Europe Propylene Market Size, Share, and COVID-19 Impact Analysis, By Production Process (Steam Cracking, Fluid Catalytic Cracking, Propane Dehydrogenation, and Methanol-to-Olefins), By Application (Polypropylene, Acrylonitrile, Propylene Oxide, Oxo-Alcohols, and Others), and Europe Propylene Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsEurope Propylene Market Insights Forecasts to 2035

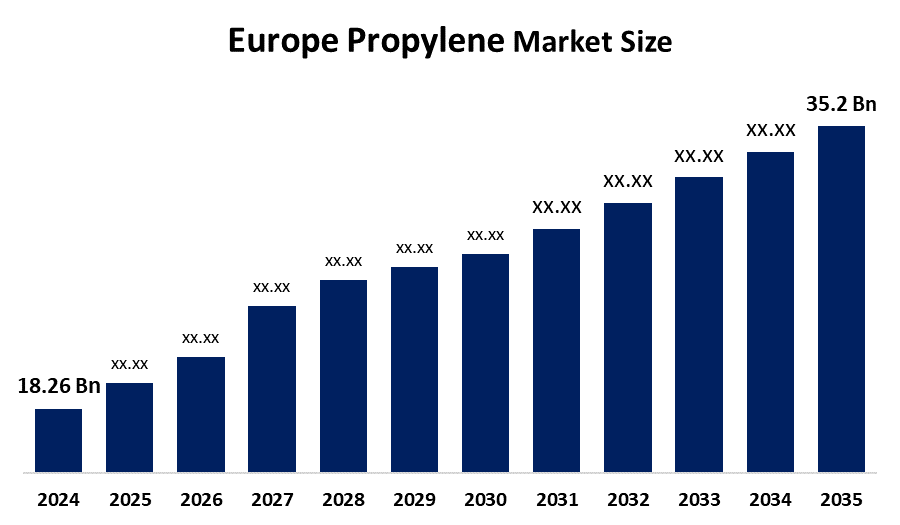

- The Europe Propylene Market Size Was Estimated at USD 18.26 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.15% from 2025 to 2035

- The Europe Propylene Market Size is Expected to Reach USD 35.2 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Propylene Market Size Is Anticipated To Reach USD 6.15 Billion By 2035, Growing At A CAGR Of 7.8% From 2025 To 2035. The market is driven by the rising demand for propylene derivatives such as acrylonitrile, propylene oxide, and Oxo-alcohols, which is supporting market expansion.

Market Overview

Propylene is both an organic substance and a colourless gas that functions as a chemical compound. The substance serves as a highly flammable hydrocarbon that people widely use for fuel purposes. The petrochemical industry uses propylene as a key foundation material because it serves as a primary olefin substance. The material functions as a feedstock that produces both polypropylene and different chemical intermediate products. The process uses this material to create polyether polyols, which serve as vital components in manufacturing polyurethane foams needed for automotive insulation and seating products.

Borealis has announced its investment of more than €100 million to establish a new production line for High Melt Strength polypropylene at its Bughouse facility located in Germany, according to the Austrian polymer manufacturer who disclosed this information during its pre-K online event.

The European propylene contract price reached its final settlement for February 2026. The period before this time saw polymer-grade propylene prices decrease to about 622.50/mt by late December 2025 after they had reached more than 781/mt during mid-2025. According to EU REACH regulations, the first reporting window for industrial uses of synthetic polymer micro particles will start in 2026. The deadline for all companies to submit their 2025 emissions data is set for May 2026.

Report Coverage

This research report categorises the European propylene market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe propylene market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe propylene market.

Europe Propylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18.26 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 6.15% |

| 2035 Value Projection: | USD 35.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application , By Production Process |

| Companies covered:: | Borealis INEOS Shell PLC Lyondell Basil Industries BASF SE Perstorp AB Clariant Chemicals Proviron Primagaz France Protos Packaging Ltd Others key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The propylene market in Europe is driven by packaging, automotive, and healthcare applications, which are expanding rapidly. The demand for flexible packaging and rigid packaging continues to increase. The adoption of the technology increases through its cost-effective features. The rising consumption of packaged food and consumer goods leads to higher demand for propylene derivatives. People choose materials that are both lightweight and durable. European infrastructure development creates a growing need for propylene-based piping systems, insulation products and building materials. Urbanization creates a higher demand for housing development and utility infrastructure projects.

Restraining Factors

The propylene market in Europe is restrained due to the price of propylene depends mostly on the prices of crude oil and feedstock materials. The price variations directly affect the profit margins of the business. The company needs to recover its expenses through price increases, which will happen after customer demand reaches its peak. European countries are experiencing growing expenses for environmental regulations. The company needs to make investments in pollution control systems.

Market Segmentation

The Europe propylene market share is categorised into production process and application.

- The steam cracking segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Propylene Market Size is segmented by production process into steam cracking, fluid catalytic cracking, propane dehydrogenation, and methanol-to-olefins. Among these, the steam cracking segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the Europe has established a complete operational system for steam crackers that produce three valuable products through their current process. The high cost of energy and carbon taxes in Europe has led to recent capacity retrenchments which resulted in facilities operating at 75-85% efficiency.

- The polypropylene segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Europe Propylene Market Size is segmented into polypropylene, acrylonitrile, propylene oxide, oxo-alcohols, and others. Among these, the polypropylene segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The polypropylene segment generated 69.45% of its revenue, which made it the biggest section in 2022. The market experienced growth because customers wanted more polypropylene and propylene oxide products. The naphtha cracking process creates ethylene during refinery cracking operations, which serve as its primary production method for propylene. The propane dehydrogenation process converts propane into propylene while producing hydrogen as a by-product.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe propylene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Borealis

- INEOS

- Shell PLC

- Lyondell Basil Industries

- BASF SE

- Perstorp AB

- Clariant Chemicals

- Proviron

- Primagaz France

- Protos Packaging Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe propylene market based on the below-mentioned segments:

Europe Propylene Market, By Production Process

- Steam Cracking

- Fluid Catalytic Cracking

- Propane Dehydrogenation

- Methanol-to-Olefins

Europe Propylene Market, By Application

- Polypropylene

- Acrylonitrile

- Propylene Oxide

- Oxo-Alcohols

- Others

Frequently Asked Questions (FAQ)

-

What is the Europe propylene market size?Europe propylene market size is expected to grow from USD 18.26 billion in 2024 to USD 35.2 billion by 2035, growing at a CAGR of 6.15% during the forecast period 2025-2035.

-

What is propylene, and its primary use?Propylene exists as both an organic substance and a colourless gas that functions as a chemical compound. The substance serves as a highly flammable hydrocarbon that people widely used for fuel purposes

-

What are the key growth drivers of the market?Market growth is driven by packaging, automotive, and healthcare applications, which are expanding rapidly. The demand for flexible packaging and rigid packaging continues to increase.

-

What factors restrain the Europe propylene market?The market is restrained by the price of propylene, which depends mostly on the prices of crude oil and feedstock materials. The price variations directly affect the profit margins of the business.

-

How is the market segmented by production process?The market is segmented into steam cracking, fluid catalytic cracking, propane dehydrogenation, and methanol-to-olefins

-

Who are the key players in the Europe propylene market?Key companies include Borealis, INEOS, Shell PLC, Lyondell Basell Industries, BASF SE, Perstorp AB, Clariant Chemicals, Proviron, Primagaz France, and Protos Packaging Ltd.

Need help to buy this report?