Europe Microspheres Market Size, Share, and COVID-19 Impact Analysis, By Type (Hollow, Solid), By Raw Material (Glass, Ceramic, Fly Ash, Polymer, Metallic), By Application (Construction Composites, Medical Technology, Cosmetics & Personal Care, Automotive, Oil & Gas), and Europe Microspheres Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Microspheres Market Insights Forecasts to 2035

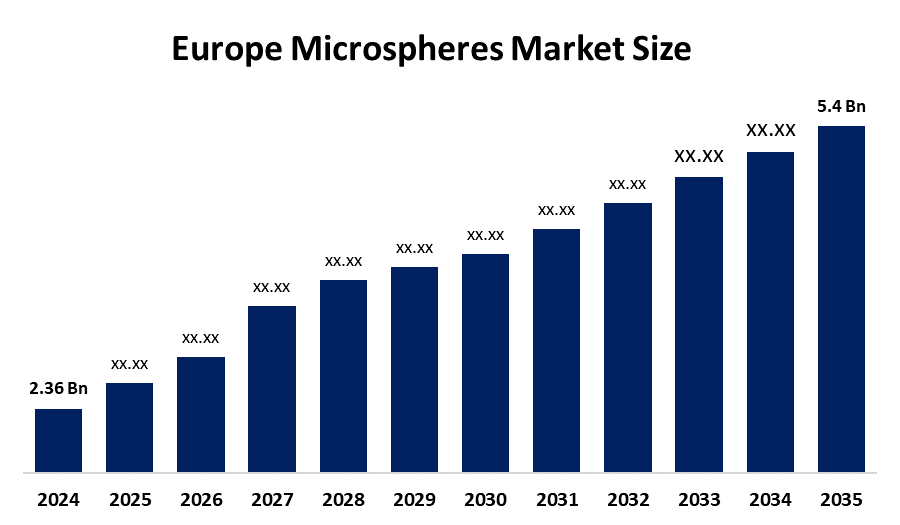

- The Europe Microspheres Market Size Was Estimated at USD 2.36 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.82% from 2025 to 2035

- The Europe Microspheres Market Size is Expected to Reach USD 5.4 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Microspheres Market Size is anticipated to reach USD 5.4 Billion by 2035, growing at a CAGR of 7.82% from 2025 to 2035. The market is driven by microspheres that are applied for drug delivery, embolization, and medical device testing and development. They are employed in the production of elastics, plastics, metals, vehicles, personal care, and beauty care products.

Market Overview

Microspheres are tiny spherical particles that have the characteristics of being biocompatible and biodegradable, and are found in the shape of a powder that flows freely. Among the types of microspheres that are most widely used are floating, magnetic, and metallic microspheres. They are produced with glass, ceramics, polymers, and metals and come in the forms of beads, balls, and micro-balloons. Their application areas include drug discovery, clinical diagnostics, and biomedical research, and they are also widely used in the construction, medical, chemical, and cosmetic industries. In addition, they are an important factor in bone tissue engineering and the production of embolic bead products used for hyper vascular tumours.

In 2021, the UK government declared an investment of USD 18.8 billion that would support oil companies in their search for new oil sources in the North Sea, as well as help them cut emissions of carbon dioxide by the end of the decade. In September 2024, Sirtex Medical announced that it received certification under the European Union Medical Device Regulation (EU MDR) for marketing SIR-Spheres Y-90 resin microspheres and delivery systems.

The environmental and safety standards, the EU Green Deal and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) set the high bar, and it is the producers who ensure that the microsphere products meet these requirements. The Energiewende program from Germany favors lightweight building materials to improve construction performance.

Report Coverage

This research report categorizes the market for the Europe Microspheres Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe microspheres market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe microspheres market.

Europe Microspheres Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.36 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 7.82% |

| 2035 Value Projection: | USD 5.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Application, By Application |

| Companies covered:: | 3M Company, Potters Industries LLC, Sigmund Linder GmbH, Mo-Sci Corporation, MicroSphere SA, InSphero, Microphyt, Frilite SA, Microcaps, Micropore Technologies, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The microspheres market in Europe is driven by the need for lightweight and high-performance composites. More than 60% of total composite materials consumed in both construction and automotive sectors have hollow microspheres as their essential constituent, serving to lower weight and improve thermal insulation. The market for biodegradable and biocompatible microspheres for drug delivery systems and diagnostic imaging increased by 12% in 2022. Thereby, further demand for such advanced microsphere solutions has been generated. Besides, the rising investments in medical technology have been a major factor in the demand for microspheres due to they allow for the creation of innovative and patient-centred healthcare solutions.

Restraining Factors

The microspheres market in Europe is restrained by the advanced microspheres are associated with high production costs. Often, the total cost of producing bio-based and synthetic microspheres is around 30-40% higher than that of traditional materials, making them less accessible for small manufacturers. Over 60% of SMEs mention high price as the main reason keeping them away from adopting advanced microspheres. There is a lack of awareness among small manufacturers about the advantages of using advanced microspheres. Moreover, raw material price changes may harm the microspheres market's growth rate.

Market Segmentation

The Europe Microspheres Market share is categorised into type, raw material, and application.

- The hollow segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Microspheres Market Size is segmented by type into hollow, solid. Among these, the hollow segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment of hollow microspheres held the largest proportion of 60.7% of the European market in 2024. The leading position comes from their extensive application in the lightest of composites, giving the best thermal insulation and weight reduction. Increasing the funds allocated to hollow microspheres technology, the multifunctionality, and dependability of hollow microspheres guarantee their unbreakable grip on the market.

- The glass segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on raw material, the Europe Microspheres Market Size is segmented into glass, ceramic, fly ash, polymer, metallic. Among these, the glass segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the glass's rising demand for the production of various goods, including paint, coating, rubber, plastics, etc. The low-density filling and high-crush-strength moulding and compounding processes are highly effective for producing a variety of materials. Glass microspheres are the primary reason behind the reduction in the weight of the products since they are extremely low in density.

- The construction composites segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Microspheres Market Size is segmented by application into construction composites, medical technology, cosmetics & personal care, automotive, oil & gas. Among these, the construction composites segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, the segment ruled the European market, possessing a 40.7% share of the continent's market. The rising application of construction composites in areas such as lightweight concrete and thermal insulation, where they offer the best strength-to-weight ratios and energy savings, is the reason for the segment's domination. The increasing investments in green building technologies point towards the vital involvement of microspheres in the progression of these technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe microspheres market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M Company

- Potters Industries LLC

- Sigmund Linder GmbH

- Mo-Sci Corporation

- MicroSphere SA

- InSphero

- Microphyt

- Frilite SA

- Microcaps

- Micropore Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In January 2025, Merz Aesthetics launched Ultherapy PRIME in Europe, the Middle East and Africa, an evolution of the non-invasive skin lifting Ultherapy and presented six abstracts at the 2025 International Master Course on Ageing Science (IMCAS) World Congress, highlighting its product portfolio and its contribution to the field of regenerative aesthetics.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Microspheres Market based on the below-mentioned segments:

Europe Microspheres Market, By Type

- Hollow

- Solid

Europe Microspheres Market, By Raw Material

- Glass

- Ceramic

- Fly Ash

- Polymer

- Metallic

Europe Microspheres Market, By Application

- Construction Composites

- Medical Technology

- Cosmetics & Personal Care

- Automotive

- Oil & Gas

Frequently Asked Questions (FAQ)

-

What is the Europe microspheres market size?Europe Microspheres market size is expected to grow from USD 2.36 billion in 2024 to USD 5.4 billion by 2035, growing at a CAGR of 7.82% during the forecast period 2025-2035

-

What are microspheres, and their primary use?Microspheres are tiny spherical particles that have the characteristics of being biocompatible and biodegradable, and are found in the shape of a powder that flows freely. Among the types of microspheres that are most widely used are floating, magnetic, and metallic microspheres. They are produced with glass, ceramics, polymers, and metals and come in the forms of beads, balls, and micro-balloons

-

What are the key growth drivers of the market?Market growth is driven by the need for lightweight and high-performance composites. More than 60% of total composite materials consumed in both construction and automotive sectors have hollow microspheres as their essential constituent, serving to lower weight and improve thermal insulation. The market for biodegradable and biocompatible microspheres for drug delivery systems and diagnostic imaging increased by 12% in 2022

-

What factors restrain the Europe microspheres market?The market is restrained by the advanced microspheres are associated with high production costs. Often, the total cost of producing bio-based and synthetic microspheres is around 30-40% higher than that of traditional materials, making them less accessible for small manufacturers.

-

How is the market segmented by type?The market is segmented into hollow and solid.

-

Who are the key players in the Europe microspheres market?Key companies include 3M Company, Potters Industries LLC, Sigmund Linder GmbH, Mo-Sci Corporation, MicroSphere SA, InSphero, Microphyt, Frilite SA, Microcaps, and Micropore Technologies.

Need help to buy this report?