Europe Tablet Market Size, Share, and COVID-19 Impact Analysis, By Product (Detachable and Slate), By Operating System (Android, IOS, Windows), By End User (Consumer and Commercial), and Europe Tablet Market Insights, Industry Trends, Forecast to 2035

Industry: Semiconductors & ElectronicsEurope Tablet Market Size Insights Forecasts to 2035

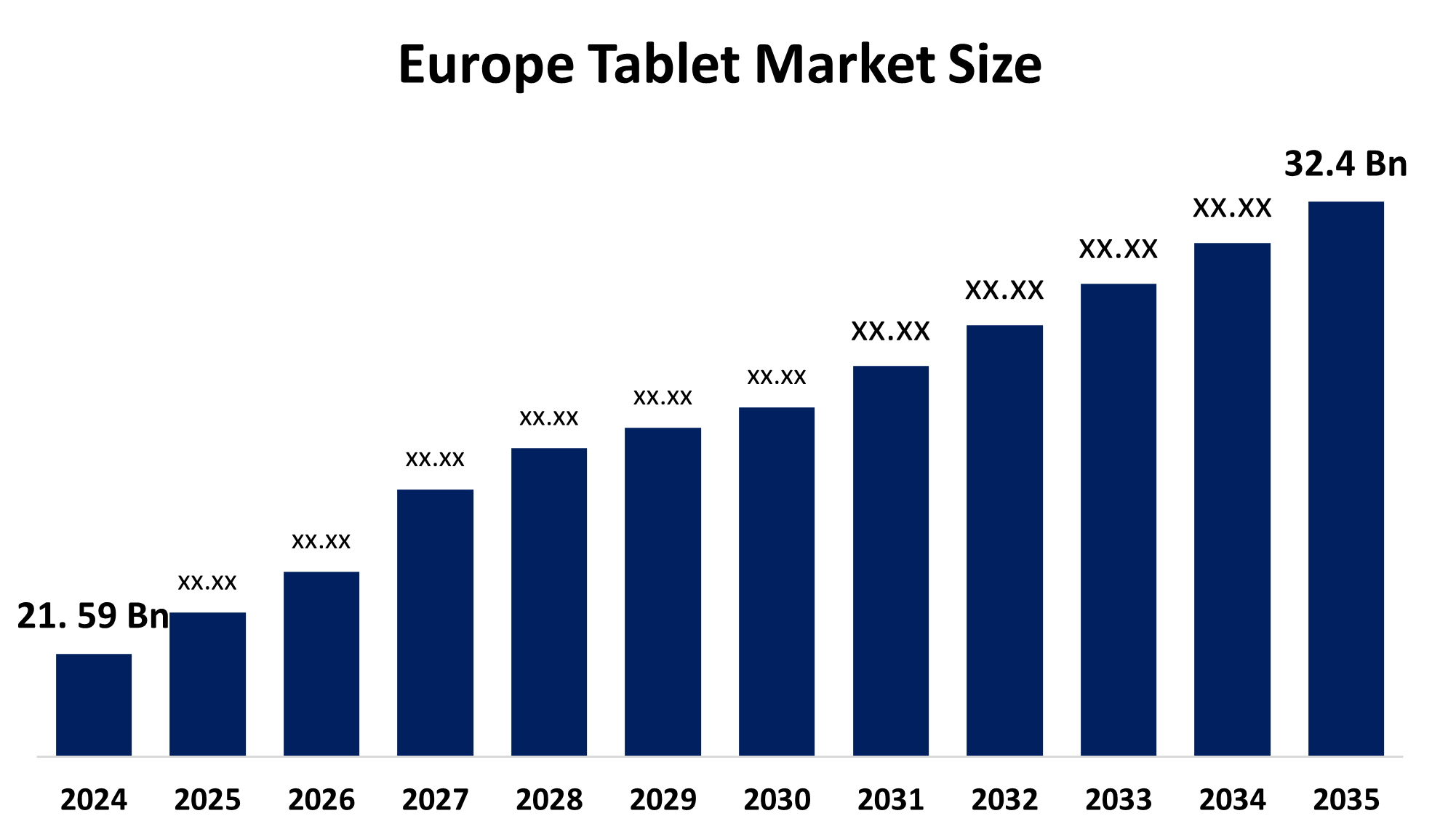

- The Europe Tablet Market Size Was Estimated at USD 21.59 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.76% from 2025 to 2035

- The Europe Tablet Market Size is Expected to Reach USD 32.4 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Tablet Market Size is Anticipated to Reach USD 32.4 Billion by 2035, Growing at a CAGR of 3.76% from 2025 to 2035. The market is driven by the unceasing innovations in tablet technology, the growing population of tech-friendly users, composed of all age groups, and the emergence of telecommuting and mobile lifestyle trends.

Market Overview

A tablet device is a portable and handheld device that is mostly equipped with a flat touchscreen display in the field of computing and technology. It is meant to be the personal computing device that does everything a laptop or desktop can do, but in a smaller and more mobile form factor. The use of tablets has been greatly embraced by students as they can use them for digital book access, educational apps and online resources. The easy-to-use touch interfaces and high-quality displays attract mobile gamers.

Deutsche Telekom in August 2023 had a milestone by introducing smartphones like T Phone and T Phone Pro under its brand for the first time. The iconic T Tablet has now become the carrier's first Android tablet.

Smartphones, cordless phones, and tablets, which are new to the EU market, are subjected to fresh EU ecodesign and energy labeling regulations. The regulations aimed at raising the product's life span, energy management, and repair work will also be helpful in making consumers' choice of purchasing more knowledgeable and eco-friendlier. In addition to the government's digital literacy programs, there are other initiatives, such as the EU's new regulation that requires manufacturers to provide a minimum of five years of software support for their devices to reduce e-waste, which significantly contribute to the market adoption and shaping.

Report Coverage

This research report categorises the Europe Tablet Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe tablet market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe tablet market.

Europe Tablet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 21.59 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.76% |

| 2035 Value Projection: | USD 32.4 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By Operating System |

| Companies covered:: | Apple, Samsung, Lenovo, Amazon, Microsoft, Huawei, Xiaomi, Dell, Panasonic, Zebra and Other key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The tablet market in Europe is driven by the growing digitisation in companies, educational institutions, and medical facilities. The significant transition towards working remotely and online has, in a major way, contributed to the increased demand for portable devices with multiple functions, like tablets. Additionally, the continuous advancements in display technology (OLED, high-resolution), processing power, and battery life are contributing greatly to consumer attraction by improving the user experience. Moreover, the incorporation of features like 5G connectivity, AI, AR, and VR gives the tablets even more applications, ranging from smart classrooms to gaming and business intelligence.

Restraining Factors

The tablet market in Europe is restrained by risk due to the sourcing of components. This is particularly true for semiconductors and lithium-ion batteries, which can cause disruptions in production and make the process more costly. Input from the major vendors with developed distribution networks will be more of a challenge for new players to enter the market, thereby creating a situation of stagnation in innovation.

Market Segmentation

The Europe tablet market share is categorised into product, operating system and end user.

- The slate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Tablet Market Size is segmented by product into detachable and slate. Among these, the slate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The slate segment had a 55.9% share of the European market in 2024. The affordability and ease of use of slate tablets are the main reasons driving the growth of the slate tablets segment in the European market. 70% of slate tablet users use them mainly for streaming and gaming. Their limited functionality as compared to detachable tablets makes them less suitable for professionals' use.

- The android segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on operating system, the Europe Tablet Market Size is segmented into android, IOS, windows. Among these, the android segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In 2024, the android segment made up 50.7% of the European market. The leading position can be attributed to the price as well as the fact that it is compatible with a large number of devices, hence accessible to price-sensitive buyers. The open-source character of the Android system grants the users and the companies’ wide opportunities for customization which is one of the main reasons why they like it.

- The consumer segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Tablet Market Size is segmented by end user into consumer and commercial. Among these, the consumer segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, the consumer segment took the lion's share of the European market with a whopping 65.8%. The consumer segment's stronghold is motivated by the extensive use of tablets for leisure, e-commerce, and personal productivity. Among the various age groups, tablets are most favored by the young, as a staggering 80% of the 16-34 age group use them every day for watching and playing games.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Tablet Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Apple

- Samsung

- Lenovo

- Amazon

- Microsoft

- Huawei

- Xiaomi

- Dell

- Panasonic

- Zebra

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Samsung Electronics announced the new Galaxy XCover7 Pro and Galaxy Tab Active5 Pro, enterprise-ready devices designed to meet the demands of today’s fast-paced, high-intensity work environments.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Tablet Market Size based on the below-mentioned segments:

Europe Tablet Market, By Product

- Detachable

- Slate

Europe Tablet Market, By Operating System

- Android

- IOS

- Windows

Europe Tablet Market, By End User

- Consumer

- Commercial

Frequently Asked Questions (FAQ)

-

Q: What is the Europe tablet market size?A: Europe tablet market size is expected to grow from USD 21.59 billion in 2024 to USD 32.4 billion by 2035, growing at a CAGR of 3.76% during the forecast period 2025-2035.

-

Q: What is tablet, and its primary use?A: A tablet computer or a tablet device is a portable and handheld device that is mostly equipped with a flat touchscreen display in the field of computing and technology.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growing digitisation in companies, educational institutions, and medical facilities. The significant transition towards working remotely and online has, in a major way, contributed to the increased demand for portable devices with multiple functions, like tablets.

-

Q: What factors restrain the Europe tablet market?A: The market is restrained by risk due to the sourcing of components. This is particularly true for semiconductors and lithium-ion batteries, which can cause disruptions in production and making the process more costly.

-

Q: How is the market segmented by product?A: The market is segmented into detachable and slate.

-

Q: Who are the key players in the Europe tablet market?A: Key companies include Apple, Samsung, Lenovo, Amazon, Microsoft, Huawei, Xiaomi, Dell, Panasonic, and Zebra.

Need help to buy this report?