Europe Sulphuric Acid Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Base Metal Smelters, Elemental Sulfur, Pyrite Ore and Others), By Form (Concentrated, 66-Degree Baume Sulfuric Acid, Glover Acid, Fertilizer Acid, Battery Acid and Dilute Sulfuric Acid), and Europe Sulphuric Acid Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Sulphuric Acid Market Size Insights Forecasts to 2035

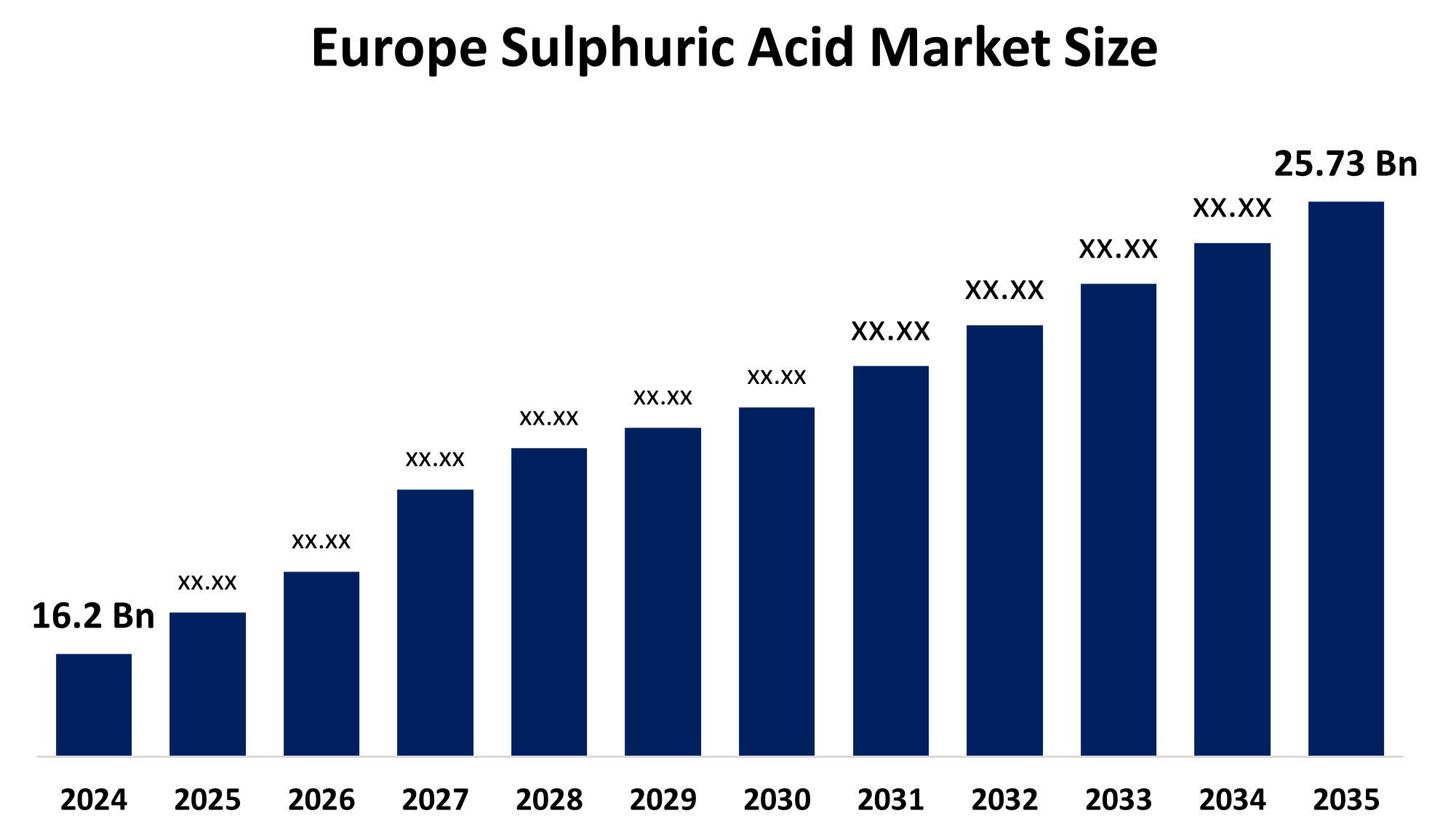

- The Europe Sulphuric Acid Market Size Was Estimated at USD 16.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.3% from 2025 to 2035

- The Europe Sulphuric Acid Market Size is Expected to Reach USD 25.73 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Sulphuric Acid Market Size is Anticipated to Reach USD 25.73 Billion by 2035, Growing at a CAGR of 4.3% from 2025 to 2035. The market is driven by sustained demand from fertilizer manufacturing, expanding non-ferrous metal processing and the increasing role of sulfuric acid in battery materials and circular applications.

Market Overview

Sulfuric acid serves as a common laboratory reagent that scientists use in their experimental work and analytical testing methods. The chemical functions as a reagent for titrations, sample preparation processes and different chemical testing methods. The production of inorganic phosphate fertilizers requires sulfuric acid to create both ammonium sulfate and superphosphate of lime. The chemical serves as a raw material that manufacturers use to create monoammonium phosphate and diammonium phosphate because these fertilizers help improve agricultural productivity through tilling.

In April 2025, BASF announced that it will build a new semiconductor-grade sulfuric acid plant at its Ludwigshafen site in Germany, targeting operations by 2027. The facility is intended to fulfil the increasing requirement for ultra-pure chemicals, which European chip-fabrication facilities need to expand their operations throughout the continent.

The sulphuric acid serves three main functions, which include its application in titrations and its use for preparing samples and conducting chemical tests. The market has shifted from an oversupply situation to a more balanced market due to the sulfur shortages and planned maintenance at key smelters like Aurubis' Hamburg facility. The agriculture sector and chemical manufacturing, metal processing and wastewater treatment sectors operate as the main forces that create demand for products.

Report Coverage

This research report categorises the European sulphuric acid market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe sulphuric acid market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe sulphuric acid market.

Europe Sulphuric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 16.2 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.3% |

| 2035 Value Projection: | USD 25.73 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Raw Material, By Form |

| Companies covered:: | AkzoNobel, INEOS, Solvay SA, BASF SE, Aurubis AG, Life Supplies NV, Nouryon, Hugo Petersen GmbH, Nyrstar, Airedale Group and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The sulphuric acid market in Europe is driven by phosphate-based fertilizer production, which serves as the main factor that drives the European sulphuric acid market. European agricultural productivity depends on phosphate fertilizers so the industry needs a steady supply of sulfuric acid to produce these critical soil nutrients. The region's strong non-ferrous metal sector, which focuses on copper and nickel, and zinc refining, creates two functions for sulfuric acid because it develops an industrial cycle that supports its use. The Europe sulfuric acid market experiences growth due to various factors. Through the contact process, technology mined sulphide ores release sulfur dioxide during their smelting process, which transforms into sulfuric acid.

Restraining Factors

The sulphuric acid market in Europe is restrained by the European Union's strict regulations, which include REACH and the EU hazardous chemical act create operational challenges for manufacturers because they must comply with safety requirements, emission regulations and waste disposal procedures. The European market has experienced molten sulfur shortages due to refinery maintenance shutdowns, and geopolitical conflicts have disrupted supply chains, resulting in unpredictable contract pricing for certain manufacturers.

Market Segmentation

The Europe sulphuric acid market share is categorised into raw material and form.

- The elemental sulfur segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Sulphuric Acid Market Size is segmented by raw material into base metal smelters, elemental sulfur, pyrite ore and others. Among these, the elemental sulfur segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The largest revenue segment reached 54.95% through its elemental sulfur segment in 2025. The agricultural industry needs large-scale production while food security issues continue to rise, and integrated fertilizer manufacturers maintain their production levels, resulting in constant high demand for sulfuric acid.

- The fertilizer acid segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on form, the Europe Sulphuric Acid Market Size is segmented into concentrated, 66-degree baume sulfuric acid, glover acid, fertilizer acid, battery acid and dilute sulfuric acid. Among these, the fertilizer acid segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The fertilizer acid dominated the Europe sulfuric acid market by accounting for a 62.7% share in 2024. The fertilizers segment maintains its dominant position because phosphate-based fertilizers serve an essential function in sustaining soil fertility throughout agricultural practices across the continent.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Sulphuric Acid Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AkzoNobel

- INEOS

- Solvay SA

- BASF SE

- Aurubis AG

- Life Supplies NV

- Nouryon

- Hugo Petersen GmbH

- Nyrstar

- Airedale Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Sulphuric Acid Market Size based on the below-mentioned segments:

Europe Sulphuric Acid Market, By Raw Material

- Base Metal Smelters

- Elemental Sulfur

- Pyrite Ore

- Others

Europe Sulphuric Acid Market, By Form

- Concentrated

- 66-Degree Baume Sulfuric Acid

- Glover Acid

- Fertilizer Acid

- Battery Acid

- Dilute Sulfuric Acid

Frequently Asked Questions (FAQ)

-

Q: What is the Europe sulphuric acid market size?A: Europe Sulphuric Acid market size is expected to grow from USD 16.2 billion in 2024 to USD 25.73 billion by 2035, growing at a CAGR of 4.3% during the forecast period 2025-2035.

-

Q: What is sulphuric acid, and its primary use?A: Sulfuric acid serves as a common laboratory reagent that scientists use in their experimental work and analytical testing methods. The chemical functions as a reagent for titrations and sample preparation processes and different chemical testing methods.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by phosphate-based fertilizer production, which serves as the main factor that drives the European sulphuric acid market. European agricultural productivity depends on phosphate fertilizers so the industry needs a steady supply of sulfuric acid to produce these critical soil nutrients.

-

Q: What factors restrain the Europe sulphuric acid market?A: The market is restrained by the European Union's strict regulations which include REACH and the EU hazardous chemical act create operational challenges for manufacturers because they must comply with safety requirements and emission regulations and waste disposal procedures.

-

Q: How is the market segmented by raw material?A: The market is segmented into base metal smelters, elemental sulfur, pyrite ore and others.

-

Q: Who are the key players in the Europe sulphuric acid market?A: Key companies include AkzoNobel, INEOS, Solvay SA, BASF SE, Aurubis AG, Life Supplies NV, Nouryon, Hugo Petersen GmbH, Nyrstar, and Airedale Group.

Need help to buy this report?