Europe Tax Management Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Software and Professional Services), By Deployment (Cloud and On-premise), and Europe Tax Management Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyEurope Tax Management Software Market Size Insights Forecasts to 2035

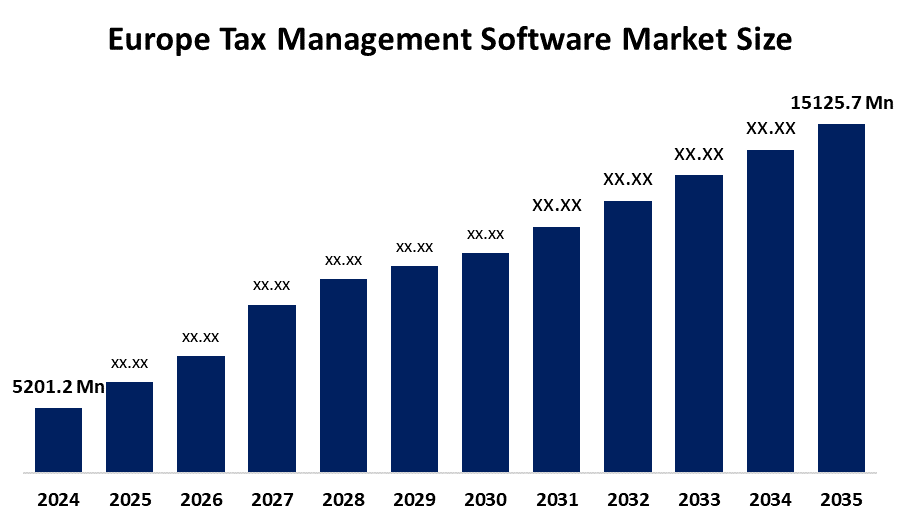

- The Europe Tax Management Software Market Size Was Estimated at USD 5201.2 Million in 2024.

- The Market Size is Growing at a CAGR of 10.19% between 2025 and 2035.

- The Europe Tax Management Software Market Size is Anticipated to Reach USD 15125.7 Million by 2035.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Europe Tax Management Software Market Size is anticipated to Hold USD 15125.7 Million by 2035, Growing at a CAGR of 10.19% from 2025 to 2035. Strong growth potential exists within the Europe Tax Management Software market due to increasing use of digital tax compliance, growing acceptance of cloud-based solutions, increasing automation of complicated filings, and rising demand for on-demand reporting and AI-Enhanced accuracy among small to medium enterprises (SMEs).

Market Overview

Tax software designed for businesses located throughout Europe is referred to as "European tax software." It is made available to provide businesses with the technology needed to assist in automating their tax calculations, tax filings, tax reporting, and tax compliance to satisfy different types of laws and tax authorities across various jurisdictions. This type of software allows businesses to effectively manage complex tax structures, decrease the chance of human error when calculating taxes, and ensure that their calculations remain accurate while they continue to perform transaction processes. As European countries enact increasingly stringent requirements regarding the use of electronic methods to record and submit tax-related documents, therefore, the European Tax Software market is experiencing a steady increase in demand for these products because of the increased efficiency produced by using an automated platform versus using manual spreadsheets. Cloud-based tax systems, AI-enhanced data analytics, and integration with an organization’s enterprise financial systems are also driving up demand for European tax software. Furthermore, as more businesses engage in cross-border trade and strive to establish themselves as audit-ready with their tax document systems, the demand for European tax software continues to grow.

Report Coverage

This research report categorizes the market for the Europe tax management software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe tax management software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe tax management software market.

Europe Tax Management Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5201.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.19% |

| 2035 Value Projection: | USD 15125.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 86 |

| Segments covered: | By Component, By Deployment and COVID-19 Impact Analysis |

| Companies covered:: | TaxSlayer, Vertex, TaxJar, HRB & Associates, Corvee, Thomson Reuters Corp, Intuit Inc, and Wolters Kluwer NV |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Segmentation of the Europe tax management software market is based on cloud vs on-premise hosting availability, country, business or profession, and end customer/business type. Increasingly complex regulations and strict compliance regulations in European countries are motivating businesses to implement automated solutions in order to meet compliance requirements. The trend toward a cloud-based tax system allows companies to provide real-time data, integrate tax software into ERP/accounting systems, perform better business functions, and thus improve the efficiency of their operations. Furthermore, the rise of small and medium-sized enterprises (SMEs), e-commerce, and cross-border trading will further drive demand for taxation software solutions that support multiple jurisdictions and provide accurate taxation accounts. Lastly, the increased use of government legislation for e-filing taxes, e-invoicing, and tax audit readiness will create additional opportunities for vendors of tax management software in Europe.

Restraining Factors

A number of factors that create challenges for the European tax management software market are such as the significant costs associated with implementing the software, the complexity associated with integrating it into existing systems, system data security and the lack of a willingness by more traditional companies to adopt new technologies.

Market Segmentation

The Europe tax management software market share is classified into component and deployment.

Get more details on this report -

- The software segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe tax management software market is segmented by component into software and professional services. Among these, the software segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The software segment dominates due to increasing demand for automated, cloud-based tax solutions that ensure compliance, real-time reporting, and integration with financial systems. Professional services grow rapidly as businesses need expert implementation, customization, and ongoing support.

- The cloud segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe tax management software market is segmented by deployment into cloud and on-premise. Among these, the cloud segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Cloud deployment offers scalability, easier updates (especially in rapidly changing tax regulations), lower upfront infrastructure cost, and faster implementation making it especially attractive to SMEs and firms operating across multiple European jurisdictions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe tax management software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TaxSlayer

- Vertex

- TaxJar

- HRB & Associates

- Corvee

- Thomson Reuters Corp

- Intuit Inc

- Wolters Kluwer NV

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe tax management software market based on the following segments:

Europe Tax Management Software Market, By Component

- Software

- Professional Services

Europe Tax Management Software Market, By Deployment

- Cloud

- On-premise

Frequently Asked Questions (FAQ)

-

Q: What is the Europe tax management software market size?A: Europe tax management software market size is expected to grow from USD 5201.2 Million in 2024 to USD 15125.7 Million by 2035, growing at a CAGR of 10.19 % during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Growth in SMEs, e-commerce, and cross-border trade increases the demand for accurate, multi-jurisdictional tax compliance.

-

Q: What factors restrain the Europe tax management software market?A: The Europe tax management software market faces restraints from high implementation costs, complexity of integration with existing systems, data security concerns, and resistance to adopting new technologies among traditional businesses.

-

Q: How is the market segmented by component?A: The market is segmented into component into software and professional services.

-

Q: Who are the key players in the Europe tax management software market?A: Key companies include TaxSlayer, Vertex, TaxJar, HRB & Associates, Corvee, Thomson Reuters Corp, Intuit Inc, and Wolters Kluwer NV.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?