Europe Sodium Sulphate Market Size, Share, and COVID-19 Impact Analysis, By Nature (Synthetic and Natural), By End User (Glass, Paper & Pulp, Detergents, Food & Beverages, and Others), and Europe Sodium Sulphate Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Sodium Sulphate Market Insights Forecasts to 2035

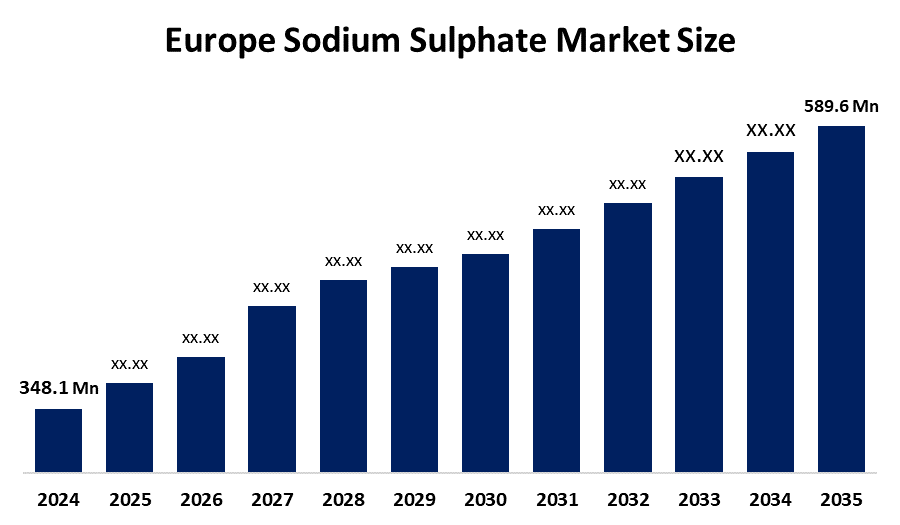

- The Europe Sodium Sulphate Market Size Was Estimated at USD 348.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.91% from 2025 to 2035

- The Europe Sodium Sulphate Market Size is Expected to Reach USD 589.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Sodium Sulphate Market Size is anticipated to reach USD 589.6 Million by 2035, growing at a CAGR of 4.91% from 2025 to 2035. The market is driven by advancements in technology have enabled the use of sodium sulphate in solar energy storage. With the increasing demand for glass products, particularly in construction and packaging, the glass manufacturing industry is expected to grow steadily.

Market Overview

Sodium sulphate is a white crystalline solid that manufacturers use to create products such as glass, detergents, kraft paper, cardboard and various chemical compounds. The market for sodium sulphate is expanding significantly in Europe due to its multiple industrial uses and the increasing demand for sustainable solutions. Sodium sulphate serves as the main raw material for producing detergents, glass, paper, pulp and textile products in European countries. The detergent industry, especially, depends on sodium sulphate as a filler, which helps to adjust active ingredient concentrations while improving product flow characteristics.

Soda Sanayii A.S. (TR) upgraded its production facilities in July 2025 to implement new technologies, which improved environmental sustainability while reducing waste output.

The Europe Sodium Sulphate Market Size in Germany faced negative impacts because rising inflation and a decrease in the consumer climate index to -22.4 resulted in reduced customer spending. The sodium sulphate market received some support from export activity, which allowed foreign markets to become more competitive due to decreasing freight costs.

The European Council has granted its ultimate approval of the detergent and surfactant regulations. The new legislation will create better conditions for selling those products throughout the Europe Sodium Sulphate Market Size while safeguarding both human health and environmental protection.

Report Coverage

This research report categorises the Europe Sodium Sulphate Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe sodium sulphate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe sodium sulphate market.

Europe Sodium Sulphate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 348.1 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.91% |

| 2035 Value Projection: | USD 589.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Nature ,By End User |

| Companies covered:: | Elementis PLC, Grupo Industrial Crimidesa, Alkim Alkali Kimya, Minera de Santa Marta, Lenzing AG, Elementis PLC, Sulquisa S.A., Cordenka GmbH & Co. KG, Chemtrade International Co., Grillo Werke AG, and Other Key Players |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The Europe Sodium Sulphate Market Size in Europe is driven by the increasing consumer demand for environmentally safe and efficient cleaning solutions, which enables manufacturers to use sodium sulphate as both a filler and a builder material in their detergent products leads to business growth. The demand for sustainable packaging solutions, combined with eco-friendly printing materials, results in higher sodium sulphate consumption needed for pulp processing and paper production. The market expansion stems from manufacturing process innovations, which include sustainable extraction methods and processing techniques that improve product quality while decreasing operational expenses.

Restraining Factors

The Europe Sodium Sulphate Market Size in Europe is restrained by producers' need to invest substantial amounts of capital because they must comply with strict emission standards and waste disposal regulations. A growing consumer preference for liquid detergents that do not require sodium sulphate is eroding demand in this core segment. In various industrial processes, sodium sulphate faces competition from more economical or accessible alternatives.

Market Segmentation

The Europe Sodium Sulphate Market share is categorised into nature and end user.

- The natural segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Sodium Sulphate Market Size is segmented by nature into synthetic and natural. Among these, the natural segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the abundant natural resources of the company, with its reduced manufacturing expenses. The compound functions as a filler component in powder detergents, while it serves as a material to eliminate air bubbles during glass manufacturing.

- The detergents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe Sodium Sulphate Market Size is segmented into glass, paper & pulp, detergents, food & beverages, and others. Among these, the detergents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Detergent production in Europe increased by more than 4.5% during 2024 because there was a simultaneous rise in demand for environmentally friendly products. The essential requirement of sodium sulphate as a filler material for laundry powders and cleaning products drives the segmental market expansion. Sodium sulphate functions as an essential component for high-efficiency detergent products because it maintains a consistent granule size throughout the manufacturing process.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Sodium Sulphate Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Elementis PLC

- Grupo Industrial Crimidesa

- Alkim Alkali Kimya

- Minera de Santa Marta

- Lenzing AG

- Elementis PLC

- Sulquisa S.A.

- Cordenka GmbH & Co. KG

- Chemtrade International Co.

- Grillo Werke AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Sodium Sulphate Market Size based on the below-mentioned segments:

Europe Sodium Sulphate Market, By Nature

- Synthetic

- Natural

Europe Sodium Sulphate Market, By End User

- Glass

- Paper & Pulp

- Detergents

- Food & Beverages

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe sodium sulphate market size?A: Europe sodium sulphate market size is expected to grow from USD 348.1 million in 2024 to USD 589.6 million by 2035, growing at a CAGR of 4.91% during the forecast period 2025-2035.

-

Q: What is sodium sulphate, and its primary use?A: Sodium sulphate is a white crystalline solid that manufacturers use to create products such as glass, detergents, kraft paper, cardboard and various chemical compounds. The market for sodium sulphate is expanding significantly in Europe because of its multiple industrial uses and the increasing demand for sustainable solutions.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing consumer demand for environmentally safe and efficient cleaning solutions, which enables manufacturers to use sodium sulphate as both a filler and a builder material in their detergent products leads to business growth.

-

Q: What factors restrain the Europe sodium sulphate market?A: The market is restrained by producers' need to invest substantial amounts of capital because they must comply with strict emission standards and waste disposal regulations.

-

Q: How is the market segmented by nature?A: The market is segmented into synthetic and natural.

-

Q: Who are the key players in the Europe sodium sulphate market?A: Key companies include Elementis PLC, Grupo Industrial Crimidesa, Alkim Alkali Kimya, Minera de Santa Marta, Lenzing AG, Elementis PLC, Sulquisa S.A., Cordenka GmbH & Co. KG, Chemtrade International Co., and Grillo Werke AG.

Need help to buy this report?