Europe Joint Reconstruction Devices Market Size, Share, and COVID-19 Impact Analysis, By Technique (Joint Replacement, Osteotomy, Arthroscopy, Resurfacing, and Others), By Joint (Knee, Hip, Shoulder, Ankle and Others), and Europe Joint Reconstruction Devices Market Insights, Industry Trends, Forecast to 2035

Industry: HealthcareEurope Joint Reconstruction Devices Market Insights Forecasts to 2035

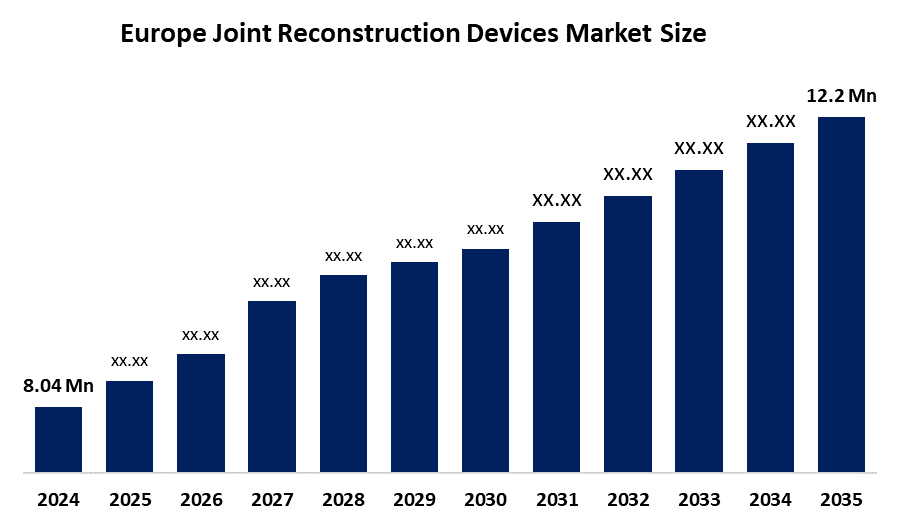

- The Europe Joint Reconstruction Devices Market Size Was Estimated at USD 8.04 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.86% from 2025 to 2035

- The Europe Joint Reconstruction Devices Market Size is Expected to Reach USD 12.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Joint Reconstruction Devices Market size is anticipated to reach USD 12.2 Million by 2035, growing at a CAGR of 3.86% from 2025 to 2035. The market is driven by advances in medical technology, including the development of minimally invasive surgical techniques and improved implant materials, which have also contributed to market expansion.

Market Overview

Joint reconstruction devices are medical implants and instruments that assist in surgical procedures for the replacement or repair of joints that are damaged or arthritic, among them the knee, hip, and shoulder. Joint reconstruction devices are usually composed of long-lasting and biocompatible materials like metal alloys, ceramics, and plastics, and are designed to mimic the motion of a healthy, natural joint, thereby alleviating pain and re-establishing the range of motion and function. Pain in the joints is the most common reason for joint replacement, which is usually due to the wearing down of cartilage.

In March 2022, Exactech, the developer of innovative implants, instrumentation, and smart technologies for joint replacement surgery, announced that the revolutionary Equinoxe Humeral Reconstruction Prosthesis is now accessible for clinical usage in Europe.

The governmental financial support for the healthcare infrastructure, orthopedic research, and regulations on reimbursement for joint replacement surgery have led to the investments that stimulate the growth and commercialization of the orthopedic care market. Joint Reconstruction is an important aspect of orthopedic care at present times. The population of rheumatoid arthritis affected individuals in Germany will amount to approximately 284,000 by 2040, which would mark a 38% rise of 38%.

Report Coverage

This research report categorises the European joint reconstruction devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe joint reconstruction devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe joint reconstruction devices market.

Europe Joint Reconstruction Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.04 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.86% |

| 2035 Value Projection: | USD 12.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Smith & Nephew PLC, Zimmer Biomet, Stryker Co., Johnson & Johnson, Medtronic Plc, Conmed Co., NuVassive, Inc., MicroPort International, DJO Global, B. Braun Melsungen SE, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The joint reconstruction devices market in Europe is driven by a significant number of individuals affected by a variety of conditions, such as osteoarthritis, rheumatoid arthritis, and osteoporosis, besides those suffering from sports injuries or trauma, who require orthopedic treatments and joint replacements. The collaboration of the medical field with materials science, personalized implants through 3D printing, and the increasing adoption of robotic and computer-assisted surgical systems, which are making surgery more precise, is leading to improved patient care and, therefore, the expansion of the market size.

Restraining Factors

The joint reconstruction devices market in Europe is restrained by the European Union's Medical Device Regulation (MDR), which has imposed increased complexity, compliance costs, and exhaustive documentation, thus making the process lengthier for innovating and getting products into the market. The financial burden of high-tech implants plus their surgical procedures, together with different limits on national health system budgets and discrepancies in reimbursement practices, not only reduces profits but also impedes the quick embrace of new devices.

Market Segmentation

The Europe joint reconstruction devices market share is categorised into technique and joint.

- The joint replacement segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe joint reconstruction devices market is segmented by technique into joint replacement, osteotomy, arthroscopy, resurfacing, and others. Among these, the joint replacement segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, the European joint reconstruction devices market will be the largest, with a share of 56.1%, due to the great number of people suffering from osteoarthritis and rheumatoid arthritis; the only way to help them regain the use of a joint is by surgery. The significance of this operation is the long-term outcome achieved with a modern implant, which is 20 years of life span.

- The knee segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on joint, the Europe joint reconstruction devices market is segmented into knee, hip, shoulder, ankle and others. Among these, the knee segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The market in 2024 was primarily driven by the knee reconstruction segment, which occupied 45.2% of the market share. The dominance is due to the large number of knee osteoarthritis patients, which is over 40 million in Europe. Germany has the largest number of knee operations, with more than 200,000 surgeries done every year. Newer to the market are the female and male specific model implants, which improve the comfort and usability of the artificial joints.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe joint reconstruction devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smith & Nephew PLC

- Zimmer Biomet

- Stryker Co.

- Johnson & Johnson

- Medtronic Plc

- Conmed Co.

- NuVassive, Inc.

- MicroPort International

- DJO Global

- B. Braun Melsungen SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe joint reconstruction devices market based on the below-mentioned segments:

Europe Joint Reconstruction Devices Market, By Technique

- Joint Replacement

- Osteotomy

- Arthroscopy

- Resurfacing

- Others

Europe Joint Reconstruction Devices Market, By Joint

- Knee

- Hip

- Shoulder

- Ankle

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe joint reconstruction devices market size?A: Europe joint reconstruction devices market size is expected to grow from USD 8.04 million in 2024 to USD 12.2 million by 2035, growing at a CAGR of 3.86% during the forecast period 2025-2035.

-

Q: What are joint reconstruction devices, and their primary use?A: Joint reconstruction devices are medical implants and instruments that assist in surgical procedures for the replacement or repair of joints that are damaged or arthritic, among them the knee, hip, and shoulder.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by a significant number of individuals affected by a variety of conditions, such as osteoarthritis, rheumatoid arthritis, and osteoporosis, besides those suffering from sports injuries or trauma, who require orthopedic treatments and joint replacements.

-

Q: What factors restrain the Europe joint reconstruction devices market?A: The market is restrained by the European Union's Medical Device Regulation (MDR), which has imposed increased complexity, compliance costs, and exhaustive documentation, thus making the process lengthier for innovating and getting products into the market.

-

Q: How is the market segmented by technique?A: The market is segmented into joint replacement, osteotomy, arthroscopy, resurfacing, and others.

-

Q: Who are the key players in the Europe joint reconstruction devices market?A: Key companies include Smith & Nephew PLC, Zimmer Biomet, Stryker Co., Johnson & Johnson, Medtronic Plc, Conmed Co., NuVassive, Inc., MicroPort International, DJO Global, and B. Braun Melsungen SE.

Need help to buy this report?