Europe Mobile Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Proximity Payments, Remote Payments), By Transaction Type (Peer-To-Peer, In-Store Point-Of-Sale, Person-To-Merchant, and Other), By Application (Retail and E-Commerce, Transportation and Logistics, Hospitality and Food-Service, and Others), By End-User (Personal, Business), and Europe Mobile Payments Market Insights Forecasts to 2035

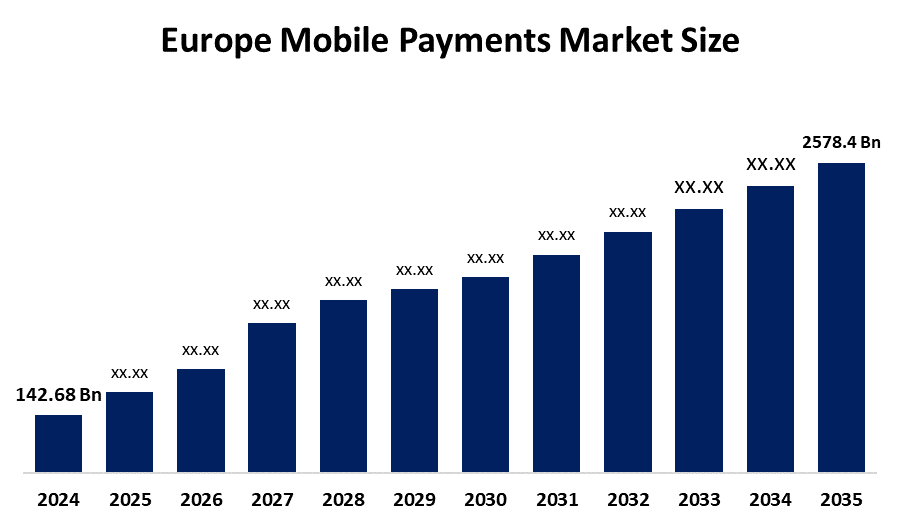

Industry: Information & Technology- The Europe Mobile Payments Market Size Was Estimated at USD 142.68 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 30.1% from 2025 to 2035

- The Europe Mobile Payments Market Size is Expected to Reach USD 2578.4 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Mobile Payments Market Size is Anticipated to Reach USD 2578.4 Billion by 2035, Growing at a CAGR of 30.1% from 2025 to 2035. The market is driven by the increasing use of smartphones and the inclination towards cashless payments, and the move to cashless economies backed by governments. Besides, there are digital wallets' wide acceptance, cooperation with loyalty programs and rewards, and the use of blockchain technology.

Market Overview

A mobile payment is defined as any financial transaction made via a mobile device, for instance, a smartphone, tablet, or wearable, with the intention of buying products or services or moving money. In contrast to conventional payment methods that depend on the physical presence of cash or credit cards, these payments rely on digital communication channels that interact with the payment processors or other users. The rise of online transactions and the proliferation of mobile applications dedicated to facilitating shopping payments are driving factors in the use of mobile payment methods.

Mobile payments provide checkout experiences that are rapid, safe, and easy to use. Based on the OECD data, mobile payments at points of sale in the European Union increased dramatically from €4 billion in 2017 to €195 billion in 2022, which represented 21% of the total POS value and a 36% share by 2030 forecasts. The digital wallet created by the European Payments Initiative (EPI), which entered the German market in July 2024, is on its way to France and Belgium next.

SAP SE announced in March 2024 a novel composable payment solution for retailers to keep pace with the changing customer expectations. The cutting-edge solution, SAP Commerce Cloud, which is an open payment framework, enables retailers to be more adaptive as new payment methods like buy now, pay later are becoming widely accepted.

The growth of open banking and greater cooperation with fintech startups. QR code payments are becoming more popular, especially in the southern and eastern parts of Europe, where the number of smartphone users is on the rise. The use of QR code payments has been increasing by 25% every year.

Report Coverage

This research report categorizes the market for the Europe mobile payments market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe mobile payments market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe mobile payments market.

Europe Mobile Payments Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 142.68 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 30.1% |

| 2035 Value Projection: | USD 2578.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Payment Type, By Transaction Type |

| Companies covered:: | NTH Mobile, Mobile Pay, Checkout.com, Cell Point Digital, S-Payment GmbH, Dynamic Mobile Billing, European Merchant Services, Micro Payment, Sum-up, Pay Point, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Mobile Payments Market Size in Europe is driven by the rapid growth of smartphones and the availability of high-speed internet connections. By the year 2023, over 85% of people living in the European Union owned smartphones, and the internet was accessible in 90% of homes. Furthermore, digital payments through cards and other online payment methods were used more often from year to year by 20%. The European Union's implementation of the Revised Payment Services Directive has been a key factor in the improvement of mobile payment systems' security and interoperability.

Restraining Factors

The Mobile Payments Market Size in Europe is restrained by the European Commission has reported that 40% of small companies in the region exclusively use cash for their transactions, which is a clear sign of the slower adoption rates in the area. Payment systems are still heavily reliant on cash in these regions. The dissimilarity between the EU's PSD2/PSD3 regulation and the UK's post-Brexit financial laws is leading to two separate paths for compliance. Also, if there are no common rules across various national payment systems, it will be difficult to carry out smooth and hassle-free transactions across borders.

Market Segmentation

The Europe Mobile Payments Market share is categorised into payment type, transaction type, application and end user.

- The proximity payments segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Mobile Payments Market Size is segmented by payment type into proximity payments, remote payments. Among these, the proximity payments segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, the proximity payments segment led the market by capturing 70.8% of the market share, which was largely due to the across-the-board usage of contactless technologies like NFC and QR codes in retail, public transport, and restaurants. More than 80% of the card terminals in the Eurozone are set up for contactless payment, which helps in making transactions very smooth.

- The in-store point-of-sale segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on transaction type, the Europe Mobile Payments Market Size is segmented into peer-to-peer, in-store point-of-sale, person-to-merchant, and other. Among these, the in-store point-of-sale segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment accounted for 45.22% of the market share. The market is mainly occupied by in-store and proximity mobile payments, which are the result of the high penetration of contactless-enabled terminals and consumer preference for tap-to-pay options. European Union regulations that require real-time account crediting for all transactions have made the settlement process more certain for merchants and thus have encouraged more POS digitisation to follow.

- The retail and e-commerce segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Mobile Payments Market Size is segmented by application into retail and e-commerce, transportation and logistics, hospitality and food service, and others. Among these, the retail and e-commerce segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to retail makes easy transactions possible via mobile apps and contactless payments. It enhances customer experience, simplifies payments, and boosts transaction efficiency. In the year 2024, a European bank dubbed ABN Amro launched a Pay on Invoice tool for business-to-business e-commerce, which gave the firms a chance to avail the Pay Later service with delayed payments of a maximum period of 30 days.

- The personal segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe Mobile Payments Market Size is segmented into personal, business. Among these, the personal segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Personal accounted for 80.12% of the transaction value in 2024. This was mainly due to the widespread use of smartphones and people's confidence in handling digital wallets. In certain places like the Nordics and the UK, mobile is already the dominant wallet, as people are interacting with super-apps that merge payments, loyalty, and micro-investing functionalities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Mobile Payments Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NTH Mobile

- Mobile Pay

- Checkout.com

- CellPoint Digital

- S-Payment GmbH

- Dynamic Mobile Billing

- European Merchant Services

- Micro Payment

- SumUp

- PayPoint

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In September 2025, Thunes, the Smart Superhighway to move money around the world, and Ripple, the leading provider of digital asset infrastructure for financial institutions, announced an expanded partnership to transform cross-border payments globally.

In June 2025, Alipay+ launched the World’s First Smart Glasses-Embedded Payment Solution. In collaboration with Meizu, a global industry leader, Alipay+ completed the world's first real-world smart glasses-embedded e-wallet payment transaction in Hong Kong.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Mobile Payments Market based on the below-mentioned segments:

Europe Mobile Payments Market, By Payment Method

- Proximity Payments

- Remote Payments

Europe Mobile Payments Market, By Transaction Type

- Peer-To-Peer

- In-Store Point-Of-Sale

- Person-To-Merchant

- Other

Europe Mobile Payments Market, By Application

- Retail and E-commerce

- Transportation and Logistics

- Hospitality and Food-Service

- Others

Europe Mobile Payments Market, By End User

- Personal

- Business

Frequently Asked Questions (FAQ)

-

What is the Europe mobile payments market size?Europe Mobile Payments market size is expected to grow from USD 142.68 billion in 2024 to USD 2578.4 billion by 2035, growing at a CAGR of 30.1% during the forecast period 2025-2035

-

What are mobile payments, and their primary use?A mobile payment is defined as any financial transaction made via a mobile device, for instance, a smartphone, tablet, or wearable (e.g., smartwatch), with the intention of buying products or services or moving money. In contrast to conventional payment methods that depend on the physical presence of cash or credit cards, these payments rely on digital communication channels that interact with the payment processors or other users.

-

What are the key growth drivers of the market?Market growth is driven by the rapid growth of smartphones and the availability of high-speed internet connections were the main driving factors. By the year 2023, over 85% of people living in the European Union owned smartphones and the internet was accessible in 90% of homes. Furthermore, digital payments through cards and other online payment methods were used more often from year to year by 20%.

-

What factors restrain the Europe mobile payments market?The market is restrained by the European Commission has reported that 40% of small companies in the region exclusively use cash for their transactions, which is a clear sign of the slower adoption rates in the area. Payment systems are still heavily reliant on cash in these regions. The dissimilarity between the EU's PSD2/PSD3 regulation and the UK's post-Brexit financial laws is leading to two separate paths for compliance.

-

How is the market segmented by payment method?The market is segmented into proximity payments, remote payments.

-

Who are the key players in the Europe mobile payments market?Key companies include NTH Mobile, Mobile Pay, Checkout.com, CellPoint Digital, S-Payment GmbH, Dynamic Mobile Billing, European Merchant Services, Micro Payment, SumUp, and PayPoint.

Need help to buy this report?