. What challenges are limiting the Europe Veterinary Services Market?The regulatory uncertainty and the prevalence of counterfeit veterinary products remain key restraints in the Europe veterinary services market.

-

6. What are the latest trends in the Europe veterinary services market?Introduction of telemedicine for veterinary consultations and advancements in veterinary technology are the key trends in the Europe veterinary services market.

Need help to buy this report?