Europe Private 5G Services Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By Spectrum (Licensed, Unlicensed), By Frequency (Sub-6 GHz, mm Wave), By Deployment Mode (Standalone, Hybrid and Others), By Enterprise Size (Small and Medium-Sized Enterprise and Large Enterprise), and Europe Private 5G Services Market Insights, Industry Trends, Forecast to 2035

Industry: Information & TechnologyEurope Private 5G Services Market Size Insights Forecasts to 2035

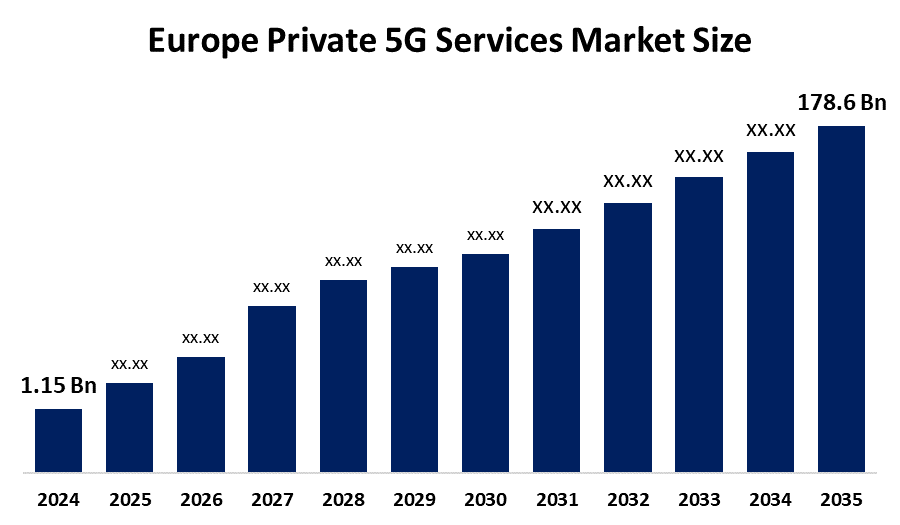

- The Europe Private 5G Services Market Size Was Estimated at USD 1.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 58.2% from 2025 to 2035

- The Europe Private 5G Services Market Size is Expected to Reach USD 178.6 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Europe Private 5G Services Market Size is anticipated to Reach USD 178.6 Billion by 2035, Growing at a CAGR of 58.2% from 2025 to 2035. The market is driven by the increasing demand for high-speed, low-latency, and secure wireless communication, technological advancements and increasing demand for tailored solutions.

Market Overview

The market for private 5G networks refers to the provision of private 5G network solutions to companies across the continent. These networks are starting to be widely used in different sectors like manufacturing, logistics, and healthcare as they offer fast connectivity, low latency, and secure communication. Unlike public 5G networks, private 5G networks are owned and operated by the enterprise, thus giving them better control and more customisation options.

The European Commission has given the green light for the European Cybersecurity Certification Scheme, which implies that the EU has the first cyber certification of ICT products. In October 2024, NEC Corp, the top player in IT-network technologies fusion, will join hands with Cisco to roll out a new private 5G network solution to its clientele. Europe is responsible for 35.5% of the total number of 5G networks that have been launched around the world, with 135 operators in 43 countries.

The government players and strategic allocation of spectrum are the primary drivers for the brisk growth of the private 5G market. The BNetzA of Germany has set aside a mid-band RF spectrum of 3.7-3.8 GHz with a total of 100 MHz only for enterprise networks.

Report Coverage

This research report categorizes the market for the Europe private 5G services market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe private 5G services market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe private 5G services market.

Europe Private 5G Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.15 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 58.2% |

| 2035 Value Projection: | USD 178.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 186 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Component, By Spectrum and COVID-19 Impact Analysis |

| Companies covered:: | Nokia, Ericsson, Huawei, Cisco, Siemens, Bosch, NEC, Vodafone, Orange Business, BT Group, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The private 5G services market in Europe is driven by the transition to 5G standalone (SA) networks, which are based on a dedicated 5G core, representing the next development in mobile connectivity. 5G SA is capable of providing the advantages of higher throughput, lower latency, better reliability, wider coverage, stronger indoor signals, and enhanced security compared to previous non-standalone (NSA) 5G networks that depended on LTE cores. The introduction of Industry 4.0, that is, the application of cutting-edge technology like IoT, AI, and robotics in production processes.

Restraining Factors

The private 5G services market in Europe is restrained due to private 5G networks are at risk of facing cybersecurity threats. The adoption of private 5G networks in Europe will be subject to regulatory hurdles, especially in terms of spectrum allocation and licensing. In Europe, the rollout of public 5G networks is ongoing, and this may lead to competition between public and private 5G networks in terms of market share.

Market Segmentation

The Europe private 5G services market share is categorised into component, spectrum, frequency, deployment mode, and enterprise size.

Get more details on this report -

- The hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe private 5G services market is segmented by component into hardware, software, and services. Among these, the hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2025, the hardware segment was the most significant and accounted for 77.96% of the total revenue. Huge investments in physical equipment, such as base stations, antennas, small cells, and core network hardware, are needed for large-scale rollouts to meet the increasing connectivity demand.

- The unlicensed segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on spectrum, the Europe private 5G services market is segmented into licensed, unlicensed. Among these, the unlicensed segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the 5G NR-U standards and open bands like 5GHz and 6GHz, combined with its cost-effectiveness, accessibility, and deployment flexibility help it achieve faster and lower-priced rollouts, particularly advantageous for small and mid-sized enterprises. Moreover, unlicensed spectrum bandwidth is easily accessible everywhere and highly in demand for enormous machine-type communications.

- The sub-6 GHz segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe private 5G services market is segmented by frequency into sub-6 GHz, mm wave. Among these, the sub-6 GHz segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, 78% of the total deployments were using Sub-6 GHz. Sub-6 GHz can cover vast areas and suppress walls and urban barriers far better than mmWave. Thus, it becomes the main option for nationwide and regional deployments, including rural, suburban and urban areas with fewer base stations.

- The standalone segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on deployment mode, the Europe private 5G services market is segmented into standalone, hybrid and others. Among these, the standalone segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Stand-alone systems got 42% of the revenue in 2024 because the early adopters wanted to have total control. The complete 5G features, as ultra-low latency, high reliability, and network slicing, were the main reasons for the enterprise demand. Such implementations in smart manufacturing, logistics, and autonomous systems will be made possible through continued support from telecom vendors and enterprises' growing investment.

- The large enterprise segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe private 5G services market is segmented by enterprise size into small and medium-sized enterprise and large enterprise. Among these, the large enterprise segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, big companies had a lion's share of 63% in spending, which was the result of their possession of both budgetary and in-house engineering resources. Besides their large budgets, their operational challenges and focus on digital transformation were the reasons for the decision. They used private 5G for facilitating the above-mentioned deployments, consisting of automated processes, real-time data processing, and secure communication over large distances. They employed edge computing and smart technologies to increase control efficiency and scalability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe private 5G services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nokia

- Ericsson

- Huawei

- Cisco

- Siemens

- Bosch

- NEC

- Vodafone

- Orange Business

- BT Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In February 2025, Sofia Airport launched a private 5G network. SOF Connect, the concessionaire of Bulgaria's Vasil Levski Sofia Airport, is implementing a private 5G mobile network, the country's first, in partnership with telecommunications company A1 Bulgaria and Greek digital solutions provider WINGS ICT Solutions.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe private 5G services market based on the below-mentioned segments:

Europe Private 5G Services Market, By Component

- Hardware

- Software

- Services

Europe Private 5G Services Market, By Spectrum

- Licensed

- Unlicensed

Europe Private 5G Services Market, By Frequency

- Sub-6 GHz

- mm Wave

Europe Private 5G Services Market, By Deployment Mode

- Standalone

- Hybrid

- Others

Europe Private 5G Services Market, By Enterprise Size

- Small and Medium-Sized Enterprise

- Large Enterprise

Frequently Asked Questions (FAQ)

-

Q: What is the Europe private 5G services market size?A: Europe private 5G services market size is expected to grow from USD 1.15 billion in 2024 to USD 178.6 billion by 2035, growing at a CAGR of 58.2% during the forecast period 2025-2035.

-

Q: What is private 5G services, and its primary use?A: The market for private 5G networks in Europe refers to the provision of private 5G network solutions to companies across the continent. These networks are starting to be widely used in different sectors like manufacturing, logistics, and healthcare as they offer fast connectivity, low latency, and secure communication.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the transition to 5G standalone (SA) networks, which are based on a dedicated 5G core, representing the next development in mobile connectivity. The introduction of Industry 4.0 that is, the application of cutting-edge technology like IoT, AI, and robotics in production processes.

-

Q: What factors restrain the Europe private 5G services market?A: The market is restrained by private 5G networks are at risk of facing cybersecurity threats. The adoption of private 5G networks in Europe will be subject to regulatory hurdles, especially in terms of spectrum allocation and licensing

-

Q: How is the market segmented by component?A: The market is segmented into hardware, software, and services.

-

Q: Who are the key players in the Europe private 5G services market?A: Key companies include Nokia, Ericsson, Huawei, Cisco, Siemens, Bosch, NEC, Vodafone, Orange Business, and BT Group.

Need help to buy this report?