Europe Hydrochloric Acid Market Size, Share, and COVID-19 Impact Analysis, By Type (Synthetic and By-Product), By Application (Steel Pickling, Oil Well Acidizing, Ore Processing, Food Processing, Pool Sanitation, Calcium Chloride and Others), By End User (Food and Beverages, Steel Industry, Pharmaceuticals, Textile, Oil and Gas, Chemical Industry and Others), and Europe Hydrochloric Acid Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsEurope Hydrochloric Acid Market Insights Forecasts to 2035

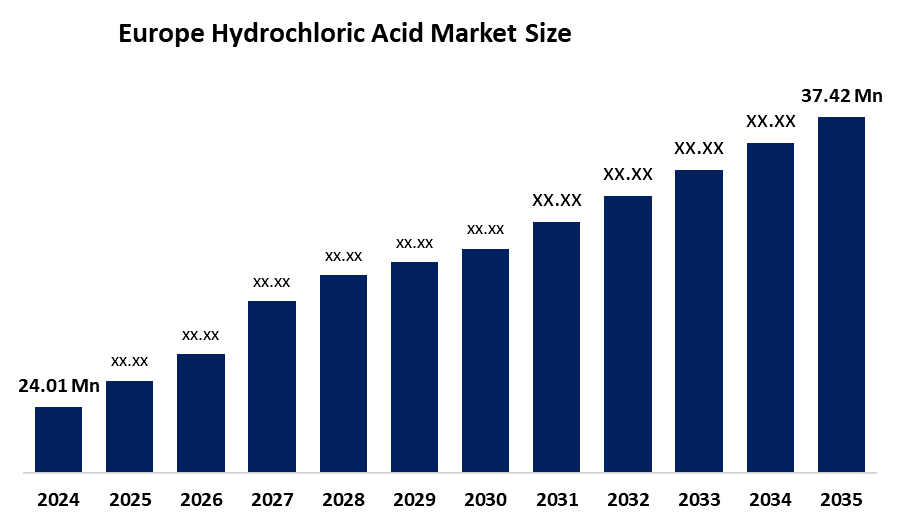

- The Europe Hydrochloric Acid Market Size Was Estimated at USD 24.01 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.12% from 2025 to 2035

- The Europe Hydrochloric Acid Market Size is Expected to Reach USD 37.42 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Europe Hydrochloric Acid Market size is anticipated to reach USD 37.42 Million by 2035, growing at a CAGR of 4.12% from 2025 to 2035. The market is driven by the extensive utilization of hydrochloric acid for water treatment, augmenting product demand from the steel industry, and the production of household cleaners.

Market Overview

Hydrochloric acid (HCL) or muriatic acid is a mineral acid that originates from multiple inorganic compounds, and its chemical formula is HCl. The substance exists as a colorless material that displays strong acidic properties and corrosive effects while producing an extremely strong odor. The food industry uses the largest portion of HCL produced commercially. HCL functions as a bleaching agent, which industrial facilities use to neutralize alkaline materials in their metal, food and textile operations, among other sectors.

The companies INEOS ChlorVinyls and Solvay established a partnership agreement in August 2024 to create and market advanced HCl production technology, which operates at higher efficiency levels.

The EU27 chemical industry experienced a 10.6% decline in production, became its third-largest production drop during the period from January to September 2023. The sector's capacity utilization reached 74.1% during the third quarter of 2023. The automotive sector uses hydrochloric acid to treat metal surfaces, while the pharmaceutical industry depends on hydrochloric acid, driving market growth.

Report Coverage

This research report categorises the European hydrochloric acid market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe hydrochloric acid market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe hydrochloric acid market.

Europe Hydrochloric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 24.01 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.12% |

| 2035 Value Projection: | USD 37.42 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | BASF SE, Covestro AG, INOVYN, Vynova Group, Kuhlmann Europe, Solvay, Ercross, Merck KGaA, Murphy & Son Ltd, Hydrachem Ltd, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The hydrochloric acid market in Europe is driven by HCl, which serves as an essential raw material that manufacturers use to produce chlorinated compounds, including polyvinyl chloride and other organic intermediates, such as vinyl chloride monomer and isocyanates. The pharmaceutical industry established its main centers which now require high-purity HCl for drug synthesis, and food processing uses HCl to maintain pH levels. The European market experiences growth because the food and beverage industry increasingly uses hydrochloric acid for food processing and preservation purposes.

Restraining Factors

The hydrochloric acid market in Europe is restrained by the new EU rules for chemical safety enforcement, which will begin their implementation in July 2026, requiring industries to follow enhanced digital labeling and hazard communication standards. The full implementation of REACH regulations together with the EU Green Deal requires ongoing funding for advanced clean production methods and system achieve zero liquid waste disposal.

Market Segmentation

The Europe hydrochloric acid market share is categorised into type, application, and end user.

- The synthetic segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe hydrochloric acid market is segmented by type into synthetic and by-product. Among these, the synthetic segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the synthetic hydrochloric acid exists as aqueous hydrogen chloride solutions. The synthetic grade HCL serves multiple industrial and food chemical applications, which require pH control and solution neutralization. The need for this specific hydrochloric acid type is currently rising.

- The steel pickling segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the Europe hydrochloric acid market is segmented into steel pickling, oil well acidizing, ore processing, food processing, pool sanitation, calcium chloride and others. Among these, the steel pickling segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the building sector's rapid expansion, which is driving increased steel demand. The pickling solution contains hydrochloric acid as its standard component. Hydrochloric acid provides the capability to perform wire pickling and metal stripping and restore used pickling solutions through its continuous, large-scale industrial treatment solutions.

- The food and beverages segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe hydrochloric acid market is segmented by end user into food and beverages, steel industry, pharmaceuticals, textile, oil and gas, chemical industry and others. Among these, the food and beverages segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by its essential role in food processing operations. Food acidification and pH adjustments and processing assistance to create gelatine and produce sugar and high-fructose corn syrup rely on hydrochloric acid applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Europe hydrochloric acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Covestro AG

- INOVYN

- Vynova Group

- Kuhlmann Europe

- Solvay

- Ercross

- Merck KGaA

- Murphy & Son Ltd

- Hydrachem Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe hydrochloric acid market based on the below-mentioned segments:

Europe Hydrochloric Acid Market, By Type

- Synthetic

- By-Product

Europe Hydrochloric Acid Market, By Application

- Steel Pickling

- Oil Well Acidizing

- Ore Processing

- Food Processing

- Pool Sanitation

- Calcium Chloride

- Others

Europe Hydrochloric Acid Market, By End User

- Food and Beverages

- Steel Industry

- Pharmaceuticals

- Textile

- Oil and Gas

- Chemical Industry

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Europe hydrochloric acid market size?A: The Europe hydrochloric acid market size is expected to grow from USD 24.01 million in 2024 to USD 37.42 million by 2035, growing at a CAGR of 4.12% during the forecast period 2025-2035.

-

Q: What is hydrochloric acid, and its primary use?A: Hydrochloric acid (HCL) or muriatic acid is a mineral acid that originates from multiple inorganic compounds, and its chemical formula is HCl. The substance exists as a colorless material that displays strong acidic properties and corrosive effects while producing an extremely strong odor.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by HCl, which serves as an essential raw material that manufacturers use to produce chlorinated compounds, including polyvinyl chloride and other organic intermediates, such as vinyl chloride monomer and isocyanates.

-

Q: What factors restrain the Europe hydrochloric acid market?A: The market is restrained by the new EU rules for chemical safety enforcement, which will begin their implementation in July 2026, requiring industries to follow enhanced digital labeling and hazard communication standards.

-

Q: How is the market segmented by type?A: The market is segmented into synthetic and by-product.

-

Q: Who are the key players in the Europe hydrochloric acid market?A: Key companies include BASF SE, Covestro AG, INOVYN, Vynova Group, Kuhlmann Europe, Solvay, Ercross, Merck KGaA, Murphy & Son Ltd, and Hydrachem Ltd.

Need help to buy this report?