Europe Impact Investing Market Size, Share, and COVID-19 Impact Analysis, By Asset Class (Equity, Fixed Income, Multi-asset, and Alternatives), By Investor Type (Institutional Investors and Retail Investors), and Europe Impact Investing Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialEurope Impact Investing Market Insights Forecasts to 2035

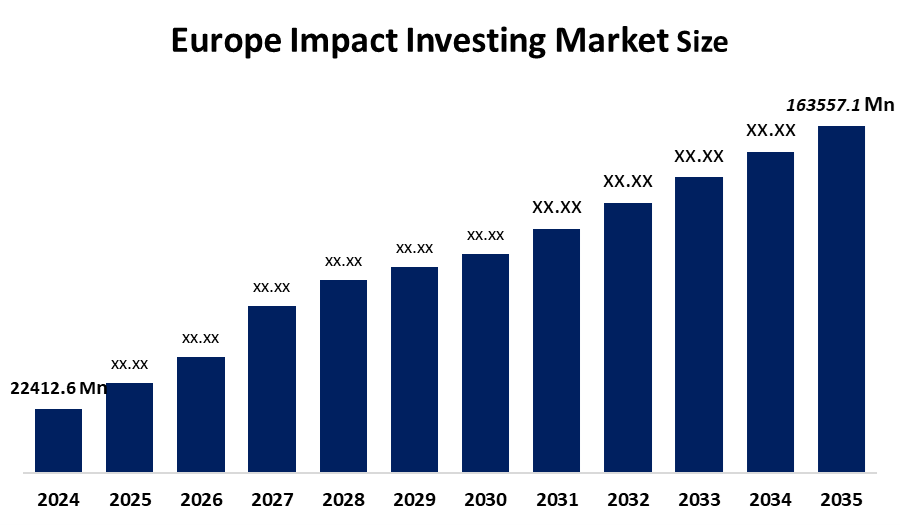

- The Europe Impact Investing Market Was Estimated at USD 22412.6 Million in 2024.

- The Market Size is Growing at a CAGR of 19.8% between 2025 and 2035.

- The Europe Impact Investing market is Anticipated to Reach USD 163557.1 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe impact investing market is anticipated to Hold USD 163557.1 Million by 2035, growing at a CAGR of 19.8% from 2025 to 2035. The Europe Impact Investing Market is poised to grow as a result of increasing investor and regulatory interest in sustainable finance, renewable energy projects, social enterprises, ESG-focused portfolios, green bonds and technology-driven impact investments.

Market Overview

The Europe's impact investing market is comprised of investments made with the goal of creating both a positive social/environmental impact, plus financial return on those investments. The growth of the impact investing market has recently increased due to increased investor interest in sustainability, climate action/social responsibility. Increased interest in ESG (Environmental/Social/Governance) factors, supportive government regulations, and the increase in popularity of green bonds and other sustainable financial instruments, has caused the growth of the impact investing marketplace. This market covers several different sectors including renewable energy, clean technology, social enterprises and sustainable agriculture. In addition to the increase of private investors along with financial institutions and public entities working together will help to make impact investing a mainstream investment strategy in Europe and will continue to grow even larger with more and more opportunities for both Investors and Funds to be created based on measurable environmental and societal results.

Report Coverage

This research report categorizes the market for the Europe impact investing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe impact investing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe impact investing market.

Europe Impact Investing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 22412.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 19.8% |

| 2035 Value Projection: | 163557.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Community Investment Management LeapFrog Investments Vital Capital Manulife Financial Corp Schroders PLC Prudential Financial Inc Morgan Stanley Bain Capital Specialty Finance Inc |

| Pitfalls & Challenges: | COVID-19 Impact Analysis, |

Get more details on this report -

Driving Factors

An increase in the number of investors who are aware of their environmental, social and governance (ESG) activities combined with support from governments for funding environmental, social and governance projects has resulted in the growth of the Europe Impact Investing market opportunity for investors to invest ethically. In addition, growing fears of climate change and social inequality, corporate responsibility and the increasing availability of green bonds; social bond; ESG investments provide Investors with increases options to invest their capital where they can see measurable returns financially and returns in Increases in social/environmental benefits.

Restraining Factors

The Europe impact investing market faces restraints from limited standardized measurement of social and environmental impact, high investment risks, longer payback periods, and lack of awareness among traditional investors.

Market Segmentation

The Europe impact investing market share is classified into asset class and investor type.

- The equity segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe impact investing market is segmented by asset class into equity, fixed income, multi-asset, and alternatives. Among these, the equity segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The equity segment dominates due to high investor preference for growth-oriented, socially responsible companies offering long-term returns. Fixed Income grows rapidly as sustainable bonds and debt instruments gain popularity, providing stable returns while supporting environmental and social initiatives.

The institutional investors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe impact investing market is segmented by Investor type into institutional investors and retail investors. Among these, the institutional investors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The institutional investors segment dominates due to large capital allocations and long-term investment strategies in ESG and sustainable projects. Retail investors are growing rapidly as awareness of impact investing, ethical portfolios, and sustainable financial products increases across Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe impact investing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

Community Investment Management

LeapFrog Investments

Vital Capital

Manulife Financial Corp

Schroders PLC

Prudential Financial Inc

Morgan Stanley

Bain Capital Specialty Finance Inc

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe impact investing market based on the following segments.

Europe Impact Investing Market, By Asset Class

- Equity

- Fixed Income

- Multi-asset

- Alternatives

Europe Impact Investing Market, By Investor Type

- Institutional Investors

- Retail Investors

Frequently Asked Questions (FAQ)

-

Q: What is the Europe impact investing market size?A: Europe impact investing market size is expected to grow from USD 22412.6 Million in 2024 to USD 163557.1 Million by 2035, growing at a CAGR of 19.8 % during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: The Europe impact investing market is driven by increasing awareness of environmental, social, and governance (ESG) factors among investors, government incentives for sustainable projects, and the growing demand for ethical investment options.

-

Q: What factors restrain the Europe impact investing market?A: The Europe impact investing market faces restraints from limited standardized measurement of social and environmental impact, high investment risks, longer payback periods, and lack of awareness among traditional investors.

-

Q: How is the market segmented by asset class?A: The market is segmented into asset class into equity, fixed income, multi-asset, and alternatives.

-

Q: Who are the key players in the Europe impact investing market?A: Key companies include Community Investment Management, LeapFrog Investments, Vital Capital, Manulife Financial Corp, Schroders PLC, Prudential Financial Inc, Morgan Stanley, and Bain Capital Specialty Finance Inc.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?