Europe Mobility Aids Market Size, Share, and COVID-19 Impact Analysis, By Product (Rollators, Walkers, Wheelchairs, Powered), By Sector (Public, Private), By Distribution Channel (Online, Offline), and Europe Mobility Aids Market Insights, Industry Trends, Forecast to 2035

Industry: Consumer GoodsEurope Mobility Aids Market Insights Forecasts to 2035

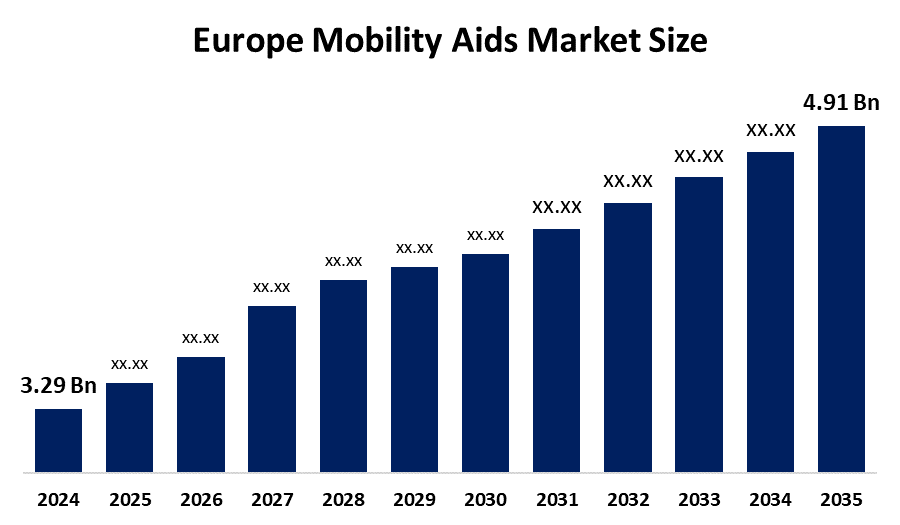

- The Europe Mobility Aids Market Size Was Estimated at USD 3.29 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.71% from 2025 to 2035

- The Europe Mobility Aids Market Size is Expected to Reach USD 4.91 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Mobility Aids Market size is anticipated to reach USD 4.91 Billion by 2035, growing at a CAGR of 3.71% from 2025 to 2035. The market is driven by increasing geriatric population, the growing prevalence of target diseases impairing mobility, the increasing availability of technologically advanced products, and the rising demand for home healthcare services & staff.

Market Overview

The mobility aids market is active and dynamic, and is influenced by the ageing population and a robust healthcare system. Mobility aids are tools or materials intended for individuals with limitations in movement due to factors such as old age, injury, chronic illness, or disability. They redistribute the leg's load to the upper body, provide stability while standing, and mitigate the pain, thus making the user perform the daily activities with better access and self-sufficiency. Moreover, it is used to give balance support and assist with weight reduction, often among those who are prone to falling.

In February 2025, a collaboration was formed between Rehasense Europe and DocMorris, the online health platform, to furnish the rollators and walking aids produced by Rehasense through a specified digital channel that would be available in Germany and the Netherlands.

France has made a significant announcement that starting from December 2025, its public health insurance system would give a 100% reimbursement for wheelchairs, such as sports wheelchairs as well. The use of technology, AI, IoT, and tele-rehab connectivity among others, has been applied to the devices such as smart wheelchairs and LTC beds for monitoring and safety.

Report Coverage

This research report categorizes the market for the Europe mobility aids market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe mobility aids market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe mobility aids market.

Europe Mobility Aids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.29 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.71% |

| 2035 Value Projection: | USD 4.91 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Sector, By Distribution Channel |

| Companies covered:: | Invacare Corporation, Sunrise Medical, MEYRA GmbH, Drive DeVilbiss Healthcare, Ottobock, Karma Mobility, Human Care HC, Medline Industries Inc., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The mobility aids market in Europe is driven by the rise in the occurrence of mobility disabilities related to ageing and long-term ailments such as arthritis, Parkinson's, and osteoporosis is the leading factor for the increased need for assistive devices in the market. Physical disability due to congenital conditions, accidents, or illnesses like spinal cord injuries is a potential market for devices. The adoption of smart technologies, including IoT, AI, and high-tech sensors in mobility aids, is a reason for the market to grow. Modern inventions in mobility, such as wheelchairs with GPS, fall detection, and remote monitoring capabilities, make users more independent, safer, and comfortable.

Restraining Factors

The mobility aids market in Europe is restrained by the reimbursement policies that vary from country to country in Europe are not only complex but also inconsistent, hence they will always harm the purchase decisions. Countries such as Germany and the UK have established friendly frameworks, but many regions still lack funding mechanisms, and this means that patients will have to incur high out-of-pocket costs for the premium products. The inaccessibility of many public spaces, old buildings, and transportation systems has made it difficult for people to use and accept mobility aids, hence the shortage in the market for such products.

Market Segmentation

The Europe mobility aids market share is categorised into product, sector, and distribution channel.

Get more details on this report -

- The wheelchairs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe mobility aids market is segmented by product into rollators, walkers, wheelchairs, powered. Among these, the wheelchairs segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2022, a considerable portion of 32.8% of the total revenue was generated by the wheelchair segment. This was due to wheelchairs being the most preferred mobility aids for the elderly and disabled people. The wheelchairs segment is also divided into two categories such as manual and powered wheelchairs.

- The private segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on sector, the Europe mobility aids market is segmented into public, private. Among these, the private segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The private segment was the largest revenue source in 2022 with a share of about 50.0% and it is projected to have the highest 3.3% CAGR during the projected period. The private sector consists mainly of a great number of privately owned companies. Such companies not only provide a variety of unique products but also engage in new product launches extensively to win over their rivals in the market.

- The offline segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe mobility aids market is segmented by distribution channel into online, offline. Among these, the offline segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2022, the segment of offline sales accounted for the largest share of total revenue with 66.3%. The reason for this increase was the consumers' preference for physically purchasing mobility aids. Patients can then evaluate comfort, sitting adjustments, and the way for a device to be used trial; thus, it will be very helpful in the process of selecting the right assistive devices for the specifically first-time user, whereby the viewing of devices is not allowed through the online channel.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe mobility aids market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Invacare Corporation

- Sunrise Medical

- MEYRA GmbH

- Drive DeVilbiss Healthcare

- Ottobock

- Karma Mobility

- Human Care HC

- Medline Industries Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In December 2025, Invacare launched the new limited edition Kuschall Element.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe mobility aids market based on the below-mentioned segments:

Europe Mobility Aids Market, By Product

- Rollators

- Walkers

- Wheelchairs

- Powered

Europe Mobility Aids Market, By Sector

- Public

- Private

Europe Mobility Aids Market, By Distribution Channel

- Online

- Offline

Frequently Asked Questions (FAQ)

-

Q: What is the Europe mobility aids market size?A: Europe mobility aids market size is expected to grow from USD 3.29 billion in 2024 to USD 4.91 billion by 2035, growing at a CAGR of 3.71% during the forecast period 2025-2035.

-

Q: What are mobility aids, and their primary use?A: The mobility aids market is active and dynamic, and is influenced by the ageing population and a robust healthcare system. Mobility aids are tools or materials intended for individuals with limitations in movement due to factors like old age, injury, chronic illness, or disability.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rise in the occurrence of mobility disabilities related to aging and long-term ailments, such as arthritis, Parkinson's, and osteoporosis is the leading factor for the increased need for assistive devices in the market

-

Q: What factors restrain the Europe mobility aids market?A: The market is restrained by the reimbursement policies that vary from country to country in Europe are not only complex but also inconsistent, hence they will always harm the purchase decisions.

-

Q: How is the market segmented by distribution channel?A: The market is segmented into online, offline.

-

Q: Who are the key players in the Europe mobility aids market?A: Key companies include Invacare Corporation, Sunrise Medical, MEYRA GmbH, Drive DeVilbiss Healthcare, Ottobock, Karma Mobility, Human Care HC, and Medline Industries Inc.

Need help to buy this report?