Europe Liquid Carbon Dioxide Market Size, Share, and COVID-19 Impact Analysis, By Source (Natural and Industrial), By Application (Food & Beverages, Chemicals, Electronics, Agriculture, Healthcare, and Others), and Europe Liquid Carbon Dioxide Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Liquid Carbon Dioxide Market Insights Forecasts to 2035

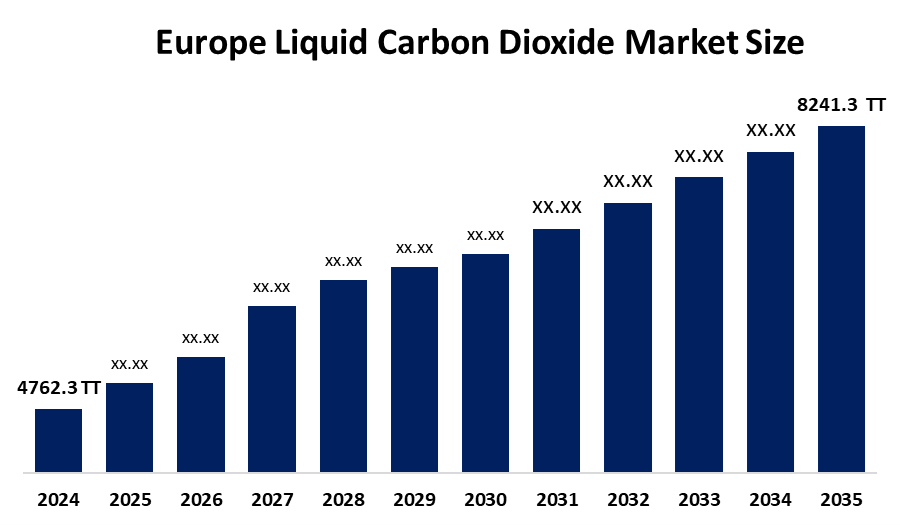

- The Europe Liquid Carbon Dioxide Market Size Was Estimated at 4762.3 Thousand Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.11% from 2025 to 2035

- The Europe Liquid Carbon Dioxide Market Size is Expected to Reach 8241.3 Thousand Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Liquid Carbon Dioxide Market size is anticipated to reach 8241.3 thousand tonnes by 2035, growing at a CAGR of 5.11% from 2025 to 2035. The market is driven by the growing industrial applications, increasing food and beverage industry needs, expanding chemical and medical application and rising use of environmentally sustainable technologies.

Market Overview

The liquid carbon dioxide (CO2) market demand rises from food processing needs, beverage carbonation requirements and industrial usage. The market experiences substantial growth because Carbon Capture utilization and storage technologies support European Union green deals. Liquid carbon dioxide exists as a cryogenic liquid, which appears colourless and odourless and displays non-flammable properties. The industrial process uses liquid carbon dioxide to create dry ice, which functions as a refrigerant and preservative in multiple industrial applications.

The Bio-Energy Carbon Capture and Storage project of Stockholm Exergi selected Air Liquide's Cryocap LQ large-scale carbon dioxide liquefaction technology, which they developed as their innovative solution in July 2024.

The European Union introduced its permanent CBAM implementation in January 2026. All importers bringing carbon-heavy products, which include steel and aluminium, cement and fertilisers and hydrogen must acquire CBAM certificates at prices determined by EU ETS allowance auctions. The upcoming 2026 carbon allowance system will experience an 8% decrease in available carbon allowances when compared to the 2025 system.

Report Coverage

This research report categorises the European liquid carbon dioxide market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe liquid carbon dioxide market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe liquid carbon dioxide market.

Europe Liquid Carbon Dioxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 4762.3 thousand tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.11% |

| 2035 Value Projection: | 8241.3 Thousand tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Source |

| Companies covered:: | Lind PLC, Air Liquide, Messer Group, SOL Group, Air Products and Chemicals, Yara International, SIAD Group, Westfalen AG, Calor, Liquigas, Others, and key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The liquid carbon dioxide market in Europe is driven by the carbon border adjustment mechanism, which will begin its implementation in January 2026, and the EU Emissions Trading System will become stricter, serving as the main drivers of the study. European automobile production, which now reaches 14.8 million vehicles per year, creates a growing requirement for LCO2 as a shielding gas used in welding and metal fabrication. The treatment now finds application in medical procedures that require minimal invasiveness, in breathing treatment and in drug production.

Restraining Factors

The liquid carbon dioxide market in Europe is restrained by the production of liquid CO2 depends primarily on the needs of industries that produce ammonia, ethanol and hydrogen. The EU Emissions Trading System (ETS) cap tightening, with the free allowance phase-out, will lead to a 180 million tonne annual reduction for allowance supply in 2026, which will create a market shortage that increases operating expenses for CO2 extraction and liquefaction processes.

Market Segmentation

The Europe liquid carbon dioxide market share is categorised into source and application.

- The industrial segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe liquid carbon dioxide market is segmented by source into natural and industrial. Among these, the industrial segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the metal fabrication industry and the chemical industry, which show high demand for their products because Carbon Capture and Utilization and Storage (CCUS) technologies are becoming increasingly popular. Although natural geological sources exist, industrial by-product capture has become the main method because of strict environmental regulations and the requirement to obtain sustainable CO2 from local sources.

- The food & beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Europe liquid carbon dioxide market is segmented into food & beverages, chemicals, electronics, agriculture, healthcare, and others. Among these, the food & beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the food industry, which requires carbonation for its beverage production, the food freezing process, and modified atmosphere packaging (MAP), which extends product shelf life. The region's processed food industry growth and high carbonated drink consumption in Germany, France and Italy drive this market dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe liquid carbon dioxide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lind PLC

- Air Liquide

- Messer Group

- SOL Group

- Air Products and Chemicals

- Yara International

- SIAD Group

- Westfalen AG

- Calor

- Liquigas

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Nippon Sanso Holdings Corp., a supplier of industrial, electronic, and medical gases, announced the launch of a Carbon dioxide processing plant in Zorbig, Germany. The company has invested approximately 30 million euros or 5.1 billion Japanese yen in the project.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe liquid carbon dioxide market based on the below-mentioned segments:

Europe Liquid Carbon Dioxide Market, By Source

- Natural

- Industrial

Europe Liquid Carbon Dioxide Market, By Application

- Food & Beverages

- Chemicals

- Electronics

- Agriculture

- Healthcare

- Others

Frequently Asked Questions (FAQ)

-

What is the Europe liquid carbon dioxide market size?The Europe liquid carbon dioxide market size is expected to grow from 4762.3 thousand tonnes in 2024 to 8241.3 thousand tonnes by 2035, growing at a CAGR of 5.11% during the forecast period 2025-2035

-

What is liquid carbon dioxide, and its primary use?The liquid carbon dioxide (CO2) market demand originates from food processing needs, beverage carbonation requirements and industrial usage. The market experiences substantial growth because Carbon Capture Utilization and Storage technologies support the European Union's green deals

-

What are the key growth drivers of the market?Market growth is driven by the Carbon Border Adjustment Mechanism, which will begin its implementation in January 2026, and the EU Emissions Trading System will become stricter, serving as the main drivers of the study

-

What factors restrain the Europe liquid carbon dioxide market?The market is restrained by the production of liquid CO2, which depends primarily on the needs of industries that produce ammonia, ethanol and hydrogen.

-

How is the market segmented by source?: The market is segmented into natural and industrial.

-

Who are the key players in the Europe liquid carbon dioxide market?Key companies include Linde PLC, Air Liquide, Messer Group, SOL Group, Air Products and Chemicals, Yara International, SIAD Group, Westfalen AG, Calor, and Liquigas.

Need help to buy this report?