Europe Travel Retail Market Size, Share, and COVID-19 Impact Analysis, By Product (Perfume & Cosmetics, Wine & Spirits, Fashion & Accessories, Tobacco Products, Electronics & Gifts, and Others), By Distribution Channel (Airports, Train Stations, Ferries, and Others), and

Industry: Consumer GoodsEurope Travel Retail Market Insights Forecasts to 2035

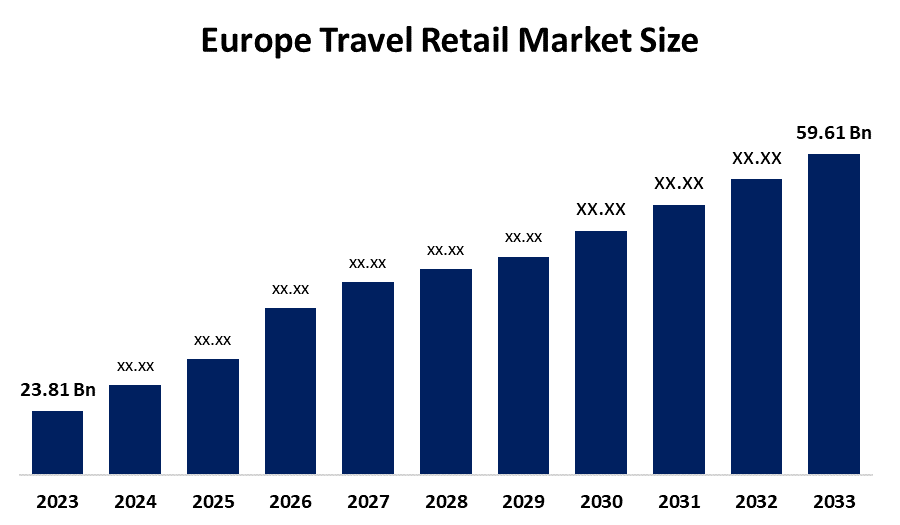

- The Europe Travel Retail Market Size Was Estimated at USD 23.81 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.7% from 2025 to 2035

- The Europe Travel Retail Market Size is Expected to Reach USD 59.61 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Travel Retail Market size is anticipated to reach USD 59.61 Billion by 2035, growing at a CAGR of 8.7% from 2025 to 2035. The market is driven by an increase in the number of travel and tourism industry, the rapid rise in urbanization, and lifestyle changes have all been contributing forces to the rising disposable income of consumers. Further economic development and growth in disposable income.

Market Overview

Travel retail refers to the selling of products and services to travelers who are on their way and usually at places such as airports, ships, border shops, and railway stations that cater especially to international travelers. Travel retail offers a one-of-a-kind shopping experience, as retailers are placed in the prime spots of the moving crowds at the airports, thus getting a constant flow of possible clients who are frequently in the mood to spend due to their going out for holidays or buying gifts.

The French market will lead the way with an impressive 13.41% CAGR until 2030, leaving the competitors far behind. Groupe ADP reported that retail sales in airports increased by 10.6% and amounted to EUR 1.43 billion (USD 1.65 billion) in the first three quarters of 2024, which was a result of the renovation of terminals and the growth of long-haul flight arrivals.

According to the European Travel Retail Confederation (ETRC), the retailers that opted for an omnichannel strategy experienced a conversion rate increase of 31% on average and a transaction value increase of 17% as opposed to traditional retail models.

The area has some of the largest apparel and cosmetics names, like LVMH from France and H&M from Sweden, which are major players in the luxury apparel, perfumes and cosmetics market, thus making it one of the top travel retail markets. There was an increasing trend of digital preorder platforms where travelers could look over, choose, and pay for products prior to getting to the airport, with collection at designated pickup points airside. Also, transit cruise passenger movements in the Mediterranean rose remarkably in 2024, with precise data reflecting more than 26 million movements being recorded.

Report Coverage

This research report categorizes the market for the Europe Travel Retail Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe travel retail market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe travel retail market.

Europe Travel Retail Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 23.81 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.7% |

| 2035 Value Projection: | USD 59.61 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product,By Distribution Channel |

| Companies covered:: | Gebr.heinemann,Aer Rianta International,Lagardere Travel Retail, Lvmh Moet Hennessy Louis Vuitton SE,Logardere Travel Retail,Logardere Travel Retail,Tourvest retail Services,Hardling Retail,Blackjack Promotions,Travelport International,LBL Travel Retail, And other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The travel retail market in Europe is driven by the revival of long-haul international air traffic into Europe has contributed to the continent's flourishing tourism sector. The number of international visitors reached 550 million in 2023, a representation that equates to a 91% recovery to the pre-pandemic level. The airport retail market is being propelled by the incremental building up of air travel facilities and the deployment of more routes. ACI Europe, the Airports Council International in Europe, stated that the total of 2.3 billion passengers who went through European airports in 2023 represented an upward growth of 19% in relation to 2022. The rise in disposable income is the main factor behind the increase in spending in travel retail areas. Statistical data from Eurostat shows that in 2023, real disposable income in the EU went up by 3.8%, whilst the European Central Bank reported that annual consumer spending on luxury and duty-free goods had increased by 7.2%.

Restraining Factors

The travel retail market in Europe is restrained by the continuous increase in both international and domestic passenger movement, backed by better travel infrastructure and connectivity, which has greatly increased the demand for travel retail items like perfumes, cosmetics, and luxury goods. The major European airports are creating more retail spaces and giving a better shopping experience, as demonstrated by the expansion of Aer Rianta International at Dublin Airport, along with other companies that are making use of the growing number of passengers to boost their sales.

Market Segmentation

The Europe travel retail market share is categorised into product and distribution channel.

- The perfume & cosmetics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe travel retail market is segmented by product into perfume & cosmetics, wine & spirits, fashion & accessories, tobacco products, electronics & gifts, and others. Among these, the perfume & cosmetics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, the European travel retail market was still dominated by fragrances and cosmetics, with 38.25% due to their universal appeal, suitability as gifts, and high margins. The segment also utilizes the buying habits of customers and good supply chains to maintain its volume, but at the same time, it is losing some of its growth as rich travelers are switching to durable souvenirs.

- The airports segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on distribution channel, the Europe travel retail market is segmented into airports, train stations, ferries, and others. Among these, the airports segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. A significant share of 58.18%, airports led the travel retail market in Europe in 2024, taking advantage of their size and walk-through layouts to reach the maximum number of customers. The large number of passengers, the long waiting times in the security zones of the airports, and the collaboration between the airport and international retailers also drive the growth of the segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe travel retail market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gebr.heinemann

- Aer Rianta International

- Lagardere Travel Retail

- Lvmh Moet Hennessy Louis Vuitton SE

- Logardere Travel Retail

- Tourvest retail Services

- Hardling Retail

- Blackjack Promotions

- Travelport International

- LBL Travel Retail

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Schiphol, a Corporate Partner of the FTE Digital, Innovation & Startup Hub, opened the largest shop in partnership with Lagardère Travel Retail: the flagship store of the new retail concept ‘Today Duty Free’.

- In May 2025, Lagardere Travel Retail’s New Aelia Duty Free store at Verona Airport Blends Retail and Cultural Heritage

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Travel Retail Market based on the below-mentioned segments:

Europe Travel Retail Market, By Product

- Perfume & Cosmetics

- Wine & Spirits

- Fashion & Accessories

- Tobacco Products

- Electronics & Gifts

- Others

Europe Travel Retail Market, By Distribution Channel

- Airports

- Train Stations

- Ferries

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe travel retail market size?A: Europe Travel Retail market size is expected to grow from USD 49.52 billion in 2024 to USD 115.62 billion by 2035, growing at a CAGR of 8.01% during the forecast period 2025-2035

-

Q: What is travel retail, and its primary use?A: Travel retail refers to the selling of products and services to travelers who are on their way and usually at places like airports, ships, border shops, and railway stations that cater especially to international travelers. Travel retail offers a one-of-a-kind shopping experience, as retailers are placed in the prime spots of the moving crowds at the airports, thus getting a constant flow of possible clients who are frequently in the mood to spend due to their going out for holidays or buying gifts.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the revival of long-haul international air traffic into Europe has contributed to the continent's flourishing tourism sector. The number of international visitors reached 550 million in 2023, a figure that equates to a 91% recovery to the pre-pandemic level. The airport retail market is being propelled by the incremental building up of air travel facilities and the deployment of more routes.

-

Q: What factors restrain the Europe travel retail market?A: The market is restrained by the continuous increase in both international and domestic passenger movement, backed by better travel infrastructure and connectivity, which has greatly increased the demand for travel retail items like perfumes, cosmetics, and luxury goods.

-

Q: How is the market segmented by distribution channel?A: The market is segmented into perfume & cosmetics, wine & spirits, fashion & accessories, tobacco products, electronics & gifts, and others.

-

Q: Who are the key players in the Europe travel retail market?A: Key companies include Gebr.heinemann, Aer Rianta International, Lagardere Travel Retail, Lvmh Moet Hennessy Louis Vuitton SE, Logardere Travel Retail, Tourvest retail Services, Hardling Retail, Blackjack Promotions, Travelport International, and LBL Travel Retail.

Need help to buy this report?