Europe Inverter Welding Equipment Market Size, Share, and COVID-19 Impact Analysis, By Type (Manual Arc Welding, and Mechanized Arc Welding), By Application (Automotive & Transportation, Construction, Manufacturing & Fabrication, Oil & Gas, and Others), and Europe Inverter Welding Equipment Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentEurope Inverter Welding Equipment Market Insights Forecasts to 2035

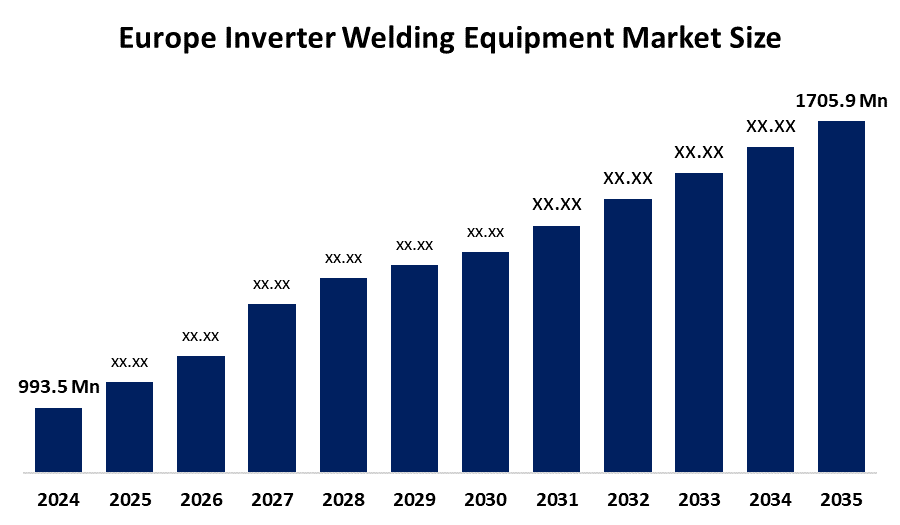

- The Europe Inverter Welding Equipment Market Was Estimated at USD 993.5 Million in 2024.

- The Market Size is Growing at a CAGR of 5.04 % between 2025 and 2035.

- The Europe Inverter Welding Equipment market is Anticipated to Reach USD 1705.9 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe inverter welding equipment market is anticipated to Hold USD 1705.9 Million by 2035, growing at a CAGR of 5.04 % from 2025 to 2035.Opportunities in the Europe Inverter Welding Equipment Market stem from an increasing level of automation in manufacturing, as well as greater use of more energy-efficient welding systems within the manufacturing sector.Increasing demand for portable and high-performance welding equipment to support diverse industry applications has driven substantial growth in both the automotive and construction industries.

Market Overview

The Europe inverter welding equipment market includes equipment that uses inverter technology for efficient, accurate and energy-efficient welding processes. The current demand for these machines is growing at a steady pace, due to the increasing levels of industrial automation, expansion of industrial production and the growing need for lightweight and portable welding systems. In addition to being more energy-efficient than traditional welding machines (those that use transformers), inverter welders also provide improved control of welding variables, lower operating costs and significantly improved performance in complex welding situations. The automotive, construction, shipbuilding and metal fabrication industry are all experiencing increased levels of demand for inverter welders which further supports the continued use of inverter welders in these industries. Another factor that is enabling the growth of inverter welding machine use is the initiatives being taken by government agencies and industrial organizations to promote the use of energy-efficient manufacturing equipment and to support the evolution of digitalized welding systems throughout Europe.

Report Coverage

This research report categorizes the market for the Europe inverter welding equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe inverter welding equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe inverter welding equipment market.

Europe Inverter Welding Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 993.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.04 % |

| 2035 Value Projection: | USD 1705.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 120 |

| Companies covered:: | Ador Welding, Fronius, GYS, Kemppi, Miller Electric Company, Migatronic, Panasonic Industry,and Voestalpine AG |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There are many factors leading to the rapid growth of the inverter welding market in Europe. The automotive, manufacturing and construction industries have all embraced inverter technology and many consumers are converting to this type of welding solution because it is portable and offers energy efficiency. With increased industrial automation, regulated EU energy-efficiency standards, a greater need for lighter, higher performance welding machines and the continuing development of infrastructure; coupled with the increasing number of small fabrication shops being set up in Europe, these trends all indicate that there will be continued success within the inverter welding equipment market in Europe.

Restraining Factors

Due to high upfront prices, insufficient knowledge about this type of product among lower tier users, and the need for highly trained workers to operate and maintain such equipment, the European market for inverter welding machines is constrained. In addition, price inflation of raw materials, as well as the complexity of maintaining Inverter Welders, can inhibit companies operating within low-profit margins from utilizing inverter welding machines.

Market Segmentation

The Europe inverter welding equipment market share is classified into type and application.

- The manual arc welding segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe inverter welding equipment market is segmented by type into manual arc welding and mechanized arc welding. Among these, the manual arc welding segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its widespread use across small workshops, repair applications, and construction projects, combined with its lower equipment cost, portability, and ease of operation. Manual arc welding continues to be preferred for general fabrication tasks, making it a dominant and steadily expanding segment in Europe.

- The manufacturing & fabrication segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe inverter welding equipment market is segmented by application into automotive & transportation, construction, manufacturing & fabrication, oil & gas, and others. Among these, the automotive & transportation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by rising automation in production facilities, increasing demand for precise and energy-efficient welding solutions, and the expansion of metal fabrication activities across Europe’s industrial sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe inverter welding equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ador Welding

- Fronius

- GYS

- Kemppi

- Miller Electric Company

- Migatronic

- Panasonic Industry

- Voestalpine AG

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe inverter welding equipment market based on the following segments:

Europe Inverter Welding Equipment Market, By Type

- Manual Arc Welding

- Mechanized Arc Welding

Europe Inverter Welding Equipment Market, By Application

- Automotive & Transportation

- Construction

- Manufacturing & Fabrication

- Oil & Gas

- Other

Frequently Asked Questions (FAQ)

-

Q: What is the Europe inverter welding equipment market size?A: Europe inverter welding equipment market size is expected to grow from USD 993.5 Million in 2024 to USD 1705.9 Million by 2035, growing at a CAGR of 5.04 % during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: The Europe inverter welding equipment market is driven by the growing adoption of energy-efficient and portable welding solutions across manufacturing, automotive, and construction sectors.

-

Q: What factors restrain the Europe inverter welding equipment market?A: The Europe inverter welding equipment market faces restraints due to high initial costs, limited awareness among small-scale users, and the need for skilled operators.

-

Q: How is the market segmented by type?A: The market is segmented into manual arc welding and mechanized arc welding.

-

Q: Who are the key players in the Europe inverter welding equipment market?A: Key companies include Ador Welding, Fronius, GYS, Kemppi, Miller Electric Company, Migatronic, Panasonic Industry, and Voestalpine AG.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?