Europe Household Cooking Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product (Ovens, Cooktops & Cooking Ranges, and Specialized Appliances), By Structure (Built-in, Freestanding), By Distribution Channel (Brick & Mortar, E-commerce), and Europe Household Cooking Appliances Market Insights, Industry Trends, Forecast to 2035

Industry: Consumer GoodsEurope Household Cooking Appliances Market Insights Forecasts To 2035

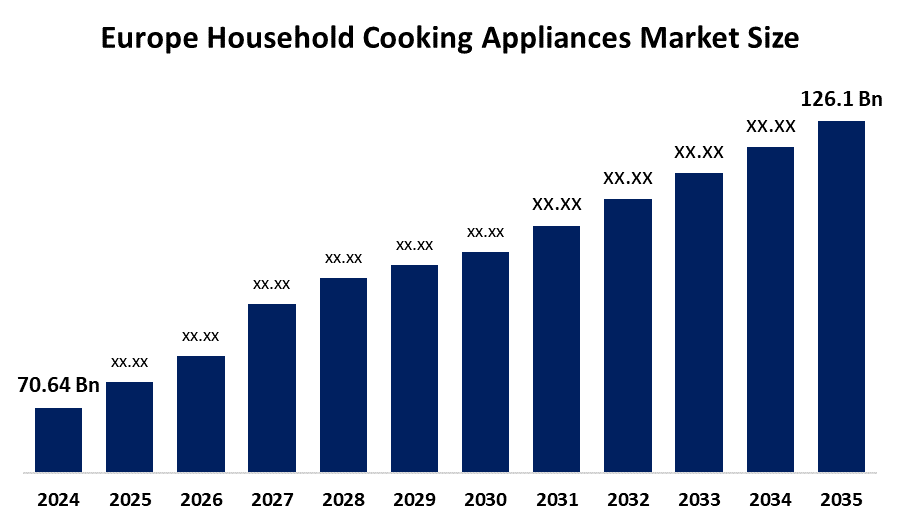

- The Europe Household Cooking Appliances Market Size Was Estimated At USD 70.64 Billion In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 5.41% From 2025 To 2035

- The Europe Household Cooking Appliances Market Size Is Expected To Reach USD 126.1 Billion By 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The Europe Household Cooking Appliances Market Size Is Anticipated To Reach USD 126.1 Billion By 2035, Growing At A CAGR Of 5.41% From 2025 To 2035. The market is driven by rising adoption of smart and energy-efficient appliances, urbanization, and increasing disposable incomes in emerging markets. Changing consumer preferences toward healthy cooking methods.

Market Overview

Household Cooking Appliances Are Machines That Play A Role In Food Preparation And Cooking In Private Households. These devices include large, built-in units as well as smaller, portable countertop models, all designed to make cooking easier, faster, and more efficient. The primary cooking method in many kitchens is the oven. Ovens are used for baking, roasting, frying, and boiling. Cooktops and cooking ranges commanded the largest share of most companies’ revenue in 2023. In addition, microwaves are now used for quick heating, defrosting, and cooking of various food items, thus saving a significant amount of time and energy when compared to traditional ovens for small tasks.

In September 2024, Electrolux Took A Large Step In The Kitchen Appliance Sector By Launching A New Line Of AEG Products That Came With AI-Powered And Energy-Efficient Features. In June 2025, the collaboration of HAIER EUROPE APPLIANCES HOLDING BV and KLIMA KFT paved the way for a research and development centre to be set up in Hungary. Also, in October 2024, Haier Europe was granted an investment of €200 million for the increase of its production capacity.

The Italian Government Is Providing Up To 200, Which Is A 30% Subsidy For Specific Energy-Efficient Devices, specifically eligible appliances for lower-income households, and for the years 2023-2025, plus in some areas of Spain and France.

Report Coverage

This Research Report Categorizes The Market Size For The Europe Household Cooking Appliances Market Based On Various Segments And Regions, And Forecasts Revenue Growth And Analyses Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Europe household cooking appliances market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Europe household cooking appliances market.

Europe Household Cooking Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 70.64 Billion |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 5.41% |

| 2023 Value Projection: | USD 126.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Structure |

| Companies covered:: | Smeg, Electrolux AB ADR, Koninklijke Philips NV, BSH Hausgeräte GmbH, Whirlpool Corporation, Samsung Electronics, LG Electronics, Haier Smart Home, Arcelik, Miele, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Household Cooking Appliances Market Size In Europe Is Driven By The Increased Acceptance Of Smart Appliances That Come With Internet Of Things (Iot) Technology And Such Features As AI-Assisted Cooking, Monitoring From A Distance, And Taking Commands Through Voice. The strict EU regulations and the increasing consumers' understanding of climate change are resulting in the demand for energy and eco-friendly appliances being increased. Urbanisation is also contributing to the demand by creating more dual-income and single-person households, which, in turn, applies to small, multi-functional, and compact appliances that are able to serve several purposes. The rise of disposable incomes in Europe has enabled consumers to purchase high-end appliances that have better performance and aesthetics.

Restraining Factors

The Household Cooking Appliances Market Size In Europe Is Restrained By The Fluctuation In The Prices Of Fundamental Materials Such As Steel, Iron, Plastic, Glass, And Electronic Parts Greatly Affects The Cost Of Manufacturing And The Margins Of Profit. Penetration of standard appliances in developed European markets is at a very high level, leading to a market that is very competitive

Market Segmentation

The Europe household cooking appliances market share is categorised into product, structure, and distribution channel.

- The cooktops & cooking ranges segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Household Cooking Appliances Market Size Is Segmented By Product Into Ovens, Cooktops & Cooking Ranges, And Specialized Appliances. Among these, the cooktops & cooking ranges segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the home cooking appliances have reached a new generation, which is offered in several sizes, installation is very simple, and operation. Consequently, their attractiveness to consumers is higher than before, and so provides new economic possibilities. This category outlines cooktops and action ranges, which can be gas, electric, or induction. Digital temperature control panel induction cooktops are very efficient in both time and power consumption.

- The freestanding segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based On Structure, The Europe Household Cooking Appliances Market Size Is Segmented Into Built-In, Freestanding. Among these, the freestanding segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the process of cleaning and maintaining standalone home equipment is quite simple, which is one of the reasons for the massive rise in the market for the appliances in the upcoming years. Stand-alone appliances cost less than built-in ones and also spare parts can be easily found. Freestanding appliances have the most flexibility regarding placement, because they can be moved easily and can be installed anywhere.

- The e-commerce segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Europe Household Cooking Appliances Market Size Is Segmented By Distribution Channel Into Brick & Mortar, E-Commerce. Among these, the e-commerce segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the surge in sales has a lot to do with the coupled functions like quicker buying process, discounts and promotions, easy price and product comparison, sufficient stock, simple returns, and product exchange options. In other words, due to the growing acceptance of online shopping, most producers launched their e-commerce sites.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Europe Household Cooking Appliances Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smeg

- Electrolux AB ADR

- Koninklijke Philips NV

- BSH Hausgeräte GmbH

- Whirlpool Corporation

- Samsung Electronics

- LG Electronics

- Haier Smart Home

- Arcelik

- Miele

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In September 2024, Samsung Electronics announced that it is launching the Bespoke AI Laundry Combo to the European market at IFA 2024 in Berlin.

Market Segment

This Study Forecasts Revenue At The Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Europe household cooking appliances market based on the below-mentioned segments:

Europe Household Cooking Appliances Market, By Product

- Ovens

- Cooktops & Cooking Ranges

- Specialized Appliances

Europe Household Cooking Appliances Market, By Structure

- Built-in

- Freestanding

Europe Household Cooking Appliances Market, By Distribution Channel

- Brick & Mortar

- E-commerce

Frequently Asked Questions (FAQ)

-

What is the Europe household cooking appliances market size?Europe household cooking appliances market size is expected to grow from USD 70.64 billion in 2024 to USD 126.1 billion by 2035, growing at a CAGR of 5.41 % during the forecast period 2025-2035

-

What is household cooking appliances, and its primary use?Household cooking appliances are machines that play a role in food preparation and cooking in private households. These devices include large, built-in units as well as smaller, portable countertop models, all designed to make cooking easier, faster, and more efficient.

-

What are the key growth drivers of the market?Market growth is driven by the increased acceptance of smart appliances that come with Internet of Things (IoT) technology and such features as AI-assisted cooking, monitoring from a distance, and taking commands through voice.

-

What factors restrain the Europe household cooking appliances market?The market is restrained by the fluctuation in the prices of fundamental materials such as steel, iron, plastic, glass, and electronic parts greatly affect the cost of manufacturing and the margins of profit.How is the market segmented by distribution channel?

-

How is the market segmented by distribution channel?The market is segmented into brick & mortar, e-commerce.

-

Who are the key players in the Europe household cooking appliances market?Key companies include Smeg, Electrolux AB ADR, Koninklijke Philips NV, BSH Hausgeräte GmbH, Whirlpool Corporation, Samsung Electronics, LG Electronics, Haier Smart Home, Arcelik, and Miele.

Need help to buy this report?