Europe Polyvinyl Chloride Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Rigid PVC, Flexible PVC, Low-Smoke PVC, and Others), By Stabilizer Type (Calcium Based, Lead Based, Tin and Organotin Based, and Others), By Application (Pipes and Fittings, Films and Sheets, Wires and Cables, and Others), and Europe Polyvinyl Chloride Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Polyvinyl Chloride Market Size Insights Forecasts to 2035

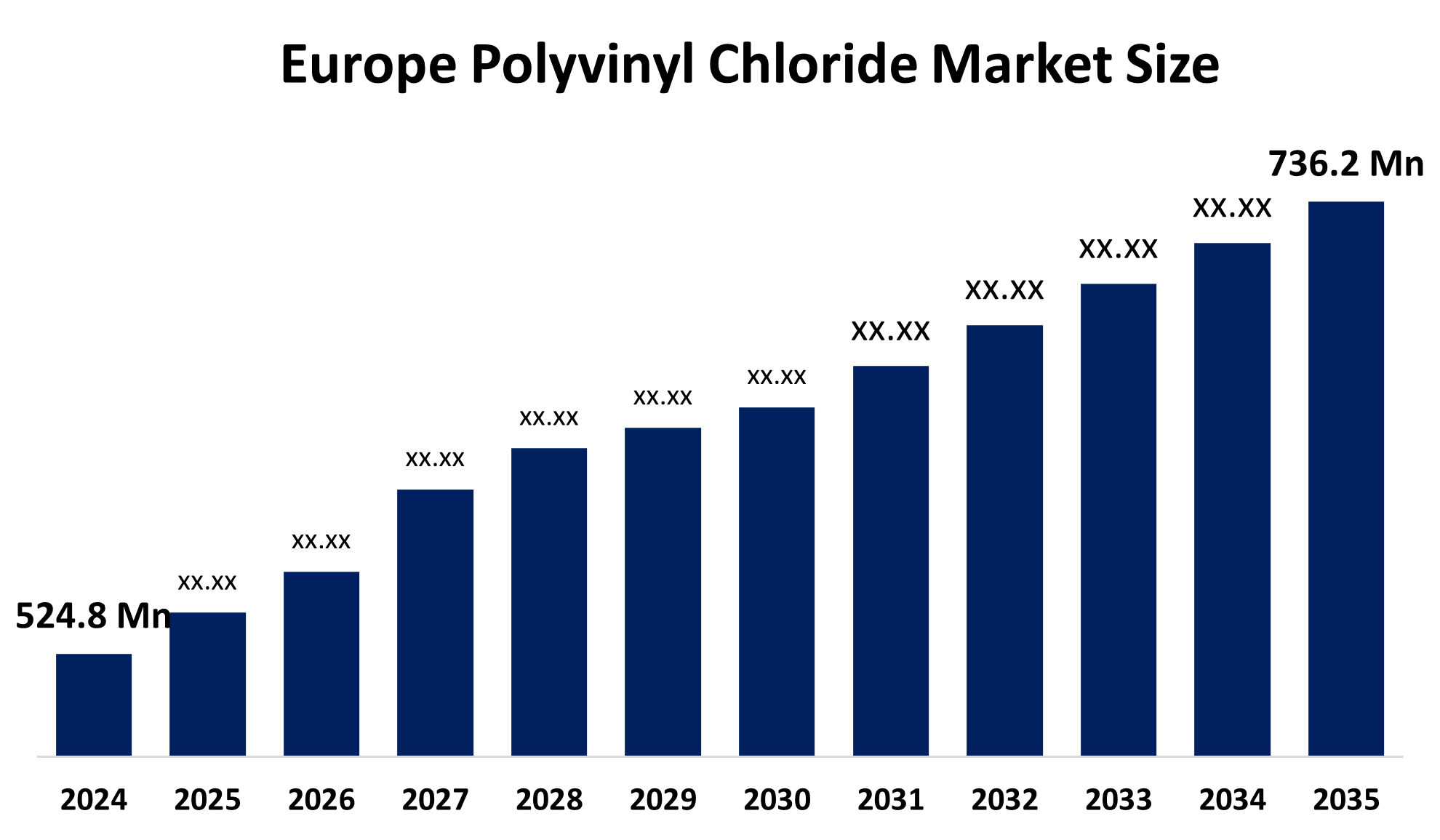

- The Europe Polyvinyl Chloride Market Size Was Estimated at USD 524.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.12% from 2025 to 2035

- The Europe Polyvinyl Chloride Market Size is Expected to Reach USD 736.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Polyvinyl Chloride Market Size is Anticipated to Reach USD 736.2 Million by 2035, Growing at a CAGR of 3.12% from 2025 to 2035. The market is driven by the growing demand for durable and flexible materials to manufacture consumer products, the rising purchase of personal cars, and the increasing focus on strengthening wire insulation.

Market Overview

Polyvinyl chloride (PVC) refers to a synthetic plastic polymer composed of repeating units of vinyl chloride. The material exists as a white solid that lacks a definite shape yet can be produced with flexible or rigid characteristics based on the production additives that manufacturers select. Its exceptional chemical, acid and base resistance properties enable its use across multiple industrial applications. The material possesses built-in flame-retardant features, which make it a secure option for electrical wiring and construction materials. The rising demand for improved wire insulation and cable sheathing in electronic devices, which delivers electrical insulation and environmental protection, creates positive market conditions for the industry.

Westlake Chemical Corporation Vinnolit subsidiary in Germany, introduced GreenVin Polyvinyl Chloride (PVC) as a sustainable PVC alternative, which produces fewer carbon emissions than standard PVC and is one of the most common plastics used in construction, automotive, and medical applications.

The European Commission has established permanent anti-dumping duties which will apply to imports of suspension PVC (s-PVC) from Egypt and the United States starting on January 9 2025. The anti-dumping duties imposed range from 74.2 % to 100.1% for imports from Egypt and from 58% to 77% for imports from the USA.

The VinylPlus program operates through industry leadership to raise awareness of recycling and bio-based PVC solutions which create new business opportunities that support environmental sustainability. The European Union’s strategy to renovate 35 million buildings by 2030 is a major driver for rigid PVC in energy-efficient windows and insulation.

Report Coverage

This research report categorises the Europe Polyvinyl Chloride Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe polyvinyl chloride market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe polyvinyl chloride market.

Europe Polyvinyl Chloride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 524.8 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.12% |

| 2035 Value Projection: | USD 736.2 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product Type, By Stabilizer Type |

| Companies covered:: | INEOS, Solvay SA, KEM ONE, Vynova Group, Shin-etsu Chemical, Westlake Co., Benvic Group, PVC4 Pipes, PVC Recycling BV, Heute Fur Morgen and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The polyvinyl chloride market in Europe is driven by the building and construction sector, which operates as the primary consumer of PVC in Europe, generating more than 55% of PVC demand, which will occur in 2025. The durability, cost-effectiveness, and low maintenance requirements of PVC make it a common material used in pipes and fittings, window profiles and flooring and roofing applications. The automotive sector uses PVC to produce lightweight components, which include dashboards, door panels, and wiring harnesses that improve fuel efficiency while decreasing emissions.

Restraining Factors

The polyvinyl chloride market in Europe is restrained by EU REACH regulations, which create substantial compliance expenses and operational challenges that PVC manufacturers must overcome. The production and disposal of PVC materials create environmental issues because they release dangerous substances, which include carcinogenic vinyl chloride monomer and hazardous phthalates and heavy metal additives.

Market Segmentation

The Europe polyvinyl chloride market share is categorised into product type, stabilizer type, and application.

- The rigid PVC segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Polyvinyl Chloride Market Size is segmented by product type into rigid PVC, flexible PVC, low-smoke PVC, and others. Among these, the rigid PVC segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Rigid grades anchored 60.42% of the Europe PVC market share in 2025, driven by pipes, profiles and fittings, which remained the most used materials in building and water-supply networks. Rigid PVC exhibits exceptional durability because it withstands various chemical substances, corrosion and weather-related damage. This material displays suitability for outdoor and extreme conditions. The material costs less than most other materials, which enables its economical use in various applications.

- The calcium-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on stabilizer type, the Europe Polyvinyl Chloride Market Size is segmented into calcium-based, lead-based, tin and organotin-based, and others. Among these, the calcium-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The stabilizer market in 2025 accounted 42.55% of its total consumption from calcium-based solutions, which showed that the market had turned after the EU lead ban. The packages will experience a 3.47% compound annual growth rate until 2031, which will lead to the majority of additive-level value expansion in the European PVC market. The stabilizers provide better safety for human health and environmental protection, which enables their use in food-contact and medical products.

- The pipes and fittings segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Polyvinyl Chloride Market Size is segmented by application into pipes and fittings, films and sheets, wires and cables, and others. Among these, the pipes and fittings segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Pipes and fittings absorbed 49.01% of 2025 resin demand, which shows that civil-works spending and utility network rehabilitation projects maintained their normal level of activity. Pipes and fittings made from PVC exhibit durability, extended shelf life and weather resistance, which allows their use in both indoor and outdoor environments. PVC exists as a lighter material than various options, which include metal pipes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Polyvinyl Chloride Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- INEOS

- Solvay SA

- KEM ONE

- Vynova Group

- Shin-etsu Chemical

- Westlake Co.

- Benvic Group

- PVC4 Pipes

- PVC Recycling BV

- Heute Fur Morgen

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, Vynova announced the launch of a research & development programme to further advance PVC recycling and help the PVC value chain accelerate towards circularity.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Polyvinyl Chloride Market Size based on the below-mentioned segments:

Europe Polyvinyl Chloride Market, By Product Type

- Rigid PVC

- Flexible PVC

- Low-Smoke PVC

- Others

Europe Polyvinyl Chloride Market, By Stabilizer Type

- Calcium-Based

- Lead-based

- Tin and Organotin Based

- Others

Europe Polyvinyl Chloride Market, By Application

- Pipes and Fittings

- Films and Sheets

- Wires and Cables

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe polyvinyl chloride market size?A: The Europe Polyvinyl Chloride market size is expected to grow from USD 524.8 million in 2024 to USD 736.2 million by 2035, growing at a CAGR of 3.12% during the forecast period 2025-2035.

-

Q: What is polyvinyl chloride, and its primary use?A: Polyvinyl chloride (PVC) refers to a synthetic plastic polymer composed of repeating units of vinyl chloride. The material exists as a white solid that lacks a definite shape yet can be produced with flexible or rigid characteristics based on the production additives that manufacturers select.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the building and construction sector, which operates as the primary consumer of PVC in Europe, generating more than 55% of PVC demand, which will occur in 2025.

-

Q: What factors restrain the Europe polyvinyl chloride market?A: The market is restrained by the EU REACH regulations, which create substantial compliance expenses and operational challenges that PVC manufacturers must overcome.

-

Q: How is the market segmented by product type?A: The market is segmented into rigid PVC, flexible PVC, low-smoke PVC, and others.

-

Q: Who are the key players in the Europe polyvinyl chloride market?A: Key companies include INEOS, Solvay SA, KEM ONE, Vynova Group, Shin-etsu Chemical, Westlake Co., Benvic Group, PVC4 Pipes, PVC Recycling BV, and Heute Fur Morgen.

Need help to buy this report?