Europe Proteomics Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments, Reagents and Consumables, and Services), By Application (Drug Discovery, Clinical Diagnostics, and Others), By Technology (Microarray, X-Ray Crystallography, Spectroscopy, Chromatography, Electrophoresis, Surface Plasma Resonance Systems, and Others), and Europe Proteomics Market Insights, Industry Trends, Forecast to 2035

Industry: HealthcareEurope Proteomics Market Insights Forecasts to 2035

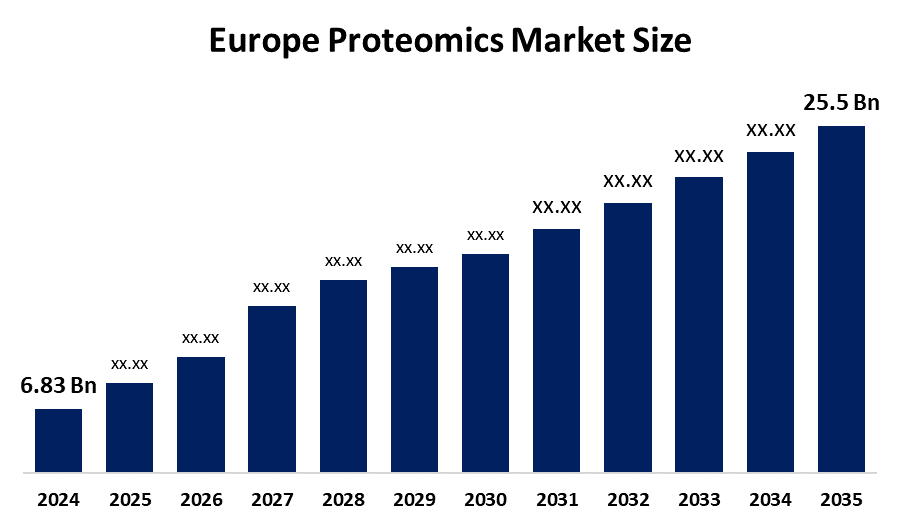

- The Europe Proteomics Market Size Was Estimated at USD 6.83 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 12.72% from 2025 to 2035

- The Europe Proteomics Market Size is Expected to Reach USD 25.5 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Proteomics Market size is anticipated to reach USD 25.5 Billion by 2035, growing at a CAGR of 12.72% from 2025 to 2035. The market is driven by the amplified focus on personalized medicine, which was instigated by the discovery of biomarkers and disease profiling. The support in the form of EU funding, public-private partnerships, and strategic alliances also plays a significant role

Market Overview

The market of proteomics is exhibiting a fast growth as clinical laboratories, pharmaceutical firms and life science researchers understand that protein-level analysis is becoming increasingly aware of its efficiency in diagnosis, biomarker detection and drug development. The regional manufacturers and service providers are introducing new integrated systems, which will enhance the workflow from sample input to data interpretation, and the systems are being powered by the continuous development of high-resolution mass spectrometry, microfluidic sample preparation and advanced bioinformatics.

In July 2023, SomaLogic Operating Co., Inc., an innovator in the area of data-driven proteomics technology, announced its partnership with Dante Genomics, which is a worldwide leader in the fields of genomics and precision medicine, thereby bringing a full solution able to deliver proteomics testing in large volumes throughout Europe. Dante will become the initial SomaLogic-certified site in Italy.

The European Commission's Europe program has allocated a total of €95.5 billion for the whole of research and innovation for the next seven years, from 2021 to 2027, and a large portion of it will be spent on life sciences studies, including proteomics, as the main area of research. The European Federation of Pharmaceutical Industries and Associations (EFPIA) states that the pharmaceutical industry spent about €41.5 billion on research and development in Europe in 2022, where the application of proteomics technology for the detection and validation of therapeutic targets was growing at a fast pace. Government and institutional funding for proteomics research is growing, thus facilitating innovation and the establishment of new technologies.

Report Coverage

This research report categorizes the market for the Europe proteomics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe proteomics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe proteomics market.

Europe Proteomics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.83 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.72% |

| 2035 Value Projection: | USD 25.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application, By Technology |

| Companies covered:: | Roche Holding AG, Merck KGaA, Bruker Corporation, F. Hoffmann-La Roche, Olink, Biognosys AG, Proteome Sciences, DiaSorin S.p.A., QIAGEN N.V, Bio-Rad, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The proteomics market in Europe is driven by the discovery of new biomarkers and translational research has strong European Union and national funding programmes supporting these areas. The demand for precision medicine solutions includes companion diagnostics and stratified patient care. The growth of academic and industry partnerships and consortia is accelerating technology validation. Regulatory bodies are encouraging advanced safety and efficacy testing in drug development. There is pressure to improve early-stage disease detection and to monitor therapeutic responses.

Restraining Factors

The proteomics market in Europe is restrained by the high capital investments and operational costs associated with the latest instruments and specialised staff, complicated processes of preparing samples and inconsistency across different laboratories, the handling of large proteomic datasets and a lack of standardised procedures are all factors causing data management slowdown.

Market Segmentation

The Europe proteomics market share is categorised into product, application, and technology.

Get more details on this report -

- The reagents and consumables segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe proteomics market is segmented by product into instruments, reagents and consumables, and services. Among these, the reagents and consumables segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Reagents & consumables are the largest segment with a revenue share of 72.48% in 2024. Instruments, which are capital expenditures made once, require reagents and consumables that are needed for each experiment, resulting in constant and large-volume repeat purchases. Each stage of proteomic workflows, such as protein extraction, purification, labelling, and quantification, relies heavily on reagents.

- The drug discovery segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Europe proteomics market is segmented into drug discovery, clinical diagnostics, and others. Among these, the drug discovery segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the increasing occurrence of long-term health conditions like cancer, heart diseases, lung diseases, kidney diseases, and more, the growing use of personalized drugs, and the enhanced application of proteomics for drug development. This is also attributed to the increasing investment in drug discovery and development from pharmaceutical and biopharmaceutical companies, along with research institutions.

- The spectroscopy segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe proteomics market is segmented by technology into microarray, x-ray crystallography, spectroscopy, chromatography, electrophoresis, surface plasma resonance systems, and others. Among these, the spectroscopy segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the owing to its exceptional sensitivity, resolution, and quantitative power for identifying/quantifying complex proteins; it has become indispensable for drug discovery, diagnostics, and personalised medicine. The method is extremely flexible, enabling scientists to work with complex protein mixtures from different sample types for analysis.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe proteomics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Roche Holding AG

- Merck KGaA

- Bruker Corporation

- F. Hoffmann-La Roche

- Olink

- Biognosys AG

- Proteome Sciences

- DiaSorin S.p.A.

- QIAGEN N.V

- Bio-Rad

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe proteomics market based on the below-mentioned segments:

Europe Proteomics Market, By Product

- Instruments

- Reagents and Consumables

- Services

Europe Proteomics Market, By Application

- Drug Discovery

- Clinical Diagnostics

- Others

Europe Proteomics Market, By Technology

- Microarray

- X-Ray Crystallography

- Spectroscopy

- Chromatography

- Electrophoresis

- Surface Plasma Resonance Systems

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe proteomics market size?A: Europe proteomics market size is expected to grow from USD 6.83 billion in 2024 to USD 25.5 billion by 2035, growing at a CAGR of 12.72% during the forecast period 2025-2035

-

Q: What is proteomics, and its primary use?A: In Europe, the market of proteomics is exhibiting a fast growth as clinical laboratories, pharmaceutical firms and life science researchers understand that protein-level analysis is becoming increasingly aware of its efficiency in diagnosis, biomarker detection and drug development.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the discovery of new biomarkers and translational research has strong European Union and national funding programmes supporting these areas. The demand for precision medicine solutions is including companion diagnostics and stratified patient care.

-

Q: What factors restrain the Europe proteomics market?A: The market is restrained by the high capital investments and operational costs associated with the latest instruments and specialized staff, complicated processes of preparing samples and inconsistency across different laboratories, the handling of large proteomic datasets and lack of standardized procedures are all factors causing data management slowdown.

-

Q: How is the market segmented by product?A: The market is segmented into instruments, reagents and consumables, and services

-

Q: Who are the key players in the Europe proteomics market?A: Key companies include Roche Holding AG, Merck KGaA, Bruker Corporation, F. Hoffmann-La Roche, Olink, Biognosys AG, Proteome Sciences, DiaSorin S.p.A., QIAGEN N.V., and Bio-Rad.

Need help to buy this report?