Europe Paper Packaging Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, and Others), By Grade (Solid Bleached, Coated Recycled, Uncoated Recycled, and Others), By Packaging Level (Primary Packaging, Secondary Packaging, Tertiary Packaging), By End User (Food, Beverages, Personal Care and Home Care, Healthcare, and Others), and Europe Paper Packaging Market Size Insights, Industry Trends, Forecast to 2035

Industry: Consumer GoodsEurope Paper Packaging Market Size Insights Forecasts to 2035

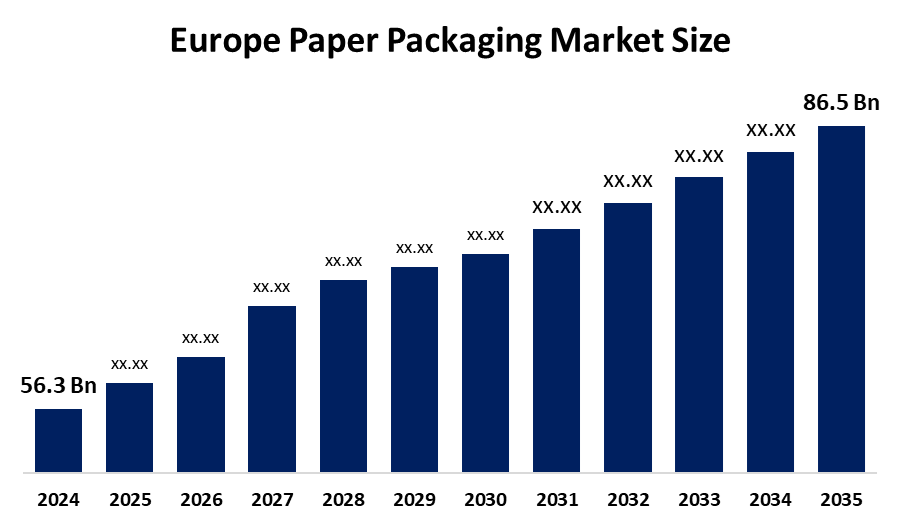

- The Europe Paper Packaging Market Size Was Estimated at USD 56.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.98% from 2025 to 2035

- The Europe Paper Packaging Market Size is Expected to Reach USD 86.5 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Europe Paper Packaging Market Size is anticipated to reach USD 86.5 Billion by 2035, growing at a CAGR of 3.98% from 2025 to 2035. The market is driven by the increasing consumer demand for sustainable packaging, stringent government regulations, advancements in packaging technology, growth in the e-commerce sector, rising environmental awareness, and innovation in design and printing.

Market Overview

Paper Packaging refers to the consumption of paper-based products such as corrugated boxes, cartons, and paper bags, which are mainly used to wrap, protect, store, and transport various kinds of products. It is composed of natural, renewable resources like wood pulp or recycled paper fibers and is considered environmentally friendly due to its biodegradability, light weight, and high recyclability, which are in line with Europe's strictest environmental goals. It is a common practice for dry foods, perishable goods, and liquids, such as cereal boxes, coffee cups, takeaway boxes, and beverage cartons. Innovations consist of the application of grease and moisture-resistant coatings to ensure food safety and prolong shelf life.

Saica Group, which is among the top notches in the packaging solutions industry, and Mondelez, a top manufacturer of fast-moving consumer goods, partnered together to introduce a new paper-based product aimed at the confectionery, biscuits, and chocolate markets' multipack products. In November 2024, the company All4Labels unveiled its STARPACK solution for product bundling, which was made from renewable and FSC-certified materials and was meant to be a substitute for the regular plastic packaging.

In February 2025, Tetra Pak inaugurated a recycling plant worth EUR 3.1 million in the Netherlands, which is intended to treat the non-fiber parts of beverage cartons. The regulatory framework is greatly influenced by the Packaging and Packaging Waste Regulation (PPWR), which was officially implemented.

Report Coverage

This research report categorises the European Paper Packaging Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe Paper Packaging Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe Paper Packaging Market Size.

Europe Paper Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 56.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.98% |

| 2035 Value Projection: | 86.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Grade |

| Companies covered:: | Smurfit Westrock, DS Smith Plc, Mondi Group, Stora Enso Oyj, Metsa Board Oyj, Huhtamaki Oyj, International Paper Company, MM Packaging, Macfarlane Packaging, Winfried Wirth, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The paper packaging market in Europe is driven by the considerable turn in consumer preference and brand owners' pledge towards environmentally friendly, recyclable, and compostable packaging alternatives to plastics, that is, the shift in consumer preference and brand commitments to environmentally friendly, recyclable, and biodegradable packaging instead of plastics. The European Union rules and regulations, like the Single-Use Plastics Directive and the Circular Economy Action Plan, support plastic waste reduction and recyclability. The fast growth of online shopping throughout Europe has created a huge need for protective, strong, yet light and perfectly sized packaging.

Restraining Factors

The paper packaging market in Europe is restrained by the fluctuations in prices and availability of raw materials, such as wood pulp and recycled fiber have a huge impact on the costs of production and thereby on the profits of the mills. Even though there are restrictions imposed on the use of plastics, other materials still compete with paper, and so do the advancements in flexible plastics that are enhancing their recyclability and performance, thereby reducing the edge of the paper market over others.

Market Segmentation

The Europe Paper Packaging Market Size share is categorised into product type, grade, packaging level, and end user.

- The folding boxes and cases segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Paper Packaging Market Size is segmented by product type into corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others. Among these, the folding boxes and cases segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the increased need for eco-friendly and recyclable packaging options, since individuals and companies more and more consider it their responsibility to protect the environment. The segment takes advantage of the progress in packaging technology, which improves the physical properties of folding boxes such as strength and durability, thus allowing them to be used for a large variety of products, including food and electronics.

- The uncoated recycled segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on grade, the Europe Paper Packaging Market Size is segmented into solid bleached, coated recycled, uncoated recycled, and others. Among these, the uncoated recycled segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the demand for green packaging solutions. The environmental awareness of both customers and retailers has resulted in an increased liking for eco-friendly supplies such as uncoated recycled paper that is compostable and reusable.

- The primary packaging segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Paper Packaging Market Size is segmented by packaging level into primary packaging, secondary packaging, tertiary packaging. Among these, the primary packaging segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the growing consumer preference for sustainability and eco-friendly materials in packaging, which is one of the causes of the increase in paper packaging market share, as paper packaging is both biodegradable and recyclable, thus being a more appealing option than plastic. Moreover, the escalating acceptability of paper packaging in the food and beverage sector is one of the factors contributing to the market growth since it is a guarantee of safe, hygienic, and contamination-free packaging solutions.

- The food segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe Paper Packaging Market Size is segmented into food, beverages, personal care and home care, healthcare, and others. Among these, the food segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the demand for packing that can naturally decompose and is environmentally friendly is on the rise constantly. The number of consumers who care about health and environmental issues has increased enormously, and this is one of the major reasons why companies are changing their packaging preferences to paper and other biodegradable and recyclable materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Paper Packaging Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smurfit Westrock

- DS Smith Plc

- Mondi Group

- Stora Enso Oyj

- Metsa Board Oyj

- Huhtamaki Oyj

- International Paper Company

- MM Packaging

- Macfarlane Packaging

- Winfried Wirth

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In May 2025, Amazon announced that it would deploy advanced machines for making custom-fit packaging across its European network, enabling the production of custom-made cardboard boxes and paper bags for customer deliveries.

In March 2025, UPM and Orkla Suomi introduced paper packaging for Panda Milk chocolate. UPM Speciality Papers and Orkla Suomi are piloting a new paper wrapper for Panda Milk chocolate. During a six-month pilot period, the new wrappers replace traditionally used PP-plastic wrappers.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Paper Packaging Market Size based on the below-mentioned segments:

Europe Paper Packaging Market Size, By Product Type

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

Europe Paper Packaging Market Size, By Grade

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

Europe Paper Packaging Market Size, By Packaging Level

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

Europe Paper Packaging Market Size, By End User

- Food

- Beverages

- Personal Care and Home Care

- Healthcare

- Others

Frequently Asked Questions (FAQ)

-

What is the Europe Paper Packaging Market Size?Europe Paper Packaging Market Size is expected to grow from USD 56.3 billion in 2024 to USD 86.5 billion by 2035, growing at a CAGR of 3.98% during the forecast period 2025-2035.

-

What is paper packaging, and its primary use?Paper packaging refers to the consumption of paper-based products such as corrugated boxes, cartons, and paper bags, which are mainly used to wrap, protect, store, and transport various kinds of products.

-

What are the key growth drivers of the market?Market growth is driven by the considerable turn in consumer preference and brand owners' pledge towards environmentally friendly, recyclable, and compostable packaging alternatives to plastics, that is, the shift in consumer preference and brand commitments to environmentally friendly, recyclable, and biodegradable packaging instead of plastics.

-

What factors restrain the Europe Paper Packaging Market Size?The market is restrained by the fluctuations in prices and availability of raw materials such as wood pulp and recycled fiber have a huge impact on the costs of production and thereby on the profits of the mills.

-

How is the market segmented by product type?The market is segmented into corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

-

Who are the key players in the Europe Paper Packaging Market Size?Key companies include Smurfit Westrock, DS Smith Plc, Mondi Group, Stora Enso Oyj, Metsa Board Oyj, Huhtamaki Oyj, International Paper Company, MM Packaging, Macfarlane Packaging, and Winfried Wirth.

Need help to buy this report?