Europe IoT Integration Market Size, Share, and COVID-19 Impact Analysis, By Services (Device and Platform Management, System Design and Architecture, Advisory Services, Database and Block Storage Management and Others), By Enterprises Size (Large Enterprise and Small and Medium Enterprises), By Industry Vertical (Consumer Electronics, Wearbales Devices, Automotive & Transportation, BFSI, Healthcare, Retail and Others) and Europe IoT Integration Market Insights, Industry Trends, Forecast to 2035.

Industry: Information & TechnologyEurope IoT Integration Market Insights Forecasts to 2035

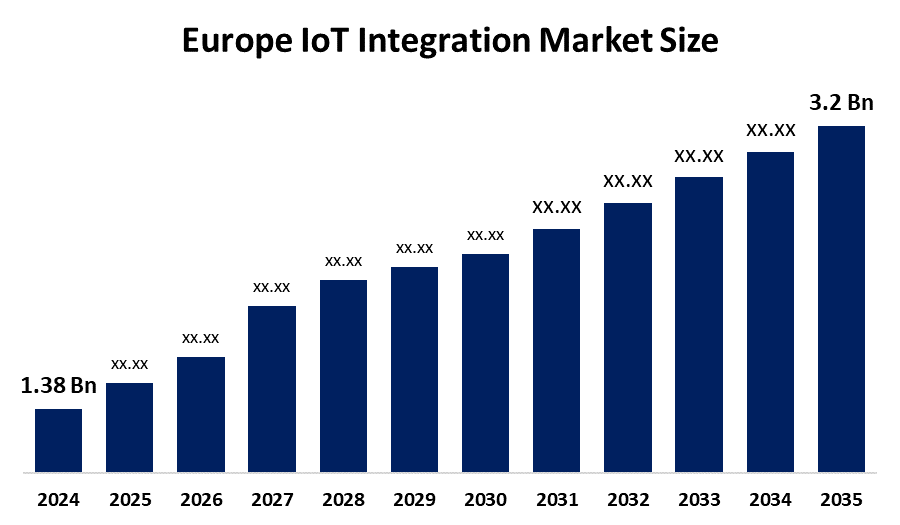

- The Europe IoT Integration Market Size Was Estimated at USD 1.38 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.95% from 2025 to 2035

- The Europe IoT Integration Market Size is Expected to Reach USD 3.2 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe IoT Integration Market size is anticipated to reach USD 3.2 Billion by 2035, growing at a CAGR of 7.95% from 2025 to 2035. The market is driven by the proliferation of smart devices across industries, a growing demand for operational efficiency, and the need for businesses to leverage complex IoT data to drive informed decision-making and digital transformation.

Market Overview

The IoT integration market is the area of business that includes all the functions and services required for the connection and unification of the different parts of an Internet of Things (IoT) solution into integrated business solutions from start to finish. It is about making the combination of new IoT devices, the data they produce, the IoT platforms that supervise them, and the specific IoT applications work together without any problems with the existing IT assets, including old data, business applications, and cloud services.

Tuya Smart, which is a worldwide provider of cloud platform services, announced in February 2025 the incorporation of Le Chat, the most recent artificial intelligence model from Mistral AI, into the Tuya Cloud Developer Platform.

The European Commission has allowed the use of €1.75 billion (around $2 billion) of public money from France, Germany, Italy, and the U.K. to finance a microelectronics joint research and innovation project that will tackle the Internet of Things, connected and autonomous vehicles. In 2024, 60% of the medical institutions in Europe started using IoT-based systems for monitoring patients, and in agriculture, there were 2 million devices that were connected and used for precision farming.

Report Coverage

This research report categorizes the market for the Europe IoT integration market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe IoT integration market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe IoT integration market.

Europe IoT Integration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.38 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.95% |

| 2035 Value Projection: | USD 3.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Service, By Enterprises Size, By Industry Vertical |

| Companies covered:: | Software AG, SAP SE ADR, Accenture, Capgemini, Atos SE, Siemens AG, Bosch Software Innovations, SAP SE, ABB, Nokia, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The IoT integration market in Europe is driven by the digital transformation initiatives in every business sector. Companies are enthusiastically embracing IoT as a means to upgrade their processes, automate more, and make decisions that are based on real-time data. The large and connected ecosystem created by the widespread usage of connected sensors, wearables, and machines in areas like homes, industries, transportation, and healthcare will require sophisticated integration services to function without hitches.

Restraining Factors

The IoT integration market in Europe is restrained by the high cost of implementation. A solid IoT infrastructure scheduling that covers sensor and device purchases, establishing solid network infrastructure, and using advanced integration software platforms and analytics tools. All the interlinked devices make the attack surface larger, thus raising the chances of getting hacked, leaking data, and even infiltration of sensitive operational and personal data.

Market Segmentation

The Europe IoT integration market share is categorised into services, enterprises size and industry vertical.

Get more details on this report -

- The device and platform management segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe IoT integration market is segmented by services into device and platform management, system design and architecture, advisory services, database and block storage management and others. Among these, the device and platform management segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Device and platform management has become the most significant segment contributing to the revenue share of 39.18% in 2024. The increased use of smart devices and sensors in various sectors like industrial, commercial, and consumer. To facilitate real-time communication, interoperability, and compatibility among different hardware setups, companies are focusing on having seamless device connectivity as the IoT ecosystem continues to grow.

- The large enterprise segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on enterprises size, the Europe IoT integration market is segmented into large enterprise and small and medium enterprises. Among these, the large enterprise segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The share of the IoT market in 2024 significantly belonged to large enterprises at 67.60%, and they took advantage of high-cost teams working all over the world to manage the installation of their systems. Large companies went for IoT big time, making it a part of their day-to-day operations to ensure no time loss and thereby lifting their output. With their strong financial support, they were able to go for the best integration service providers, the latest technology in AI-driven automation, and top-of-the-range security.

- The automotive & transportation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe IoT integration market is segmented by industry vertical into consumer electronics, wearbales devices, automotive & transportation, BFSI, healthcare, retail and others. Among these, the automotive & transportation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. There is an upward trend in the use of IoT in machine tools, predictive maintenance systems and real-time monitoring solutions across manufacturing, energy and utility sectors. The growth of these technologies is driven by the need for greater operational efficiency, cost reduction and adherence to strict safety and regulatory standards.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe IoT integration market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Software AG

- SAP SE ADR

- Accenture

- Capgemini

- Atos SE

- Siemens AG

- Bosch Software Innovations

- SAP SE

- ABB

- Nokia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In November 2025, STMicroelectronics launched two new NB-IoT wireless modules and an enhanced development ecosystem aimed at accelerating the creation of smart IoT solutions using narrowband cellular connectivity.

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe IoT integration market based on the below-mentioned segments:

Europe IoT Integration Market, By Service

- Device and Platform Management

- System Design and Architecture

- Advisory Services

- Database and Block Storage Management

- Others

Europe IoT Integration Market, By Enterprises Size

- Large Enterprise

- Small and Medium Enterprises

Europe IoT Integration Market, By Industry Vertical

- Consumer Electronics

- Wearbales Devices

- Automotive & Transportation

- BFSI

- Healthcare

- Retail

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe IoT integration market size?A: Europe IoT integration market size is expected to grow from USD 1.38 billion in 2024 to USD 3.2 billion by 2035, growing at a CAGR of 7.95% during the forecast period 2025-2035.

-

Q: What is IoT integration, and its primary use?A: The IoT integration market is the area of business that includes all the functions and services required for the successful connection and unification of the different parts of an Internet of Things (IoT) solution into integrated business solutions from start to finish.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the digital transformation initiatives in every business sector. Companies are enthusiastically embracing IoT as a means to upgrade their processes, automate more, and make decisions that are based on real-time data

-

Q: What factors restrain the Europe IoT integration market?A: The market is restrained by the high cost of implementation. A solid IoT infrastructure scheduling that covers sensor and device purchases, establishing solid network infrastructure, and using advanced integration software platforms and analytics tools.

-

Q: How is the market segmented by service?A: The market is segmented into device and platform management, system design and architecture, advisory services, database and block storage management and others.

-

Q: Who are the key players in the Europe IoT integration market?A: Key companies include Software AG, SAP SE ADR, Accenture, Capgemini, Atos SE, Siemens AG, Bosch Software Innovations, SAP SE, ABB, and Nokia.

Need help to buy this report?