Europe Nitrile Butadiene Rubber Market Size, Share, and COVID-19 Impact Analysis, By Product (Belts, Adhesives & Sealants, Rubber Compounds, Gloves, Hoses, Seals & O-Rings, Cables and Others), By Application (Automotive, Construction, Medical, Mechanical Engineering, Oil & Gas and Others), and Europe Nitrile Butadiene Rubber Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Nitrile Butadiene Rubber Market Insights Forecasts to 2035

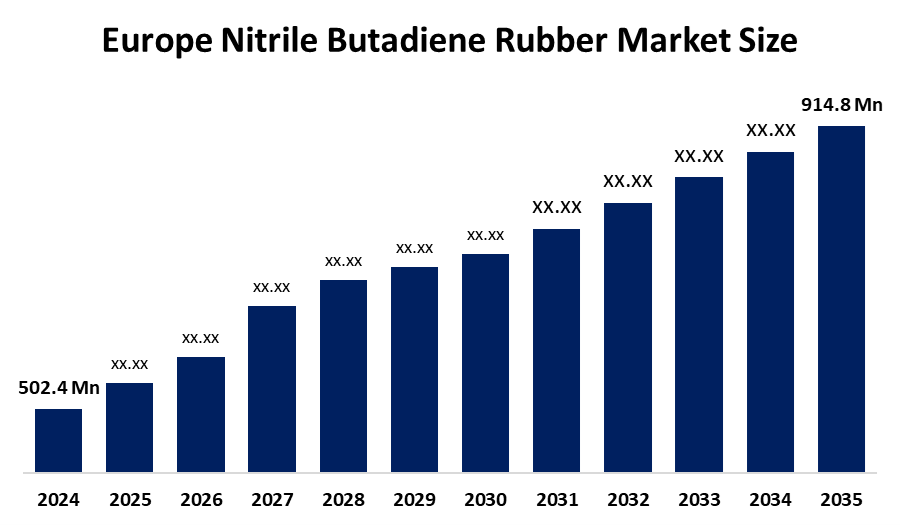

- The Europe Nitrile Butadiene Rubber Market Size Was Estimated at USD 502.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.6% from 2025 to 2035

- The Europe Nitrile Butadiene Rubber Market Size is Expected to Reach USD 914.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Nitrile Butadiene Rubber Market Size is anticipated to reach USD 914.8 Million by 2035, Growing at a CAGR of 5.6% from 2025 to 2035. The market is driven by expanding automotive manufacturing, the expansion of healthcare production and an increased requirement for high-performance materials in industrial and protective applications

Market Overview

Nitrile butadiene rubber (NBR) refer to as Buna-N represents a synthetic rubber that manufacturers create through the polymerization process of acrylonitrile (ACN) and butadiene. The European market in 2026 shows a strong commitment to sustainable bio-based solutions and the implementation of AI-based smart manufacturing systems, which help businesses comply with strict environmental requirements. Automotive uses fuel and oil handling hoses as well as seals and gaskets, O-rings and timing belts. The material has found growing applications in electric vehicle battery systems and thermal management processes.

In February 2025, Synthomer launched a biobased nitrile butadiene rubber (NBR) latex for the glove industry in cooperation with Neste and PCS Pte. Ltd.

The EU-wide restriction on PFAS substances, which firefighting foams contain, creates significant administrative challenges for organizations. Sites that use firefighting foams must establish both a site-specific management plan and a fluorine-free alternative transition strategy by October 23 2026. The high-performance tiers include Hydrogenated NBR (HNBR) material for high-pressure seals and powdered NBR material for specialized industrial applications, which achieve price premiums that range from 20 to 40% above their commodity grades.

Report Coverage

This research report categorises the European nitrile butadiene rubber market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe nitrile butadiene rubber market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe nitrile butadiene rubber market.

Europe Nitrile Butadiene Rubber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 502.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.6% |

| 2035 Value Projection: | USD 914.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product |

| Companies covered:: | Syensqo SA, Dynasol Group, Sibur, Eni, Arlanxeo, Lanxess AG, Versalis Spa, Synthos S.A., Zeon Co., Nantex Industry Co., Ltd, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The nitrile butadiene rubber market in Europe is driven by nitrile butadiene rubber in the automotive and aeronautical industries to produce fuel hoses, oil hoses, grommets, seals and binders of frictional materials. Increased requirements for hygienic protection through non-powdered medical gloves result from two factors: higher hygiene standards and growing latex allergy concerns. The development of Industrial 4.0 and IoT markets in Europe creates an increased demand for reliable seals and gaskets, which protect automated systems and robotic equipment.

Restraining Factors

The nitrile butadiene rubber market in Europe is restrained by the prices of petrochemicals are dependent on the price of natural gas and crude oil. Europe, which controls a major portion of the world's oil supply, causes crude oil prices to fluctuate because of its ongoing political unrest and its current supply-demand imbalance.

Market Segmentation

The Europe nitrile butadiene rubber market share is categorised into product and application.

- The seals & o-rings segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe nitrile butadiene rubber market is segmented by product into belts, adhesives & sealants, rubber compounds, gloves, hoses, seals & o-rings, cables and others. Among these, the seals & o-rings segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The revenue share of seals and o-rings reached 18.92% in 2023, which made them the most important market segment. The segment dominance exists because seals and o-rings function as vital components within automotive, machinery and oil and gas industrial applications, which use them to stop fluid and gas leaks.

- The automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Europe nitrile butadiene rubber market is segmented into automotive, construction, medical, mechanical engineering, oil & gas and others. Among these, the automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to NBR's outstanding ability to withstand oil, fuel and heat, which makes this material suitable for essential automotive parts that include seals and gaskets, hoses and belts. The Chinese automotive industry maintains its position as a global production leader, which includes its rapidly expanding electric vehicle market, resulting in increased demand for long-lasting rubber materials that deliver exceptional performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe nitrile butadiene rubber market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Syensqo SA

- Dynasol Group

- Sibur

- Eni

- Arlanxeo

- Lanxess AG

- Versalis Spa

- Synthos S.A.

- Zeon Co.

- Nantex Industry Co., Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe nitrile butadiene rubber market based on the below-mentioned segments:

Europe Nitrile Butadiene Rubber Market, By Product

- Belts

- Adhesives & Sealants

- Rubber Compounds

- Gloves

- Hoses

- Seals & O-Rings

- Cables

- Others

Europe Nitrile Butadiene Rubber Market, By Application

- Automotive

- Construction

- Medical

- Mechanical Engineering

- Oil & Gas

- Others

Frequently Asked Questions (FAQ)

-

What is the Europe nitrile butadiene rubber market size?Europe nitrile butadiene rubber market size is expected to grow from USD 502.4 million in 2024 to USD 914.8 million by 2035, growing at a CAGR of 5.6% during the forecast period 2025-2035.

-

What is nitrile butadiene rubber, and its primary use?Nitrile Butadiene Rubber (NBR) refer to as Buna-N represents a synthetic rubber that manufacturers create through the polymerization process of acrylonitrile (ACN) and butadiene. Automotive uses fuel and oil handling hoses as well as seals and gaskets, O-rings and timing belts.

-

What are the key growth drivers of the market?Market growth is driven by the development of Industrial 4.0 and IoT markets in Europe creates an increased demand for reliable seals and gaskets, which protect automated systems and robotic equipment.

-

What factors restrain the Europe nitrile butadiene rubber market?The market is restrained by the prices of petrochemicals are dependent on the price of natural gas and crude oil.

-

How is the market segmented by product?The market is segmented into belts, adhesives & sealants, rubber compounds, gloves, hoses, seals & o-rings, cables and others.

-

Who are the key players in the Europe nitrile butadiene rubber market?Key companies include Syensqo SA, Dynasol Group, Sibur, Eni, Arlanxeo, Lanxess AG, Versalis Spa, Synthos S.A., Zeon Co., and Nantex Industry Co., Ltd.

Need help to buy this report?