Europe Rigid Food Packaging Market Size, Share, and COVID-19 Impact Analysis, By Material (Plastic, Paperboard, Metal, and Others), By End User (Dairy Products, Bakery & Confectionery, Ready-to-Eat, Meat, Poultry, & Seafood and Others), and Europe Rigid Food Packaging Market Insights, Industry Trends, Forecast to 2035

Industry: Consumer GoodsEurope Rigid Food Packaging Market Insights Forecasts to 2035

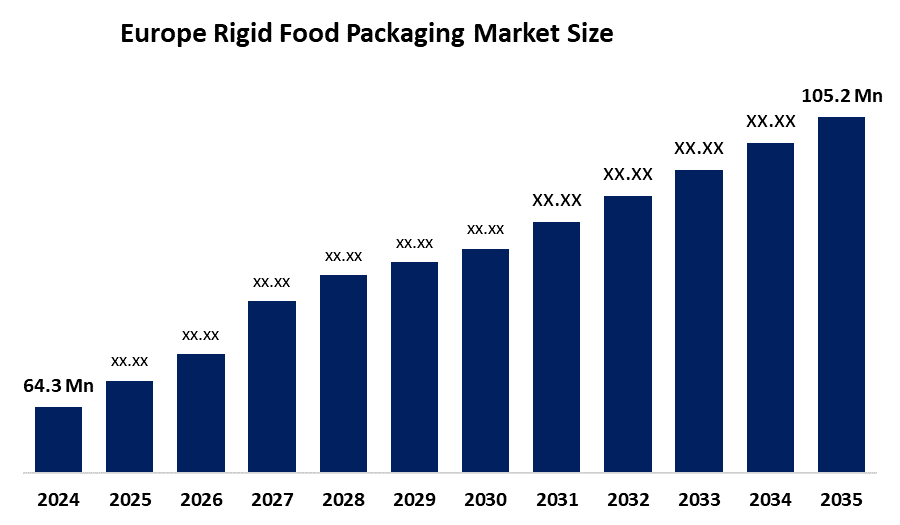

- The Europe Rigid Food Packaging Market Size Was Estimated at USD 64.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.58% from 2025 to 2035

- The Europe Rigid Food Packaging Market Size is Expected to Reach USD 105.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Rigid Food Packaging Market size is anticipated to reach USD 105.2 Million by 2035, growing at a CAGR of 4.58% from 2025 to 2035. The market is driven by the increasing demand for sustainable packaging solutions, which seems to be the primary driver; consumers are becoming more environmentally conscious.

Market Overview

Europe's rigid food packaging market is characterized by the use of robust containers for safeguarding various food items such as dairy, beverages, ready-to-eat meals, and sauces. The main aims behind this market are the trends of e-commerce, convenience, hygiene, and sustainability that are mainly oriented towards the use of recycled materials (PCR), thereby making the market a must for the safe storage, transport, and attractive consumer presentation. Rigid food packaging is one of the major factors that drives the food industry due to its versatility and operability with automated filling lines. Mainly by the factors of temperature stability and contamination protection, it shapes the packaging for value-added dairy products such as milk, yogurt cups, single-serve drinks, and cheese.

In November 2025, the world's major sustainable packaging and paper manufacturer, Mondi, is going to solidify its position as a reliable supporter of the food sector by introducing a wider range of food packaging products.

The French government has officially delayed the plan to ban single-use plastic cups, which was originally scheduled to take effect from January 2026 to 2030, hence the prolongation of the deadline. Meanwhile, the European Union is backing a project with €4 million to develop a natural coating for thermoplastic cups that will be suitable for home composting. All packaging and packaging waste in the European market, including all materials and packaging in commercial, household, industrial, and other sectors, are subject to EU law.

Report Coverage

This research report categorises the European rigid food packaging market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe rigid food packaging market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe rigid food packaging market.

Europe Rigid Food Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 64.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.58% |

| 2035 Value Projection: | USD 105.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Smurfit Westrock, Greiner Packaging, Huhtamaki, Graphic Packaging International, ALPLA, Amcor PLC, Amcor, Mondi, Stora Enso, Sealed Air, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rigid food packaging market in Europe is driven by the packaging and packaging waste regulations of the European Union, which are among the most significant factors driving this transition. These rules are used only for that content that can be recycled, reused, or made out of paper; they also require that the plastics used in packaging have a certain percentage of recycled content by a specific date. The changing urban lifestyle, with its daily rush and the increasing number of single-person households, are some of the reasons for the growing demand for fast, on-the-go, and ready-to-eat (RTE) meal options. The rigid packaging not only provides excellent barrier protection but also its high strength prevents food contamination or damage, thus prolonging the freshness and life span of the product.

Restraining Factors

The rigid food packaging market in Europe is restrained due to manufacturers facing tough pressure from strict regulations, such as the EU Packaging and Packaging Waste Regulation, to reduce plastic waste and ensure that all packaging is either recyclable or reusable by 2030. The lack of predictability with respect to the cost and availability of raw materials, especially virgin and recycled PET and HDPE, poses a significant challenge to keeping profit margins and prices stable.

Market Segmentation

The Europe rigid food packaging market share is categorised into material and end user.

- The plastic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe rigid food packaging market is segmented by material into plastic, paperboard, metal, and others. Among these, the plastic segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, plastic led the market as the largest segment with a revenue share of 70.63% due to its longevity, lightness, and low cost. It has a wide range of food applications that the manufacturers can use to meet different consumer needs. On the other hand, glass is gradually becoming the favorite among the premium and organic food brands.

- The dairy products segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe rigid food packaging market is segmented into dairy products, bakery & confectionery, ready-to-eat, meat, poultry & seafood and others. Among these, the dairy products segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by Packaged require high barrier able to prevent permeation, contamination, and damage, thus making rigid formats the only safe and long-lasting option for dairy items such as milk, yogurt, cheese, butter, cream, and flavored drinks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe rigid food packaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smurfit Westrock

- Greiner Packaging

- Huhtamaki

- Graphic Packaging International

- ALPLA

- Amcor PLC

- Amcor

- Mondi

- Stora Enso

- Sealed Air

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In December 2025, advancing sustainable food packaging in Denmark was launched through a new collaborative recycling initiative supported by Amcor, a global provider of responsible packaging solutions.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Rigid Food Packaging Market based on the below-mentioned segments:

Europe Rigid Food Packaging Market, By Material

- Plastic

- Paperboard

- Metal

- Others

Europe Rigid Food Packaging Market, By End User

- Dairy Products

- Bakery & Confectionery

- Ready-to-Eat

- Meat, Poultry & Seafood

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe rigid food packaging market size?A: Europe rigid food packaging market size is expected to grow from USD 64.3 million in 2024 to USD 105.2 million by 2035, growing at a CAGR of 4.58% during the forecast period 2025-2035.

-

Q: What is rigid food packaging, and its primary use?A: Europe's rigid food packaging market is characterized by the use of robust containers for safeguarding various food items such as dairy, beverages, ready-to-eat meals, and sauces. The food industry due to its versatility and operability with automated filling lines.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the packaging and packaging waste regulations of the European Union, which are among the most significant factors driving this transition.

-

Q: What factors restrain the Europe rigid food packaging market?A: The market is restrained by manufacturers facing tough pressure from strict regulations, such as the EU Packaging and Packaging Waste Regulation, to reduce plastic waste and ensure that all packaging is either recyclable or reusable by 2030.

-

Q: How is the market segmented by material?A: The market is segmented into plastic, paperboard, metal, and others.

-

Q: Who are the key players in the Europe rigid food packaging market?A: Key companies include Smurfit Westrock, Greiner Packaging, Huhtamaki, Graphic Packaging International, ALPLA, Amcor PLC, Amcor, Mondi, Stora Enso, and Sealed Air.

Need help to buy this report?