Europe Linear Alpha Olefins Market Size, Share, and COVID-19 Impact Analysis, By Type (Butene, Hexene, Octene, Decene, Dodecene, and Others), By End User (LLDPE, Detergent Alcohols, HDPE, Lubricants, LDPE, and Others), and Europe Linear Alpha Olefins Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Linear Alpha Olefins Market Insights Forecasts to 2035

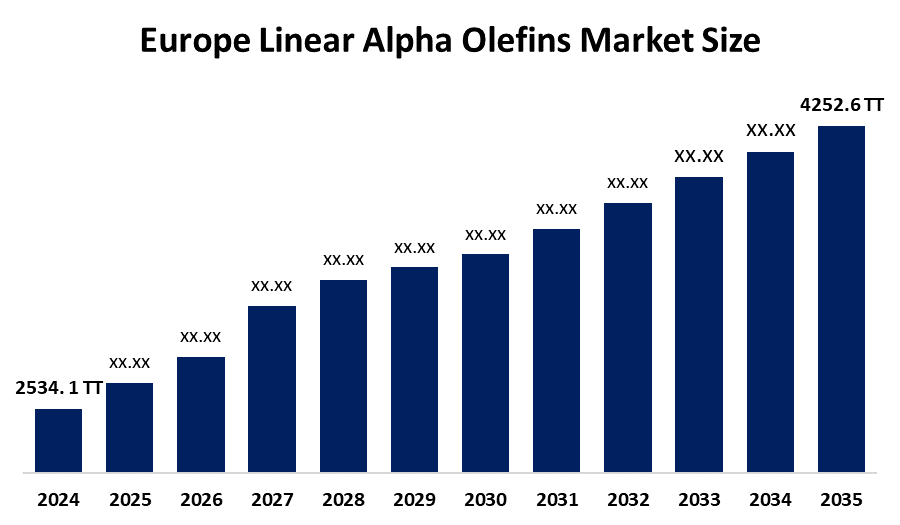

- The Europe Linear Alpha Olefins Market Size Was Estimated at 2534.1 Thousand Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.82% from 2025 to 2035

- The Europe Linear Alpha Olefins Market Size is Expected to Reach 4252.6 Thousand Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Europe Linear Alpha Olefins Market Size Is Anticipated To Reach 4252.6 Thousand Tonnes By 2035, Growing At A CAGR Of 4.82% From 2025 To 2035. The market is driven by the growing need for polyethene products, the development of the lubricant industry and the increasing use of products in the detergent and cleaning product market.

Market Overview

Linear alpha olefins (LAOs) represent a type of alkenes that possess a double bond that occurs at their first carbon position along an unbroken straight chain. LAOs function as essential industrial intermediates because they result from the oligomerization process, which converts ethylene into these chemical compounds. The automotive industry needs LAO to produce PAO, which has led to an increased demand for this substance. The production of polyethene detergent, alcohol plasticizer alcohol and other products depends on the usage of linear alpha olefins as a raw material.

Chevron Phillips declared its intention to construct a low-viscosity PAO facility in Beringen, Belgium, in 2022. By this expansion project, the corporation will raise its Belgian PAO manufacturing capacity to 120 kilotons. It is anticipated that the facility will start up in 2024.

ExxonMobil invest US$2 billion to create linear alpha olefins through its latest investment. ExxonMobil will launch its first market entry through a new linear alpha olefins facility that will produce 350000 tons per year of Elevexx-branded products. The Shell Group operates one of the largest facilities in the region, known as the Stanlow chemical facility, located in the United Kingdom. The facility uses the Shell Higher Olefins Process to create both Linear Alpha Olefins and internal olefins.

Report Coverage

This research report categorises the European linear alpha olefins market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe linear alpha olefins market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe linear alpha olefins market.

Europe Linear Alpha Olefins Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Type, By End User |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The linear alpha olefins market in Europe is driven by an increasing demand for polyethylene which the automotive and packaging industries require. The production capabilities of alpha olefin technology have improved through technological progress and capacity expansion investments. The packaging, automotive and construction sectors require durable, flexible, lightweight plastics, which drives substantial market development.

Restraining Factors

The linear alpha olefins market in Europe is restrained by the raw material prices keep changing. The rising price of the raw material will harm production costs, which will lead to a rise in the overall cost. The price increase of alpha olefin will create obstacles that prevent the industry from achieving growth.

Market Segmentation

The Europe linear alpha olefins market share is categorised into type and end user.

- The butene segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe linear alpha olefins market is segmented by type into butene, hexene, octene, decene, dodecene, and others. Among these, the butene segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the production process of linear low-density polyethene (LLDPE) and high-density polyethene (HDPE) materials, which are used in packaging and containers, and pipes have established these materials as common industrial standards. The material offers multiple practical applications because it remains affordable while it improves both flexibility and strength properties of polyethene materials.

- The LLDPE segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the Europe linear alpha olefins market is segmented into LLDPE, detergent alcohols, HDPE, lubricants, LDPE, and others. Among these, the LLDPE segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by its extensive use in film applications, which include stretch and shrink wraps, liners and food packaging. The properties of LLDPE provide high tensile strength and flexible performance and protection against punctures and tears, which make it suitable for different uses. The increasing market demand for LLDPE exists because people use it to make products such as bags, containers and cables.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe linear alpha olefins market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- INEOS Oligomers

- Royal Dutch Shell

- Evonik Industries

- Sasol Ltd

- SABIC

- Exxon Mobil Chemical

- Borealis

- OMV AG

- Vynova Group

- Elix Polymers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe linear alpha olefins market based on the below-mentioned segments:

Europe Linear Alpha Olefins Market, By Type

- Butene

- Hexene

- Octene

- Decene

- Dodecene

- Others

Europe Linear Alpha Olefins Market, By End User

- LLDPE

- Detergent Alcohols

- HDPE

- Lubricants

- LDPE

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe linear alpha olefins market size?A: Europe linear alpha olefins market size is expected to grow from 2534.1 thousand tonnes in 2024 to 4252.6 thousand tonnes by 2035, growing at a CAGR of 4.82% during the forecast period 2025-2035.

-

Q: What is linear alpha olefins, and its primary use?A: Linear alpha olefins (LAOs) represent a type of alkenes that possess a double bond that occurs at their first carbon position along an unbroken straight chain. LAOs function as essential industrial intermediates because they result from the oligomerization process, which converts ethylene into these chemical compounds.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by an increasing demand for polyethylene which the automotive and packaging industries require. The production capabilities of alpha olefin technology have improved through technological progress and capacity expansion investments.

-

Q: What factors restrain the Europe linear alpha olefins market?A: The market is restrained by the raw material prices keep changing. The rising price of the raw material will harm production costs, which will lead to a rise in the overall cost.

-

Q: How is the market segmented by type?A: The market is segmented into butene, hexene, octene, decene, dodecene, and others.

-

Q: Who are the key players in the Europe linear alpha olefins market?A: Key companies include INEOS Oligomers, Royal Dutch Shell, Evonik Industries, Sasol Ltd, SABIC, Exxon Mobil Chemical, Borealis, OMV AG, Vynova Group, and Elix Polymers.

Need help to buy this report?