Europe Offshore Subsea Service Market Size, Share, and COVID-19 Impact Analysis, By Type (Subsea & Offshore Installation, Subsea Interventions), By Application (Oil & Gas, Renewables), By Location (Shallow Water Services, Deepwater and Ultra Deepwater Services), and Europe Offshore Subsea Service Market Insights, Industry Trends, Forecast to 2035

Industry: Machinery & EquipmentEurope Offshore Subsea Service Market Size Insights Forecasts to 2035

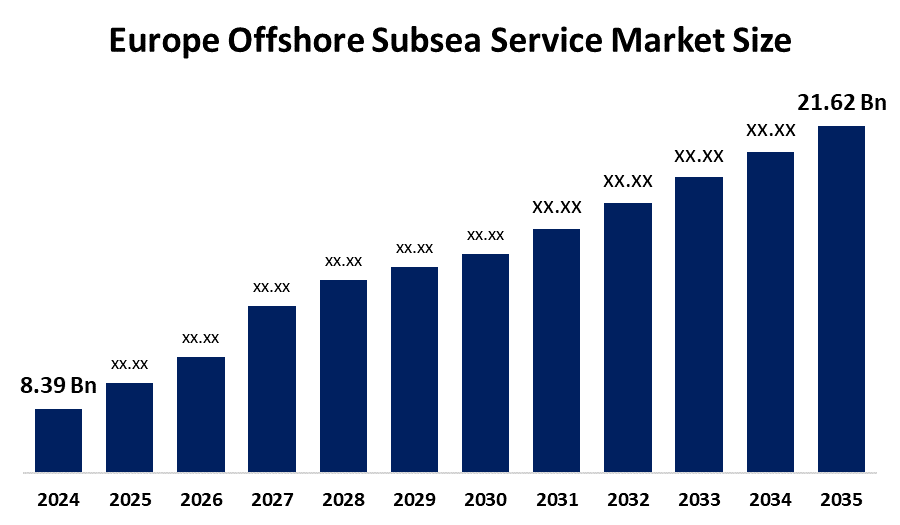

- The Europe Offshore Subsea Service Market Size Was Estimated at USD 8.39 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.99% from 2025 to 2035

- The Europe Offshore Subsea Service Market Size is Expected to Reach USD 21.62 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Europe Offshore Subsea Service Market Size is anticipated to Reach USD 21.62 Billion by 2035, Growing at a CAGR of 8.99% from 2025 to 2035. The market is driven by rising energy demand, rich offshore resources, technological advancements, and government support for green energy.

Market Overview

The subsea and offshore services market is a dynamic and rapidly expanding market that plays an important role in the energy economy of the region. The market encompasses a whole range of services and technologies that are involved in offshore oil and gas exploration, production, and transportation, and these are mainly the operations occurring under water and on the surface. The term subsea and offshore services covers a broad spectrum of specialized operations as well as modern technologies that are employed to support the exploration, extraction, and production of oil and gas deposits located under the seabed. These services are indispensable for the energy sector's ability to obtain valuable resources from the ocean floor.

In May 2025, a sales and representation contract was concluded between Cellula Robotics Limited and Subsea Europe Services GmbH (SES), along with its defence arm, FLANQ. This strategic alliance aims to increase the market reach of Cellula’s cutting-edge autonomous underwater vehicle (AUV) technologies throughout Northern Europe.

By 2023, the UK government had increased the upper strike price for wind projects located offshore by 66% (making it £73/MWh) and for floating seabed wind projects by 52% (reaching up to £176/MWh) as ways to attract more investors and deal with global issues in the sector. The European Commission took measures to support the local wind power sector, such as fast-tracking installations, refining auction formats and making finance more accessible.

Report Coverage

This research report categorizes the market for the Europe offshore subsea service market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe offshore subsea service market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe offshore subsea service market.

Europe Offshore Subsea Service Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.39 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.99% |

| 2035 Value Projection: | USD 21.62 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 134 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | TechnipFMC, Subsea 7, Saipem, DeepOcean, Oceaneering International, Fugro, Aker Solutions, BAE Systems, DOF Subsea, Heerema Marine Contractors, Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The offshore subsea service market in Europe is driven by Europe's energy demand, which is forcing oil and gas companies to explore and produce in even the deepest offshore areas, since the onshore and shallow-water fields are in maturity and decline. Besides installation, cable laying, and maintenance, the EU Green Deal capacity targets have attracted a lot of investment and government support for offshore wind farms; hence, subsea services are in high demand. The use of advanced remotely operated vehicles, autonomous underwater vehicles, and digitalization have been among the innovations that greatly improved the efficiency, safety, and reliability of subsea operations.

Restraining Factors

The offshore subsea service market in Europe is restrained by high investment needs and the need for special tools, boats, and integrated systems. The high costs of operation and maintenance can push investors away, especially in the case of projects with uncertain returns. Changes in oil and gas prices bring about uncertainties, so the operators have to wait or even cancel the spending on the offshore projects that have already been marked as heavy capital during the downturns.

Market Segmentation

The Europe offshore subsea service market share is categorised into type, application, and location.

Get more details on this report -

- The subsea & offshore installation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe offshore subsea service market is segmented by type into subsea & offshore installation, subsea interventions. Among these, the subsea & offshore installation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the extensive laying of subsea pipes, the setting up of offshore platforms, and the construction of underwater structures, which have been necessitated by new oil and gas explorations along with the wind farm expansion in the North Sea. A significant part of the revenue of this segment comes from installing the turbines, creating the foundations, and laying the power cables under the sea for connecting to the grid.

- The oil & gas segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Europe offshore subsea service market is segmented into oil & gas, renewables. Among these, the oil & gas segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the enormous existence of old subsea infrastructures that consist of rigs, pipelines, and manifolds, as well as control systems, which are in need of constant inspection, repair, and maintenance. In 2026, the North Sea will still be the main area for the development of the old fields by using EOR and new subsea ties for the purpose of making the region self-sufficient in energy.

- The deepwater and ultra-deepwater services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe offshore subsea service market is segmented by location into shallow water services, deepwater and ultra-deepwater services. Among these, the deepwater and ultra-deepwater services segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by operators facing the need to relocate to deeper offshore areas since the North Sea onshore and shallow-water fields are no longer productive. Their investments in subsea processing equipment, like Subsea Umbilicals, Risers, and Flowlines (SURF), and High-tech Subsea Production Systems, have made the deepwater operations more cost-effective and safer.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe offshore subsea service market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TechnipFMC

- Subsea 7

- Saipem

- DeepOcean

- Oceaneering International

- Fugro

- Aker Solutions

- BAE Systems

- DOF Subsea

- Heerema Marine Contractors

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe offshore subsea service market based on the below-mentioned segments:

Europe Offshore Subsea Service Market, By Type

- Subsea & Offshore Installation

- Subsea Interventions

Europe Offshore Subsea Service Market, By Application

- Oil & Gas

- Renewables

Europe Offshore Subsea Service Market, By Location

- Shallow Water Services

- Deepwater and Ultra Deepwater Services

Frequently Asked Questions (FAQ)

-

Q: What is the Europe offshore subsea service market size?A: Europe offshore subsea service market size is expected to grow from USD 8.39 billion in 2024 to USD 21.62 billion by 2035, growing at a CAGR of 8.99% during the forecast period 2025-2035

-

Q: What is offshore subsea service, and its primary use?A: The Europe subsea and offshore services Market is a dynamic and rapidly expanding market that plays an important role in the energy economy of the region. The market encompasses a whole range of services and technologies that are involved in offshore oil and gas exploration, production, and transportation, and these are mainly the operations occurring under water and on the surface.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the installation, cable laying, and maintenance, the EU Green Deal capacity targets have attracted a lot of investment and government support for offshore wind farms; hence, subsea services are in high demand.

-

Q: What factors restrain the Europe offshore subsea service market?A: The market is restrained by high investment needs and the need for special tools, boats, and integrated systems. The high costs of operation and maintenance can push investors away, especially in the case of projects with uncertain returns.

-

Q: How is the market segmented by type?A: The market is segmented into subsea & offshore installation, subsea interventions

-

Q: Who are the key players in the Europe offshore subsea service market?A: Key companies include TechnipFMC, Subsea 7, Saipem, DeepOcean, Oceaneering International, Fugro, Aker Solutions, BAE Systems, DOF Subsea, and Heerema Marine Contractors.

Need help to buy this report?