Europe Metal Fabrication Equipment Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Machining, Cutting, Welding, Forming, and Others), By End User (Automotive, Construction, Aerospace, Electrical and Electronics, and Others), and Europe Metal Fabrication Equipment Market Insights, Industry Trends, Forecast to 2035

Industry: Construction & ManufacturingEurope Metal Fabrication Equipment Market Size Insights Forecasts to 2035

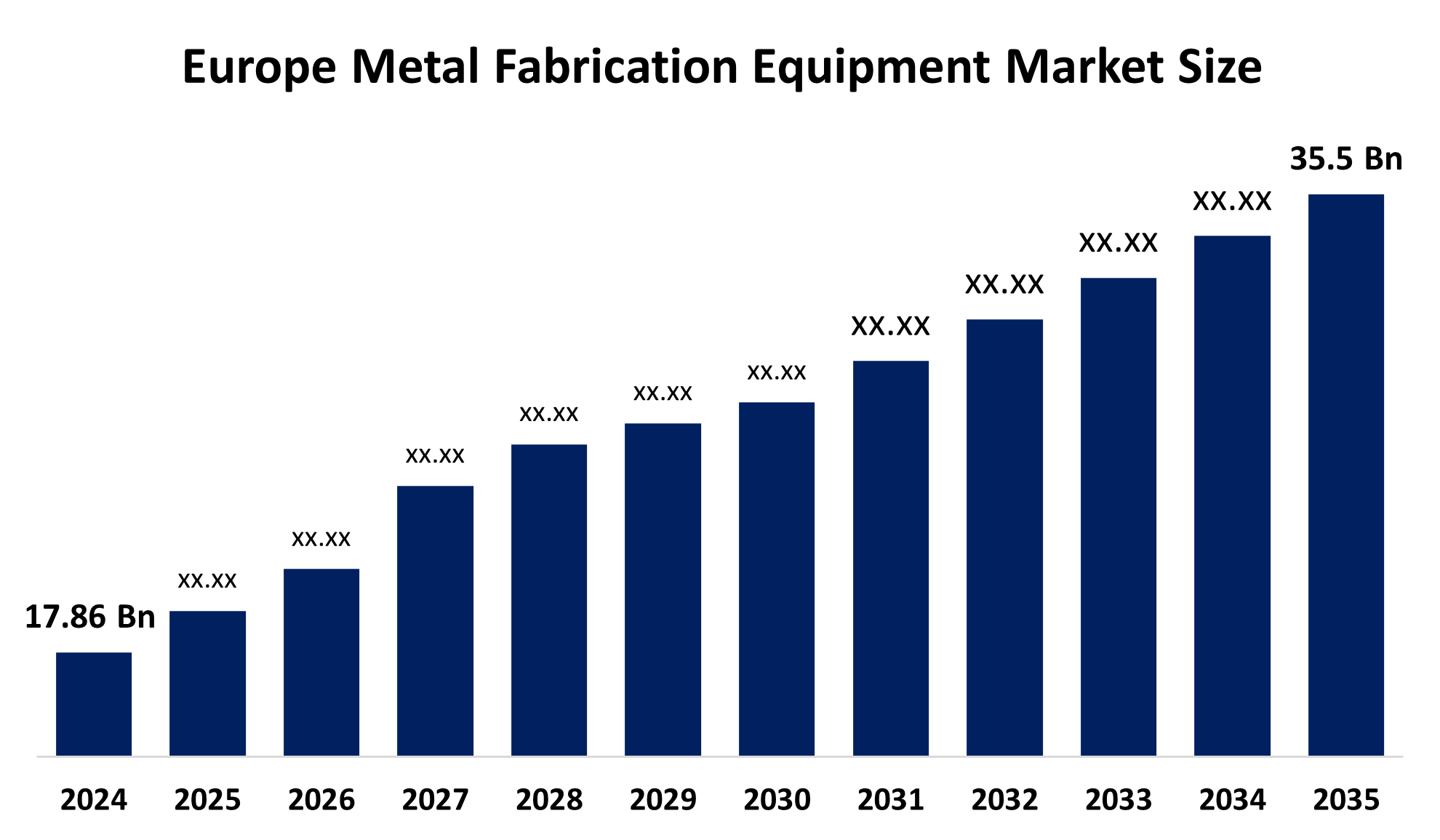

- The Europe Metal Fabrication Equipment Market Size Was Estimated at USD 17.86 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.44% from 2025 to 2035

- The Europe Metal Fabrication Equipment Market Size is Expected to Reach USD 35.5 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Metal Fabrication Equipment Market Size is Anticipated to Reach USD 35.5 Billion by 2035, Growing at a CAGR of 6.44% from 2025 to 2035. The market is driven by the growing implementation of sophisticated metalworking technologies in industries like as automotive, aerospace, construction, and electronics.

Market Overview

Metal fabrication equipment consists of the machines and tools needed to carry out metal processing and to produce different items and parts through a series of operations including cutting, bending, welding, and assembling. Metal fabrication is necessary for the automotive, aerospace, construction, electronics, and heavy machinery sectors' structural parts, frames, and tailored components. Applied in the making of car parts, chassis, and body panels. A key factor in 2026 is the manufacturing of electric vehicle (EV) battery enclosures and lightweight aluminum parts.

ABB, in June 2025, announced the debut of the IRB 6730S, IRB 6750S and IRB 6760 in partnership with the broader robot portfolio. The company assures that it can provide the most extensive industrial robots and variants on the market to its clients.

Poland's industrial production has been boosted due to the investments made in cutting-edge manufacturing machines. The Polish authorities are committed to increasing industrial production, with the manufacturing sector contributing more than a quarter of GDP. The government's strategy, which provides financial support for innovation and the use of digital technologies in the industry, has increased the progress of precision fabrication technology.

Report Coverage

This research report categorizes the market for the Europe Metal Fabrication Equipment Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe metal fabrication equipment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe metal fabrication equipment market.

Europe Metal Fabrication Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 17.86 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.44% |

| 2035 Value Projection: | USD 35.5 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Service Type, By End User |

| Companies covered:: | TRUMPF, Bystronic, Amada, DMG MORI, GF Machining Solutions, IPG Photonics, Messer Cutting Systems, Prima Industry, Mazak, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The metal fabrication equipment market in Europe is driven by the adoption rate of smart fabrication systems has grown about 15% every year during the last three years. This movement is seen as a sign of readiness for wider installation. Demand unlockers consist of the EU-funded schemes and grants for digital changeover and eco-friendly manufacturing. A €1 billion fund by the European Investment Bank for manufacturing modernization, recently announced, is another important driver. Moreover, various European nations are working on the introduction of different programs that would facilitate the use of Industry 4.0 technologies.

Restraining Factors

The metal fabrication equipment market in Europe is restrained by the gradual improvement of metal manufacturing operations by means of automation, or machinery still needs a proficient labor force that is able to operate, maintain and program the sophisticated machines. Besides, companies are in a competitive battle with the dominant players in Asia, who frequently supply machinery at more economical prices.

Market Segmentation

The Europe metal fabrication equipment market share is categorised into service type and end user.

- The cutting segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Metal Fabrication Equipment Market Size is segmented by service type into machining, cutting, welding, forming, and others. Among these, the cutting segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Cutting technologies accounted for 45.9% of the total revenue in 2024. The demand for cutting technologies was driven by its indispensable function in producing metals for the following processes, demand from main industries, and the ongoing development of high-precision, automation technologies such as fiber lasers, plasma, and waterjets, which increase efficiency and lower scrap.

- The automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe Metal Fabrication Equipment Market Size is segmented into automotive, construction, aerospace, electrical and electronics, and others. Among these, the automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In 2024, automatic systems contributed significantly to the total revenue with a 47.8% share. These systems are driven mainly by their enormous production volumes, the switch to electric vehicles (EVs) that demand sophisticated lightweight materials, and the incessant need for precision-fabricated parts of a chassis, body, and engine, which consequently bring about new developments in automation and high-grade finishing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe Metal Fabrication Equipment Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TRUMPF

- Bystronic

- Amada

- DMG MORI

- GF Machining Solutions

- IPG Photonics

- Messer Cutting Systems

- Prima Industrie

- Mazak

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, TRUMPF launched a new generation of efficient fiber lasers at the Munich Light Expo in Germany, which can meet the diverse welding needs of the entire industry, such as high-precision welding of electric vehicle batteries.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe Metal Fabrication Equipment Market Size based on the below-mentioned segments:

Europe Metal Fabrication Equipment Market, By Service Type

- Machining

- Cutting

- Welding

- Forming

- Others

Europe Metal Fabrication Equipment Market, By End User

- Automotive

- Construction

- Aerospace

- Electrical and Electronics

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe metal fabrication equipment market size?A: Europe metal fabrication equipment market size is expected to grow from USD 17.86 billion in 2024 to USD 35.5 billion by 2035, growing at a CAGR of 6.44% during the forecast period 2025-2035.

-

Q: What is metal fabrication equipment, and its primary use?A: Metal fabrication equipment consists of the machines and tools needed to carry out metal processing and to produce different items and parts through a series of operations, including cutting, bending, welding, and assembling. Metal fabrication is necessary for the automotive, aerospace, construction, electronics, and heavy machinery sectors' structural parts.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the adoption rate of smart fabrication systems has grown about 15% every year during the last three years. This movement is seen as a sign of readiness for wider installation. various European nations are working on the introduction of different programs that would facilitate the use of Industry 4.0 technologies.

-

Q: What factors restrain the Europe metal fabrication equipment market?A: The market is restrained by the gradual improvement of metal manufacturing operations by means of automation or machinery still needs a proficient labor force that can operate, maintain and program the sophisticated machines.

-

Q: How is the market segmented by service type?A: The market is segmented into machining, cutting, welding, forming, and others.

-

Q: Who are the key players in the Europe metal fabrication equipment market?A: Key companies include TRUMPF, Bystronic, Amada, DMG MORI, GF Machining Solutions, IPG Photonics, Messer Cutting Systems, Prima Industrie, and Mazak.

Need help to buy this report?