Europe Sovereign Cloud Market Size, Share, and COVID-19 Impact Analysis, By Deployment (Cloud, On-Premise), By Functionality (Data Sovereignty, Technical Sovereignty, Operational Sovereignty), By Enterprise Size (Large Enterprises, Small and Medium Enterprises), By End User (Government and Defence, Healthcare, BFSI, Telecommunications, Energy and Utilities and Others), and Europe Sovereign Cloud Market Size Insights, Industry Trends, Forecast to 2035

Industry: Electronics, ICT & MediaEurope Sovereign Cloud Market Size Insights Forecasts to 2035

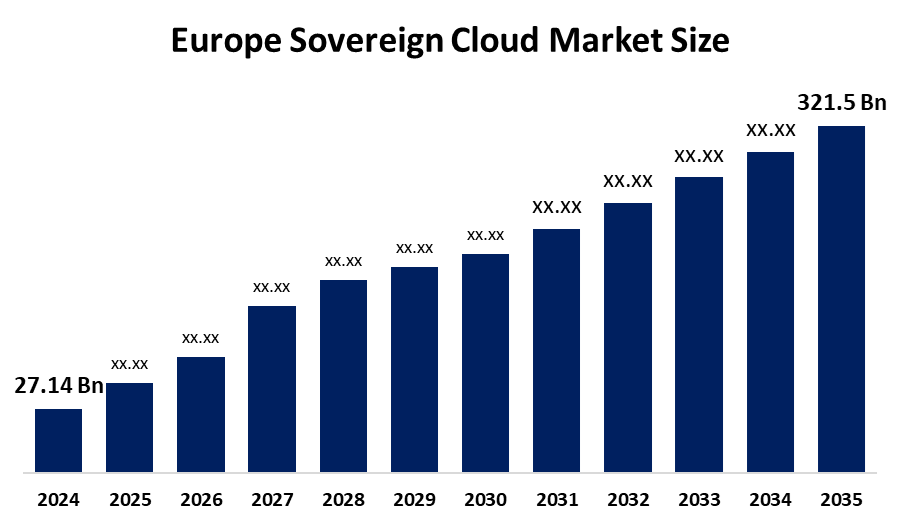

- The Europe Sovereign Cloud Market Size Was Estimated at USD 27.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 25.2% from 2025 to 2035

- The Europe Sovereign Cloud Market Size is Expected to Reach USD 321.5 Billion by 2035

Get more details on this report -

According to a Research Report published by Spherical Insights & Consulting, The Europe Sovereign Cloud Market Size is Anticipated to reach USD 321.5 Billion by 2035, growing at a CAGR of 25.2% from 2025 to 2035. The market is driven by the transformation of industries by digital technologies, with companies moving to cloud-based solutions for all the things like remote work, teamwork, and service provision.

Market Overview

Sovereign cloud is indeed a cloud computing service that is highly regulated and is meant to meet the exact requirements of data sovereignty by ensuring that the whole data lifecycle is conducted in a certain geographical area. Normally, the sovereign clouds keep the data under the control and government of either the local authority or a trust partner nominated for the purpose, which is very important for industries and governments that have strict requirements regarding privacy, security, and compliance.

The EU sovereign cloud initiative is on the front burner of this task, making certain that data, workloads, and operations stay within the boundaries of European technical and legal control. It is a necessary component of the overall EU digital sovereignty strategy. The Commission takes a step ahead in cloud sovereignty by giving an EUR 180 million public tender in October 2025.

In Germany, Google Cloud and T-Systems are joining hands for the purpose of delivering a large-scale cloud that is free from government control to the healthcare and public sector organizations.

Thales has teamed up with Google; SAP has collaborated with Arvato; Microsoft has joined hands with Telefónica. Likewise, Capgemini and Orange have partnered to establish Bleu, a French hyperscale cloud powered by Microsoft Azure, which will comply with the privacy, data sovereignty, governance, and transparency needs of the French government.

Report Coverage

This research report categorizes the market for the Europe Sovereign Cloud Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe Sovereign Cloud Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe Sovereign Cloud Market Size.

Europe Sovereign Cloud Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 27.14 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 25.2% |

| 2035 Value Projection: | 321.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Deployment, By Functionality |

| Companies covered:: | T-Systems, SAP SE ADR, Claritas Solutions Ltd, Nordcloud, Cloud Temple, SoftIron, FelCloud, Brightsolid, Scaleway, Sic Degrees Group, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sovereign cloud market in Europe is driven by governments, businesses, and regulators coming closer together to work on a complete regulatory framework. This is increasingly influencing the global corporations’ decision-making. The European Union sees it as a must to get hold of the crucial digital infrastructure that they consider a prerequisite for its security, resilience, and competitiveness amidst the rapid change in technology and geopolitics.

Restraining Factors

The sovereign cloud market in Europe is restrained by the digital sovereignty is quite difficult and intricate as the discussions around it are exceeding the normal pace and at the same time the technology is adjusting. The newly born sovereign cloud market is full of confusion, noise and quick changes. Moreover, it is imperative for the leaders of the companies to understand that there will be no single solution that will cater to all their digital sovereignty requirements.

Market Segmentation

The Europe Sovereign Cloud Market Size share is categorised into deployment, functionality, enterprise size and end user.

- The cloud segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Sovereign Cloud Market Size is segmented by deployment into cloud, on-premise. Among these, the cloud segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the strict EU regulations (like GDPR), which will eventually lead to data localisation, and the cloud's excellent features of scalability, flexibility, and cost-effectiveness. More and more companies are turning to cloud computing in order to get the advantages of remote access and collaboration, and to cut down on their IT costs.

- The data sovereignty segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on functionality, the Europe Sovereign Cloud Market Size is segmented into data sovereignty, technical sovereignty, operational sovereignty. Among these, the data sovereignty segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The data sovereignty market segment, which was the main part of the UK sovereign cloud market, is going to be a growing one that would see a 20.8% CAGR during the period of forecast, and it would still be the largest market till 2032. It means that the digital systems, like cloud infrastructure and communication networks, are under the protection of the national jurisdiction. Besides, it also reduces the dependence on foreign technologies, which may be prone to weaknesses or equipped with backdoors.

- The large enterprises segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Sovereign Cloud Market Size is segmented by enterprise size into large enterprises, small and medium enterprises. Among these, the large enterprises segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The large enterprise market would record a significant growth rate of 23.2% per year on average during the forecast period. Cloud sovereignty assures highly secure access controls, encryption, and data isolation, all of which are necessary for compliance with the afore-mentioned requirements. Large corporations generally team up with sovereign cloud providers since the cloud delivers tailor-made services that are compatible with their regional business requirements.

- The government and defence segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe Sovereign Cloud Market Size is segmented into government and defence, healthcare, BFSI, telecommunications, energy and utilities and others. Among these, the government and defence segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the ever-increasing acceptance of digital platforms by the government for public services like tax systems, healthcare portals, and smart city projects necessitates a cloud infrastructure that is both secure and compliant. By establishing data sovereignty in the cloud, the companies will no longer depend on foreign cloud providers; hence, the risks concerning unauthorized access to data will be significantly reduced, as well as the risk of being surveilled by foreign governments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Sovereign Cloud Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- T-Systems

- SAP SE ADR

- Claritas Solutions Ltd

- Nordcloud

- Cloud Temple

- SoftIron

- FelCloud

- Brightsolid

- Scaleway

- Sic Degrees Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In December 2025, in Las Vegas, Cohesity—the leader in AI-powered data security—announced at AWS re:Invent 2025 that it is a launch partner for the AWS European Sovereign Cloud.

In January 2025, European IT organizations, including Arsys, BIT, Gdansk University of Technology, Infobip, IONOS, Kontron, MONDRAGON Corporation, and Oktawave, launched Virt8ra, a multi-provider edge cloud designed for Europe.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Sovereign Cloud Market Size based on the below-mentioned segments:

Europe Sovereign Cloud Market Size, By Deployment

- Cloud

- On-Premise

Europe Sovereign Cloud Market Size, By Functionality

- Data Sovereignty

- Technical Sovereignty

- Operational Sovereignty

Europe Sovereign Cloud Market Size, By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises

Europe Sovereign Cloud Market Size, By End User

- Government and Defence

- Healthcare

- BFSI

- Telecommunications

- Energy and Utilities

- Others

Frequently Asked Questions (FAQ)

-

What is the Europe Sovereign Cloud Market Size?The Europe Sovereign Cloud Market Size size is expected to grow from USD 27.14 billion in 2024 to USD 321.5 billion by 2035, growing at a CAGR of 25.2% during the forecast period 2025-2035.

-

What is sovereign cloud, and its primary use?Sovereign cloud is indeed a cloud computing service that is highly regulated and is meant to meet the exact requirements of data sovereignty by ensuring that the whole data lifecycle is conducted in a certain geographical area. Normally, the sovereign clouds keep the data under the control and government of either the local authority or a trust partner nominated for the purpose, which is very important for industries and governments that have strict requirements regarding privacy, security, and compliance.

-

What are the key growth drivers of the market?Market growth is driven by governments, businesses, and regulators coming closer together to work on a complete regulatory framework. This is increasingly influencing the global corporations’ decision-making. The European Union sees it as a must to get hold of the crucial digital infrastructure that they consider a prerequisite for its security, resilience, and competitiveness amidst the rapid change in technology and geopolitics

-

What factors restrain the Europe Sovereign Cloud Market ?The market is restrained by the digital sovereignty is quite difficult and intricate as the discussions around it are exceeding the normal pace and at the same time the technology is adjusting. The newly born sovereign cloud market is full of confusion, noise and quick changes

-

How is the market segmented by deployment?The market is segmented into cloud, on-premise

-

Who are the key players in the Europe Sovereign Cloud Market ?Key companies include T-Systems, SAP SE ADR, Claritas Solutions Ltd, Nordcloud, Cloud Temple, SoftIron, FelCloud, Brightsolid, Scaleway, and Sic Degrees Group.

Need help to buy this report?